Quick Answer: Business electricity standing charges are fixed daily fees (typically 40p-£1.60/day for SMEs) that you pay regardless of energy consumption. They cover network infrastructure, metering, and supplier costs. In 2025, the average UK business pays around 63p/day (£230/year) in standing charges alone - but this can rise to £8-£20/day for half-hourly metered sites or businesses on deemed rates.

TL;DR: Key Takeaways

What Standing Charges Cover: Network costs (DUoS for local distribution, TNUoS for national transmission), metering and data collection, supplier administration, and contributions to government policy schemes.

Typical 2025 Costs: SMEs pay 40p-£1.60/day (£146-£584/year). Half-hourly metered businesses pay £8-£20/day (£2,920-£7,300/year). Out-of-contract standing charges are significantly higher as suppliers load margin into them.

The Undisclosed Trap: Some energy brokers add commission to standing charges as well as unit rates. Not all suppliers allow this, but those that do may have no cap on uplift - meaning predatory brokers can inflate both components of your bill.

Regional Variation: Businesses in London may pay 0-47p/day on some tariffs, while rural Scotland and North Wales face significantly higher network charges due to DUoS and TNUoS differentials. We’ve analysed regional business energy pricing across the UK - the gap can be as high as 39%.

The Meet George Approach: We show standing charges transparently alongside unit rates, so you can compare total annual costs - not just headline p/kWh figures that hide expensive fixed fees.

What Is a Business Electricity Standing Charge?

A business electricity standing charge is the fixed daily fee you pay simply to have a live electricity supply - before you use a single kWh. Think of it as the “membership fee” for being connected to the electricity network.

Unlike your unit rate (which varies with consumption), the standing charge is payable every day, whether your business uses 1,000 kWh or zero. This makes it particularly significant for:

- Seasonal businesses (tourism, events, agriculture)

- Multi-site operators with low-usage locations

- Landlords with vacant commercial properties

- Businesses that have downsized but kept their meter

According to Utility4Business (opens in new tab), UK businesses are paying an average of 63.4p per day in standing charges - adding up to over £231 per year before using any electricity.

