TL;DR: Key Takeaways

Brokers Aren’t All Bad: For complex I&C businesses with half-hourly metering, on-site generation, and strategic energy needs, a skilled broker is a genuine partner worth paying for.

The Mis-Sell Problem: The consultancy model designed for factories is being sold to coffee shops - with fees that don’t match the service delivered.

The Sophistication Gap: “Sophisticated” doesn’t mean smarter. It means operational complexity. Most SMEs don’t have it, and don’t need to pay for services designed for those who do.

The £3,000 Question: A typical SME pays £3,000+ in broker fees over a 3-year contract. For most, that’s like paying hedge fund prices for petty cash management.

The October 2024 Shift: Ofgem’s transparency rules (opens in new tab) now require commission disclosure. You can finally ask: “What exactly am I paying for?”

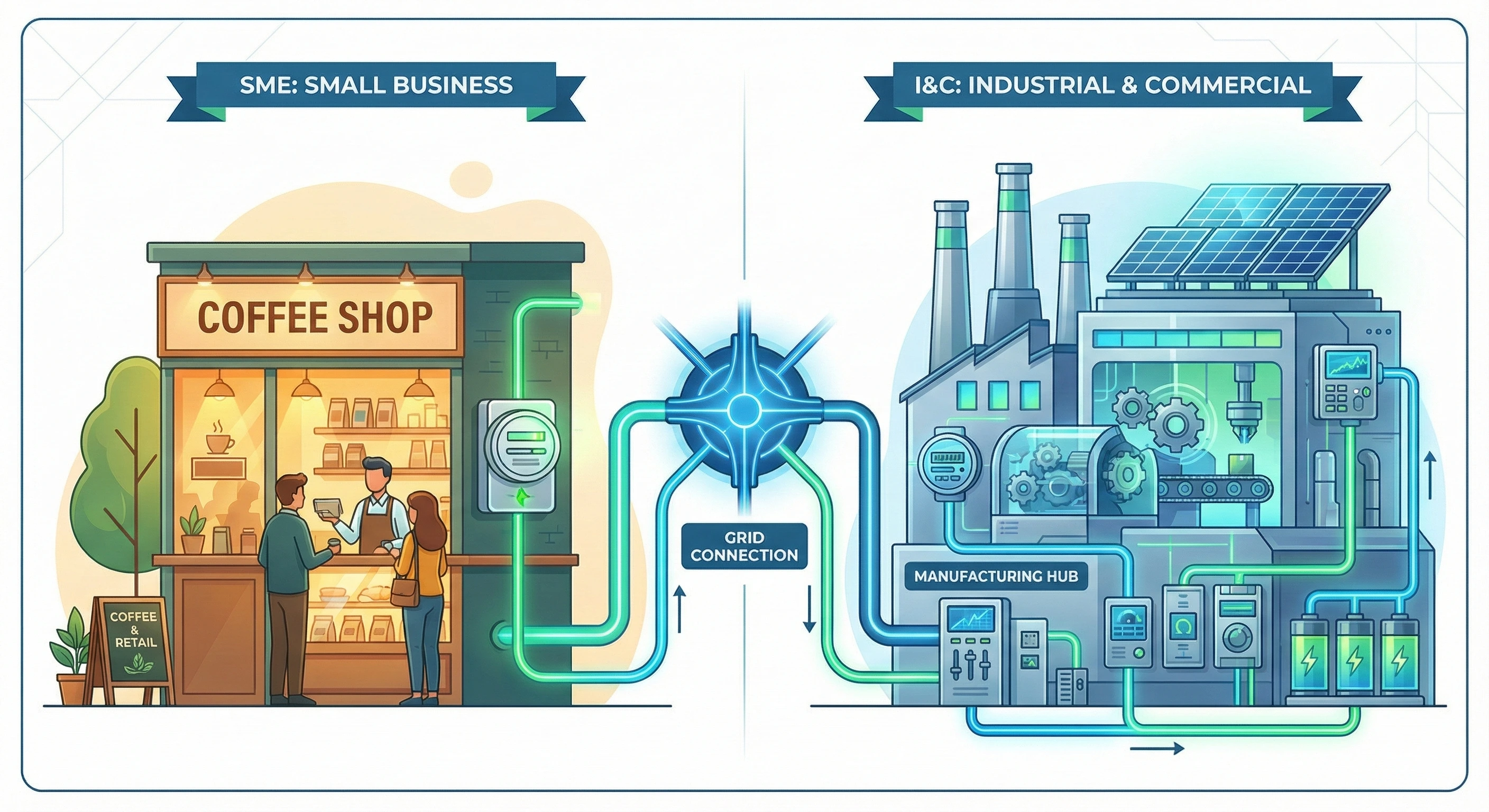

Two Customers, One Industry, Two Different Needs

In the UK energy market, there’s a massive divide between two types of business customers: the Sophisticated I&C User and the Typical SME.

The problem isn’t that brokers exist. The problem is that the “consultancy” model designed for large energy users is being mis-sold to small businesses - often with a price tag that doesn’t match the service.

The trust deficit is real: Ofgem’s 2024 research found that 50% of small businesses hold negative perceptions of energy brokers. Half the market actively distrusts the intermediaries designed to help them. That’s not a minor PR problem - it’s a structural failure. The Energy Ombudsman data backs this up: broker complaints rose 112% in 2024, with 88% relating to sales practices.

Here’s where a broker adds genuine value, and where they just add unnecessary cost.

