TL;DR: Key Takeaways

What is Uplift? Uplift is the hidden commission that brokers add to your unit rate. Instead of sending you a bill for their service, they silently inflate your pence-per-kWh rate - often by 3-5p or more.

The Real Cost: A typical small business using 25,000 kWh/year could pay £2,250 more over a 3-year contract just in hidden broker fees - money that should be in your bank account.

The Standing Charge Trick: It’s not just unit rates. Some brokers inflate your standing charge too - adding £657+ to your bill over 3 years in a place you’re unlikely to check.

The Law is Changing: As of October 2024, Ofgem requires commission disclosure for all business customers. The government is introducing mandatory regulation for energy brokers. But legacy contracts remain hidden.

Meet George’s Approach: We charge a transparent, fixed 1p/kWh. You see the supplier’s base rate and our fee separately. No hidden margins, no “going for gold.”

What Is Hidden Broker Commission (Uplift)?

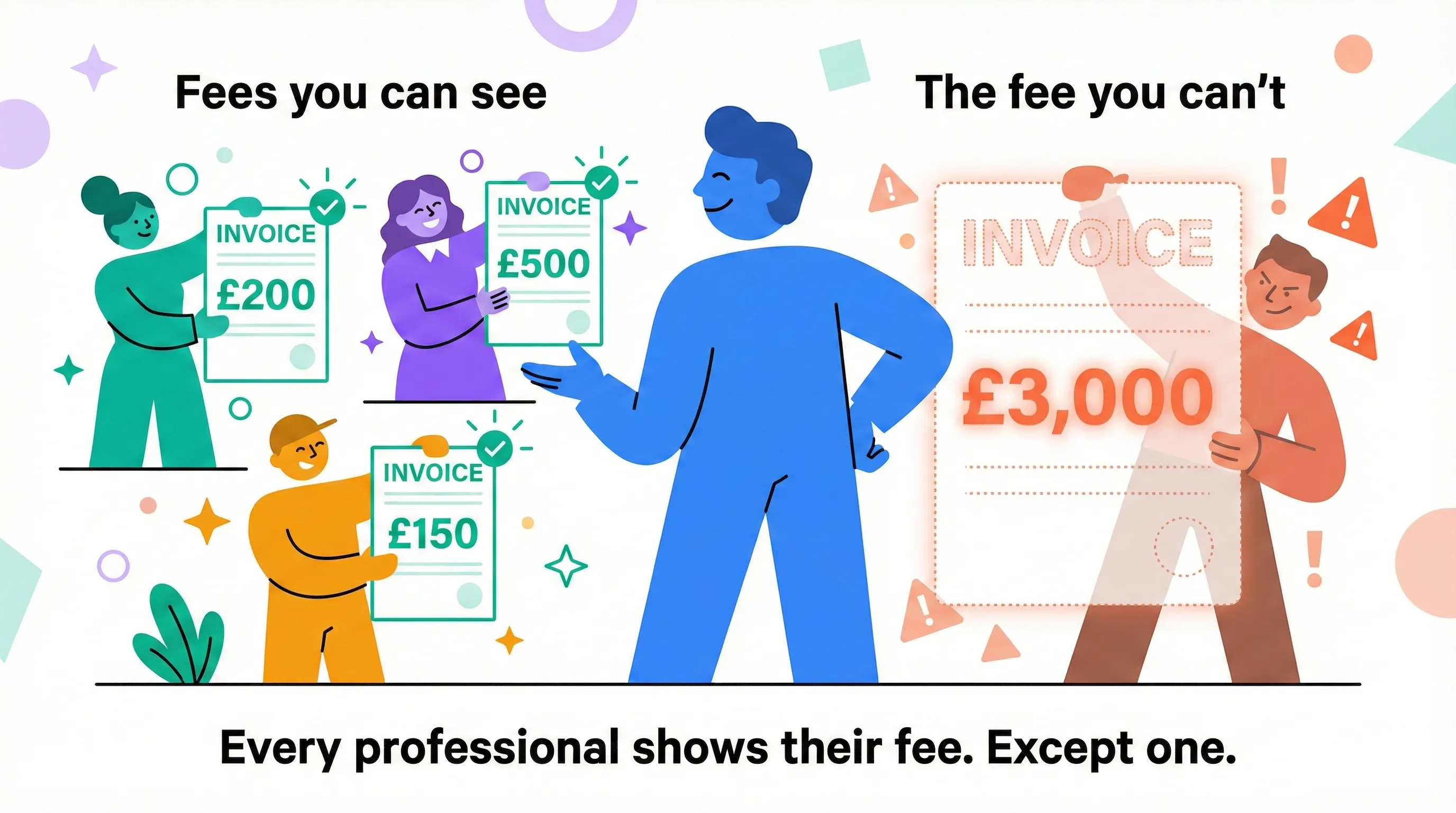

Hidden broker commission, commonly called “uplift” in the energy industry, is the practice of adding a margin to your energy rates without transparent disclosure. Instead of charging you a separate, visible fee for their service, brokers inflate your unit rate - the pence-per-kilowatt-hour you pay for energy.

The scale of unawareness is staggering: Ofgem research shows only 14% of businesses using brokers believed they were charged for the service, while 73% thought they paid nothing at all. We explore why businesses think energy brokers are free in depth - but the short answer is that the industry designed it this way. In 2023, before disclosure requirements, only 7% of businesses using brokers reported being charged - despite commissions being embedded in virtually every contract. This isn’t an accident - it’s by design.

If you bought a house, you’d pay an estate agent a fixed fee - maybe 1% or 2%. You’d know exactly what it cost.

Business energy brokers don’t work like that.

For decades, the industry has operated on this hidden commission model. You might think you’re paying the supplier’s best price. In reality, you could be paying a premium of 4p/kWh or more - costing your business thousands of pounds a year - just to line a broker’s pocket.

At Meet George, we charge a transparent, flat 1p/kWh. We want you to know exactly how the “old way” works so you can spot it a mile off.