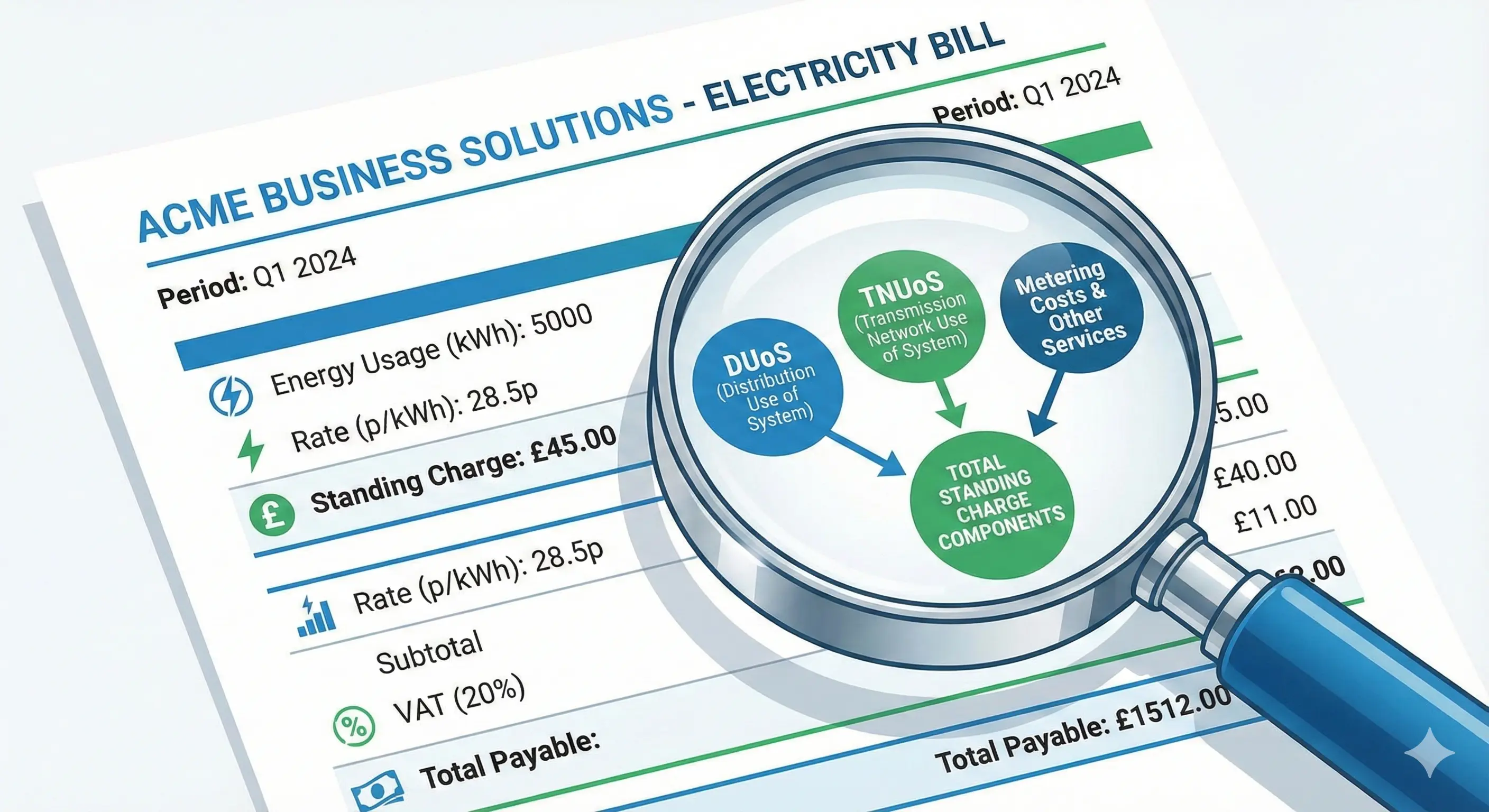

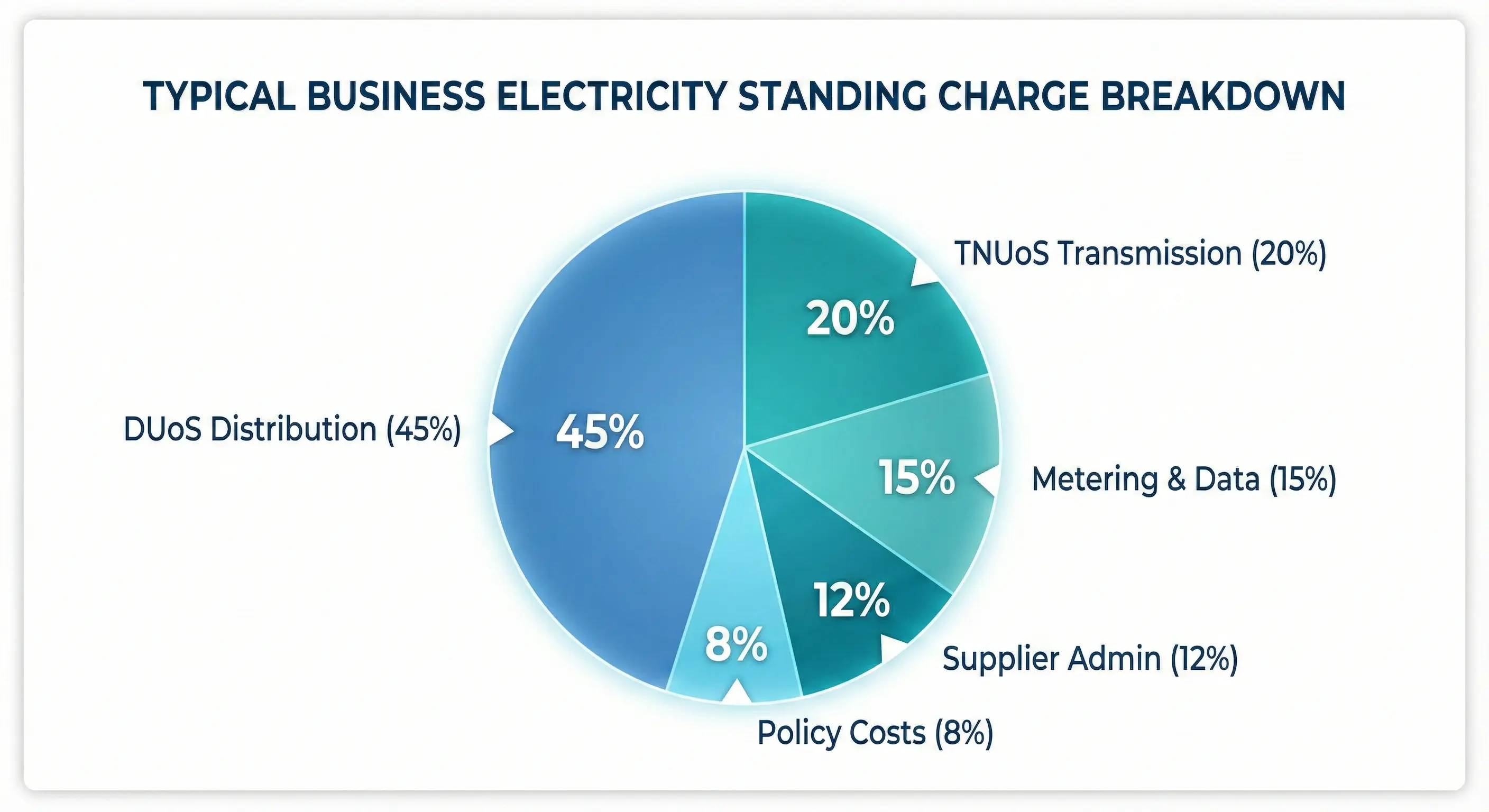

What Your Standing Charge Actually Pays For

Your standing charge isn’t arbitrary - it recovers specific costs that exist regardless of your consumption:

| Cost Component | What It Covers | Typical % of Standing Charge |

|---|---|---|

| DUoS (Distribution) | Maintaining local electricity networks - the poles, wires, and substations delivering power to your premises | 40-50% |

| TNUoS (Transmission) | National Grid infrastructure - the high-voltage network connecting power stations to local networks | 15-25% |

| Metering & Data | Your meter, meter reads, data processing, and (for smart meters) communication costs | 10-20% |

| Supplier Admin | Billing, customer service, regulatory compliance | 10-15% |

| Policy Costs | Contributions to government schemes and failed supplier recovery | 5-10% |

Important: Unlike residential customers, business energy prices are not protected by Ofgem’s price cap. There is no regulatory limit on what suppliers can charge for standing charges on commercial contracts. The House of Commons Library research on energy standing charges (opens in new tab) notes that while domestic customers have some protection through the price cap, businesses must rely on market competition.

Standing Charges vs Capacity Charges: What’s the Difference?

You’ll often see capacity charges (measured in kVA) mentioned alongside standing charges. These are related but distinct:

Standing Charge: A fixed daily fee covering basic network access, metering, and administration. Every business with a meter pays this.

Capacity Charge: An additional fixed charge based on your Maximum Import Capacity (MIC) - the maximum power your premises can draw at any moment. Only applies to larger connections (typically half-hourly metered sites).

The Highway Lane Analogy:

Think of the electricity network like a motorway:

- Your standing charge is like paying for basic road access - everyone pays to use the road network

- Your capacity charge is like reserving dedicated lanes - if your business might need to use 3 lanes of traffic at peak times, you pay to have those 3 lanes available 24/7, even if you usually only use 1