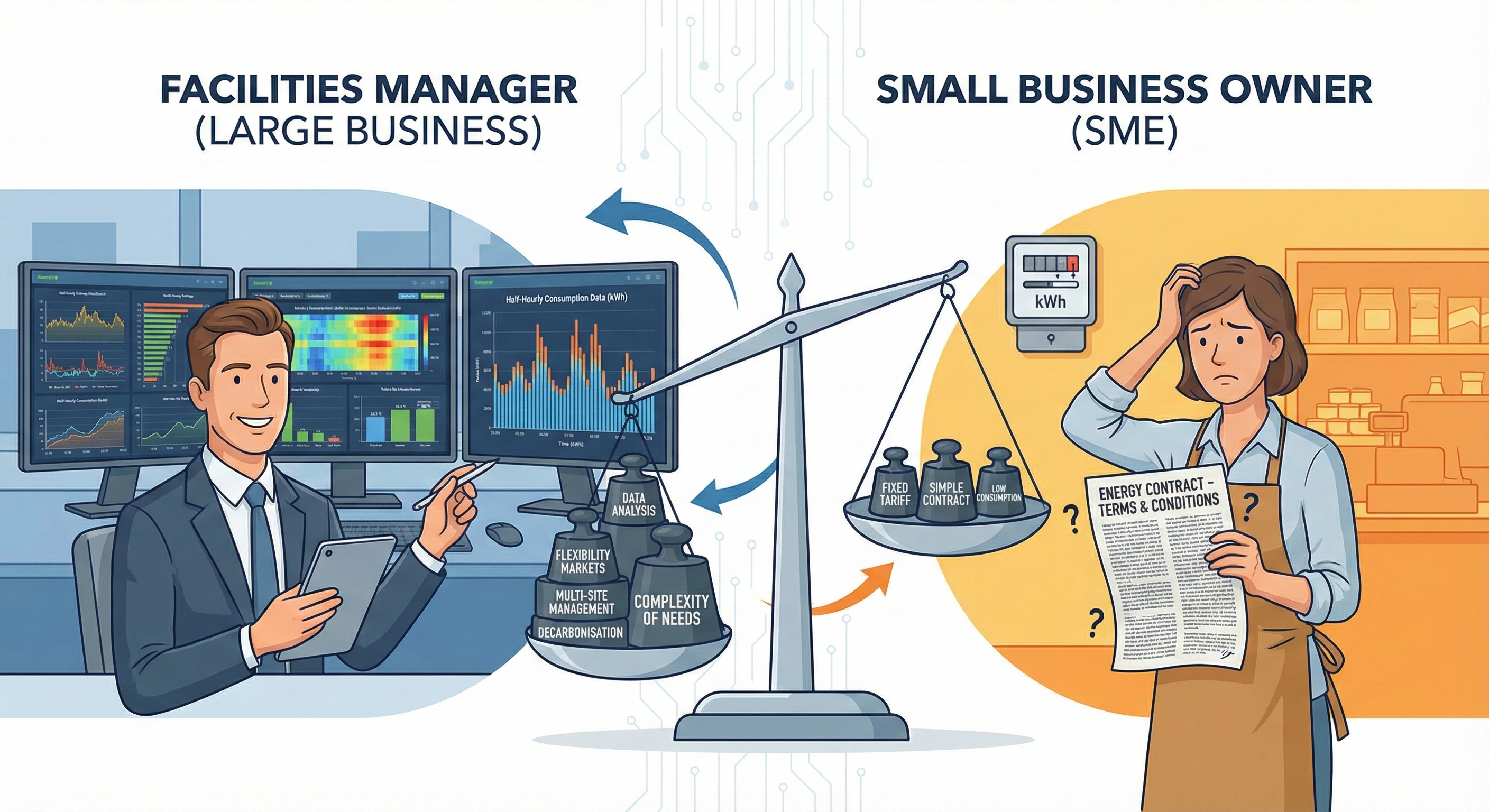

The Sophistication Gap: It’s Not About Intelligence

It’s important to understand that “sophisticated” doesn’t mean “smarter.” It means operational complexity.

The Industrial & Commercial (I&C) Customer

An I&C business might be a 24/7 manufacturing plant, a large hospital trust, or a multi-site retail franchise. They typically have:

- Dedicated facilities managers or “Heads of Sustainability”

- Half-hourly metering with granular consumption data

- On-site generation (solar PV, Combined Heat and Power units)

- Battery storage or demand-side response capabilities

- Availability agreements with the local DNO

- Maximum Import Capacity (MIC) constraints to manage

- Power factor correction equipment

They understand the nuances of their energy profile because their business depends on it. They know the game back to front.

The Typical SME

A typical SME - like a local restaurant, dentist, or design agency - is fundamentally different:

- They turn the lights on when they open and off when they close

- They don’t have an energy department; they have an owner wearing multiple hats

- Their unit rate is usually bundled (energy + networks + levies all-in-one)

- They want a fair price and accurate billing - not a strategic energy partner

The energy broker industry often treats these two groups the same, selling complex, expensive brokerage services to businesses that just need a simple utility connection.

The Misalignment: Why Brokers Charge SMEs So Much

There’s a structural reason why brokers target SMEs with high fees, and it comes down to Cost to Serve.

The Economics Don’t Work

An I&C client is often easier to deal with because they understand the terminology. The conversation is peer-to-peer. They know what a Triad charge is. They understand DUoS bands. They can interpret a half-hourly consumption profile.

An SME owner, naturally, needs more help. They need:

- The contract explained in plain English

- The jargon demystified

- The process managed step-by-step

This creates a fundamental conflict:

| The Broker’s Goal | The SME’s Goal |

|---|---|

| Justify the hours spent explaining the contract | Get the cheapest commodity price |

| Make the account profitable by adding margin | Avoid paying unnecessary fees |

| Lock in a long-term deal for upfront commission | Maintain flexibility |

These goals are completely misaligned.

The broker is essentially charging a high-end “consulting fee” to a customer who just wants to buy a commodity product. Because the SME owner often doesn’t understand undisclosed uplifts, they end up paying this “hand-holding tax” without realising it.

