Bionic is the UK’s largest business energy broker by customer numbers, serving 161,000 SMEs through a traditional sales-driven model. They also power the business energy switching arm of all major comparison sites - Uswitch, MoneySuperMarket, Compare the Market, Confused.com, and GoCompare all route to Bionic for business energy. But how much do energy brokers charge, and what are you really paying for when you use the Bionic energy broker? We analysed their publicly-filed Companies House accounts to reveal the true energy broker commission rates hidden in your bills.

Last verified: January 2026 from Companies House filing (opens in new tab)

TL;DR: Key Takeaways

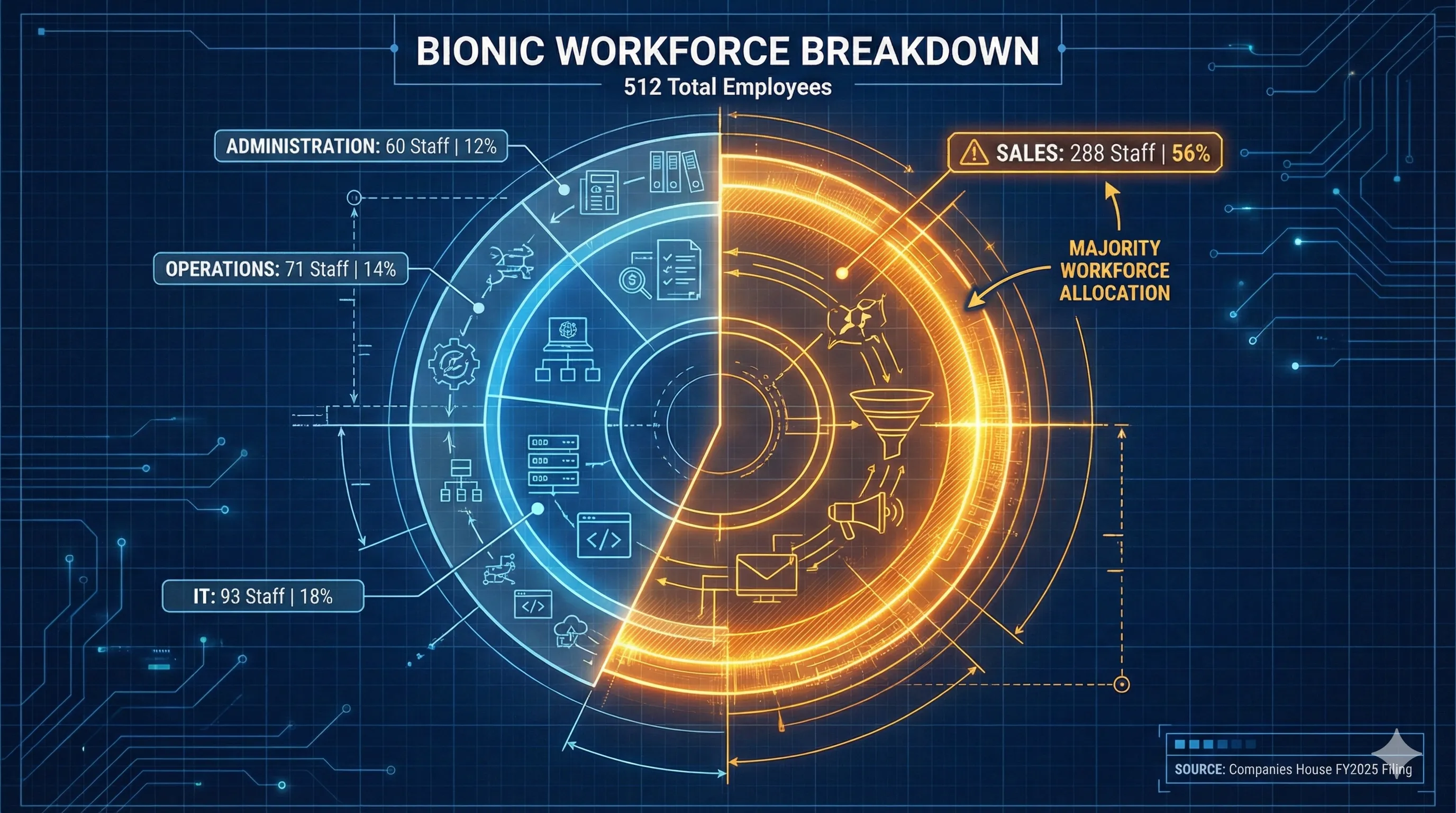

The Numbers: Bionic’s latest Companies House filing (opens in new tab) reveals they employ 288 sales staff out of 512 total employees - that’s 56% of their entire workforce dedicated to selling.

The Cost Structure: £30.4 million in annual staff costs, £290 million in debt, and £86.3 million in revenue. These costs are ultimately paid by the businesses they serve through commissions embedded in energy contracts.

The Maths: With 161,000 SME customers, that’s roughly £536 in average commission per business per annum - and the numbers suggest this model is under pressure.

The Alternative: Self-service platforms can deliver the same outcome (competitive energy prices) without the sales army, at a fraction of the cost.

What the Numbers Actually Show

Energy brokers don’t publish their commission rates. But UK company law requires all limited companies - public or private - to file accounts with Companies House. Bionic Services Limited’s FY2025 filing (year ending June 2024) is publicly available, giving us a rare window into how the traditional broker model actually works.

Let’s break down what the numbers tell us.

The Workforce: 56% Are Salespeople

| Department | Staff | Percentage |

|---|---|---|

| Sales | 288 | 56% |

| IT | 93 | 18% |

| Operations | 71 | 14% |

| Administration | 60 | 12% |

| Total | 512 | 100% |

More than half of Bionic’s workforce is dedicated to sales. This isn’t unusual for traditional brokers - the business model is fundamentally built on outbound calling and relationship management.