A small shop might only need a standard connection (no reserved lanes). But a commercial kitchen that occasionally runs all equipment simultaneously needs significant capacity reserved - and pays for that privilege through capacity charges.

Real example: THIS Workspace, a flexible office provider, has a 40 kVA capacity allocation. This means they pay capacity charges to reserve 40 kVA of network capacity, ensuring the building can handle peak demand when all meeting rooms, kitchens, and workstations are running simultaneously.

For most SMEs on standard meters, capacity charges don’t apply - you just pay the standing charge. But if you have a half-hourly meter or high-capacity connection, capacity charges can be significant and are worth reviewing regularly.

How Much Are Business Standing Charges in 2025?

Standing charges vary dramatically based on your meter type, location, and contract status. Here’s what UK businesses are typically paying in 2025:

By Business Size and Meter Type

| Business Type | Typical Daily Charge | Annual Cost | Notes |

|---|---|---|---|

| Small commercial (<20,000 kWh/year) | 45p - £1.00/day | £164 - £365 | Standard non-half-hourly meters |

| Medium commercial (~50,000 kWh/year) | 75p - £1.30/day | £274 - £475 | May include some capacity charges |

| Half-hourly metered (~100 kVA) | £8 - £20/day | £2,920 - £7,300 | Includes TNUoS/DUoS capacity elements |

| Large I&C sites (500+ kVA) | £20 - £50+/day | £7,300 - £18,250+ | Significant transmission charges |

Where does your business fit? The average UK non-domestic meter consumes 43,818 kWh annually - 44 times more than a domestic meter. However, most SMEs fall into Profile Class 03 (standard rate) with typical consumption of 15,000-20,000 kWh/year, or Profile Class 04 (Economy 7) with higher consumption of 40,000-60,000 kWh/year due to off-peak usage patterns.

Sources: Business Energy Deals (opens in new tab), Love Business (opens in new tab)

Regional Variation by DNO Area

Your location significantly affects standing charges due to differences in network infrastructure costs. The UK is divided into 14 Distribution Network Operator (DNO) regions, each with different charging structures.