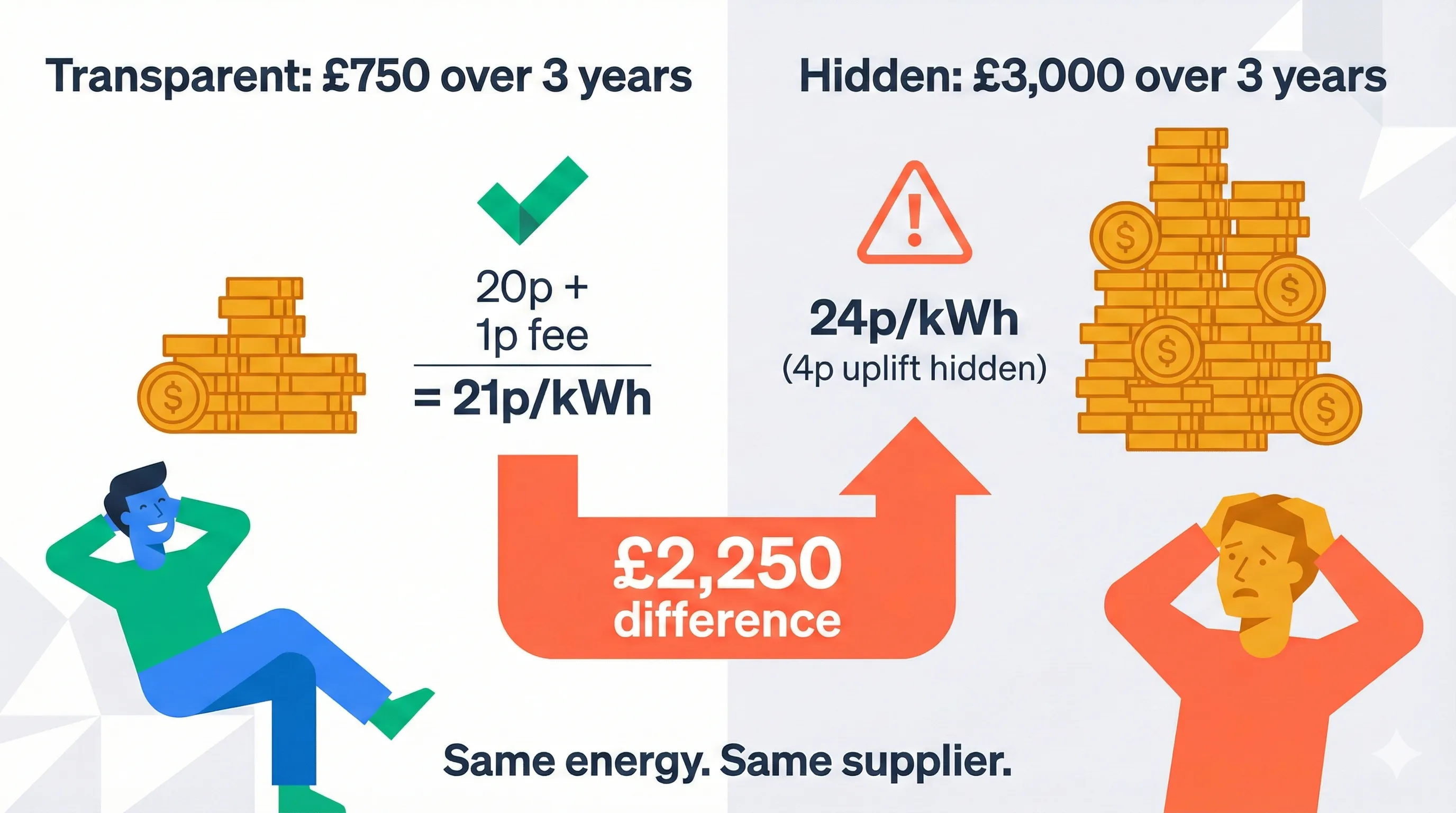

The £2,250 Difference: A Real-World Example

Let’s look at the maths for a typical small business using 25,000 kWh of electricity per year on a 3-year contract.

Scenario A: The Meet George Way (Transparent)

- Supplier Base Rate: 20p/kWh

- Meet George Commission: 1p/kWh (Fixed, shown separately)

- Total Rate You Pay: 21p/kWh

- Total Commission Paid: £250 per year (£750 total over 3 years)

Result: You pay a fair price for the service. You know exactly what you’re paying for.

Scenario B: The “Predatory Broker” Way (Hidden)

- Supplier Base Rate: 20p/kWh

- Broker “Uplift”: 4p/kWh (Hidden in your rate)

- Total Rate You Pay: 24p/kWh

- Total Commission Paid: £1,000 per year (£3,000 total over 3 years)

Result: You lose £2,250 purely because you didn’t know the broker added a 4p margin.

That £2,250 is money that should be in your bank account, not theirs.

The Problem with “Phone Deals” vs. Visual Clarity

One of the biggest issues with traditional energy brokers is that deals are often done over the phone.

When a broker rattles off a unit rate of “24.5 pence per kilowatt hour,” it sounds abstract. It is very hard for a business owner to mentally calculate what that actually means for their bottom line.

Meet George is different because it is visual. We don’t just show you the rate; we show you the “Pound Note” value:

- “You currently pay £800/month.”

- “With this switch, you will pay £650/month.”

- “You will save £1,800/year.”

Business owners understand profit and loss, not “p/kWh.” By seeing the numbers visually on screen, you can make a decision based on the actual financial impact to your business, without the confusion of energy jargon.

The “Wild West” of Uplift Limits

Not all brokers are bad, and not all suppliers are the same. But the incentives are often misaligned.