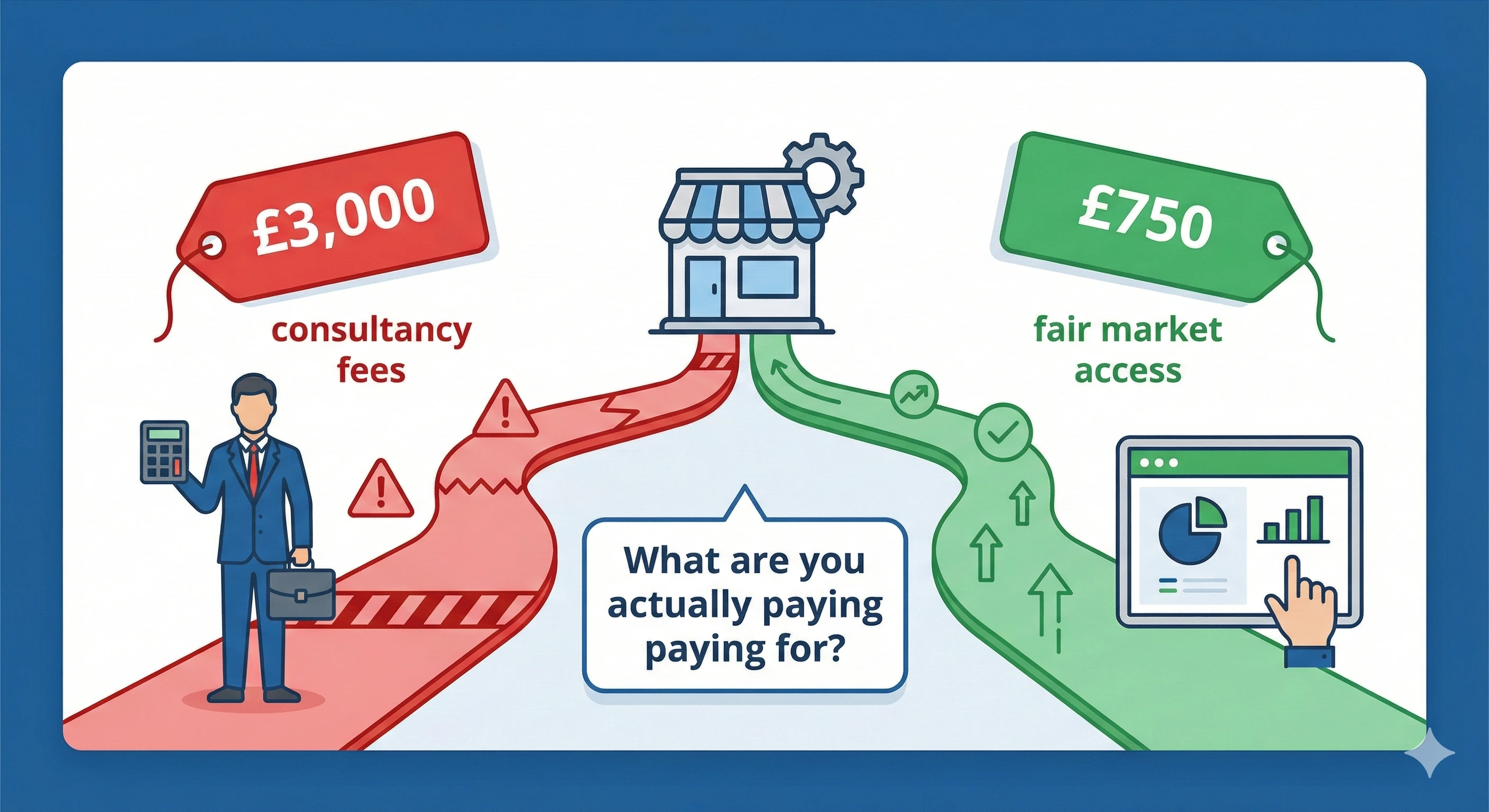

The Maths: Paying for a Service You Don’t Get

Because the price is usually “bundled” for SMEs (energy + networks + levies all in one), the broker’s fee can be easily embedded in it.

The Undisclosed Commission Trap

Brokers add a “commission uplift” on top of the supplier’s base rate. While I&C firms might negotiate a transparent fee, SMEs often face undisclosed uplifts of 2p to 4p per kWh.

The scale of this problem is staggering. According to Ofgem’s Non-Domestic Market Review (opens in new tab), some businesses have been charged commissions representing up to 50% of their total contract value - fees they were never told about at the point of sale. Some legal firms pursuing group litigation have estimated that a large proportion of UK microbusinesses may have been affected by undisclosed commissions during the 2019-2023 period when disclosure was not mandatory, leading to multiple claims for “secret commissions.”

