TL;DR: The UK Business Energy Broker Market Landscape

The Investigation: We analysed 20+ online UK business energy comparison sites and brokers to map who’s really behind them.

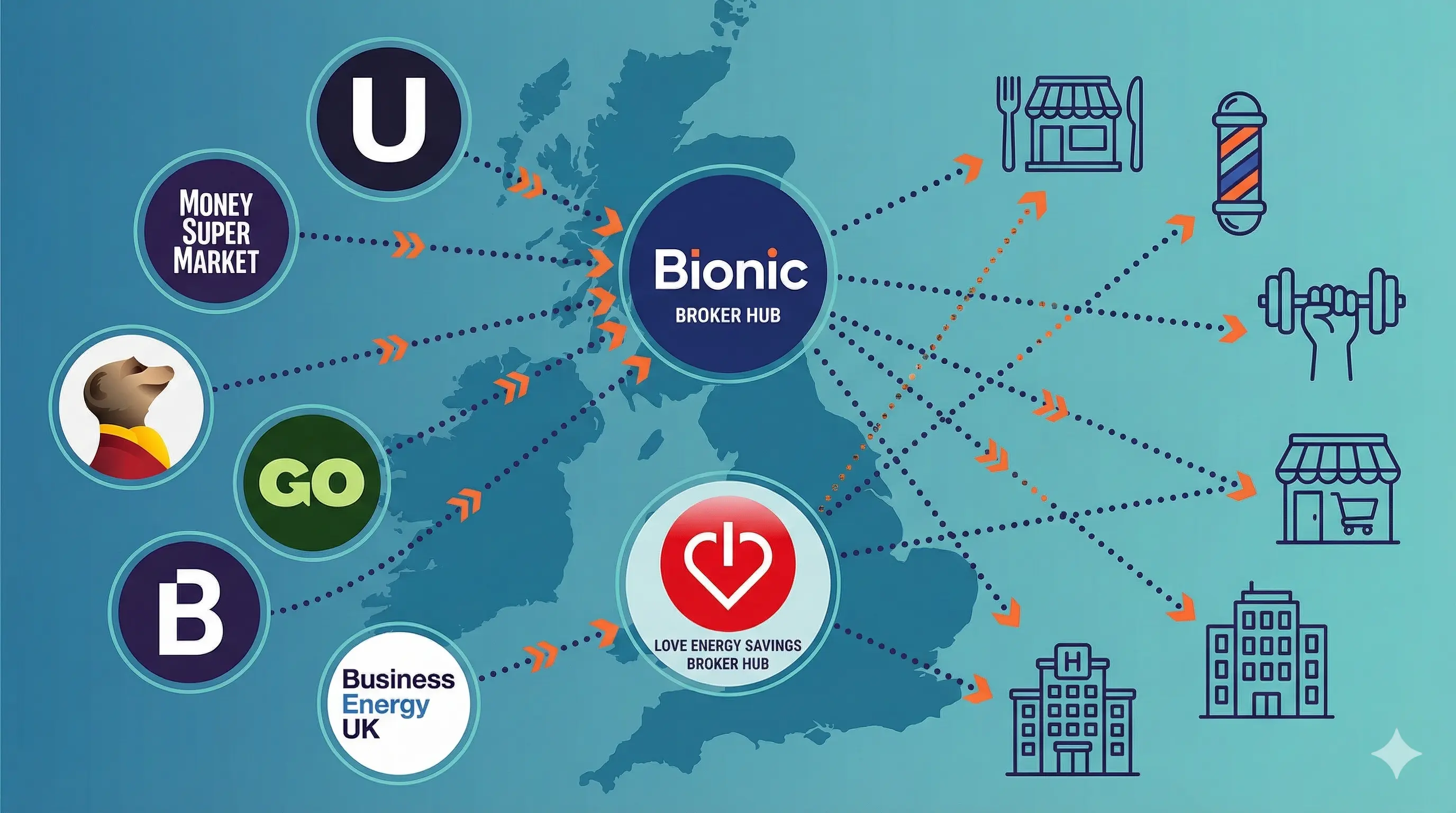

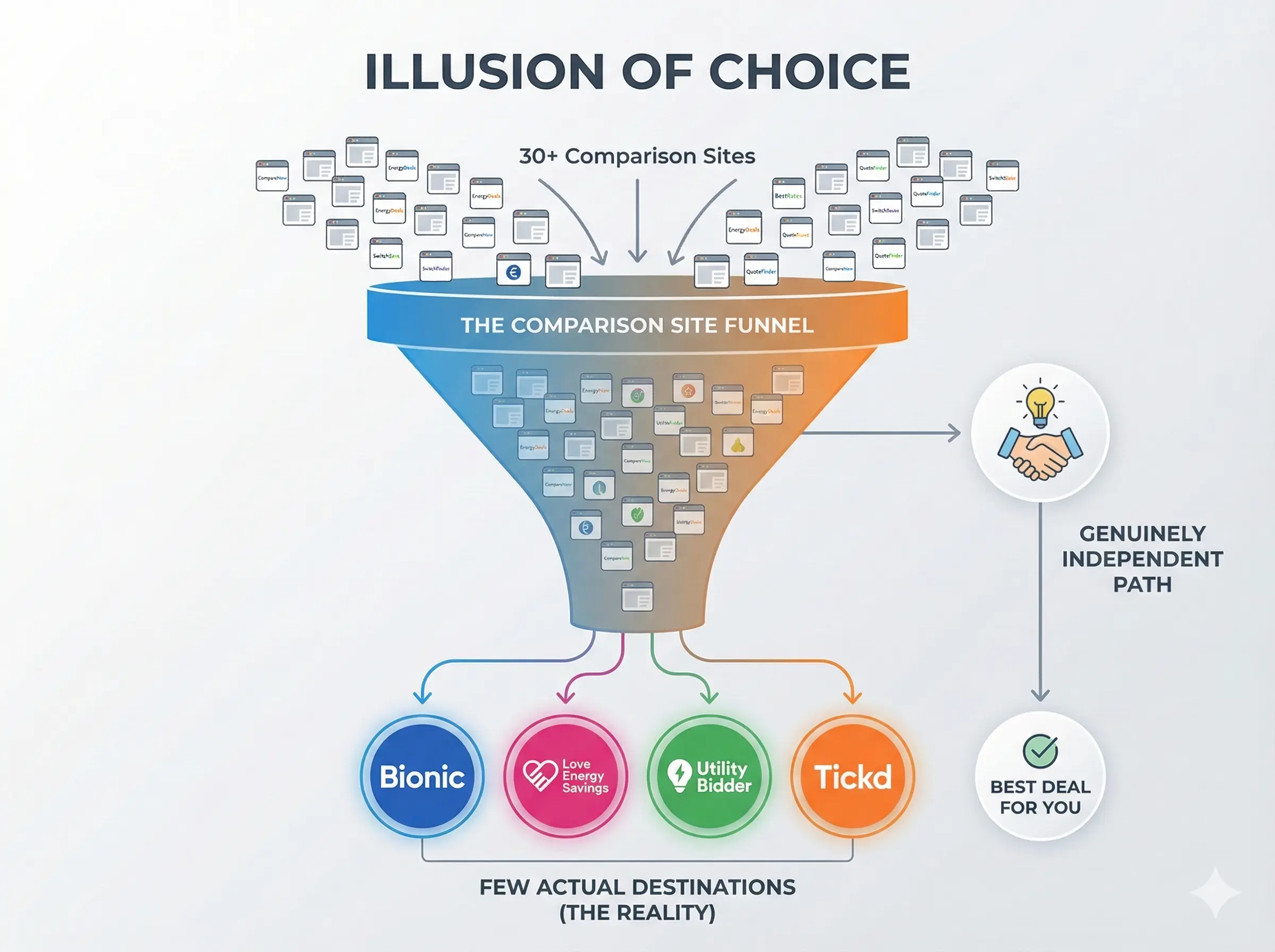

The Finding: The market is dominated by just four broker networks. Bionic powers six major comparison sites including Uswitch and MoneySuperMarket. Love Energy Savings powers three sites that appear independent. Utility Bidder and Tickd each power additional white-label sites. Together, these networks capture the majority of online switching traffic.

What This Means: When UK businesses “shop around” across multiple comparison sites, they’re often just entering the same sales funnels multiple times. The illusion of competition masks significant market consolidation.

The Deeper Problem: It’s not just the illusion of choice - these brokers all operate the same way. They use manual, phone-based sales processes with high cost-to-serve, which means commission of 2-4p/kWh embedded in your rates. Yes, Meet George works with the same suppliers - but our AI-powered approach eliminates the manual overhead, letting us pass genuine savings to you at 1p/kWh.

The Alternative: Genuinely independent options exist - both traditional brokers and new AI-powered platforms like Meet George that offer transparent pricing without white-label networks.

Why We Investigated UK Business Energy Comparison Sites

When a UK business searches for “compare business energy prices,” they expect to find independent options competing for their custom. The reality is very different.