Why? Because switching business energy is complicated. While you can see indicative quotes online, actually completing a deal involves credit checks, supplier-specific customer criteria (some won’t accept pubs, care homes, or restaurants), contract negotiation, and data validation. The process is far more complex than clicking “switch” on a consumer comparison site.

That complexity requires people. Lots of them.

The Costs: £30.4 Million on Staff Alone

The filing breaks down staff costs:

- Wages and salaries: £26.9 million

- Social security: £2.9 million

- Pension contributions: £0.6 million

- Total: £30.4 million

That’s £59,000 average cost per employee. With 288 in sales, roughly £17 million goes directly to the sales function.

But staff costs aren’t the only overhead. Bionic also carries significant debt.

The Debt: £290 Million

The balance sheet reveals:

- Permira Credit facility: £85 million

- Loan notes to parent company: £204.6 million

- Total debt: ~£290 million

This debt has to be serviced. Interest payments come out of operating profits. And operating profits come from commissions on your energy contract.

The interest cost alone was £9.9 million in FY25.

The Revenue Model: Commission-Dependent

Bionic’s revenue comes almost entirely from commissions embedded in energy contracts - what the industry calls “uplift”. When they switch a business, the supplier pays Bionic a fee calculated as:

Commission = Uplift (p/kWh) × Annual Consumption (kWh) × Contract Length (years)

For example: 2p/kWh × 50,000 kWh × 3 years = £3,000 commission

FY25 figures:

- Revenue: £86.3 million (down 5% from £90.6m)

- Operating profit: £12.9 million (down from £15.8m)

- Profit after interest: £3.0 million (down 63% from £8.1m)

The profit decline is telling. When energy prices stabilised after the 2022-2023 crisis, broker revenues compressed.

Why? During the crisis, when unit rates spiked to 40-50p/kWh, a 4-5p uplift was barely noticeable - it looked like normal market volatility. Brokers could hide larger margins without customers questioning the rates. Now that prices have stabilised around 20-25p/kWh, that same 4-5p uplift represents a much larger percentage of the total - and is harder to justify.

