TL;DR: Key Takeaways

The News: On 24th October 2025, the UK Government (DESNZ) confirmed that Ofgem will become the official regulator for energy brokers (Third Party Intermediaries).

Why It Matters: For decades, the TPI market has operated in a regulatory grey area, allowing bad actors to embed commissions in rates without disclosure, use high-pressure sales tactics, and lock businesses into unfavourable contracts.

What’s Changing: A new “General Authorisation” regime will require all energy broker licensing through Ofgem. Brokers who cannot meet compliance standards will be forced out of the market.

Our Position: At Meet George, we welcome this TPI regulation crackdown. We’ve built our platform to be compliant from Day One - transparent pricing, digital audit trails, and no undisclosed fees.

The End of the “Wild West” Era

For too long, the business energy broker market has been a regulatory grey area.

While energy suppliers have been regulated by Ofgem for years, the intermediaries who sit between suppliers and businesses - the brokers, the “consultants,” the cold-callers - have operated with minimal oversight. This lack of energy broker licensing created an environment where predatory practices could thrive.

Voluntary self-regulation has failed. RECCo launched a voluntary TPI Code of Practice in October 2023 to improve broker conduct. As of mid-2025, only 52 brokers have signed up - just 2% of the estimated 2,700+ active brokers in the UK market. We’ve written about why the TPI Code has failed to gain traction - the short version is that transparency conflicts with the undisclosed commission model. When 98% of an industry ignores voluntary standards, mandatory regulation becomes inevitable.

The problems were widespread:

- Undisclosed commissions buried in your unit rate

- Forged signatures on Letters of Authority

- High-pressure sales tactics claiming “the market is closing today”

- Zero accountability when things went wrong

The ombudsman data tells the story: The Energy Ombudsman’s 2025 Broker Report found that 58% of broker complaints are upheld in favour of the consumer, with an average financial award of £894. Critically, 88% of broker complaints relate to the sales process - not service delivery. The problem is systemic to how energy is sold, not how it’s supplied.

The Government has now confirmed what we’ve known was coming: Ofgem will become the official regulator for Third Party Intermediaries (TPIs). This Ofgem authorisation requirement will fundamentally change how business energy brokers operate.

External Resources:

- Gov.uk: Consultation on Regulating TPIs in the Retail Energy Market (opens in new tab)

- Gov.uk: Greater Protection for Families and Businesses in Energy Market (opens in new tab)