After months of investigating comparison sites, analysing company structures, inspecting website backends, and tracking where customer enquiries actually go, we’ve mapped the entire UK business energy broker landscape.

What we found surprised us: a market of approximately 2,200 active brokers generating £525 million annually in commissions is actually dominated by a handful of networks operating dozens of different brand names.

Important: Commission rates vary dramatically by customer size. The same broker charging 0.5p/kWh to a large factory might charge 2-4p/kWh to a small café. SMEs pay more per unit because they’re less likely to spot inflated rates.

Typical SME commission rates:

| Broker Type | Market Share | SME Commission Rate |

|---|---|---|

| Good brokers | 40-45% | 0.8-1.2p/kWh |

| Aggregators/white-label | 25-30% | 1.0-1.5p/kWh |

| Call-centre operations | 10-15% | 1.5-2.5p/kWh+ |

| Aggressive/predatory | 5-10% | 2.5-5.0p/kWh+ |

Meet George charges 1p/kWh - competitive with good brokers and well below the aggressive operators who dominate this market.

The four networks we investigate below capture the majority of the online switching market.

The Two Types of Business Energy Broker

Not all 2,200 UK brokers operate online comparison sites. The market splits into two categories:

Price Comparison Websites (PCWs) - The sites we investigated in this guide. They use API connections to broker platforms to generate quotes in 60-90 seconds. But here’s the catch: while quoting is fast, the actual switch is still handled manually over the phone. That’s why these sites still require sales calls despite promising “instant quotes.”