- Some reputable suppliers cap the amount of uplift a broker can add (e.g., capping it at 2.5p/kWh or 1p/kWh for renewals).

- But others - often less reputable suppliers - operate with no limits. They allow brokers to “go for gold,” adding uplifts of 6p, 8p, or even 10p.

The Trap: A low-tier broker might push you towards a slightly more expensive supplier simply because that supplier lets them add a massive commission. They are incentivised to sell you the contract that pays them the most, not the one that saves you the most money. If you’re not careful, you could end up paying rates close to deemed rate levels - even while on a fixed contract.

Documented Extreme Cases

These aren’t hypothetical scenarios. Ofgem and legal investigations have uncovered shocking real-world examples:

- Golf club: Ofgem’s Non-Domestic Market Review found a case where a broker charged a 50% commission fee - costing the club £24,000 in hidden fees

- Church: Business Energy Claims documented a church where over 50% of total utility spend was hidden commission

- Care home: A care home was initially quoted broker fees of £68,126 - reduced to just £12,606 when challenged (an 81% reduction)

The scale of potential mis-selling has led to a £2 billion class-action lawsuit filed by Harcus Parker on behalf of up to 2 million UK businesses, alleging systematic undisclosed commissions over the past decade. In extreme documented cases, commission reached 60% of total energy costs. The Energy Ombudsman’s latest data shows broker complaints rose 112% in 2024, with 88% of cases relating to sales practices.