Real-World Example: 25,000 kWh/Year SME

| Cost Element | 3-Year Total |

|---|---|

| Undisclosed 4p/kWh uplift | £3,000 |

| What you get | A few emails and phone calls |

| What you should pay | £750 (at 1p/kWh) |

That’s £2,250 overpaid for an “energy consultant” when all you needed was access to fair market rates. See exactly how much you could be paying with our commission calculator - it breaks down the cost at different commission rates so you can compare. And the problem is compounded when you think you’re “shopping around” on comparison sites - but they all route to the same broker anyway.

If you’re running a coffee shop, paying for an “energy consultant” is like hiring a hedge fund manager to run your petty cash.

When a Broker IS Essential: The I&C Model

If you’re running a 24/7 manufacturing plant with on-site solar and a Combined Heat and Power (CHP) unit, there’s genuine value in having an experienced energy broker navigate the complexities.

You’re trading a commodity, not just paying a bill.

For these users, a skilled broker acts as a strategic partner who manages:

Load Shaping and Peak Avoidance

Helping you shift production schedules to avoid expensive Triad charges (the three highest demand half-hours of the winter, which determine your transmission charges for the following year). A well-timed production shutdown during a Triad warning can save tens of thousands of pounds annually.

Brokers also help manage DUoS (Distribution Use of System) charges by identifying which of the red, amber, and green time bands your usage falls into - and restructuring operations to minimise exposure to peak rates.

Asset Optimisation and Revenue Stacking

For businesses with on-site assets, brokers can help unlock multiple revenue streams:

- Demand-Side Response (DSR): Getting paid to reduce consumption when the grid needs it

- Frequency Response: Using battery storage to provide grid balancing services

- Capacity Market: Earning payments for guaranteed availability during system stress

- Export Revenue: Optimising when to use on-site generation vs. when to export to the grid

A skilled broker understands how to “stack” these revenues - participating in multiple programmes simultaneously without conflicting obligations.

Unbundled Contracts

Negotiating contracts where energy, levies, and network costs are paid separately - giving you visibility and control. For I&C customers, unbundled contracts can reveal significant savings opportunities:

- Pass-through pricing: Paying actual network costs rather than inflated estimates

- Levy exemptions: Claiming relief on Climate Change Levy (CCL) or other environmental charges where eligible

- Flexible volumes: Adjusting contracted volumes based on actual production forecasts

Regulatory Navigation and Compliance

Managing compliance with P272 regulations (opens in new tab), capacity market obligations, and the transition to Market-wide Half-Hourly Settlement (MHHS). As the regulatory landscape evolves, I&C customers need advisors who understand the implications.

For this level of complexity, a broker’s fee is an investment that pays for itself many times over. If your annual energy spend is £500,000+ and you have on-site generation, the right broker could save you 10-15% - far exceeding their fee.

