TL;DR: Key Takeaways

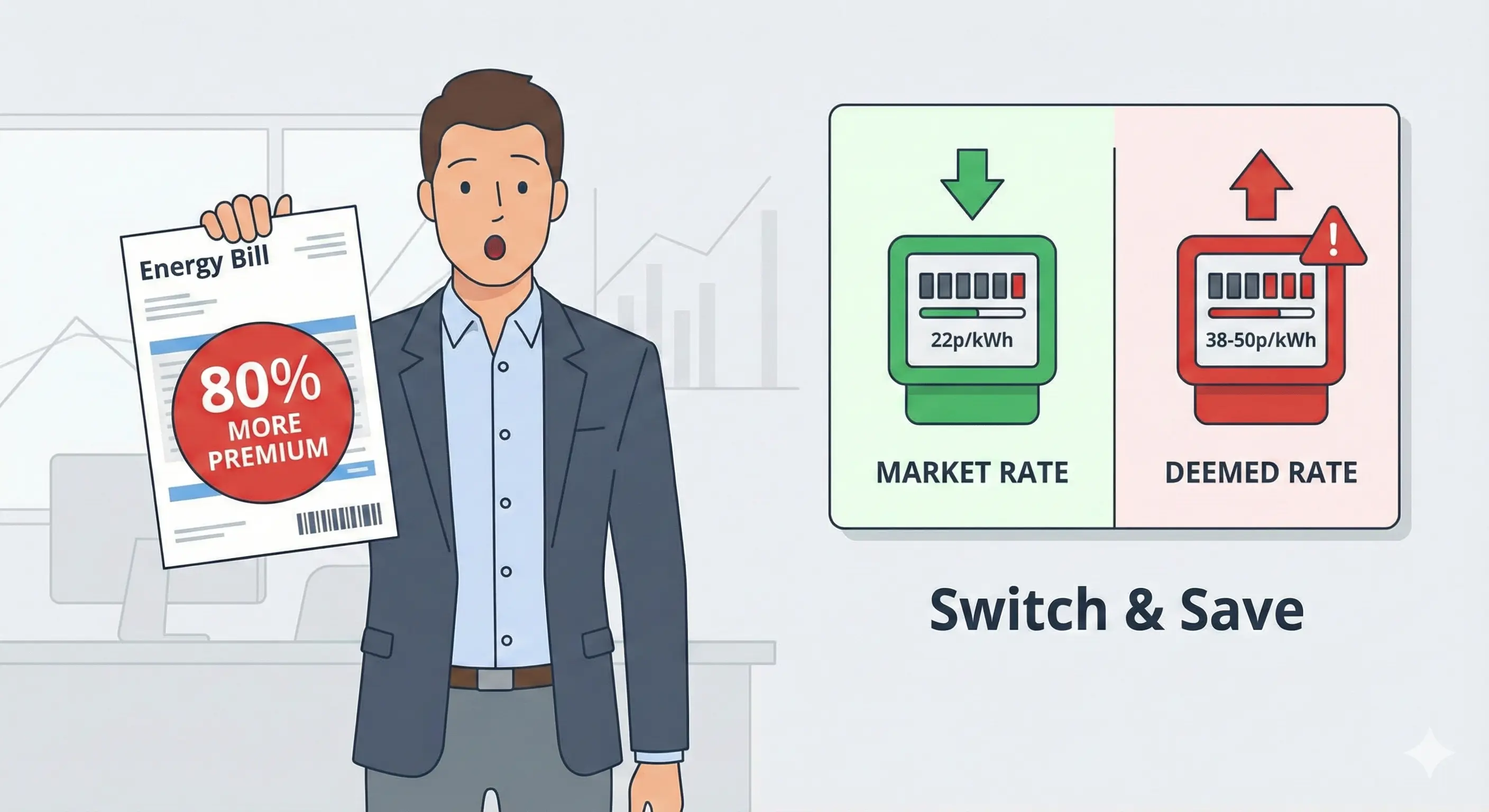

What are Deemed Rates? Deemed rates are the default, out-of-contract prices suppliers charge when your fixed deal ends and you haven’t renewed. They are currently 38-50p/kWh - nearly double the market rate of c. 22p/kWh.