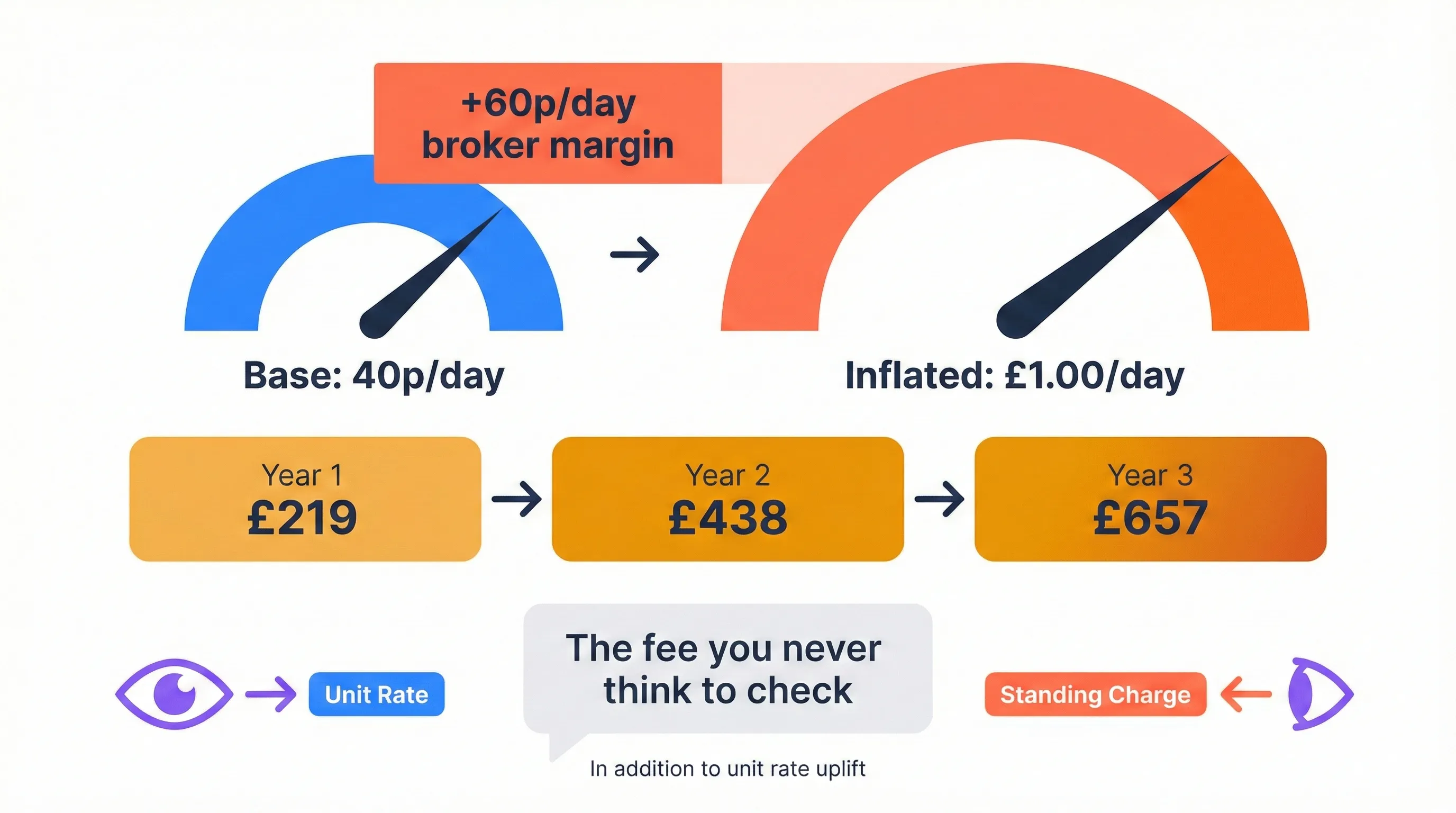

The Standing Charge Sting

It’s not just your unit rate. Some suppliers also allow brokers to add commission to your standing charge (the fixed daily fee for having a meter).

A broker might take a base standing charge of 40p/day and inflate it to £1.00/day.

The Impact: Over a 3-year contract, that extra 60p/day adds £657 to your bill.

The Deception: Because businesses focus heavily on the unit rate (p/kWh), they often ignore the standing charge, making it the perfect place to hide extra profit.

