TL;DR: Key Takeaways

Tickd’s Model: A digital switching platform that primarily serves as white-label software for energy brokers and partners. Brokers use Tickd’s technology to offer switching to their own clients.

The Key Difference: When you use Tickd, you’re often using a broker’s version of the platform - and that broker can add their own margin on top. With Meet George, there’s no middleman.

The Cost Question: Tickd charges fixed fees per meter (£100-£500/year depending on usage). For smaller businesses, this can work out more expensive than Meet George’s flat 1p/kWh.

The Transparency Trade-off: Tickd publishes its commission rates online (commendable), but broker partners can layer additional fees that aren’t as visible.

Bottom Line: Tickd digitised broker switching - useful, but fundamentally the same intermediary model. Meet George is built differently: AI-powered multi-agent systems that read contracts, explain terms, and work directly for SMEs with no broker layer in between.

Understanding Tickd: A Platform for Brokers, Not for You

Before comparing, it’s important to understand what Tickd actually is - because it’s fundamentally different from Meet George.

You Can’t Switch Directly with Tickd

Here’s the key point most people miss: SMEs cannot switch energy directly through Tickd.

Tickd is a white-label platform that energy brokers license to look like they have their own switching technology. When you use what appears to be a broker’s “proprietary platform,” you’re often using Tickd’s software with the broker’s branding on top.

This means:

- Traditional brokers with zero technical skills can appear to have sophisticated online switching

- Each broker using Tickd sets their own uplift fees - there’s no standard pricing

- You’re not dealing with Tickd - you’re dealing with whichever broker licensed their platform

- The broker you’re using might charge 1p/kWh, 3p/kWh, or 5p/kWh - you won’t know unless you ask

