77% of UK businesses believe energy brokers are “free.” They’re not. You just don’t see the fee.

Broker commissions are embedded in your unit rate - typically 2-5p/kWh for small businesses, but we’ve seen cases up to 8p/kWh. On a 3-year contract for a business using 50,000 kWh annually, that’s the difference between paying £1,500 and £12,000 in broker fees.

The question isn’t whether you’re paying. It’s whether you’re paying a fair rate - and getting value for it.

TL;DR: Commission Rate Benchmarks for SMEs

| Commission Rate | What It Means | 3-Year Cost (25,000 kWh/year) |

|---|---|---|

| 1p/kWh | Transparent, competitive | £750 |

| 2p/kWh | Reasonable if disclosed | £1,500 |

| 3p/kWh | Common - start asking questions | £2,250 |

| 4p/kWh | High - question the value | £3,000 |

| 5p+ /kWh | Predatory - walk away | £3,750+ |

A “good” rate for SMEs is 1-2p/kWh, disclosed upfront. Anything above 3p/kWh should prompt questions. At 5p+ you’re being overcharged - no service justifies that markup.

But rate alone doesn’t tell the whole story. What you get for that commission matters just as much.

What is a “Normal” Commission Rate?

There’s no single answer because commission rates vary dramatically based on:

- Your consumption volume - Higher usage = lower per-kWh rate

- Market conditions - Rates spiked during the 2022-2023 crisis

- Broker business model - Traditional phone-based vs digital self-service

- What you negotiate - Most businesses don’t negotiate; those who do pay less

Historical Context

| Period | Typical Commission Range | Why |

|---|---|---|

| Pre-crisis (before 2022) | 1-2p/kWh | Stable market, competitive pressure |

| Crisis peak (2022-2023) | 4-7p/kWh | Volatility masked higher uplift |

| Current (2024-2026) | 2-5p/kWh | Market stabilising, scrutiny increasing |

During the crisis, when unit rates spiked to 40-50p/kWh, a 5p uplift was barely noticeable - it looked like normal market volatility. Brokers could embed larger margins without customers questioning the rates.

Now that prices have stabilised around 20-25p/kWh, that same 5p uplift represents 20-25% of your total bill. It’s harder to hide - and harder to justify.