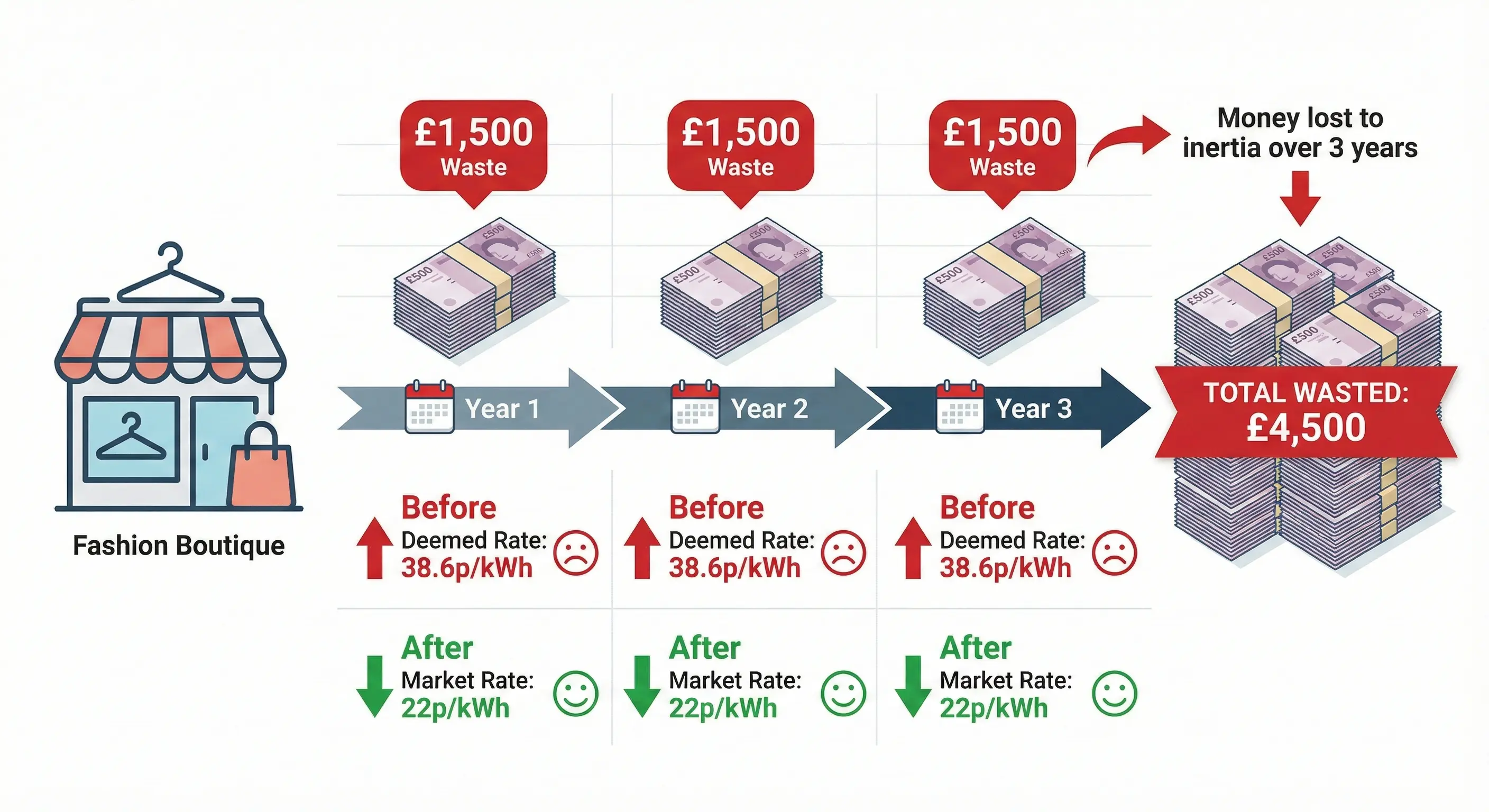

The Cost of Inertia: A small business on deemed rates can waste £1,500+ per year - that’s £4,500 over a typical 3-year contract period. This isn’t buying “better” electricity, it’s the price of not switching.