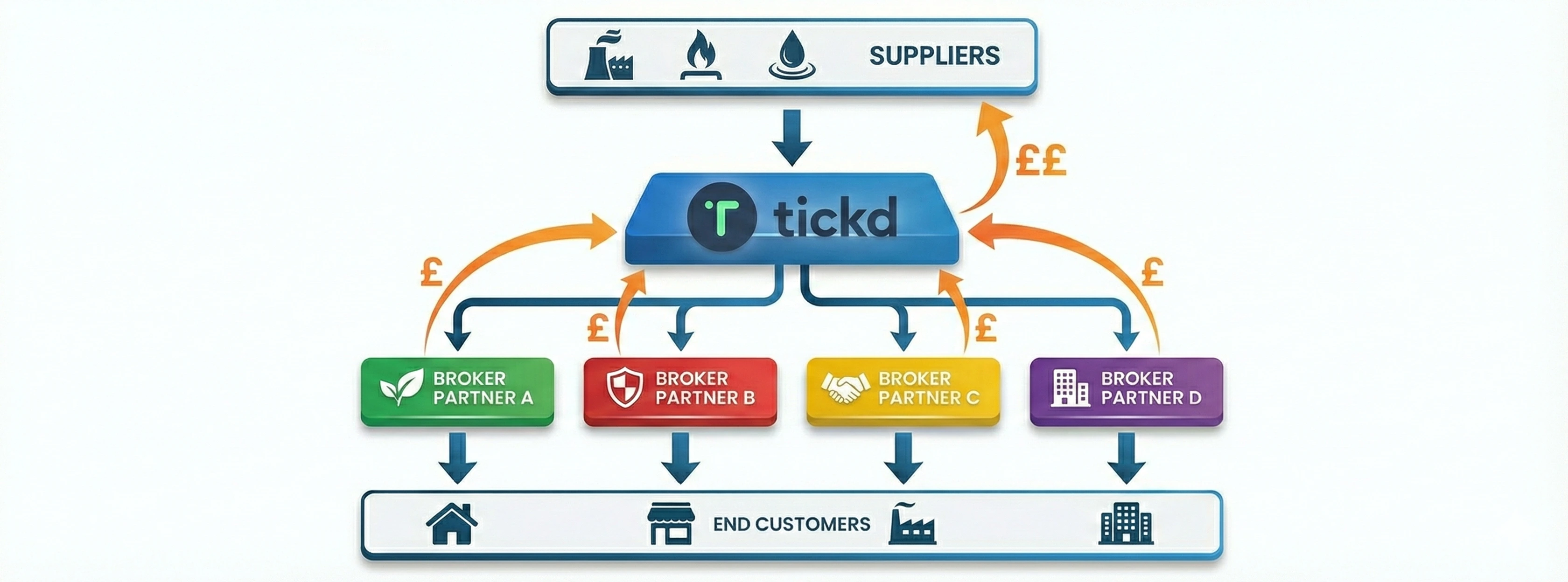

Tickd’s customers are brokers and partners, not SMEs. They license their software to:

- Energy brokers (who add their own margins)

- Suppliers (like Ecotricity (opens in new tab))

- Partner organisations (like NFU Energy (opens in new tab) - the National Farmers’ Union’s energy service)

- Community groups and franchises

How Tickd Makes Money

Tickd earns revenue in two ways:

1. Supplier Commission (Per Meter)

Tickd publishes its commission structure openly - which is commendable. The fees are fixed based on annual usage:

| Annual Usage | Tickd Commission (per fuel, per year) |

|---|---|

| Up to 15,000 kWh | £100 |

| 15,001 - 25,000 kWh | £200 |

| 25,001 - 50,000 kWh | £350 |

| Over 50,000 kWh | £500 |

These fees apply each year of a multi-year contract. So a 3-year contract on a 20,000 kWh site would generate £600 in commission for Tickd alone (£200 × 3 years). The broker using Tickd’s platform then adds their own uplift on top - that additional commission goes directly to the broker, not to Tickd.

2. SaaS Subscriptions from Broker Partners

Brokers pay Tickd monthly fees (estimated at £300-£750 based on industry norms for white-label SaaS platforms) to use the white-label platform, plus an estimated percentage of each commission. This is Tickd’s core business model.

What Tickd Does Well

Credit where it’s due - Tickd has genuine strengths:

- Solid automation - 90-second quotes, digital contracts via DocuSign (email-based, not in-platform), automated supplier integrations

- Transparent about their own fees - They publish their commission rates on their website (though broker partners add their own on top)

- No sales calls from Tickd - The platform process is self-service (though broker partners may still call you)

- Good partner support - Reviews from broker partners praise their small team’s responsiveness (though this is B2B support, not direct SME customer service)

- 91%+ on-time switches - Strong operational reliability

Tickd helped modernise an industry that was stuck in phone calls and paper forms. That’s genuinely valuable.

What Tickd Doesn’t Have

It’s worth noting what’s absent from Tickd’s platform:

- No AI assistance - The platform shows quotes but doesn’t analyse contracts or explain terms

- No direct SME access - You can’t just go to Tickd and switch; you need a broker intermediary

- No contract analysis - It won’t flag risky clauses, volume tolerances, or unfavourable terms

- No standardised pricing - Every broker using Tickd charges different fees

- No in-platform signing - Contracts go via DocuSign emails, meaning you leave the platform to complete the process

The technology is functional but not intelligent. It’s essentially a quote comparison and contract processing system - useful, but not a step-change from what brokers were doing before, just digitised.

The Problem: Every Broker Using Tickd Is Different

Here’s where it gets problematic for SMEs.

The Variable Uplift Problem

Since you can’t switch directly with Tickd, you’re always dealing with a broker who’s using their platform. And here’s the issue: every broker sets their own commission.

Broker A using Tickd might charge 1.5p/kWh uplift. Broker B using the exact same Tickd platform might charge 4p/kWh. You’d have no way of knowing unless you asked both - and even then, the uplift is often buried in the unit rate rather than shown separately.