Stable prices mean the traditional high-margin model is under pressure.

The Maths: What You’re Actually Paying

Let’s do some rough arithmetic:

- Revenue: £86.3 million

- Customers: 161,000 SMEs

- Average commission per customer: £536

That £536 average masks huge variation. Commission structures typically work as pence-per-kWh, so:

- A small shop using 20,000 kWh/year might pay 4-5p/kWh commission (£800-1,000)

- A larger business using 200,000 kWh/year might pay 1-2p/kWh (£2,000-4,000)

The point isn’t to criticise the Bionic energy broker specifically. They’ve built a successful business helping 161,000 SMEs switch energy. The point is to understand what you’re paying for - and whether those energy broker commission rates represent good value. You can calculate what commission costs at different rates with our free tool.

Why This Model Exists (And Why It’s Changing)

Traditional energy brokers exist because of a market failure: business energy prices aren’t transparent.

Unlike home energy - where Ofgem (opens in new tab) mandates comparison sites and price caps - business energy comparison is fragmented. You can see indicative rates online, but actually completing a switch independently isn’t possible yet. You either use a broker, or go direct to a single supplier (missing out on market comparison). Until platforms like Meet George launch, there’s no way to shop around and complete the switch yourself.

For 20 years, that someone was a broker with a phone. They’d call you, gather your details, run quotes through proprietary supplier systems, and present you with options. In return, they’d take a commission embedded in your unit rate.

This worked. Brokers now facilitate around 70% of all SME energy switches - and as we’ve documented in our broker market comparison, the market is more consolidated than it appears. But the model has costs:

- Sales overhead: Someone has to make those calls

- Relationship management: Someone has to follow up, handle objections, close deals

- Infrastructure: CRM systems, dialler technology, training, management

- Debt servicing: Private equity ownership means returns must be generated

All of these costs get baked into the uplift a broker charges you, which gets added to the supplier’s base energy rate.

The Shift to Digital

Interestingly, Bionic’s own filing notes that “digital renewals” grew 15% while new business declined. They’re investing in online self-service because they recognise the model is changing. (Though be cautious - digital auto-renewals can still come with the same hidden uplift problems as phone-based deals.)

The question for SMEs is simple: if you can get the same outcome (competitive energy prices) without the sales overhead, why pay for it?

What This Means For Your Business

When you use a traditional broker, you’re paying for:

- The salesperson who called you

- Their manager

- The IT systems

- The office space

- The debt interest

- The profit margin

This isn’t wrong. It’s just expensive.