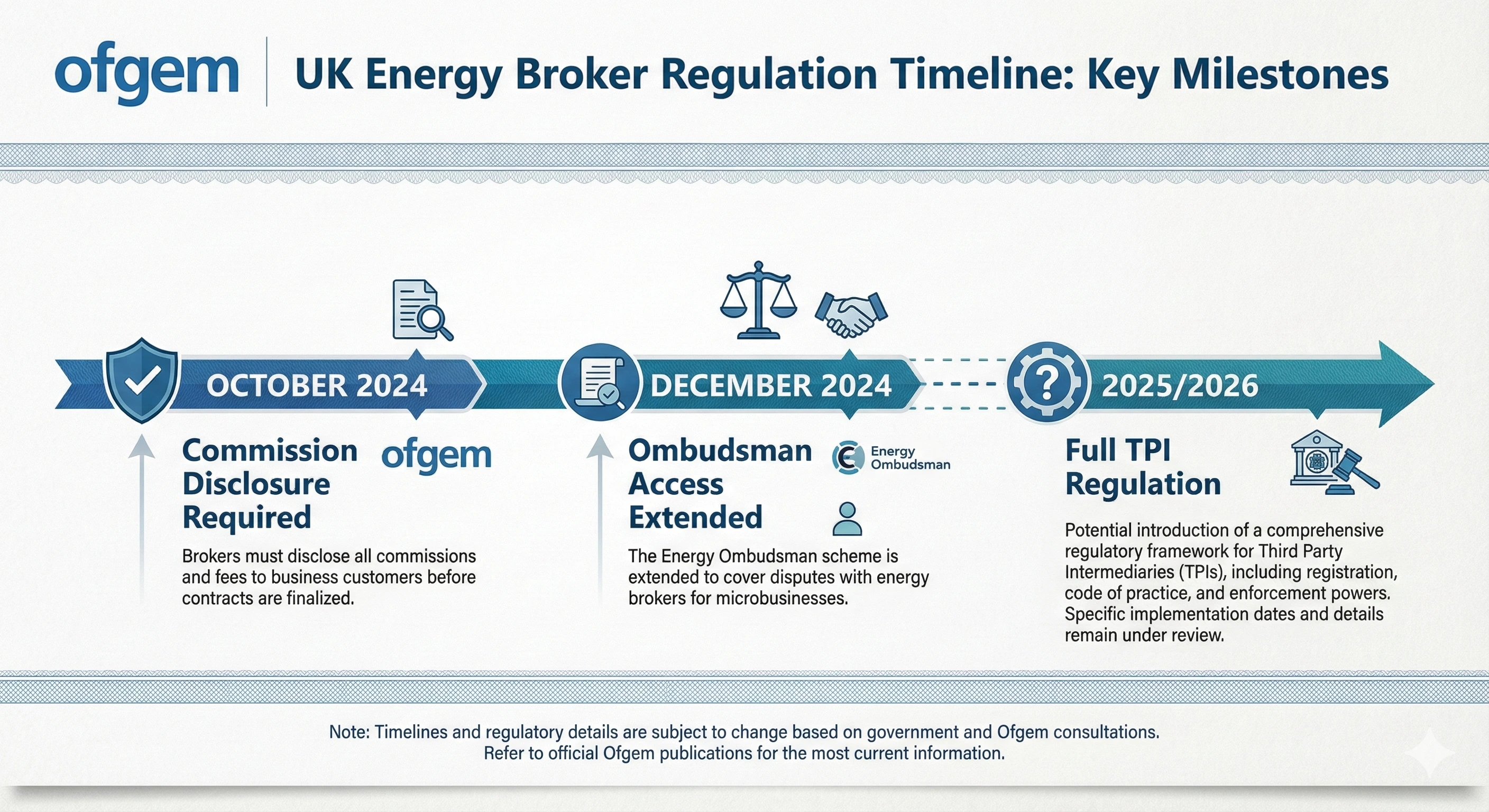

October 2024: The End of the “Undisclosed” Era

For years, high commissions were the industry’s dirty secret. But the net is tightening.

Mandatory Disclosure Rules

As of 1 October 2024, Ofgem’s transparency rules (opens in new tab) require suppliers to disclose broker commissions for all non-domestic customers, not just microbusinesses.

According to Zenergi’s analysis of the new rules (opens in new tab), suppliers must now include TPI costs in the contract’s Principal Terms, making it much harder to bury fees in the small print.

This means you can now look at your contract and ask:

“You’re charging me £3,000 in commission. What exactly are you doing for that money?”

Government Action on Broker Regulation

The government has confirmed plans to directly regulate Third Party Intermediaries (TPIs). Following consultation in late 2024 (opens in new tab), Ofgem will become the regulator (opens in new tab) with powers to:

- Require TPI registration

- Set rules and standards

- Investigate complaints

- Remove bad actors from the market

We welcome this. Read our full stance on incoming regulation.

Extended Ombudsman Access

From December 2024, small businesses (under 50 employees or £6.5m turnover) can take complaints about brokers to the Energy Ombudsman - previously only available for microbusinesses. This gives SMEs a proper route to challenge unfair treatment.

The Ombudsman Data Tells the Story: The Energy Ombudsman’s 2025 Broker Report found that 58% of broker complaints were upheld in favour of the consumer, with an average financial award of £894. Critically, 88% of broker complaints relate to the sales process - not service delivery issues. This means the problem is fundamental to how energy is sold, not how it’s supplied.

The Satisfaction Paradox

Here’s an uncomfortable truth: Ofgem research shows 73% of businesses are satisfied with their broker’s services. Sounds good, right? But the same research shows 77% of businesses believe they don’t pay broker fees - despite commissions being embedded in virtually every contract.