Tickd’s platform explicitly allows partners to “configure your commission” on contracts. This is why 77% of businesses think brokers are free - they never see the commission separated out. This means:

- The same underlying technology can produce wildly different costs for SMEs

- A broker with zero technical skills can look sophisticated while charging high margins

- There’s no price consistency - what you pay depends entirely on which broker you happened to find

- The broker’s standing charge markup could also vary

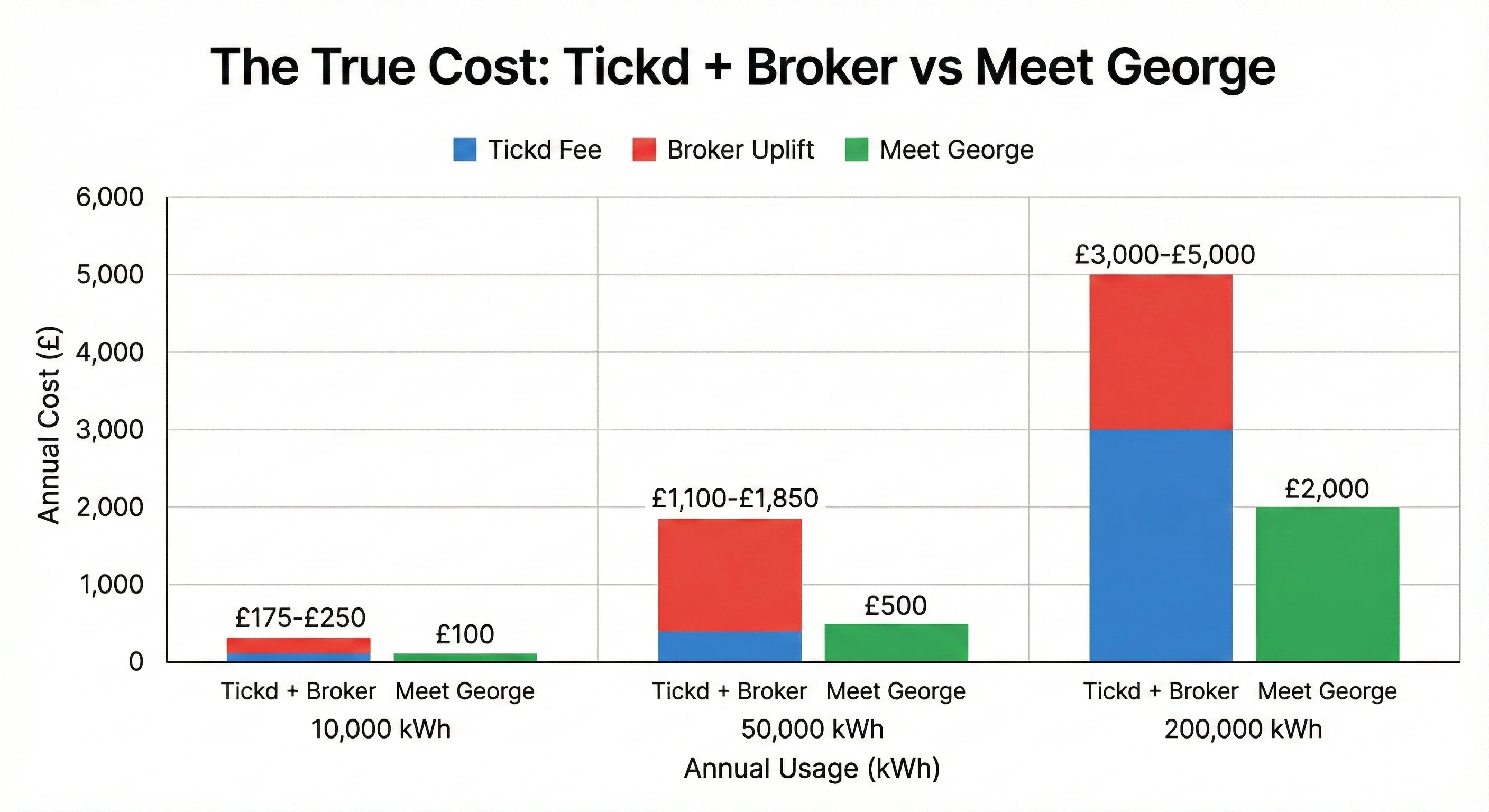

The True Cost: Tickd Fee + Broker Uplift

The table below shows what Tickd earns from suppliers - but this is only part of the picture. The broker using Tickd’s platform must add their own uplift to cover:

- Tickd’s monthly SaaS fees (estimated at £300-750/month)

- Tickd’s facilitation cut (estimated at 25-35% of each commission)

- Their own profit margin

| Your Usage | Tickd’s Cut | Broker’s Likely Uplift | Total Commission | Meet George |

|---|---|---|---|---|

| 5,000 kWh/year | £100 (2p/kWh) | +£75-150 (1.5-3p/kWh) | £175-250 (3.5-5p/kWh) | £50 (1p/kWh) |

| 25,000 kWh/year | £200 (0.8p/kWh) | +£375-750 (1.5-3p/kWh) | £575-950 (2.3-3.8p/kWh) | £250 (1p/kWh) |

| 50,000 kWh/year | £350 (0.7p/kWh) | +£750-1,500 (1.5-3p/kWh) | £1,100-1,850 (2.2-3.7p/kWh) | £500 (1p/kWh) |

At every usage level, the total cost through a Tickd-powered broker is higher than Meet George’s flat 1p/kWh. The broker isn’t running a charity - they have to cover their costs and make money too.

Limited Supplier Panel

Tickd only shows suppliers that have API integrations with their platform. From their own FAQ:

We only show suppliers that agree to work with us and integrate via API.

This means some competitive deals might not appear if the supplier hasn’t built a technical integration with Tickd. Meet George also works with 20+ API-integrated supplier partners, and we’re always looking to grow our supplier depth so we can offer wide market coverage.

Meet George: A Direct Alternative to Tickd

If you’re looking for an alternative to Tickd’s broker-powered model, Meet George takes a fundamentally different approach.

No Middlemen

We don’t white-label our platform to brokers. We don’t have partners adding their own margins. When you use Meet George, you’re dealing directly with us - and we work for you, not for a broker.

| Factor | Tickd (via broker) | Meet George |

|---|---|---|

| Who do you deal with? | Broker using Tickd’s platform | Meet George directly |

| Can fees be layered? | Yes - broker can add uplift | No - 1p/kWh is the total |

| Whose interest comes first? | Broker’s (they’re the customer) | Yours (you’re the customer) |

| Supplier panel | API-integrated only | 20+ API partners |

| Contract signing | Via email (DocuSign) | In-platform - start to finish |

| AI contract analysis | No | Yes - George reads every clause |

Why We Can Charge Less

Traditional brokers charge 2-4p/kWh because their model requires salespeople, phone calls, and relationship management. Tickd reduced that by automating the process, but they still operate through brokers who must add their own costs - covering Tickd’s estimated platform fees, Tickd’s estimated facilitation cut on each deal, plus their own profit margin.

Meet George uses AI to go further:

- George reads every contract clause and explains terms in plain English

- Flags risks like unfavourable volume tolerances or hidden exit fees

- Answers unlimited questions - no sales pressure, just information

- Operates 24/7 - unlike broker phone lines

This AI-first approach means our cost-to-serve is lower than even Tickd’s automated platform. We pass those savings directly to you: 1p/kWh, always visible, no layers on top.

The Trust Question

Tickd’s business model creates an inherent tension. Their real customers are brokers - that’s who pays the SaaS subscriptions. SMEs using the platform are valuable, but indirectly so.

Meet George’s only customer is you. We have no broker relationships to protect, no white-label partners to keep happy. Our incentive is simple: help you switch successfully, and you’ll recommend us to others.