Traditional Brokers - The majority of registered brokers work differently. They use backend platforms like POWWR, Online-direct, and Utility Click (a Utility Bidder product) to manually process quotes, then present options to customers via email or phone. The result is the same: high cost-to-serve, 2-4p/kWh commissions, opaque pricing, and slow processes.

Both models share the fundamental problem: manual, phone-based switching that requires expensive human intervention.

Meet George is different. Traditional brokers need a team: someone to gather quotes, someone to explain contracts, someone to handle paperwork. We’ve replaced that entire team with AI specialists that work together automatically - one reads your bill, another analyses contracts, another handles supplier communications. No salaries, no call centre, no overhead. These systems still cost money to build and run, but it’s a fraction of what phone-based brokers spend - and that’s how we can charge 1p/kWh.

This guide reveals:

- The four major broker networks* and every site they power

- Which brokers are genuinely independent (and what that really means)

- How to identify white-label sites before you share your details

- The true cost of broker consolidation for UK businesses

- Genuinely different alternatives to the traditional broker model

*Based on our investigation of the top 20+ online comparison sites appearing on Google pages 1-2. There may be additional white-label arrangements we haven’t identified.

Whether you’re a small business owner trying to switch energy, a finance director managing multiple sites, or simply curious about how this market really works, this is the complete picture.

Which Broker Networks Power UK Business Energy Comparison Sites?

Our investigation identified four major broker networks that power the majority of UK business energy comparison and switching sites.

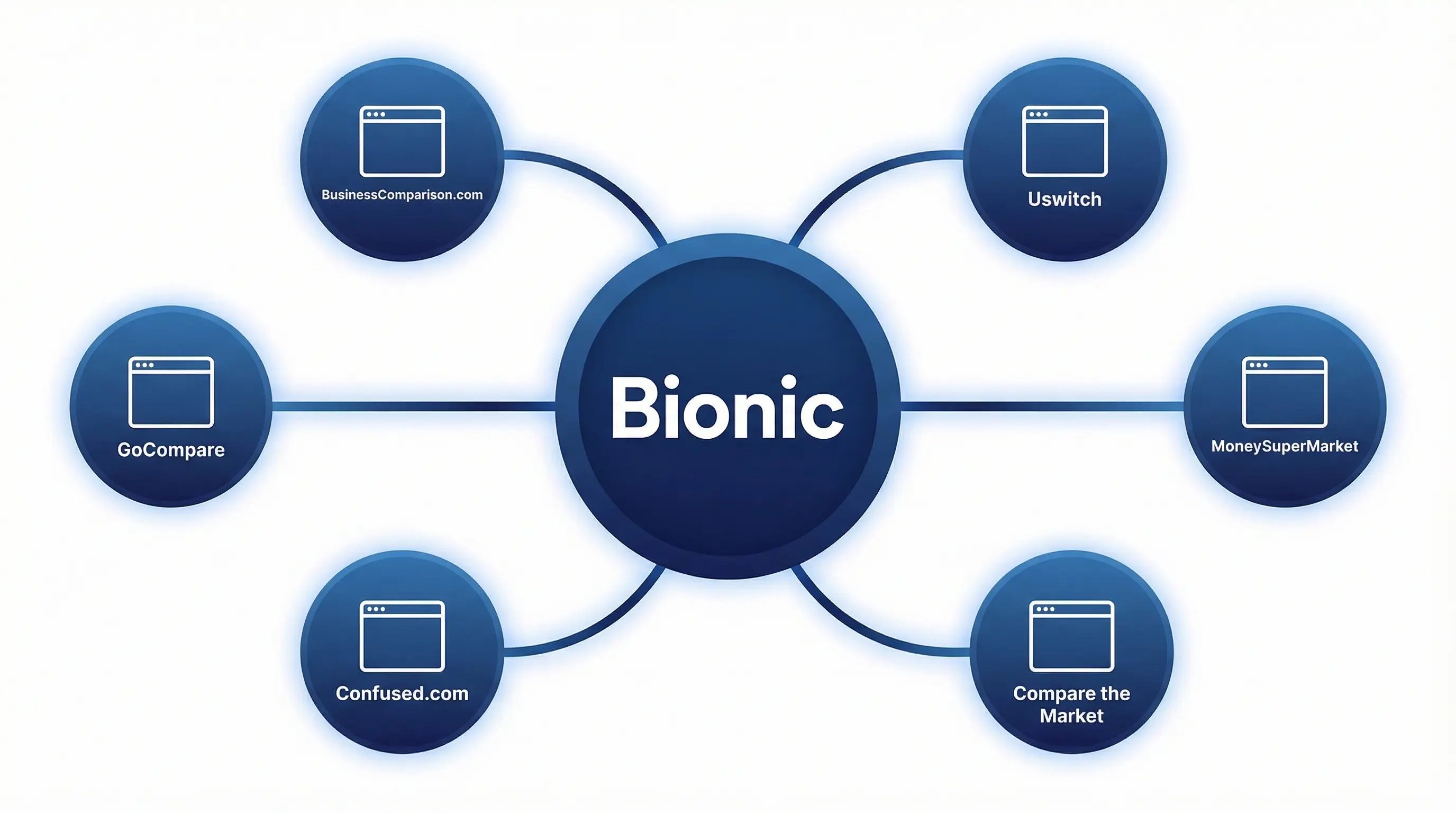

Network 1: Bionic - The UK’s Largest Business Energy Broker

Bionic (formerly MakeItCheaper) is the largest business energy broker network in the UK. Rather than competing with comparison sites, they power them.