Why So Expensive? Suppliers cannot buy your energy in advance because you could leave any time. They purchase on the volatile “day-ahead” market and pass the risk premium directly to you.

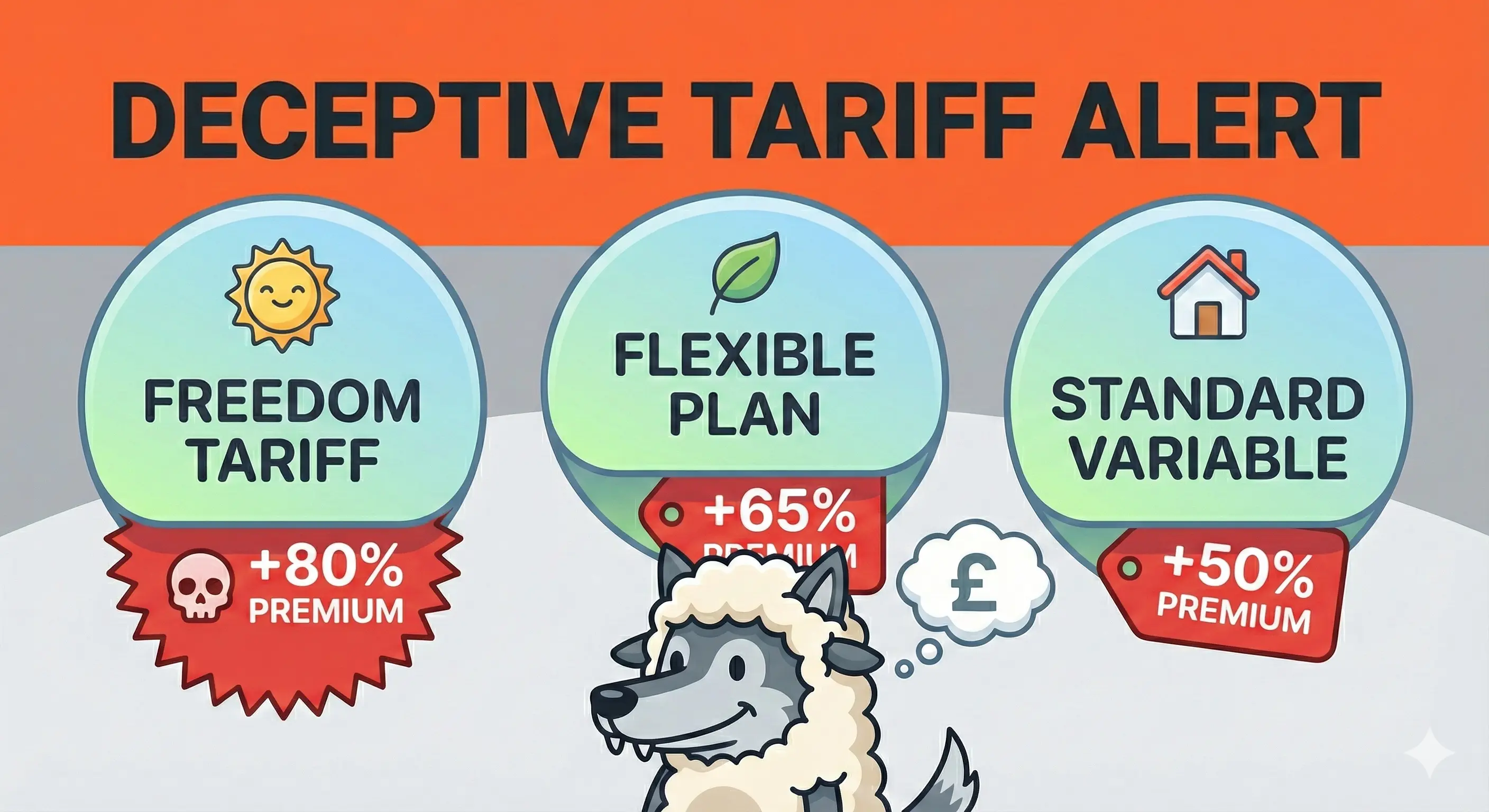

The “Freedom” Trap: Suppliers rebrand deemed rates with friendly names like “Freedom Tariff” or “Flexible Business Plan.” Don’t be fooled - that “freedom” costs you a 50-80% premium.

The Escape: You can switch away from deemed rates immediately with no exit fees. Learn how to switch in 10 minutes.

What Are Deemed Rates?

Deemed rates (also called “out-of-contract rates” or “standard variable rates”) are the default prices energy suppliers charge when your fixed-term contract expires and you haven’t actively renewed or switched to a new supplier.

If you haven’t looked at your energy contract in a while, you might be sitting on a financial time bomb. The scale of the problem is staggering: the Competition and Markets Authority found that 45% of UK microbusinesses remain trapped on expensive default tariffs, resulting in collective overcharging of £180 million annually. More recent research suggests 18% of all UK businesses remain on out-of-contract rates, collectively overspending by approximately £500 million annually on rates 30-50% higher than fixed contracts.