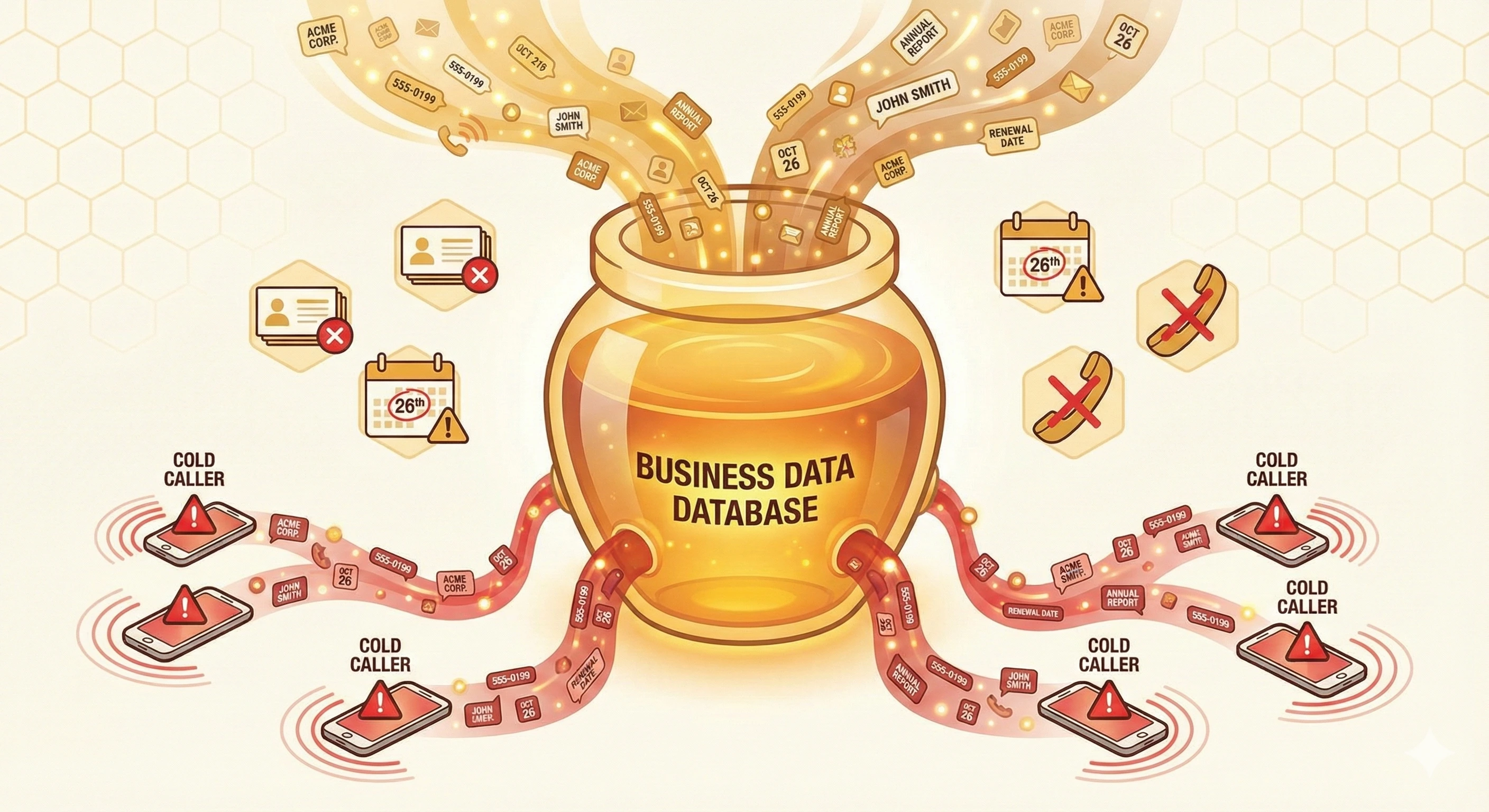

How the “Honey Pot” System Works

To understand why TPI regulation is so desperately needed, you need to understand how many traditional brokers actually operate behind the scenes.

The Data Buying Operation

Many brokers don’t find clients through marketing or referrals. They buy data.

These purchased lists contain:

- Company names and addresses

- Director and manager names

- Contact phone numbers

- Current energy supplier

- Contract end dates (the most valuable piece)

Armed with this data, brokers load it into automated diallers and cold-call hundreds of businesses per day. This business energy cold calling has become an industry unto itself. Ofgem research shows 38% of SMEs report persistent cold calls and spam emails from energy brokers - with some receiving 3+ calls weekly. Government surveys found 36% of SMEs felt “stressed” by broker dealings, and 24% felt “pressured to change supplier.”

The Deception Tactics

Former energy broker employees have described the tactics used in these operations:

The “Account Manager” Pretence: Callers are trained to imply they’re from your existing supplier or a company you’ve dealt with before. “Hi, I’m calling about your energy account” - vague enough to get past gatekeepers.

The Gatekeeper Bypass: If the receptionist won’t put them through, they’ll ask for a specific name: “Can I speak to Alison?” If there’s no Alison, they apologise and ask who handles contracts now. In large companies where employees don’t know each other, this works surprisingly often.

The Data Extraction: Even if they can’t sell you today, the call is valuable. They’ll say “We have your contract ending on X date” - even if it’s wrong. You correct them: “No, it’s actually Y date.” That corrected information goes straight back into their system.