Business energy comparison sites powered by Bionic:

| Site | Brand Recognition | How It Works |

|---|---|---|

| Bionic | Primary brand | Direct switching through Bionic |

| Uswitch | Household name | Enter details, Bionic calls you |

| MoneySuperMarket | FTSE-listed brand | Enter details, Bionic calls you |

| Compare the Market | Famous meerkat ads | Enter details, Bionic calls you |

| Confused.com | First UK comparison site | Enter details, Bionic calls you |

| GoCompare | Gio Compario character | Enter details, Bionic calls you |

| BusinessComparison.com | Business-focused | Enter details, Bionic calls you |

This was confirmed by Starling Bank’s 2020 partnership announcement, which stated that Bionic “powers comparison sites such as MoneySuperMarket and Uswitch” for business energy switching.

What this means for business energy switching in the UK: If you request quotes from Uswitch, then try MoneySuperMarket, then check Compare the Market - you’re giving the same Bionic sales team three opportunities to call you. The branding differs, but the service, commission structure, and potential auto-renewal practices are identical.

Commission: Estimated 2-4p/kWh embedded in unit rates (not disclosed upfront)

Concerns: According to Business Energy Claims (opens in new tab), approximately two-thirds of their mis-selling enquiries involve Bionic. A BBC Watchdog investigation (opens in new tab) in 2024 examined their auto-renewal practices - enabled by their use of Level 2 Letters of Authority that allow them to sign contracts on your behalf.

For the complete investigation into the Bionic network, see: The Illusion of Choice: Why All Comparison Sites Use Bionic

Network 2: Love Energy Savings - Second Largest Energy Broker White-Label Network

Love Energy Savings is the UK’s second-largest business energy broker network. Founded in 2007 and backed by £25m from LDC (part of Lloyds Banking Group), they’ve helped over 450,000 businesses.

Sites powered by Love Energy Savings:

| Site | Appears To Be | Actually Is |

|---|---|---|

| BusinessEnergy.com | Generic comparison site | Love Energy Savings white-label |

| BritishBusinessEnergy.co.uk | UK-focused independent | Love Energy Savings white-label |

| BusinessEnergyUK.com | Separate broker | Love Energy Savings white-label |

| Love Energy Savings | Primary brand | The actual broker |

What this means: If you’re looking for an “alternative” to Love Energy Savings and find BusinessEnergy.com, you’re entering the same sales funnel. The white-label strategy captures customers who think they’re comparing different options.

Commission: Typically around 1.2p/kWh according to their website - but there is no fixed cap. Customer reports vary significantly. One verified complaint revealed a 1.5p/kWh commission on a 4.37p/kWh gas rate - a 34% markup.

Concerns: Customer complaints frequently mention aggressive cold-calling, pressure to sign quickly, and hidden commission only revealed in contract paperwork.

For the complete investigation, see: Alternative to Love Energy Savings

Network 3: Utility Bidder - Growing White-Label Business Energy Broker

Utility Bidder is an award-winning business utility broker with strong Trustpilot ratings. They also operate white-label partnerships.

Sites powered by Utility Bidder:

| Site | How It Works |

|---|---|

| AquaSwitch.co.uk | Clicking “compare” loads Utility Bidder widget |

| Utility Bidder | Primary brand |

Commission: Estimated 2-4p/kWh embedded in rates (traditional broker model)

For more on Utility Bidder, see: Alternative to Utility Bidder

Network 4: Tickd - White-Label Platform for Traditional Brokers

Tickd operates differently from the other networks. Rather than serving SMEs directly, Tickd is a B2B2B platform - they license white-label switching software to energy brokers who want to appear tech-savvy without building their own systems.

How the Tickd model works:

You cannot switch energy directly through Tickd. When you use a “Tickd-powered” platform, you’re actually using a traditional broker’s version of the software. Many brokers with zero technical capability use Tickd to appear like they have sophisticated online switching.

Sites and brokers using Tickd’s white-label platform:

| Site/Broker | How It Works |

|---|---|

| SwitchPal.com | Clicking “compare” loads Tickd widget |

| Multiple traditional brokers | License Tickd’s white-label platform to serve SME customers |

Commission: Tickd charges suppliers £100-500 per meter per year, plus brokers pay £300-750/month SaaS fees. But here’s the key issue: each broker using Tickd then adds their own variable uplift on top. One Tickd-powered broker might charge 1.5p/kWh while another charges 4p/kWh - you won’t know unless you ask, and the uplift is typically hidden in the unit rate.

The result: The same underlying Tickd technology can produce wildly different costs for SMEs depending on which broker you happen to find.

For the full comparison, see: Tickd vs Meet George

What Does the UK Business Energy Broker Market Look Like?