The 2022 energy crisis made this worse. Switching activity collapsed by 73% - from 4.99 million switches in 2021 to just 1.3 million in 2022. Many businesses, faced with terrifying crisis-era rates of 30-40p/kWh, simply let their contracts lapse rather than lock in at peak prices. The result? A wave of businesses falling onto deemed rates that are only now beginning to switch as contracts signed in 2023 expire.

Suppliers are required by Ofgem regulation (opens in new tab) to publish these rates on their websites - though they are often hidden deep in the footer links. But you will notice the bill.

Deemed rates are currently hovering around 38-50p per kWh - nearly double the market rate of c. 22p.

At Meet George, we see businesses wasting thousands of pounds on these rates every month. Here is why they exist, how to spot them, and how to escape them.

The Cost of Inertia: A Real-World Case Study

Recently, we helped a small fashion boutique in London switch away from deemed rates.

Their Situation: They had rolled out of contract two years ago without realising it. This is a classic example of the digital renewal trap - missing your renewal window and falling onto expensive out-of-contract rates.

The Cost: They were paying 38.6p/kWh, but during the previous two years, their rate had spiked as high as 56p/kWh during market volatility.

The Fix: We moved them to a fixed contract at 22p/kWh.

The Result: A saving of £1,500 per year (£4,500 total over their new 3-year contract).

That £4,500 was pure waste. It wasn’t buying them “better” electricity. It was just the price of inertia.