According to Ofgem’s RIIO-ED2 framework (opens in new tab), each DNO sets its own DUoS charges based on local infrastructure costs, meaning identical businesses in different regions pay different rates.

| DNO Region | Parent Company | Relative Cost Level | Key Factors |

|---|---|---|---|

| London Power Networks | UK Power Networks | Lower fixed, higher capacity | Dense urban network, efficient infrastructure |

| South Eastern Power | UK Power Networks | Lower-medium | Suburban mix, moderate density |

| Eastern Power Networks | UK Power Networks | Medium | Mixed urban/rural, moderate costs |

| Western Power (East Midlands) | National Grid | Medium | Industrial heritage, established network |

| Western Power (West Midlands) | National Grid | Medium | Urban and suburban mix |

| Western Power (South West) | National Grid | Medium-higher | Rural and coastal areas |

| Western Power (South Wales) | National Grid | Medium-higher | Mixed terrain, some rural areas |

| Electricity North West | ENW | Medium-higher | Varied terrain, some rural |

| Northern Powergrid (Yorkshire) | Berkshire Hathaway | Medium | Industrial and rural mix |

| Northern Powergrid (Northeast) | Berkshire Hathaway | Higher capacity charges | Significant 2025 increases |

| Scottish Power (South) | Iberdrola | Medium-higher | Mixed urban/rural |

| Scottish Power (North) | Iberdrola | Higher | Rural areas, longer cable runs |

| Scottish Power (Manweb) | Iberdrola | Medium-higher | Merseyside and North Wales |

| SSE (Southern) | SSE plc | Medium | Varied geography |

| SSE (Scottish Hydro) | SSE plc | Higher | Remote areas, challenging terrain |

Why we can’t show specific pricing: Each DNO publishes their own charging statements as separate PDF documents, updated annually. There is no centralised public database aggregating this data. DNOs are not required to publish their charges in a standardised, comparable format - making it virtually impossible to create an accurate side-by-side pricing comparison. The relative cost levels above are based on industry analysis and general market patterns rather than specific tariff figures.

Key insight: According to NUS Consulting’s DUoS analysis (opens in new tab), the 2025-2026 period saw dramatic restructuring: standing charges dropped an average of 72% across regions (with some DNOs eliminating them entirely), while capacity charges more than doubled in some areas. This shift particularly affects businesses with high maximum demand.

Real-world examples:

- Businesses in London may pay as little as 0-47p/day for DUoS fixed charges

- Businesses in North Wales, Highlands, and rural Scotland typically pay significantly more due to longer cable runs and sparser networks

- Northern Powergrid Northeast saw capacity charges rise to more than 3x previous levels in 2025

The 2025 DUoS Revolution: What Changed

April 2025 marked a fundamental shift in how distribution charges are structured, following Ofgem’s Access Significant Code Review. Understanding this helps explain why your bills may look different:

Before April 2025

- Higher fixed daily standing charges

- Lower capacity-based charges

- Simpler bill structure

After April 2025

- 72% average reduction in fixed standing charges (some DNOs now charge £0)

- Capacity charges doubled or tripled in many regions

- More complex billing for half-hourly metered sites

What this means for your business:

- Low-demand businesses benefit: If your maximum demand is low relative to your consumption, the shift to capacity-based charging likely reduces your costs

- High-demand businesses pay more: If you have high peak demand (even briefly), the increased capacity charges may outweigh standing charge reductions

- The headline “standing charge” may mislead: A lower standing charge doesn’t mean lower total fixed costs if capacity charges have increased

