TL;DR: Key Takeaways

In short: Business energy switching is broken by design. The industry profits from complexity, pressure tactics, and information asymmetry. But you can navigate it - if you understand how the game is rigged.

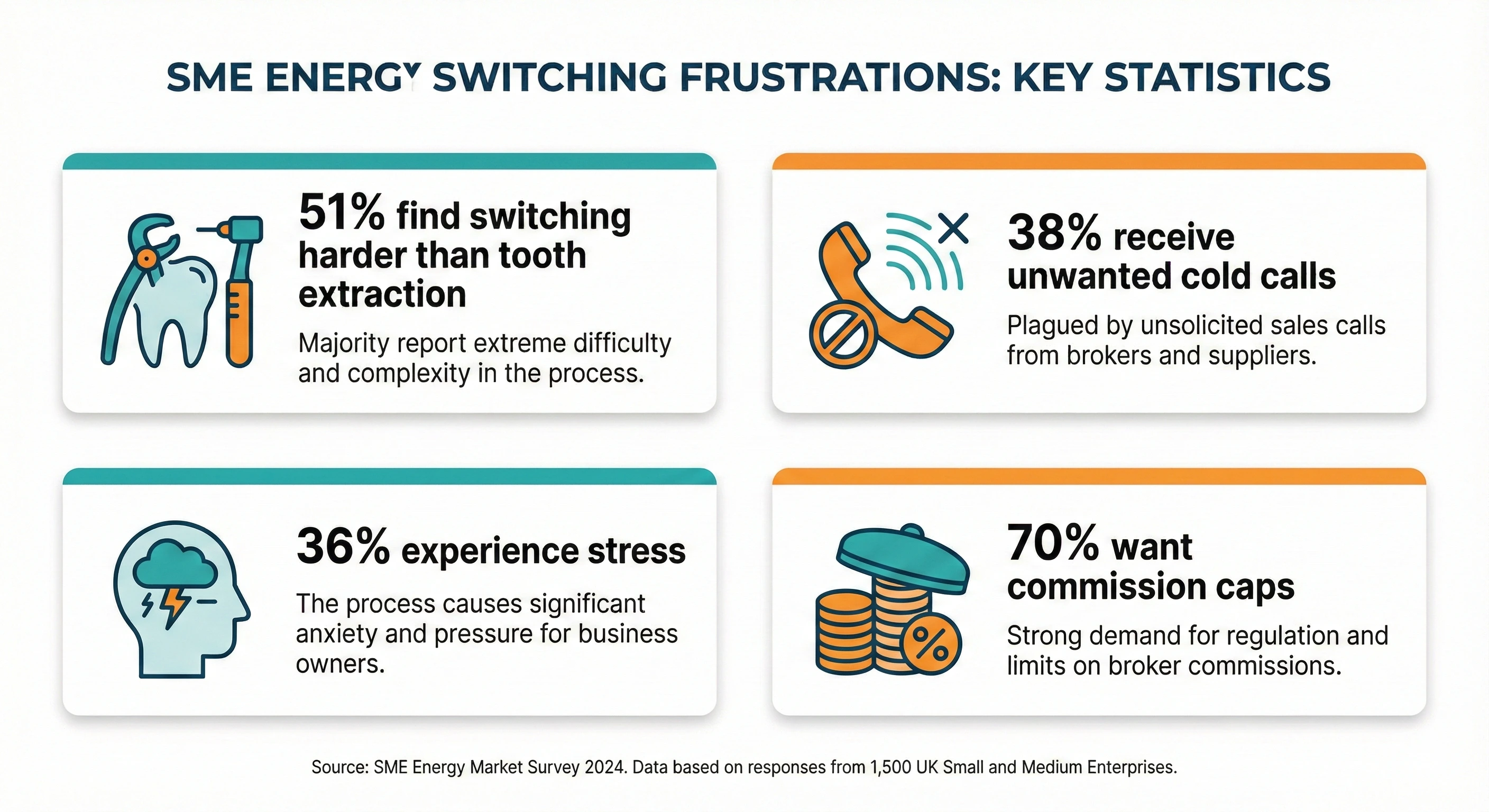

The Numbers Don’t Lie: Industry surveys show a majority of SMEs find the energy switching process frustrating and stressful. 38% report unwanted broker cold calls. 36% experience genuine stress during energy negotiations. 70% want caps on broker commissions.