When Tickd Might Be Right

To be fair, there are scenarios where Tickd’s model works well:

You’re Using a Trusted Partner

If you’re accessing Tickd through a reputable organisation like NFU Energy (for farmers) or a known supplier like Ecotricity, you benefit from:

- Their curated advice alongside Tickd’s technology

- Confidence that the partner isn’t adding excessive margins

- Industry-specific guidance (e.g., agricultural energy needs)

You Value an Existing Broker Relationship

Some business owners value existing relationships with their broker or industry body. If you trust your NFU Energy (opens in new tab) advisor (the National Farmers’ Union’s energy service) or your broker’s industry expertise, using their Tickd-powered portal keeps that relationship intact.

However, remember:

- The broker is still adding their own margin on top of Tickd’s fees

- You might not see the full supplier market

- You don’t get AI-powered contract analysis

When Meet George Is Better

You Want Full Transparency

With Meet George:

- 1p/kWh is always visible - shown separately from the supplier rate

- No additional layers - what you see is what you pay

- Full contract breakdown - George explains every clause

You Want Better Value at Any Size

Meet George serves businesses from small shops using 5,000 kWh up to larger SMEs using 500,000+ kWh. Our 1p/kWh rate works at every scale:

| Your Usage | Meet George Fee | Tickd + Broker (typical) |

|---|---|---|

| 10,000 kWh | £100/year | £175-250/year |

| 50,000 kWh | £500/year | £1,100-1,850/year |

| 200,000 kWh | £2,000/year | £3,000-5,000/year |

At every usage level, our flat rate likely beats the layered broker model.

You Want AI-Powered Guidance

Tickd’s platform is automated but not intelligent. It shows you quotes and processes contracts, but it won’t:

- Analyse your specific contract terms

- Warn you about problematic clauses

- Explain jargon in plain English

- Help you understand if a deal is genuinely good for your situation

George does all of this. Ask him “Is this exit fee normal?” or “What happens if my usage increases?” and get instant, informed answers.

You Want Direct Control

With Tickd via a broker, you’re somewhat at the mercy of which suppliers they choose to show and what margins they add. With Meet George, you see the full market and make your own decision.

The Regulatory Context

The UK energy broker market is changing. Ofgem’s non-domestic market review (opens in new tab) now requires commission disclosure for all business customers. The government is moving to directly regulate brokers (opens in new tab).

Both Tickd and Meet George support these changes. But the white-label model creates complexity:

- Who’s responsible when things go wrong - Tickd or the broker partner?

- How do customers know what the broker added vs. what Tickd charged?

- Where does accountability sit?

With Meet George, there’s one party responsible: us. That clarity benefits you if issues arise.

Making Your Choice

Choose Tickd (or a Tickd-powered partner) if:

- You have an existing trusted relationship with a broker or industry body using Tickd

- You’re comfortable with the broker layer and don’t need detailed contract analysis

- The partner offers industry-specific expertise you value (e.g., agricultural, hospitality)

- You prefer human guidance over self-service (and are willing to pay for it)

Choose Meet George if:

- You want to deal directly, with no middlemen adding undisclosed fees

- You want the lowest total commission at any usage level (5,000 - 500,000+ kWh)

- You want AI-powered contract analysis and plain-English explanations

- You value knowing exactly what you’re paying and to whom

- You prefer self-service with 24/7 AI assistance over broker phone calls

- You want in-platform contract signing - no email tennis

Questions to Ask Either Provider:

- “What is the total commission on this quote, including any partner margins?”

- “Are you showing me all suppliers, or just those with integrations?”

- “Who is responsible if something goes wrong with my switch?”

- “Can you explain this contract clause in plain English?”

The answers will tell you which model suits your needs.

Disclaimer: This analysis reflects Tickd’s publicly available information as of 2nd January 2026. Tickd may update their pricing, features, or business model in future - we recommend checking their website for the latest details.

Ready to switch with full transparency? See how Meet George’s pricing works or learn more about how broker commissions are typically embedded.

Ready to switch the transparent way? Learn the complete 5-step switching process or join the Meet George platform waitlist to see exactly what you’re paying - no undisclosed margins, no surprises.