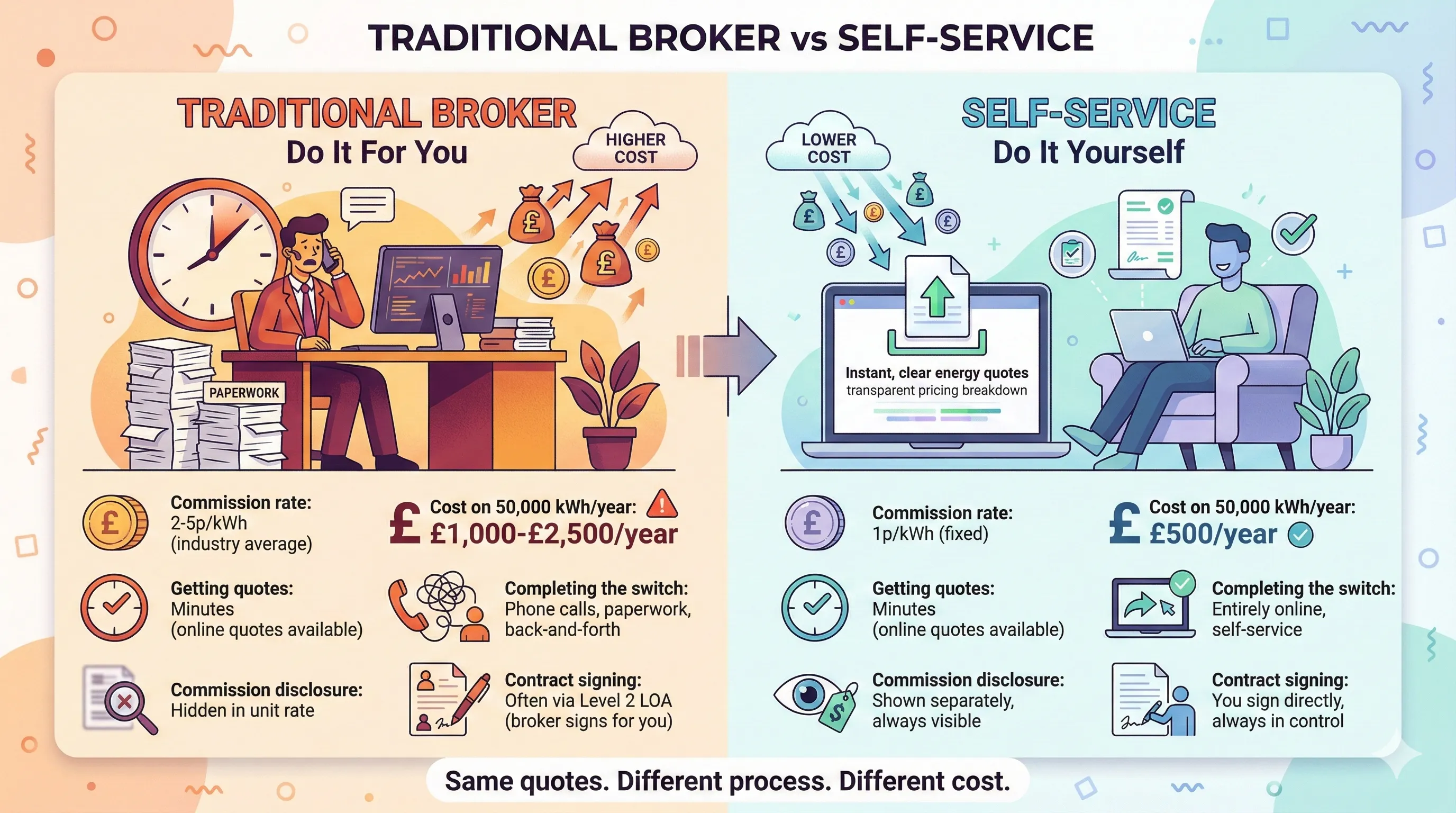

The Alternative: Self-Service

Self-service energy platforms eliminate the sales layer. Instead of calling you, they let you upload a bill and see prices instantly.

Bionic vs Meet George: Cost Comparison

| Factor | Traditional Broker (Bionic) | Self-Service (Meet George) |

|---|---|---|

| Commission rate | 2-5p/kWh (industry average) | 1p/kWh (fixed) |

| Commission on 50,000 kWh/year | £1,000-£2,500/year | £500/year |

| Getting quotes | Minutes (online quotes available) | Minutes (online quotes available) |

| Completing the switch | Phone calls, paperwork, back-and-forth | Entirely online, self-service |

| Commission disclosure | Hidden in unit rate (until Oct 2024) | Shown separately, always visible |

| Contract signing | Often via Level 2 LOA (broker signs for you) | You sign directly, always in control |

| Philosophy | ”Do It For You” - they handle everything | ”Do It Yourself” - you stay in control |

The quotes are the easy part - most brokers can show you prices in minutes. The real difference is what happens next. With traditional brokers, completing the switch means phone calls, chasing paperwork, and often signing a Level 2 LOA that lets them “do it for you” (including signing future contracts without your consent).

Bionic’s “Do It For You” model sounds convenient, but it comes with a trade-off: you lose visibility and control. When a broker can sign contracts on your behalf, you may not know what commission they’ve added until it’s too late.