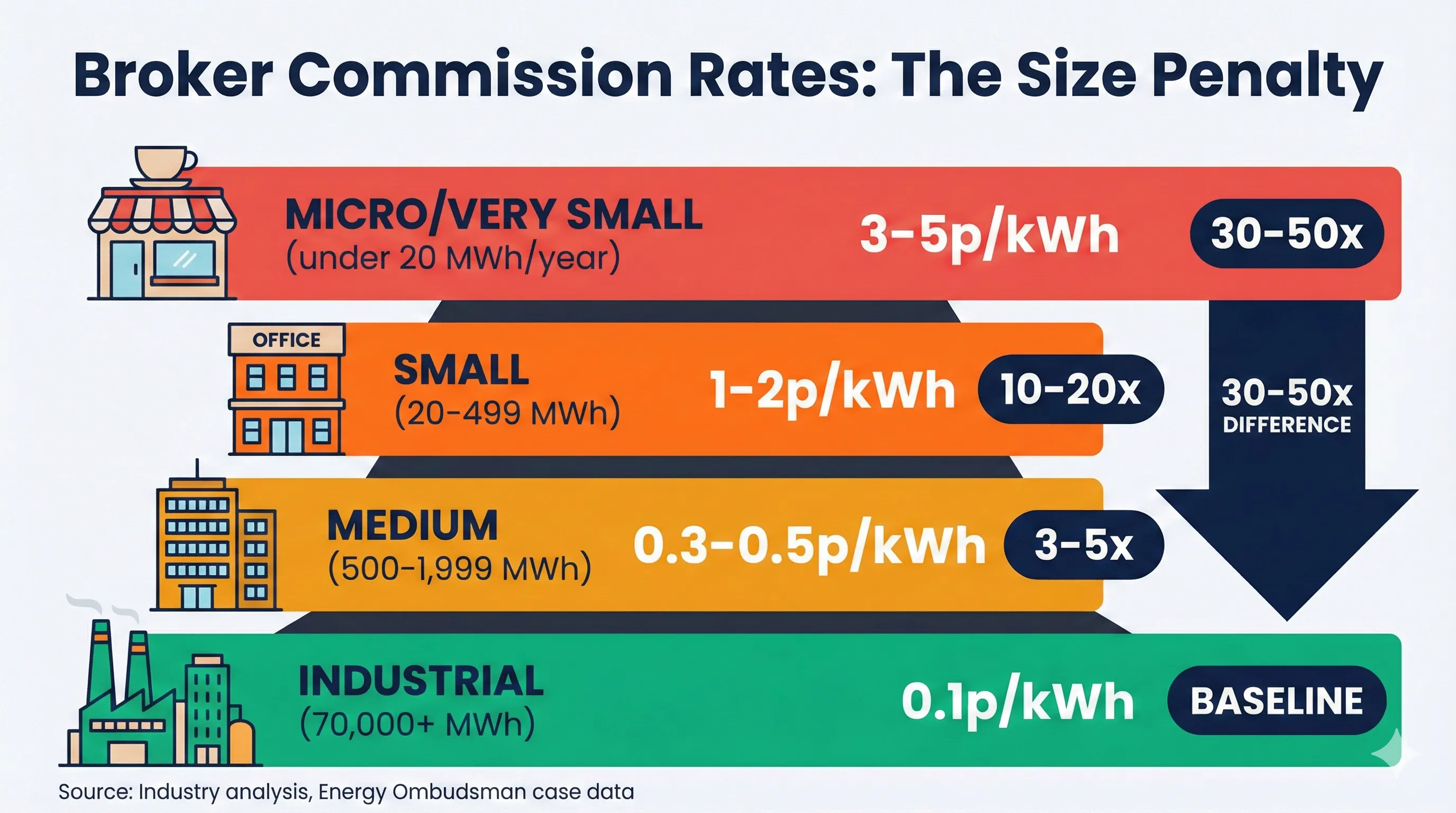

The Size Factor: Why SMEs Pay 30-50x More

Here’s the uncomfortable truth: large businesses pay dramatically less in broker commission than small ones. Not a bit less. Thirty to fifty times less.

| Business Size | Typical Commission | Range | Multiple vs Large |

|---|---|---|---|

| Micro/Very Small (under 20 MWh/year) | 3-5p/kWh | 2-8p+ | 30-50x |

| Small (20-499 MWh) | 2-4p/kWh | 1-5p | 20-40x |

| Medium (500-1,999 MWh) | 2-3p/kWh | 1-4p | 20-30x |

| Large/Industrial (70,000+ MWh) | ~0.1p/kWh | 0.05-0.2p | Baseline |

Source: Industry analysis, Energy Ombudsman (opens in new tab) case data, broker disclosures

A steel mill using 70,000 MWh per year might pay 0.1p/kWh commission - that’s still £70,000 annually, but the broker accepts thin margins on high volume. A café using 15,000 kWh pays 4p/kWh - just £600 annually, but 40x more per unit.

Why the Gap Exists

Large businesses have:

- Dedicated energy procurement teams with market expertise

- Competitive tender processes

- Visibility into wholesale markets and what rates should cost

- Leverage to negotiate rates

- Knowledge of when and how to switch

Small businesses have:

- No time for energy procurement

- No visibility into what rates are “good”

- No leverage to negotiate

- No expertise to know when they’re being overcharged

- Dependence on whoever calls them

This information asymmetry enables higher uplift. If a broker finds you on expensive deemed rates at 38p/kWh and quotes 28p/kWh, they look like heroes - even if competitive market rates are actually 22p/kWh. That 6p/kWh undisclosed margin? You’d never know.

Real Example: The Information Gap in Action

Dream Looks Boutique, a fashion shop in Marylebone, came to us after paying 38.6p/kWh on deemed rates for two years without realising it. They didn’t know they’d lapsed onto expensive out-of-contract rates - and had low trust in brokers cold-calling them, so they’d done nothing.

We switched them to a 3-year fixed contract at 22.31p/kWh (including our transparent 1p/kWh fee) - a 46% reduction saving £3,921 over 3 years.

A traditional broker finding the same situation might quote 28p/kWh - still a great saving from 38p, still genuinely helpful - but with 6p/kWh embedded commission instead of 1p. That’s the difference between paying ~£180 in fees over 3 years versus ~£1,080.

Both outcomes are better than staying on deemed rates. But one costs 6x more than the other.