This isn’t genuine satisfaction. It’s satisfaction based on incomplete information. When businesses don’t know they’re paying £2,000-3,000 in undisclosed fees, of course they’re “satisfied” with a service they think is free. The question isn’t whether you’re happy - it’s whether you’d still be happy if you knew the true cost.

Voluntary Self-Regulation Failed

Despite years of industry promises, voluntary standards haven’t worked. RECCo launched a voluntary TPI Code of Practice in October 2023 to improve broker conduct. As of mid-2025, only 52 brokers have signed up - just 2% of the estimated 2,700+ active brokers in the UK market. We’ve written about why only 52 brokers have signed the TPI Code - the short version is that transparency conflicts with the undisclosed commission model. When 98% of an industry ignores voluntary standards, mandatory regulation becomes inevitable.

How to Check Your Broker’s Commission

The new transparency rules mean you have the right to know (opens in new tab) exactly what your broker is being paid. Here’s how to find out:

Step 1: Find Your Contract Documents

Locate your energy supply agreement. For contracts signed after 1 October 2024, broker commission must be disclosed in the Principal Terms section.

Step 2: Check the Third Party Costs Section

Look for sections labelled “Third Party Costs”, “Broker Commission”, “TPI Fees” or similar. This should show the pence-per-kWh or fixed fee your broker receives.

Step 3: Request Disclosure From Your Supplier

If you can’t find commission details, email your supplier requesting full disclosure of any third-party intermediary costs included in your contract. They are legally required to provide this information under Ofgem’s non-domestic market review rules (opens in new tab).

Step 4: Calculate the Total Cost

Multiply the commission rate by your annual usage and contract length:

Example: 3p/kWh × 25,000 kWh × 3 years = £2,250 in broker fees

Step 5: Compare Against Market Rates

Check if your all-in rate is significantly higher than current market rates. A gap of 3-5p/kWh above market suggests excessive broker commission. Online Direct’s guide to TPI transparency (opens in new tab) can help you understand what’s reasonable.

What to Do If You Find Excessive Charges

If you discover your broker has added significant undisclosed commission:

- Document everything - Keep copies of all contracts and correspondence

- Contact your broker - Ask them to justify the fee in writing

- Complain to your supplier - They facilitated the non-disclosure

- Escalate to the Ombudsman - If you’re a small business, you now have this right

- Consider legal advice - Particularly for contracts signed before disclosure was mandatory

The Decision Framework: Do You Need a Broker?

You Probably Need a Broker If:

- You have high voltage connections or half-hourly meters

- You have on-site generation (solar, CHP, wind)

- You have battery storage or participate in demand response

- You have EV charging infrastructure to manage

- You have availability charges with your local DNO

- Energy is a strategic cost requiring active management

- Your annual energy spend exceeds £100,000

Their knowledge is likely worth the fee.

You Probably Don’t Need a Broker If:

- You have a single site with standard electricity/gas

- You just want the cheapest rate without the complexity

- Your energy profile is predictable (open 9-5, closed weekends)

- You don’t have facilities managers or an energy strategy

- You want transparency over “trust me” advice

- Your annual energy spend is under £100,000

You need access to fair market rates, not expensive consultancy.

Meet George: Solving the Cost-to-Serve Problem

Meet George exists because the traditional broker model is broken for SMEs.

The Problem We Solve

The “Cost to Serve” issue is real - SME owners do need guidance and support. But the solution isn’t to bury a £3,000 fee in their energy rate.

Our Approach

Fair Pricing: We charge a flat, transparent 1p/kWh fee - no undisclosed 4p uplifts. You see exactly what you pay us.

AI-Powered Support: We know business owners still have questions. That’s why we built George to answer anything:

- “Are there red flags in this quote?”

- “What does this clause mean?”

- “Is this rate competitive?”

Our AI has full contextual understanding of your contract and the energy market. Ask questions until you’re completely comfortable and ready to sign.

Self-Service, Fair Price: You get the “hand-holding” you need to feel confident, but at the low commodity price you actually deserve.

The technology handles what brokers charge thousands for - leaving you with savings, not fees.

Ready to switch without the premium? See how our transparent pricing works or learn how the undisclosed commission model works so you can spot it in your current contract.