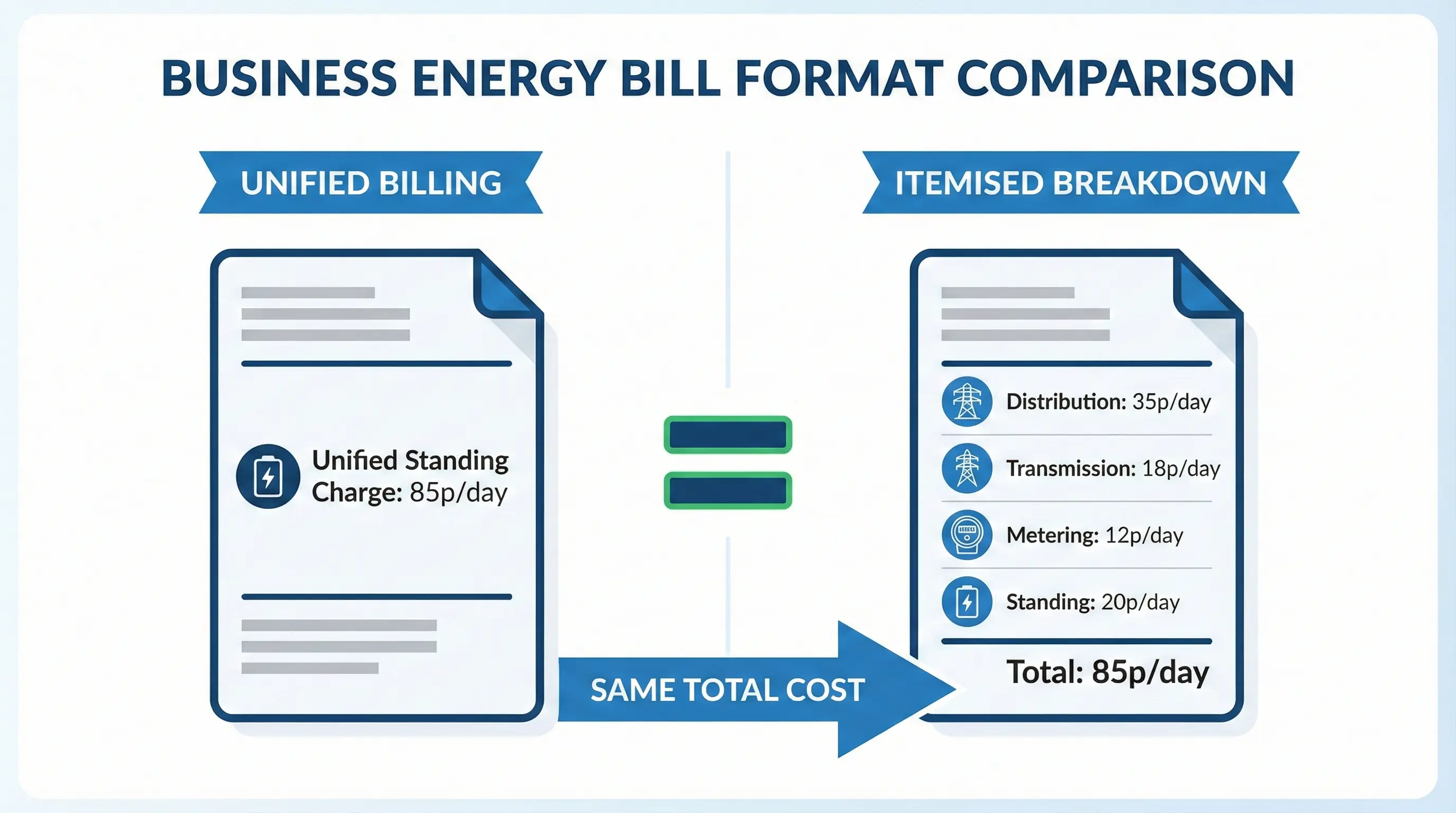

Unified vs Itemised Standing Charges

When comparing quotes, you’ll encounter two different ways suppliers present standing charges:

Unified Standing Charge

Most suppliers show a single “Standing Charge” figure that bundles all fixed costs together:

Standing Charge: 85p/day

Unit Rate: 24.5p/kWhPros: Simple to understand and compare Cons: Less transparency about what you’re actually paying for

Itemised Charges

Some suppliers (like Pozitive Energy) break out the components separately:

Distribution Charges (DUoS): 35p/day

Transmission Charges (TNUoS): 18p/day

Metering Charge: 12p/day

Standing Charge: 20p/day

---

Total Fixed Daily Cost: 85p/day

Unit Rate: 24.5p/kWhPros: Full transparency; easier to understand cost drivers Cons: Appears more complex; harder to compare quickly

The key point: When comparing quotes, always calculate total fixed daily cost regardless of how it’s presented. A “low standing charge” that excludes separately-listed DUoS charges isn’t actually cheaper.

The Undisclosed Broker Commission Problem

Here’s something most businesses don’t know: some energy brokers add commission to your standing charge as well as your unit rate.

We’ve written extensively about undisclosed broker commissions on unit rates, but the standing charge presents another opportunity for uplift.

How Standing Charge Uplift Works

Not all suppliers allow brokers to inflate standing charges, but those that do operate on a spectrum:

| Supplier Approach | What It Means For You |

|---|---|

| No standing charge uplift allowed | Broker can only add commission to unit rate |

| Capped uplift (e.g., max 10p/day) | Broker can add limited margin to standing charge |

| Uncapped uplift | Broker can add unlimited margin to standing charge |

A predatory broker working with an uncapped supplier might:

- Take a base standing charge of 50p/day

- Add 30p/day uplift

- Present you with a “standing charge” of 80p/day

Over a 3-year contract, that 30p/day uplift costs you an extra £328.50 - on top of whatever they’ve added to your unit rate.