Calculate Your Broker Cost

Use this table to convert p/kWh commission into actual pounds:

Annual Cost by Commission Rate

| Annual Usage | 1p/kWh | 2p/kWh | 3p/kWh | 4p/kWh | 5p/kWh |

|---|---|---|---|---|---|

| 15,000 kWh | £150 | £300 | £450 | £600 | £750 |

| 25,000 kWh | £250 | £500 | £750 | £1,000 | £1,250 |

| 50,000 kWh | £500 | £1,000 | £1,500 | £2,000 | £2,500 |

| 100,000 kWh | £1,000 | £2,000 | £3,000 | £4,000 | £5,000 |

3-Year Contract Cost

| Annual Usage | 1p/kWh | 2p/kWh | 3p/kWh | 4p/kWh | 5p/kWh |

|---|---|---|---|---|---|

| 15,000 kWh | £450 | £900 | £1,350 | £1,800 | £2,250 |

| 25,000 kWh | £750 | £1,500 | £2,250 | £3,000 | £3,750 |

| 50,000 kWh | £1,500 | £3,000 | £4,500 | £6,000 | £7,500 |

| 100,000 kWh | £3,000 | £6,000 | £9,000 | £12,000 | £15,000 |

The maths is simple: Commission (p/kWh) × Annual Usage (kWh) × Contract Length (years) = Total Cost

For precise calculations based on your actual usage, try our commission calculator.

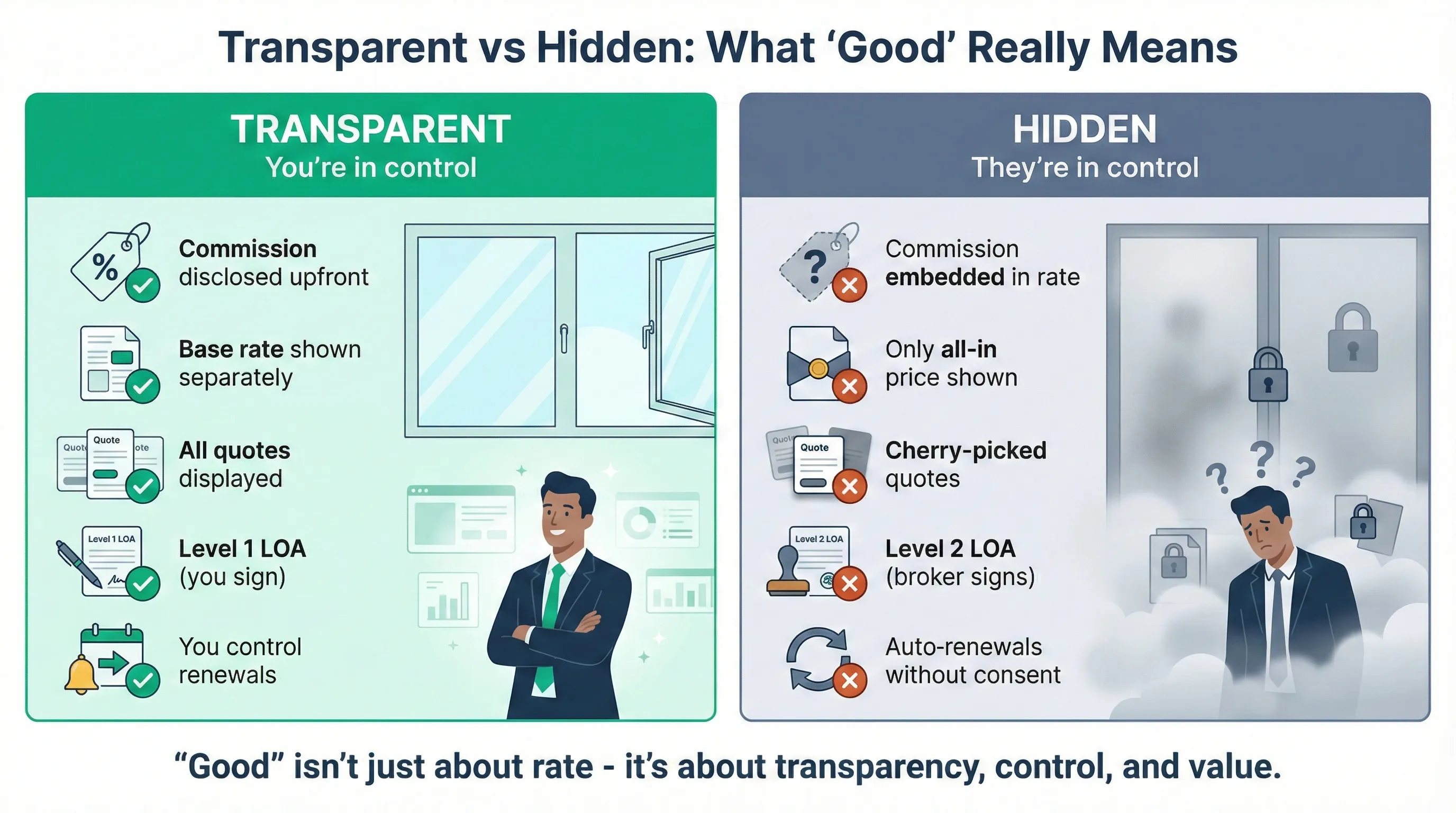

”Good” Isn’t Just About the Rate

A low commission rate doesn’t automatically mean good value. A high rate doesn’t automatically mean bad value. What matters is the combination of rate + transparency + control + service.