The “Honey Pot” Effect

Industry insiders describe these databases as a “big pot of honey” that gets continuously recycled.

Every piece of missing information triggers another call. Every correction you provide updates the database. Every unanswered call gets rescheduled.

The result: Businesses receive repeated cold calls about energy, sometimes for years, because their data keeps circulating through the system. The new energy broker compliance rules will require proper consent before this data can be used.

Why Traditional Brokers Are Worried About TPI Regulation

While many traditional brokers are scrambling to update their terms and obscure their margins, the honest ones know this regulation was inevitable.

The Manual Process Problem

The old way of broking was fundamentally inefficient:

- Buy a list of business data

- Cold-call 300 businesses per day

- Generate 2 “leads” (businesses willing to discuss switching)

- Manually check “Price Books” or email suppliers for quotes

- Present options over the phone

- Chase for signed Letters of Authority

The Cost: This manual, phone-heavy process is expensive. To cover those costs, brokers add large “uplifts” (commissions) to your rate - sometimes reportedly as high as 4-5p/kWh. The incoming broker commission disclosure requirements will make this much harder to hide.

The Justification: Servicing an SME is “high effort, low return” for traditional brokers. The undisclosed commission makes it worthwhile for them - but devastating for your business.

How Meet George is Different

We built Meet George to be the opposite of the traditional broker model - and to meet the incoming Ofgem TPI standards before they’re even mandatory.

AI-Powered Efficiency

Think of our platform as a digital assembly line:

- Bill Upload: You upload your PDF bill. Our AI extracts the exact data - no phone calls, no human error.

- Instant Tendering: We query 20+ suppliers via API in seconds.

- Contract Scanning: Our systems audit contract terms in milliseconds, flagging undisclosed exit fees and unfavourable clauses.

The Result: Our cost-to-serve is a fraction of a traditional broker’s.

The Saving: We pass that efficiency to you. We charge a transparent 1p/kWh Meet George Fee - typically 75% less than manual brokers. Full broker commission transparency from Day One.

The Two Friction Points We Eliminated

Traditional broking is slow and error-prone. We identified the two biggest friction points and solved them with technology.

Friction Point 1: The Source of Truth

Instead of telling a broker your usage over the phone (where errors happen), you upload your PDF bill directly. Our AI extracts the data from the source document. You see exactly what we see.

Friction Point 2: The Letter of Authority

We don’t send you a PDF to print, sign, scan, and email back. Our system takes your bill data and instantly populates a Digital Letter of Authority on your screen. You sign it immediately within the same session.

No email tennis. No “surprise” terms inserted later. No waiting. This is the kind of consumer consent model that will become standard under the new TPI regulations.

Ask George Anything

The biggest problem with the old market was the “knowledge gap.” Brokers knew more than business owners, and they exploited it.

Inside our platform, you can chat with George - our AI assistant. George has full context of your uploaded bill, the quotes you’re reviewing, and the contract terms from suppliers.

- “Is this standing charge high for my region?”

- “What does this credit check clause mean?”

- “Explain this exit fee in simple English.”

There are no stupid questions. You can self-service your entire business energy contract without relying on a salesperson incentivised to rush you.

The “Hyper-Compliant” Audit Trail

In the new regulated world, proof is everything.

A phone conversation is easily forgotten. A digital platform never forgets.

Because Meet George is digital-first, we create an immutable audit trail of every interaction - exactly what the new energy broker compliance framework will require:

- We record exactly what quotes you saw

- We timestamp exactly when you signed

- We log exactly what commissions were displayed

We couldn’t hide a fee even if we wanted to.

This level of “hyper-compliance” is why we welcome Ofgem’s oversight. We have nothing to hide.

Our Compliance Standards

We don’t view regulation as red tape. We view it as a safety shield for our customers.