Availability Charges: Where Brokers Can’t Add Uplift

There’s one element where brokers cannot add commission: availability charges (also called capacity charges).

Availability charges are set directly by your Distribution Network Operator (DNO) based on your agreed Maximum Import Capacity. These are genuine pass-through costs that reflect the capacity reserved for your site on the local network.

However, suppliers themselves can and do mark up availability charges before passing them to you. So while brokers can’t add to this element, you may still be paying more than the raw network cost.

How to Protect Yourself

When getting quotes:

- Ask for the breakdown: Request the supplier’s base standing charge separately from any broker fee

- Compare total fixed costs: Calculate annual standing charge cost (daily rate × 365) for each quote

- Check the contract: Since October 2024, Ofgem requires commission disclosure - look for “Third Party Costs”

- Use transparent platforms: Meet George shows our 1p/kWh addition to the unit rate separately - we don’t add any standing charge uplifts

Why Are My Standing Charges So High?

If your standing charges seem excessive, here are the most common causes:

1. You’re on Deemed or Out-of-Contract Rates

The problem: Suppliers load margin into standing charges for customers without active contracts.

The solution: Switch to a new fixed contract immediately. You can typically save 30-50% on your total bill, including standing charges.

2. You Have a Half-Hourly Meter with Excess Capacity

The problem: Half-hourly (HH) meters carry capacity-based charges (TNUoS, DUoS) that scale with your agreed Maximum Import Capacity (MIC). If your business has downsized but kept its original capacity allocation, you’re paying for capacity you don’t use.

The solution: Request a capacity review from your DNO. Reducing your MIC from 100 kVA to 50 kVA could save £1,000-£3,000/year in standing elements. Meet George can help identify whether your capacity allocation is oversized and guide you through the review process.

3. Regional Network Costs

The problem: Some regions simply have higher network charges due to infrastructure costs.

The solution: Unfortunately, you can’t change your location. Focus on optimising other elements and ensure you’re not overpaying through broker uplift.

4. Broker Uplift on Standing Charge

The problem: Your broker may have added commission to your standing charge.

The solution: Check your contract for “Third Party Costs” disclosure. Compare your standing charge against market rates. Consider switching through a transparent platform.

5. Multiple Meters

The problem: Each meter carries its own standing charge. Multi-site businesses or premises with separate gas and electricity meters multiply these fixed costs.

The solution: Audit whether all meters are necessary. Consolidate where possible. For vacant sites, consider de-energising meters.

Are No-Standing-Charge Tariffs Worth It?

Some suppliers now offer business tariffs with zero standing charge - but don’t assume this means cheaper bills.

How No-Standing-Charge Tariffs Work

To compensate for the missing fixed revenue, suppliers increase the unit rate - typically by 4-6p/kWh.

Example comparison:

| Tariff Type | Standing Charge | Unit Rate | Notes |

|---|---|---|---|

| Standard tariff | 63p/day (£230/year) | 25p/kWh | Typical SME deal |

| No-standing-charge | £0/day | 30p/kWh | Higher unit rate |

The Break-Even Calculation

To find when a no-standing-charge tariff makes sense:

Break-even kWh = Annual standing charge ÷ Unit rate difference

Example: £230 ÷ £0.05 = 4,600 kWh/yearBelow ~4,600 kWh/year: No-standing-charge tariff may be cheaper Above ~4,600 kWh/year: Standard tariff with standing charge is usually cheaper

When No-Standing-Charge Makes Sense

- Storage units with minimal lighting

- Seasonal businesses closed for extended periods

- Vacant properties awaiting sale or development

- Very low-consumption sites (under 5,000 kWh/year)

When to Avoid No-Standing-Charge

- Any business using more than ~5,000 kWh/year

- Sites with variable but generally consistent usage

- Multi-site businesses (easier to manage standard contracts)