Why It’s So Hard: Unlike households, businesses have no Energy Switch Guarantee (5-day switching), no 14-day cooling-off period, no standardised timelines, and switches can take 4-12 weeks. The system is designed for suppliers and brokers, not you.

The Traps: Deemed rates (40-60% higher than fixed), auto-renewal clauses with 2-day opt-out windows, undisclosed broker commissions adding 2-5p/kWh, and pass-through charges that increase even on “fixed” contracts.

The 2026 Crunch: TNUoS charges are nearly doubling from April 2026 - a 96% increase. Even if you do nothing wrong, your bills are rising. Action is no longer optional.

The Numbers That Should Shame an Industry

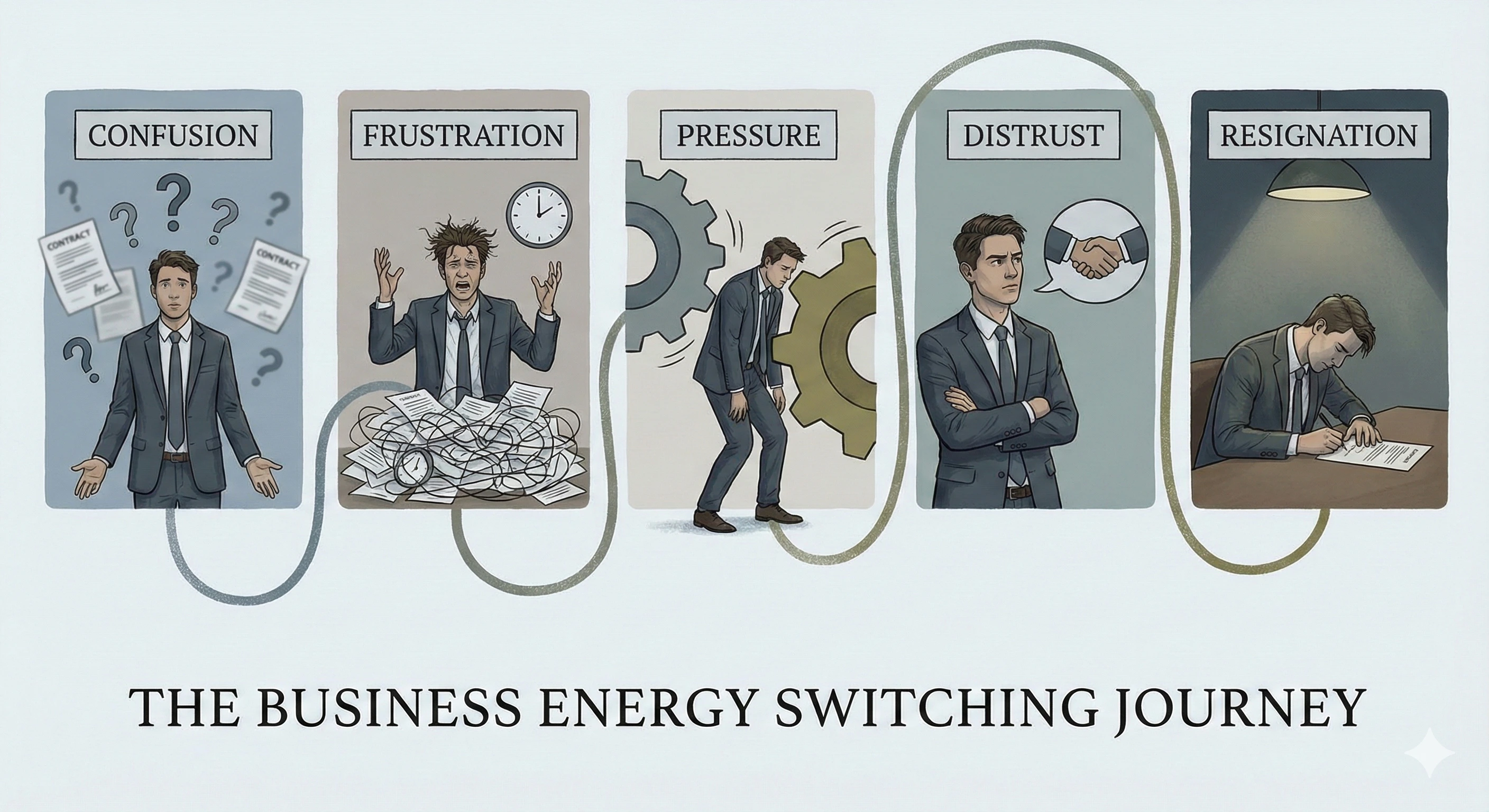

The experience of switching business energy in the UK is, by most accounts, needlessly painful. Industry surveys consistently find that a majority of SME owners consider the process one of the most frustrating aspects of running a business.

When comparing your energy options feels like an ordeal that most owners would rather avoid entirely, something has gone seriously wrong.

Here’s what SMEs actually experience:

- 38% report receiving unwanted cold calls from energy brokers - sometimes 10-15 per day from overseas call centres

- 36% experience genuine stress during energy negotiations, worrying they’re being ripped off

- 24% felt “pressured to change supplier” by aggressive broker tactics

- 70% want caps on broker commissions because they suspect (correctly) that undisclosed fees are inflating their bills

- Only 37-42% of SMEs actually use brokers - meaning the majority would rather struggle alone than deal with the industry

- 40% of SME owners have never switched energy supplier - not once (CMA research)

- 43% believe no real competition exists in the business energy market

The market structure reinforces this inertia: the Big 5-6 suppliers still control approximately 80% of business electricity market share by volume (compared to 67% in the domestic market), and business switching rates have actually declined 20% in recent quarters. Competition is weakening, not strengthening.

The Paradox: Here’s what’s interesting - Ofgem’s 2024 research found that 78% of businesses who actually switched found the process easy (up from 60% in 2023). So why the “tooth extraction” perception? Because the pain isn’t in the switch itself - it’s in the decision-making, broker pressure, fear of being ripped off, and market complexity that precedes it. Like dreading a dental procedure that turns out to be fine, the anticipation is worse than the reality. The challenge is getting businesses over the psychological barrier to act.