Based on our investigation, here’s the complete landscape of UK business energy brokers and comparison sites:

White-Label Energy Broker Networks in the UK

| Site | Routes To | Evidence |

|---|---|---|

| Uswitch | Bionic | Footer disclosure, Starling Bank announcement |

| MoneySuperMarket | Bionic | Partnership page, Starling Bank announcement |

| Compare the Market | Bionic | Footer disclosure |

| Confused.com | Bionic | Footer: “Bionic Services Limited” |

| GoCompare | Bionic | Backend investigation |

| BusinessComparison.com | Bionic | Form submission routing |

| BusinessEnergy.com | Love Energy Savings | Widget inspection |

| BritishBusinessEnergy.co.uk | Love Energy Savings | Widget inspection |

| BusinessEnergyUK.com | Love Energy Savings | Widget inspection |

| AquaSwitch.co.uk | Utility Bidder | ”Powered by Utility Bidder” widget |

| SwitchPal.com | Tickd | Loads Tickd comparison widget |

Genuinely Independent Business Energy Brokers UK

These brokers appear to operate under their own ownership with no white-label backend*:

| Broker | Type | Notes |

|---|---|---|

| Energylinx for Business | Online + Phone | Energylinx for Business Limited |

| Switcheroo | Online + Phone | Independent platform |

| SwitchMyBusiness | Phone only | No online platform |

| SwitchYourEnergy | Online + Phone | Independent |

| UKBusinessSwitch | Online + Phone | Independent |

| EnergyCosts.co.uk | Online + Phone | Independent |

| SwitchAdvisor | Phone only | No online platform |

| WhichBusinessEnergy | Phone only | No online platform |

| PriceBuddy | Online + Phone | Independent |

*We couldn’t identify white-label arrangements for these brokers, but that doesn’t guarantee they don’t exist. Our investigation was limited to publicly visible information.

Important caveat: “Independent” means separate ownership - it doesn’t mean better pricing or more transparency. Most independent brokers still use the traditional model: phone-based sales with commission embedded in rates (typically 2-4p/kWh). Their cost-to-serve is high due to manual processes, so their margins must be too.

The Self-Service Business Energy Switching Alternative

| Platform | Type | Commission Model |

|---|---|---|

| Meet George | AI-powered self-service | 1p/kWh shown separately |

Meet George operates differently: no phone calls, no white-label network, no auto-renewals. Our AI assistant George handles contract analysis and customer questions, dramatically reducing cost-to-serve and enabling genuinely lower, transparent pricing.

What Does Business Energy Market Consolidation Mean for UK Businesses?

The concentration of the business energy broker market into four main networks has significant implications.

1. The Illusion of Shopping Around for Business Energy

When UK business owners try to compare options, they typically:

- Search Google for “compare business energy”

- Find Uswitch, MoneySuperMarket, or Compare the Market

- Enter their details on 2-3 sites for “comparison”

- Receive multiple calls from… the same Bionic sales team

One MoneySavingExpert forum user (opens in new tab) described this: “All the brokers (Uswitch, ComparetheMarket, GoCompare, etc.) use the same energy broker company called Bionic… you invariably end at Bionic.”

2. No Real Price Competition Between Business Energy Comparison Sites

Because the same broker powers multiple sites, there’s no price competition between them. You’ll receive the same quotes whether you come through Uswitch or Compare the Market - because it’s the same company generating those quotes with the same uplift.

True price comparison would require checking:

- A Bionic-powered site (any one of them)

- Love Energy Savings (or their white-labels)

- Utility Bidder

- A genuinely independent broker

- Direct supplier quotes

But most consumers don’t know this, so they “compare” across white-label sites and think they’ve done due diligence.

3. Hidden Energy Broker Commission Remains Hidden

White-label arrangements obscure the commission structure further. When you use BusinessEnergy.com, you might not realise it’s Love Energy Savings - making it harder to research their commission practices or complaint history.

Under Ofgem’s October 2024 rules (opens in new tab), TPI commissions must now be disclosed in contracts. But this happens at signing stage, not when comparing quotes - and the white-label structure makes pre-research harder.

4. Less Innovation in UK Business Energy Switching

When a few networks dominate distribution, there’s less incentive to innovate. Why invest in technology when you can capture traffic through brand partnerships?

This is why most business energy “comparison” sites still require phone calls - the dominant model is phone-based sales through Bionic, and that infrastructure doesn’t support true online self-service.