Meet George takes the opposite approach: Do It Yourself. We give you the tools to compare, decide, and switch - entirely online, entirely in your control. No phone calls. No Level 2 LOAs. No one signing anything without your explicit approval.

Meet George’s model:

- You upload a bill PDF

- AI extracts your meter details (MPAN, consumption, contract end date)

- We pull live prices from 20+ suppliers

- You choose and sign a contract yourself

- We charge a flat 1p/kWh fee - fully transparent

No sales calls. No hidden uplifts. No Level 2 LOAs that let someone sign contracts without your consent.

The same outcome - a competitive energy price - at a fraction of the cost.

The Bigger Picture

This analysis isn’t about Bionic being “bad.” They’re a legitimate business that’s helped thousands of SMEs. Their Trustpilot reviews are generally positive. They employ over 500 people.

But the traditional broker model is expensive by design. It requires armies of salespeople because the process of switching business energy has never been automated. Every customer needs hand-holding through an opaque process - which is exactly why Ofgem is pushing for broker regulation.

What’s changing is that it doesn’t have to be this way anymore.

AI can read a bill. APIs can pull live prices. Digital signatures can complete contracts. The entire sales function can be replaced with software.

The businesses that understand this will pay 1p/kWh. The ones that don’t will continue paying 4-5p/kWh for someone to do it for them.

The maths speaks for itself.

Why 2026 Makes This Even More Urgent

The broker cost question isn’t just academic. Several changes hitting in 2026 make understanding what you’re paying for more important than ever:

TNUoS Charge Surge: From April 2026, Transmission Network Use of System charges are rising from £3.8bn to £7.5bn (opens in new tab) - nearly doubling. This gets passed through to business bills via standing charges and unit rates, and the impact varies significantly by region.

Market-Wide Half Hourly Settlement (MHHS): The MHHS rollout (opens in new tab) is changing how business energy is metered and billed. Accurate consumption data becomes critical.

No SME Relief: While the government announced £420m/year in savings for energy-intensive industries (opens in new tab) from April 2026, this only covers ~500 large industrial users. The 5.7 million UK SMEs get nothing.

The combination means: higher baseline costs, more complex billing, and no government help. The businesses that secure competitive rates now - and understand exactly what they’re paying in broker fees - will be better positioned than those left on deemed rates or overpaying through hidden uplift.

How to Check Your Current Broker Costs

Wondering how much your energy broker is charging you? Here’s how to find out what you’re actually paying in broker commission rates:

Step 1: Request a Commission Disclosure

Contact your current broker and ask them to disclose their commission rate in writing. Since October 2024, brokers are legally required to tell you if you ask. If they refuse or give vague answers, that’s a red flag - reputable brokers have nothing to hide.

Step 2: Check Your Letter of Authority

Find the Letter of Authority (LOA) you signed with your broker. Check if it’s:

- Level 1 (safe) - Data access only, you sign all contracts yourself

- Level 2 (risky) - Gives them authority to sign contracts on your behalf without consent

Level 2 LOAs can lead to auto-renewals with fresh uplift charges every contract cycle.

Step 3: Compare Your Rate to Current Market Prices

Upload your latest energy bill to a comparison platform to see how your current rate compares to live market prices. If your rate is 3-5p/kWh higher than quoted market rates, you’re likely paying hidden uplift.

You might be surprised what you find.

Ready to understand your options? Read our complete guide on how to switch business energy, explore our comparison of the broker market, or join the Meet George waitlist to switch with transparent pricing when we launch.

Sources:

- Bionic Services Limited - Companies House Filing (opens in new tab) (FY2025, year ending June 2024)

- Ofgem - Third Party Intermediaries (opens in new tab)

- Energy UK - Transparency Code (opens in new tab)

- Gov.uk - British businesses to save over £400m a year (opens in new tab)

- The Energyst - TNUoS changes in 2026 (opens in new tab)