These aren’t edge cases. This is the mainstream experience of running a small business in the United Kingdom.

Why Business Energy Switching Is Fundamentally Broken

The difficulties aren’t accidental. They’re structural features of a market designed to benefit suppliers and intermediaries, not customers.

1. Businesses Have Fewer Protections Than Households

When you switch your home energy, you’re protected by the Energy Switch Guarantee - switches complete within 5 working days, you get a 14-day cooling-off period, and final bills arrive within 6 weeks.

Businesses get none of this.

- No guaranteed switching timeline (can take 4-12 weeks)

- No cooling-off period (once you sign, you’re locked in)

- No standardised notice periods (buried in contract small print)

- Energy Ombudsman only covers microbusinesses

Ofgem’s TPI regulation programme (opens in new tab) is introducing new transparency rules, but mandatory broker regulation won’t arrive until 2026. In the meantime, only 52 of 2,700+ brokers have signed the voluntary TPI Code. Until then, businesses are largely on their own.

The perception barriers are just as significant as the structural ones:

- Only 39% of businesses agree there’s sufficient choice in suppliers

- Only 29% agree there’s sufficient tariff choice

- 34% actively disagree there’s sufficient product/service choice

When businesses believe the market lacks meaningful options, why would they invest time switching?

2. The Broker Model Is Built on Information Asymmetry

Traditional energy brokers don’t make money by saving you money. They make money by adding margin to your unit rate - the undisclosed uplift that can add 2-5p per kWh to your bill.

Here’s how the incentives work against you:

- Commission structures typically front-load payments - brokers often receive the majority of their commission upfront when you sign, creating an incentive to prioritise volume over ongoing service. We analysed how broker commission rates really work

- Longer contracts = bigger payouts, regardless of whether it’s the best deal for you

- Commission caps vary by supplier - some have stricter limits on broker uplift than others

- Until October 2024, commission didn’t have to be disclosed at all

A broker who gets you the “best” rate of 24p/kWh when the supplier’s base rate is 20p/kWh has just added £1,000/year to your costs on a 25,000 kWh contract. And you’d never know.