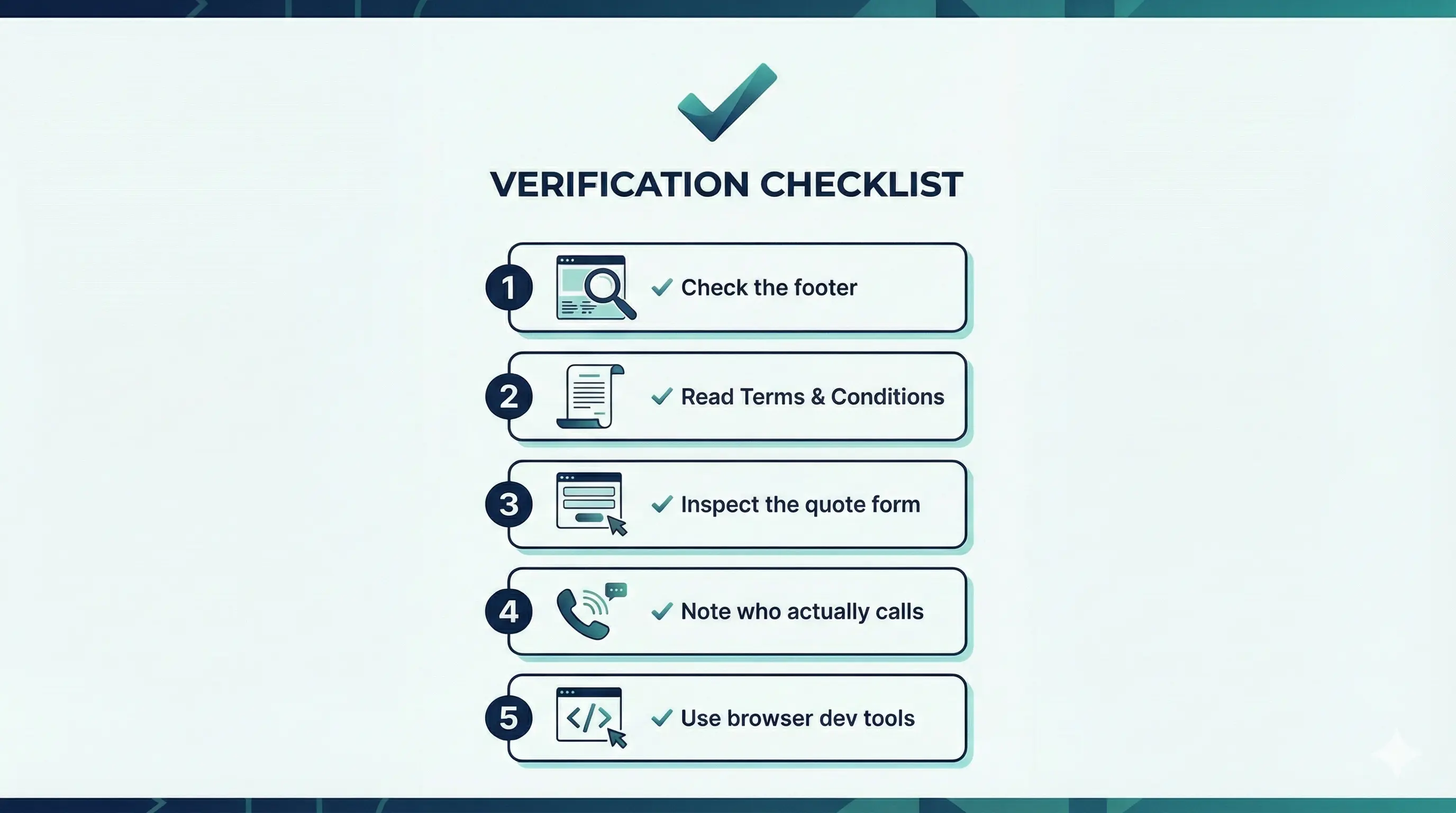

How Can You Tell If a Business Energy Site Is a White-Label?

Before sharing your details with any business energy comparison site, check whether it’s genuinely independent or a white-label:

1. Check the Footer for Energy Broker White-Label Disclosure

Scroll to the very bottom. Look for:

- “Powered by [Broker Name]”

- “In partnership with [Broker Name]”

- “Service provided by [Broker Name]”

For example, Confused.com’s footer states their business energy is “provided by Bionic Services Limited.”

2. Read the Terms and Conditions

The Terms page often reveals the actual company handling your enquiry. Look for company names and registration numbers that differ from the site’s branding.

3. Inspect the Quote Form

When you click “Get Quote” or “Compare Now,” watch for:

- The URL changing to a different domain

- A widget loading that says “Powered by…”

- A popup from a different company

This is how we confirmed SwitchPal loads Tickd’s widget and AquaSwitch loads Utility Bidder’s.

4. Note Who Actually Calls

If you do submit your details, note the company name when they call. If you submitted to “BusinessEnergy.com” but receive a call from “Love Energy Savings,” you’ve confirmed the white-label relationship.

5. Use Browser Developer Tools

For the technically inclined:

- Open Developer Tools (F12)

- Go to the Network tab

- Submit a quote request

- Look for API calls to domains other than the site you’re on

White-label sites often send your data to the parent broker’s servers.

How Much Does Using a Business Energy Broker Really Cost?

To understand what market consolidation costs UK businesses, consider the commission structure:

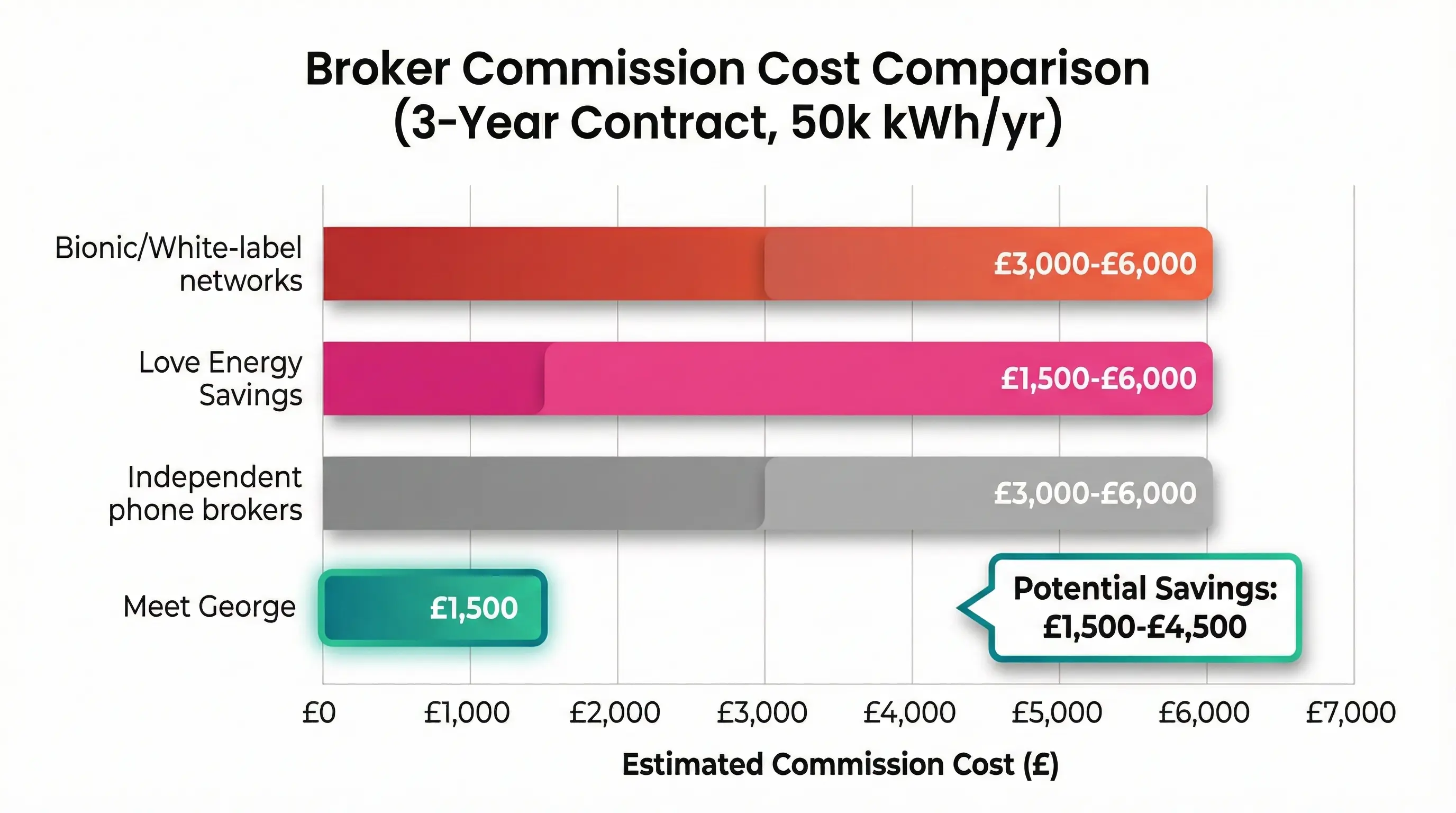

Business Energy Broker Commission Comparison UK

| Broker Type | Typical Commission | On 50,000 kWh/year (3-year contract) |

|---|---|---|

| Bionic network | 2-4p/kWh | £3,000-£6,000 |

| Love Energy Savings network | 1-4p/kWh | £1,500-£6,000 |

| Utility Bidder network | 2-4p/kWh | £3,000-£6,000 |

| Independent phone brokers | 2-4p/kWh | £3,000-£6,000 |

| Meet George | 1p/kWh (visible) | £1,500 |

Potential saving with transparent pricing: £1,500-£4,500 on a typical SME contract.

Why Do Phone-Based Business Energy Brokers Charge More?

Traditional brokers - whether networked or independent - have high costs:

- Sales teams: Commission-incentivised advisors making/taking calls

- Office infrastructure: Call centres, management, training

- Customer acquisition: Either through expensive brand partnerships (white-labels) or direct marketing

- Manual processes: Human handling of quotes, contracts, objections

These costs must be recovered through commission uplift. A broker with a cost-to-serve of £200+ per customer can’t survive on 1p/kWh.

The AI-Powered Business Energy Switching Alternative

AI-powered platforms like Meet George fundamentally change this equation:

- No sales team: Our AI assistant George handles questions without commission incentives

- No call centre: Fully digital, self-service process

- Lower acquisition cost: Direct traffic, no white-label partnerships to fund

- Automated processes: AI contract analysis at near-zero marginal cost

This enables transparent 1p/kWh pricing while still building a sustainable business.

What Are the Best Alternatives to Traditional Business Energy Brokers?

If you want to step outside the consolidated broker market, you have several options:

Option 1: Go Direct to Energy Suppliers

Contact energy suppliers directly and request quotes.

Pros:

- No broker commission

- Direct relationship

- Full control

Cons:

- Time-consuming (calling 10+ suppliers individually)

- No single market view

- Requires energy market knowledge

- No contract analysis support

This works for larger businesses with procurement expertise, but isn’t practical for most SMEs.

Option 2: Use a Genuinely Independent Business Energy Broker

Choose from the independent brokers listed above (Energylinx, Switcheroo, etc.).

Pros:

- Genuinely separate ownership

- May offer personalised service

- Established operations

Cons:

- Same commission model (2-4p/kWh embedded)

- Phone-based process

- Commission not typically disclosed upfront

Option 3: Self-Service Business Energy Switching Platforms

This is where Meet George fits in.