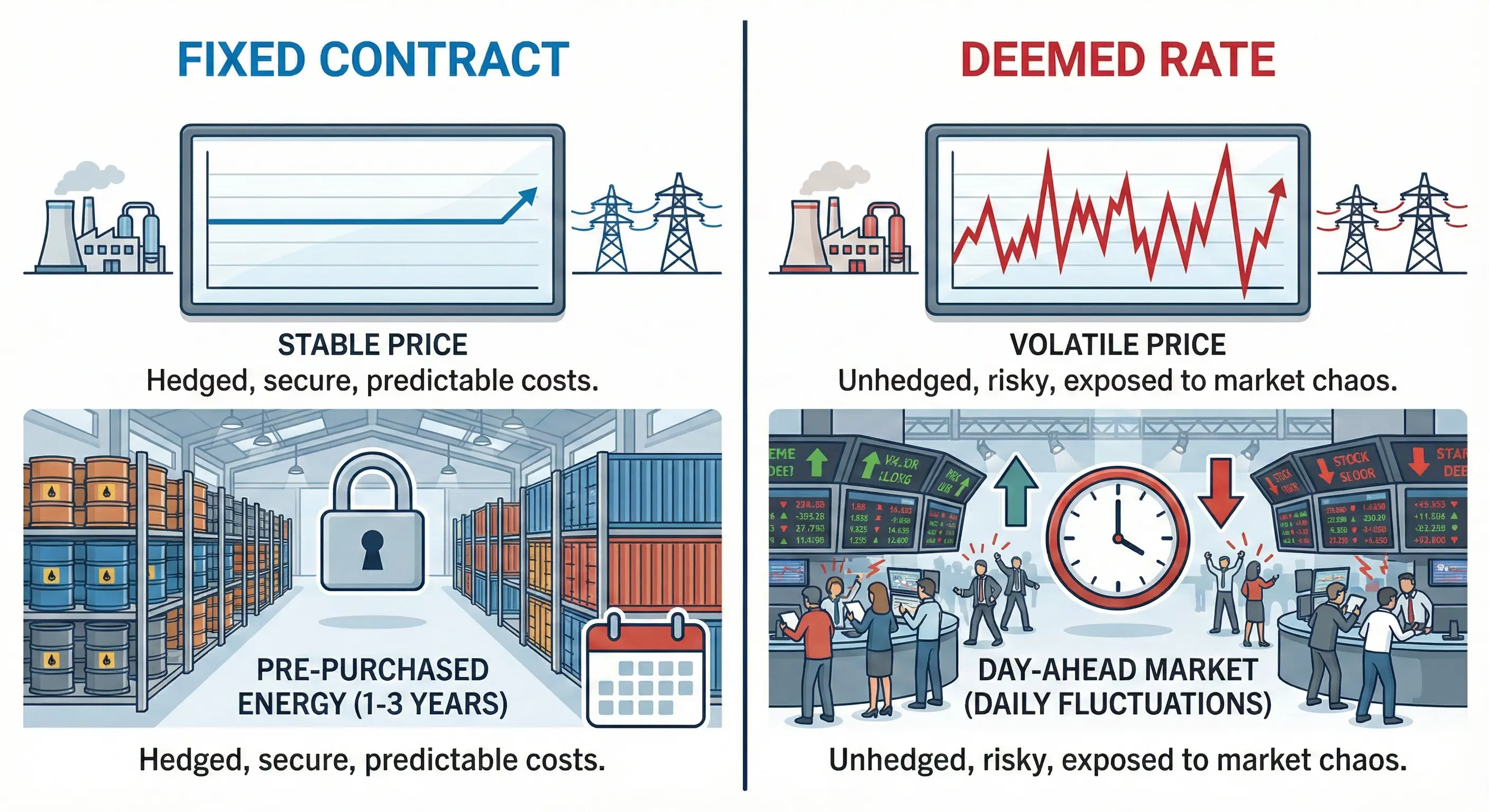

Why Are Deemed Rates So Expensive? (The “Day-Ahead” Risk)

Suppliers will tell you deemed rates are high because they are “risky.” Here is the mechanics of why that is true:

1. The Fixed Contract Strategy (Cheaper)

When you sign a 3-year deal, the supplier buys most of your energy (typically 70-80%) in advance. They hedge their costs because they know you will be a customer for the next 36 months.

They then use the “day-ahead” market only to fine-tune their needs, protecting you from massive price spikes.

2. The Deemed Rate Strategy (Volatile)

Because you are out of contract, you can leave at any time. The supplier cannot buy your energy years in advance because you might leave next week.

Instead, they must buy your power on the Day-Ahead Market (opens in new tab).

The Danger: If the UK has a cold snap and gas plants fire up to meet demand, the wholesale price spikes. On a deemed rate, that spike is passed directly to you (hence the 56p rate the boutique paid).