3. The Cold Call Culture Is Relentless

One Reddit user on r/smallbusinessuk described receiving 10-15 calls per day from energy sales teams (opens in new tab). The calls often come from overseas call centres, pretend to be from your current supplier, and use pressure tactics:

We get cold called almost every day by energy companies. It feels endless. They always ask to speak to the owner, sometimes they pretend to be from our energy company. Is anyone else experiencing this?

Another business owner asking for advice on Reddit (opens in new tab) captured the confusion perfectly:

I’ve recently taken over the ops side of a small-mid sized business and just found out our energy contract is coming up for renewal. Every time I search online I just get bombarded with comparison sites wanting my details. Who is actually reliable for business energy advice?

The responses reveal widespread distrust - with multiple users warning about brokers who push specific suppliers for higher commissions rather than finding the best deal. One reply summed up the scepticism:

Be very careful with brokers. Many of them have deals with specific suppliers and will push those regardless of whether it’s the best deal for you. Always get multiple quotes.

Meanwhile, a frustrated energy salesperson’s post (opens in new tab) inadvertently revealed why SMEs are so resistant:

New to energy sales, struggling to get heard. There’s three things I need to know if we’re coming up to the end of the contract: standing charge, unit rate, contract end date. But I can barely get past hello before they hang up.

The replies were damning - business owners explaining they had been burned before and now avoid all broker calls entirely. One user’s response captured the industry-wide distrust:

The reason nobody wants to talk is because they’ve been lied to before. The whole industry has a reputation problem.

This is not illegal. It is just how the industry operates. Brokers buy lists of businesses approaching contract renewal and blast them with calls, hoping that volume will convert into signatures.

The 38% who report unwanted calls are probably under-reporting. Many business owners have simply stopped answering unknown numbers.

4. The Deemed Rates Trap Is Deliberate

If you miss your renewal window - even by a few days - your supplier places you on deemed rates: default prices typically 40-60% higher than contracted rates.

This isn’t a regulatory requirement. It’s a commercial practice designed to profit from inattention.

Suppliers know that busy business owners miss deadlines. They know that complex contracts make it hard to find renewal dates. They know that aggressive auto-renewal emails get deleted as spam. And they profit from all of it.

At current rates, a small business on deemed rates might pay 38p/kWh when contracted rates are around 22p/kWh. That’s £4,000 per year in pure waste for a 25,000 kWh user.

5. “Fixed” Contracts Aren’t Actually Fixed

Here’s a trap that catches even sophisticated business owners: most “fixed rate” contracts only fix the commodity cost (the actual energy). The non-commodity charges - TNUoS, DNO fees, levies - are typically “pass-through” costs that increase automatically.

Why this matters in 2026:

Non-commodity charges now represent nearly 60% of typical business electricity bills. And they’re about to surge:

- TNUoS charges (opens in new tab) are increasing by 96% from April 2026 (£3.84bn to £7.52bn annually)

- This will add approximately 5%+ to business bills regardless of your contracted rate

- Network charges are expected to rise 10%+ per year through 2031

A business that signed a “fixed” 3-year contract in 2024 will still see significant bill increases in 2026 - and may not understand why until it’s too late.

The Multi-Site Penalty: Why Chains Suffer Most

If you run a hospitality group, retail chain, or franchise operation with multiple locations, the switching problem multiplies.

TNUoS charges are per-site, per-day. A business with 10 sites pays 10x the TNUoS increase, not a consolidated charge. When these charges nearly double in April 2026, multi-site businesses face compounded pain.

But it’s not just cost. The administrative burden is crushing:

- Each site may have different contract end dates

- Each site needs separate meter readings at switch

- Each site may have different Profile Classes and meter types

- Coordinating 5-10 switches simultaneously is a full-time job

This is why only 37-42% of SMEs use brokers despite the obvious time-saving benefit. The experience is so poor that most businesses would rather struggle alone.