What makes Meet George the best business energy broker alternative:

| Factor | White-Label Networks | Independent Brokers | Meet George |

|---|---|---|---|

| Ownership | Network-controlled | Independent | Independent |

| Commission | 2-4p/kWh hidden | 2-4p/kWh hidden | 1p/kWh visible |

| Process | Phone required | Phone required | Fully online |

| Contract analysis | Human advisor | Human advisor | AI-powered |

| Auto-renewal | Often included | Sometimes | Never |

| White-label network | Yes | No | No |

How Meet George Works for UK Business Energy Switching

- Upload your bill - We extract MPAN/MPRN and usage automatically

- See all quotes - 20+ suppliers with our 1p/kWh fee shown separately

- Ask George anything - AI analysis of contracts, risks, and terms

- Switch online - Complete end-to-end without phone calls

- You control renewals - We remind you, never sign on your behalf

No white-label network. No hidden commission. No sales pressure.

How Is the UK Business Energy Broker Market Regulated?

The UK government and Ofgem are increasingly focused on broker transparency.

October 2024: Business Energy Broker Commission Disclosure Rules

Ofgem’s non-domestic market review (opens in new tab) now requires all TPI commissions to be disclosed in contracts. This means white-label arrangements must eventually reveal commission amounts - but typically only at contract signing, not during comparison.

Upcoming: Direct Energy Broker Regulation UK

The UK government has confirmed plans to directly regulate Third Party Intermediaries (opens in new tab). Under the new regime:

- Brokers will require registration

- Conduct standards will be set

- Ofgem can investigate complaints

- Bad actors can be removed from the market

This should improve standards but doesn’t address market consolidation itself.

December 2024: Extended Energy Ombudsman Access for Businesses

Small businesses (under 50 employees or £6.5m turnover) can now take complaints to the Energy Ombudsman (opens in new tab). Previously limited to microbusinesses, this extends dispute resolution to more SMEs.

The ombudsman data tells the story: Energy Ombudsman statistics reveal that 69% of broker complaints are upheld in favour of the consumer, with an average financial award of £894. Critically, 88% of broker complaints relate to the sales process - not service delivery. The problem is fundamental to how energy is sold.

Voluntary Self-Regulation Has Failed

Despite years of industry promises, voluntary standards haven’t improved broker conduct. RECCo launched a voluntary TPI Code of Practice in October 2023 to establish minimum standards. As of mid-2025, only 45 brokers have signed up - just 2% of the estimated 2,200 active brokers in the UK market. When 98% of an industry ignores voluntary standards, mandatory regulation becomes inevitable.

What Won’t Regulation Fix in the Business Energy Broker Market?

Even with improved regulation:

- White-label arrangements will remain legal

- Market consolidation will continue

- Commission-based incentives will persist

- Phone-based models will dominate traditional brokers

The structural issues require market alternatives, not just regulatory oversight.

What Questions Should You Ask a Business Energy Broker?

Before committing to any broker - networked or independent - ask these questions:

1. “Who actually handles my switch?”

If you’re on BusinessEnergy.com but Love Energy Savings handles the switch, you should know that upfront. The answer reveals whether you’re dealing with a white-label.

2. “What is your commission in pence per kWh?”

Get a specific number, not “it’s included in the rate.” Under Ofgem rules, they must disclose this eventually - you’re just asking earlier.

3. “Can I see the supplier’s base rate separately?”

Transparent platforms show: Supplier rate + Broker fee = Your rate. Opaque brokers show only the total.

4. “Will you ever sign contracts on my behalf?”

This reveals auto-renewal practices. If they can sign without your explicit approval each time, you may be locked into consecutive contracts. See: Letter of Authority explained

5. “Can I complete this entirely online?”

If phone calls are mandatory, understand why - and whether that suits your preferences.

6. “What happens at renewal time?”

Will they contact you with options, or auto-renew and inform you afterwards? The answer matters significantly.

Conclusion: The UK Business Energy Broker Market Reality

The UK business energy broker market presents an illusion of competition. Behind dozens of brand names and comparison sites, just four networks dominate online switching:

- Bionic: 6+ major sites including all household-name comparisons

- Love Energy Savings: 3+ sites appearing as independent alternatives

- Utility Bidder: Growing white-label presence

- Tickd: Digital-first with white-label partnerships

Genuinely independent brokers exist, but most operate the same phone-based, embedded-commission model. Independence of ownership doesn’t mean independence of approach.

For UK businesses seeking genuine alternatives, the options are:

- Go direct to suppliers (time-consuming but commission-free)

- Use verified independent brokers (same model, separate ownership)

- Use transparent self-service platforms (different model entirely)

Meet George exists because we saw this landscape for what it is. We built something genuinely different: AI-powered, fully self-service, with transparent 1p/kWh pricing shown separately from supplier rates.

The question for your business: do you want to navigate a consolidated market of hidden commissions and white-label arrangements, or try a transparent alternative?

Ready to Switch Business Energy Differently?

Understand the market: Read our investigations into how Bionic powers all comparison sites and how hidden commissions work.

Learn about transparent pricing: See how Meet George’s 1p/kWh fee works and why we show it separately.

Switch with full transparency: Join the Meet George platform - no hidden margins, no white-label network, no sales calls, no surprises.

This investigation is based on analysis of company disclosures, website inspections, regulatory filings, and publicly available information. We update this guide as the market evolves. Last updated: 8th January 2026.