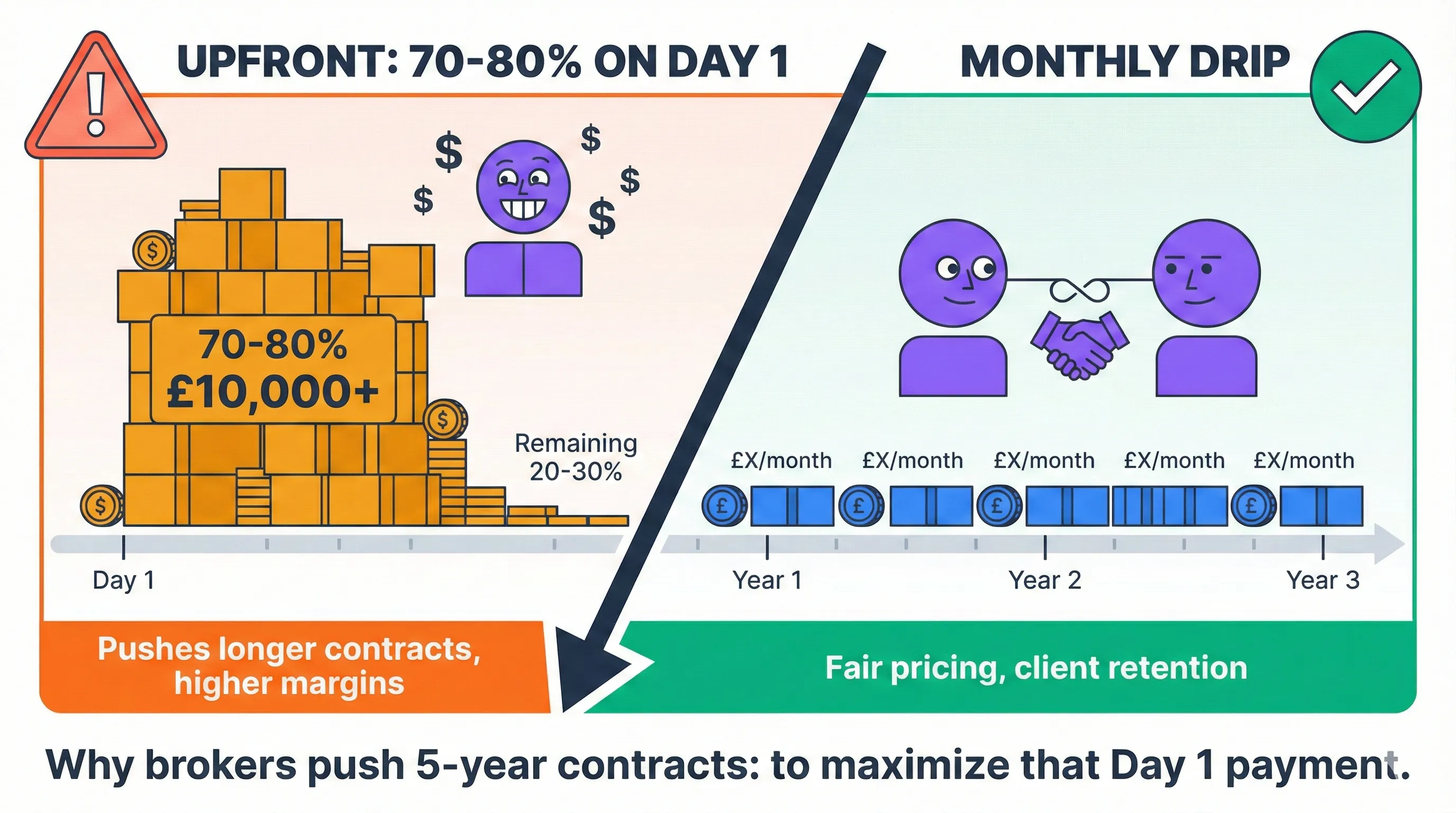

The Upfront Cash Grab (80% Now, 20% Later)

Why do predatory brokers push for long-term contracts (3, 4, or 5 years)? It’s usually about their cash flow, not your price stability.

Many suppliers offer brokers a choice:

Paid on the Drip: The broker gets paid monthly as you pay your bill. This aligns their interest with yours - if you stop paying or the business fails, they stop getting paid.

Upfront Payment: The supplier pays the broker 70-80% of the total commission on Day 1.

The “Churn and Burn” Incentive: If a broker signs you to a 5-year deal with a massive uplift, they could receive a payment from the supplier for £10,000+ next week. While there is technically a “clawback” risk (where they have to pay it back if you go bust), many low-tier brokerages ignore this. They want the cash in the bank today and will worry about the clawback later.

The Law is Changing (But Legacy Contracts Remain Hidden)

For years, broker commissions were totally hidden. But the net is tightening - and the market is already responding.

The Scale of the Problem

The UK TPI (Third Party Intermediary) market generates £525 million annually in broker commissions - more than double the £232 million it was worth in 2014. Approximately 2,700+ active brokers compete for this revenue, though the market is far more consolidated than it appears - with just four networks controlling the majority of switches.

The Energy Consultants Association (opens in new tab) provides a useful benchmark: a typical SME using 40,000 kWh annually pays around £1,000 in broker commission over a 2.5-year contract - equivalent to 1.0p/kWh.

The 2022 energy crisis fundamentally changed commission dynamics. Pre-crisis, supplier caps typically limited broker uplift to 0.05-2p/kWh. Post-crisis, documented rates range from 0.05-5p/kWh as standard, with extreme cases reaching 10p/kWh. When retail rates spiked to 30-40p/kWh, a 5-7p commission could be embedded without detection - whereas the same amount would have been conspicuous at pre-crisis rates of 16-18p/kWh.