The Emotional Toll: Why This Isn’t Just About Money

The 36% who report stress during energy negotiations aren’t being dramatic. Business energy decisions carry genuine psychological weight:

Fear of being ripped off. Every business owner has heard horror stories about undisclosed fees, locked-in contracts, and broker manipulation. When you can’t verify whether a rate is good, you’re negotiating blind.

Decision paralysis. Faced with complex tariffs, pass-through charges, contract terms, and broker pressure, many owners simply freeze. Inaction feels safer than potentially making the wrong choice - even though inaction guarantees overpayment.

Time poverty. SME owners wear multiple hats. The 22-minute phone calls, screen-share sessions, and back-and-forth emails that traditional switching requires compete with actually running the business.

Distrust of the entire system. When 70% of SMEs want commission caps, that’s not just a policy preference. It’s a market-wide loss of faith. The data supports this instinct - Energy Ombudsman complaints about brokers rose 112% in 2024. Business owners suspect they’re being exploited, and often they’re right.

The stress compounds when you add 2026’s looming cost increases. Businesses know they need to act, but the process itself is so unpleasant that many delay until forced by bill shock.

What Actually Works: A Realistic Switching Strategy

The system is broken, but you still have to operate within it. Here’s how to minimise the pain:

Start 90 Days Early (Non-Negotiable)

The single biggest mistake is starting too late. When you’re 2 weeks from contract end, you have no leverage, no time to compare, and maximum pressure to sign anything.

At 90 days out:

- You can shop around properly

- Brokers can’t use “rates expire today” pressure tactics

- You have time to read contracts properly

- You avoid the digital renewal trap

Set calendar reminders for every energy contract. Check your bills for end dates. If you can’t find them, call your supplier now.

Understand What You’re Actually Paying

Before seeking quotes, audit your current bill:

- Unit rate - The p/kWh you pay for energy consumed

- Standing charge - The daily fixed fee regardless of usage

- Non-commodity charges - TNUoS, DNO, CCL, and other pass-through costs

If non-commodity charges are already 50%+ of your bill, switching supplier alone won’t solve the problem. You need to understand whether new quotes include these as pass-through (variable) or fixed (locked in).

Get Multiple Quotes Without Commitment

The broker who cold-called you isn’t your only option. Get quotes from:

- Direct supplier websites (some publish rates online)

- Comparison platforms (though be aware that most use the same underlying broker)

- 2-3 different brokers (creates competition)

- Meet George (transparent 1p/kWh fee, no cold calls)

Critical questions to ask every source:

- “What is the supplier’s base rate versus your commission?”

- “Are non-commodity charges pass-through or fixed?”

- “What are the early termination fees?”

- “How long is the switching process?”

If they can’t or won’t answer clearly, walk away.

Compare Total Cost, Not Just Unit Rate

A quote of 22p/kWh with pass-through non-commodity charges might cost more than 24p/kWh with fixed all-in pricing - depending on how much TNUoS increases over your contract term.

Calculate total annual cost:

- (Annual kWh × unit rate) + (365 × standing charge) + estimated non-commodity charges

This is the number that matters. The headline unit rate is marketing.

Never Sign Under Pressure

“This rate expires at 5pm today” is almost always a lie. For SME contracts, suppliers typically update rates weekly or monthly, not hourly.

Pressure tactics are a red flag for bad brokers. Walk away from anyone who:

- Refuses to give you 24 hours to review

- Won’t provide written quotes

- Gets aggressive when you ask questions

- Won’t disclose their commission

The right deal will still be available tomorrow.

Why 2026 Makes Action Urgent

The April 2026 TNUoS increase isn’t a prediction - it’s already confirmed. National Grid ESO (opens in new tab) publishes these charges annually, and the 96% increase is locked in.

What this means for your business:

| Your Annual Usage | Estimated TNUoS Increase (April 2026) |

|---|---|

| 25,000 kWh | ~£100-150 per year |

| 50,000 kWh | ~£200-300 per year |

| 100,000 kWh | ~£400-600 per year |

| Multi-site (5 locations) | 5x the above |

These increases hit whether you switch or not. But businesses that act now can:

- Lock in competitive commodity rates before market movements

- Potentially find suppliers offering fixed non-commodity pricing

- Avoid deemed rates that would compound the increase

- Spread the administrative burden before crisis mode

Waiting until April when bills spike means negotiating from weakness.