Ombudsman Services / ADR: We are registered members of the Alternative Dispute Resolution scheme. While ADR registration is now mandatory for brokers under Ofgem rules, we embraced it voluntarily. We want you to have an independent judge if you ever feel treated unfairly. View our complaints process.

ICO Registered: Your energy data isn’t a commodity to be sold. We are fully registered with the Information Commissioner’s Office and treat your data with the same security as banking details. This data protection standard will be central to the new TPI regulation. See our Trust Centre.

Cyber Essentials: In an era of digital threats, we lock the doors. Our systems are vetted and secure. See our Trust Centre.

Learn more about our regulatory commitments

How to Prepare Your Business for TPI Regulation

You don’t have to wait for the law to take effect to protect your business. Here’s how to prepare now:

1. Audit Your Current Contract

Check your existing energy contract for the “Third Party Costs” section. If you signed before October 2024, your broker commission may still be undisclosed. Note your contract end date and any exit fee clauses - you’ll need this information when you’re ready to switch.

2. Request Commission Disclosure

Contact your current supplier and ask for a breakdown of any broker commission embedded in your rate. Under existing Ofgem rules, they must now disclose this for business customers. If they can’t or won’t tell you, that’s a red flag. Our commission calculator can help you estimate what you might be paying based on typical industry rates.

3. Verify Your Broker’s Credentials

If you’re working with a broker, ask them:

- Are you registered with an ADR scheme (Alternative Dispute Resolution)?

- Are you ICO registered?

- Can you show me exactly what commission you’re adding to my rate?

These will become mandatory requirements under the new Ofgem authorisation regime. If your broker can’t answer these questions today, they may not survive the regulatory changes.

4. Switch to a Transparent Platform Before Your Renewal

Before your next contract renewal, consider switching to a platform that already meets the incoming compliance standards. Look for:

- Transparent, disclosed fees (not embedded in your unit rate)

- Digital audit trails of all interactions

- ADR and ICO registration

- No high-pressure sales tactics

What Happens Next: The TPI Regulation Timeline

The new General Authorisation regime will roll out in phases over the coming years. Based on the Government’s response and standard legislative timelines, here’s what to expect:

First Half 2026 - Market Survey: Ofgem will undertake a detailed quantitative survey to map the structure of the TPI market and assess the prevalence of harmful practices. This is the preparatory groundwork before legislation.

2026/2027 - Primary Legislation: The Government will introduce primary legislation “when parliamentary time allows” to officially appoint Ofgem as the regulator and grant them powers for monitoring, investigation, and rule-making.

Post-Legislation - Rule-Making Phase: Once the law passes and Ofgem is legally appointed, they will “promptly” implement high-level principles and develop specific rules and the registration process. This typically involves consultation periods and could take 6-12 months after Royal Assent.

Late 2027/2028 - Sunrise Period: A 12-18 month transition period will open, allowing TPIs to continue operating while applying for authorisation. This gives compliant brokers time to register without disrupting the market.

2029 onwards - Full Enforcement: After the sunrise period ends, it will become illegal to operate as a TPI (arranging energy contracts) without Ofgem authorisation. Non-compliant brokers will be forced out of the market.

The takeaway: While full enforcement is unlikely before 2029, the direction of travel is clear. Brokers who cannot meet compliance standards will eventually be removed from the market. Businesses don’t need to wait - you can choose compliant platforms today.

Summary: Don’t Wait for the Law to Catch Up

The law is changing to force energy brokers to be honest.

But you don’t have to wait until the TPI regulation passes to get a fair deal. You can switch to a platform that was built honest from Day One.

- Transparent 1p/kWh Meet George Fee - full broker commission transparency

- Instant Digital LOA - meeting the incoming consumer consent standards

- No Sales Pressure - no cold calling, no “market closing” tactics

- Full Audit Trail - Ofgem-ready compliance from Day One

Ready to experience the future of business energy? Learn how to switch business energy suppliers the transparent way, or discover how undisclosed broker commissions actually work so you can spot them in your current contract.