Critically, smaller businesses pay higher commission rates per kWh than larger energy users - even when using the same broker. Here’s what the SME market actually looks like:

| Customer Size | Annual Usage | Good Brokers | Aggressive Brokers |

|---|---|---|---|

| Micro | 0-10,000 kWh | 0.8-1.2p/kWh | 1.5-4.0p/kWh+ |

| Small | 10,000-50,000 kWh | 0.8-1.2p/kWh | 1.5-4.0p/kWh+ |

| Medium | 50,000-100,000 kWh | 0.8-1.2p/kWh | 1.2-2.5p/kWh+ |

Why do SMEs pay more? They don’t have dedicated energy managers who understand the market. They negotiate less and are less likely to spot inflated rates. The businesses who need the most protection often pay the highest per-unit commissions.

Meet George charges a flat 1p/kWh - competitive with good brokers and significantly below the 2-4p/kWh charged by aggressive operators targeting SMEs. Want to see the difference for your business? Use our commission calculator to compare what you might be paying now versus transparent pricing.

October 2024: Mandatory Disclosure

As of 1 October 2024, Ofgem rules require suppliers to disclose broker commissions for all business customers (not just microbusinesses). This is a significant step forward.

The Impact: Industry sources report 20-30% reductions in average commission rates since transparency requirements took effect. Brokers who previously charged 1.5-2p/kWh have been forced to reduce rates as customers now comparison shop with full visibility.

The Catch: This only applies to new contracts signed after that date.

The Legacy Trap: If you signed a 3-year contract in 2023, your commission is still hidden. You won’t know you’ve been overcharged until you renew.

Incoming Regulation for Brokers

The government has confirmed plans to introduce mandatory regulation for Third Party Intermediaries (TPIs) - the official term for energy brokers and switching services.

We welcome this. Read more about our stance on regulation and why we believe it will clean up the market by removing predatory operators.

- Read the Government’s press release on greater protections (opens in new tab)

- Read the consultation on regulating TPIs (opens in new tab)

The Court of Appeal Ruling

In the landmark case Expert Tooling v Engie (March 2025), the Court of Appeal confirmed that brokers owe a “fiduciary duty” to their clients.

The court found that a broker had added a 5p/kWh uplift (taking 80% of it upfront) without the client’s informed consent. This created a conflict of interest that the courts deemed unacceptable.

The takeaway: The courts are waking up to this - make sure you do too.

How to Spot Hidden Uplift

Before signing any energy contract, ask these questions:

-

“What is the supplier’s base rate vs. your commission?” - If the broker can’t (or won’t) separate these, that’s a red flag.

-

“Is your commission in the unit rate, standing charge, or both?” - Force them to be specific.

-

“Are you receiving upfront payment from the supplier?” - If yes, ask what percentage and whether there’s a clawback clause.

-

Check the contract itself - Since October 2024, commission should be disclosed in the “Third Party Costs” section.

-

Compare against market rates - If your quoted rate seems 3-5p higher than publicly available rates, you’re likely paying hidden uplift.

The Meet George Difference

We built Meet George because we hated this opacity.

- Fixed Commission: We charge 1p/kWh. Always. See how we’re paid.

- Total Transparency: We show you the Supplier Base Rate + Meet George Fee = Total Rate.

- No “Go for Gold”: We scan rates from over 20 suppliers and present you with the best options for your business, not the ones that pay us the most.

- Visual Clarity: Our platform shows you everything on screen - the 1p fee, total cost, and savings - so you can’t be tricked by fast talk over the phone.

- Pro-Regulation: We welcome incoming regulation because it will clean up the market and remove the predatory operators who give the industry a bad name.

Don’t let a broker retire on your energy bill. Check the rates, ask the hard questions, or switch to a platform that tells you the truth upfront.

Ready to switch the transparent way? Learn the complete 5-step switching process or join the Meet George platform waitlist to see exactly what you’re paying - no hidden margins, no surprises.