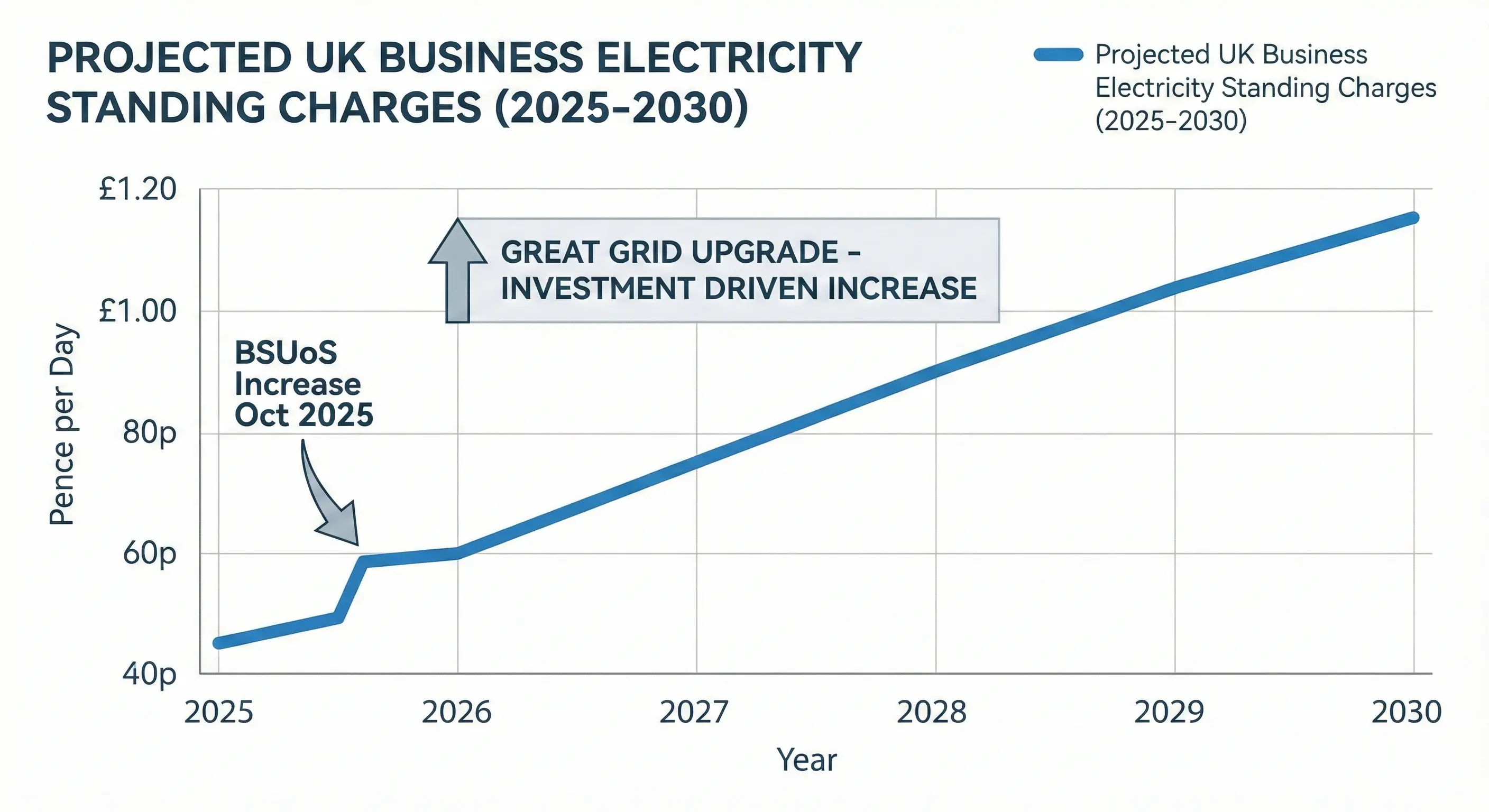

Rising Standing Charges: What’s Coming

Standing charges are set to increase over the coming years due to significant network investment:

BSUoS Increase (October 2025)

BSUoS (Balancing Services Use of System) charges - which help balance supply and demand on the grid - are rising from 1.074p/kWh to 1.569p/kWh from October 2025. That’s a 46% increase in this component.

While BSUoS is primarily a per-kWh charge, suppliers may adjust standing charge structures in response to overall cost increases.

The Great Grid Upgrade

The UK’s electricity network requires massive investment to support:

- Offshore wind connections

- Electric vehicle charging infrastructure

- Heat pump deployment

- Data centre growth

According to NFU Energy (opens in new tab), this “Great Grid Upgrade” will drive higher transmission and distribution standing charges over the next 5-10 years.

What This Means For Your Business

- Lock in rates now: Fixed contracts protect you from immediate increases

- Budget for annual increases: Plan for 5-10% annual growth in fixed charges

- Review capacity: Ensure you’re not paying for unused capacity as costs rise

- Consider flexibility: Businesses that can shift demand may benefit from time-of-use tariffs under MHHS

How to Reduce Your Business Standing Charges

1. Switch Away from Deemed Rates

If you’re out of contract, switching is the single biggest saving. Deemed rate standing charges can be 50-100% higher than contracted rates.

Action: Check your contract end date. If it’s passed, switch immediately.

2. Review Your Capacity Allocation

For half-hourly metered sites, your Maximum Import Capacity (MIC) directly affects standing charges.