You are paying a premium for the supplier’s inability to plan.

The “We Don’t Know Your Usage” Excuse is Dying

Historically, suppliers also claimed deemed rates had to be high because they didn’t know how much energy a business would use without a contract.

That excuse is dying fast. With the rollout of Market-wide Half-Hourly Settlement (MHHS) (opens in new tab), the industry is changing.

The Transition: Non-domestic meters will start migrating to this new system from April 2026.

The Data: Once migrated, suppliers will eventually receive granular, 30-minute usage data for every business.

The Future: In two years, suppliers will know exactly what you use.

However, even when they know your usage perfectly, deemed rates will likely remain high. Why? Because the duration risk remains. Even if they know you use 25,000 kWh a year, they still won’t buy it in advance if they think you might switch supplier tomorrow.

The “Freedom” Trap: Friendly Names for Bad Deals

Suppliers know that “Deemed Rates” sounds scary. So, they often rebrand these tariffs with friendly, flexible-sounding names.

Watch out for tariffs called:

- “The Freedom Tariff”

- “Flexible Business Plan”

- “Standard Variable Rate”

- “Rolling Contract”

- “Variable Business Tariff”

They sell it as a benefit: “Enjoy the freedom to leave whenever you want!”

The Reality: That “freedom” is costing you a 50-80% premium. In energy, you want to be in a contract. Stability is cheap; freedom is expensive.

Why Brokers Charge SMEs More (The “Informed Gap”)

It is worth noting that even if you are in a fixed contract, you might still be paying a high rate (e.g., 28p+). This isn’t a deemed rate - this is likely a broker uplift.

Servicing an SME takes almost as much work as servicing a larger energy user (like a large workspace or hotel). The broker still has to do the admin, explain the risks, and handle the contracts. To cover their manual overheads on a smaller deal, they often add a much larger margin.

But there is a darker reason too. Predatory brokers know that SMEs are often less informed about energy markets than large businesses with high energy use.

- A large energy user knows a supplier’s base day rate is c. 20p/kWh or less.

- A small business owner often doesn’t.

Because the likelihood of an SME agreeing to a ridiculously high uplift is far greater, some brokers simply try their luck. They present a 28p rate (when the market is 22p) hoping you won’t notice or ask questions. This is why Energy Ombudsman complaints about brokers rose 112% in 2024 - businesses are waking up to these practices.

This is why Meet George uses AI. By automating the entire process - from bill extraction to contract signing - we remove the manual cost. We can charge a flat 1p/kWh fee and still make a profit, meaning you get access to “large corporate” rates even as a small business.

How to Check if You Are on Deemed Rates

1. Check Your Tariff Name

Look at your bill for the Tariff Name. If it says “Standard Variable,” “Deemed,” “Out of Contract,” or any of the “freedom” names above, you are in the trap.

2. Check Your End Date

If your bill doesn’t show a “Contract End Date,” you likely don’t have one - because you’re out-of-contract and are in the trap.

3. Check the Rate

If you are paying more than 28p/kWh in 2025, investigate immediately. It could be:

- A deemed rate (you’re out of contract)

- A bad contract with a high broker uplift

Either way, you’re overpaying. Watch out too for volume tolerance clauses that can turn even a “cheap” fixed rate into a penalty trap if your usage doesn’t match predictions.

The Escape Route

The one advantage of deemed rates is that you are not locked in. You can switch immediately without paying an exit fee.

Don’t wait. Every day you stay on deemed rates is money wasted.

- Upload your bill to Meet George - We extract your MPAN/MPRN and consumption data automatically.

- See live market rates - We always show our 1p/kWh fee separately so you know exactly what you’re paying.

- Switch in 10 minutes - Stop the cash bleed.

Ready to escape deemed rates? Learn the complete 5-step switching process or join the Meet George platform waitlist to switch in 10 minutes with full transparency - no hidden fees, no surprises.