The Regulatory Cavalry Is Coming (But Not Yet)

There’s good news on the horizon. The Department for Energy Security and Net Zero (opens in new tab) confirmed in October 2025 that Ofgem will directly regulate TPIs (Third Party Intermediaries). Ofgem’s market survey began in early 2026, with primary legislation expected when parliamentary time allows (2026-2027) and a 12-18 month sunrise period for registration after that.

The new rules will require:

- Transparent commission disclosure on all quotes

- Mandatory registration and authorisation by Ofgem

- Minimum standards for broker conduct

- Standardised dispute resolution processes

For businesses, this means the worst broker practices - undisclosed commissions, pressure tactics, and information asymmetry - should diminish over time.

But the rules aren’t fully in place yet. Until they are, protecting yourself remains your responsibility.

What Would a Fixed System Look Like?

Imagine business energy switching that worked:

- Instant quotes - Upload a bill, get real-time prices in under 60 seconds

- Total transparency - See the supplier’s base rate and any fee separately

- No cold calls - Compare and switch entirely online, at your own pace

- Continuous monitoring - Get alerts when better deals emerge, not just at renewal

- Plain English - Actual pound savings, not abstract pence-per-kWh figures

This is not fantasy. It is how consumer energy comparison works. It is how flight booking works. It is how car insurance works.

The technology exists. The data infrastructure exists. Matrix pricing APIs mean suppliers can publish real-time rates programmatically.

The only reason business energy switching is still stuck in the 1990s - cold calls, PDFs, 22-minute phone negotiations - is that the current system profits the people who control it.

How Meet George Solves This

At Meet George, we built the alternative because we were frustrated by the same problems you face. Here is how we tackle each pain point:

No cold calls. Ever. Our entire platform works online. Upload your bill, compare quotes, and switch - all without speaking to a salesperson. Your phone stays silent.

Transparent pricing you can verify. We charge a flat 1p/kWh fee that appears separately on your quote - not embedded in the unit rate. You see the supplier’s base rate and our fee as distinct line items. No uplift, no mystery margins.

AI that explains contract terms in plain English. Our AI reads the contract small print so you do not have to. It flags pass-through clauses, auto-renewal terms, and early termination fees before you sign - and explains what they actually mean for your business.

Real pound savings, not abstract percentages. We show you exactly how much you will save in actual pounds per year, not confusing pence-per-kWh comparisons. You see the bottom line impact immediately.

Continuous monitoring after you switch. We do not disappear once you have signed. We track market movements and alert you when better deals emerge, so you are always informed - not just at renewal time.

Multi-site? We handle the complexity. For businesses with multiple locations, we consolidate your sites into a single dashboard, track different contract end dates, and coordinate switches so you are not drowning in admin.

Because switching your business energy should not be this difficult.

Quick Reference: Switching Timeline

| Timeframe | Action |

|---|---|

| 90 days before expiry | Start researching, request quotes |

| 60 days before | Compare quotes, make decision |

| 45-60 days before | Submit switch to new supplier |

| 30 days before | Confirm switch is processing |

| Switch date | Provide accurate meter readings |

| First bill | Check for errors, verify correct rates |

| Immediately after | Set reminder for next renewal (90 days before new contract ends) |

Ready to Switch Without the Stress?

If you have read this far, you understand why business energy switching is broken - and you are probably wondering if there is a better way.

There is.

Meet George takes care of everything outlined in this article:

- Upload your bill and get instant quotes - no phone calls required

- See exactly what you are paying now versus what you could pay

- Understand contract terms with AI-powered plain English explanations

- Switch when you are ready, at your own pace, with zero pressure

- Pay a transparent 1p/kWh fee shown separately - never embedded in your rate

Your next step: Learn the complete 5-step switching process or join the Meet George waitlist to be first in line when we launch. No cold calls. No undisclosed fees. Just a simpler way to switch.