Action: Request your current MIC from your supplier. Compare against your actual maximum demand (available from half-hourly data). If there’s a significant gap, request a capacity reduction from your DNO.

3. De-energise Unused Meters

Empty premises still incur standing charges on live meters.

Action: For long-term vacant sites, consider de-energisation. Note that reconnection costs apply if you need power later (typically £100-£500 depending on complexity).

4. Consolidate Multi-Site Contracts

Each meter carries its own standing charge. Managing multiple sites on separate contracts multiplies admin and may mean paying different (higher) rates on some sites.

Action: Consider a multi-site contract that consolidates billing and may offer volume-based standing charge discounts.

5. Compare Total Annual Cost, Not Just Unit Rates

Many businesses focus on p/kWh and ignore standing charges - exactly what some brokers rely on.

Action: Always calculate: (Unit rate × Annual kWh) + (Standing charge × 365) = Total annual cost

6. Ask About Standing Charge Specifically

When getting quotes, explicitly ask:

- “What is the supplier’s base standing charge?”

- “Is there any broker commission in the standing charge?”

- “Is this a unified charge or are there separate DUoS/TNUoS elements?“

7. Use a Transparent Comparison Platform

Platforms that show fees separately from supplier rates make it easier to understand true costs.

Meet George shows our 1p/kWh fee separately - we don’t embed margins in your standing charge or unit rate. You see exactly what you’re paying the supplier versus what you’re paying us.

Standing Charges for Different Business Types

Retail and Hospitality

Challenge: Often have multiple meters (main supply, kitchen, signage) multiplying standing charges.

Tip: Audit whether all meters are necessary. Consider LED signage that can run from main supply rather than separate metered connections.

Seasonal Businesses (Tourism, Events, Agriculture)

Challenge: Standing charges continue during closed seasons when consumption is zero.

Tip: Calculate whether no-standing-charge tariffs make sense for your usage pattern. For very seasonal operations, the break-even point may favour zero-standing-charge despite higher unit rates.

Multi-Site Operators

Challenge: Standing charges multiply across every location.

Tip: Negotiate portfolio deals that may include standing charge discounts for volume. Ensure low-usage sites aren’t on expensive deemed rates.

Landlords with Vacant Properties

Challenge: Paying standing charges on properties generating no income.

Tip: Consider de-energisation for long-term vacancies. For short-term vacancies, ensure you’re on a contracted rate rather than deemed.

Manufacturing and Industrial

Challenge: Half-hourly meters with high capacity allocations mean significant standing elements.

Tip: Regular capacity reviews are essential. Production changes, efficiency improvements, or shift pattern adjustments may mean your MIC is now oversized.

The Bottom Line: What to Do About Standing Charges

Standing charges are an unavoidable part of business electricity - but that doesn’t mean you should overpay.

Key actions:

- Know what you’re paying: Convert your daily standing charge to annual cost (×365)

- Check your contract status: Deemed rates mean inflated standing charges

- Understand the breakdown: Ask whether DUoS/TNUoS are included or separate

- Watch for broker uplift: Some brokers add commission to standing charges

- Compare total cost: Don’t be fooled by low unit rates with high standing charges

- Review capacity: Half-hourly sites may be paying for unused capacity

- Plan for increases: Network investment means standing charges will rise

Standing charges may feel like “dead money” - a cost you pay without getting any energy in return. But understanding them, optimising them, and avoiding overpayment can save your business hundreds or thousands of pounds per year.

Ready to see exactly what you’re paying in standing charges - with full transparency? Meet George shows supplier rates and platform fees separately, so you can compare total annual costs without undisclosed margins. Join the Platform Waitlist for early access.

Further Reading

Meet George Guides:

- Business Energy Comparison UK: Complete 2025 Guide

- Hidden Broker Commissions: How Uplift Actually Works

- What Are Deemed Rates? Why You’re Paying an 80% Premium

- How to Switch Business Energy: Complete Step-by-Step Guide

- Volume Tolerance: The Cheapest Contract Trap

- Business Energy Glossary - All terms explained in plain English

External Resources:

- Ofgem: Energy Advice for Businesses (opens in new tab) - Official regulator guidance

- House of Commons Library: Energy Standing Charges (opens in new tab) - Parliamentary research briefing

- Ofgem: RIIO-ED2 Price Control (opens in new tab) - How distribution network costs are regulated

- NUS Consulting: UK DUoS Charges 2025 (opens in new tab) - Detailed regional DUoS analysis

- Business Energy Deals: Standing Charges Explained (opens in new tab) - Detailed breakdown by meter type

- NFU Energy: Upcoming Changes to Standing Charges (opens in new tab) - Network upgrade impacts