What Should You Get for Your Commission?

| Factor | Transparent Broker | Traditional Broker (Variable) |

|---|---|---|

| Commission disclosure | Shown upfront, before you engage | Often only on request (or on contract after October 2024) |

| Rate visibility | Supplier’s base rate shown separately | All-in rate only - can’t see the breakdown |

| All quotes shown | Every supplier quote, not cherry-picked | Often just the “recommended” option |

| Contract signing | You sign directly (Level 1 LOA) | Broker may sign on your behalf (Level 2 LOA) |

| Renewals | You’re notified, you decide | May auto-renew with fresh commission |

| Sales process | No pressure, self-service | Phone calls, relationship management |

The Level 1 vs Level 2 LOA Question

This is crucial. A Letter of Authority (LOA) grants your broker permission to act on your behalf. There are two types:

Level 1 LOA (Information Only):

- Broker can access your meter data

- Broker can request quotes from suppliers

- You sign all contracts yourself

- You stay in control

Level 2 LOA (Contract Authority):

- Broker can sign contracts on your behalf

- Enables auto-renewals without your explicit consent

- Can lock you into new contracts with fresh commissions

- You may not know until it’s done

The Expert Tooling vs Engie case (opens in new tab) that reached the Court of Appeal in 2025 involved a broker with Level 2 authority who added 5p/kWh undisclosed uplift - increasing the client’s costs by 31%. The court found the broker breached fiduciary duty by not disclosing the exact commission.

Always check what type of LOA you’re signing. If a broker asks for Level 2 authority, ask why they need it - and whether you’re comfortable giving someone else control over your energy contracts.

The Auto-Renewal Trap

With a Level 2 LOA, brokers can execute renewals without contacting you. This enables a pattern we’ve documented in Energy Ombudsman complaint data:

- Broker signs initial contract with embedded commission

- Contract approaches expiry

- Broker auto-renews with fresh commission (often higher)

- Business discovers months later

88% of broker complaints to the Energy Ombudsman in 2024 were sales-related - including undisclosed commissions and auto-renewals without informed consent.

Red Flags: When Commission Becomes Exploitation

Not all high commissions are predatory. A broker providing genuine value - market expertise, complex multi-site coordination, ongoing account management - may justify 3-4p/kWh. But certain patterns suggest exploitation rather than service:

Warning Signs

| Red Flag | What It Means |

|---|---|

| ”Our service is free” | Commissions are always paid - if they say free, they’re hiding how |

| Won’t disclose rate in p/kWh | Since October 2024, they must tell you if asked. Refusal = red flag |

| Only shows one or two quotes | May be cherry-picking suppliers who pay highest commission |

| Pushes for immediate signature | Pressure tactics suggest they don’t want you shopping around |

| Requests Level 2 LOA | Wants contract-signing authority - ask why |

| Commission above 5p/kWh | This is predatory pricing - no service justifies this markup |

| Blend-and-extend offers | Often extends contract length while adding fresh commission |

| Hasn’t signed TPI Code | Only 52 of 2,700+ brokers have committed to transparency standards |

Documented Cases

The Energy Ombudsman’s 2025 Broker Report (opens in new tab) found:

- 1,568 complaints in 2024 (up 112% from 2023)

- 58% upheld in customer’s favour

- Average award: £894

- 88% were sales-related (not service delivery)

Care England reported (opens in new tab) that one care home was quoted £68,126 in broker fees - reduced to £12,606 when independently reviewed. That’s an 81% markup.

For more documented cases, see our analysis of energy broker mis-selling cases.

These aren’t edge cases. Ofgem’s 2024 Non-Domestic Market Review (opens in new tab) found brokers “in some cases nearly doubling the cost” of energy contracts.

What to Ask Your Broker

Before signing anything, ask these questions:

Essential Questions

| Question | Why It Matters |

|---|---|

| ”What is your commission rate in p/kWh?” | Forces specific disclosure. Calculate the £ cost yourself. |

| ”Can I see the supplier’s base rate separately?” | Reveals whether you can compare broker costs across providers |

| ”Can you show me all the quotes you received?” | Exposes cherry-picking vs full market comparison |

| ”Have you signed the TPI Code of Practice?” | Verifiable at recportal.co.uk/tpis (opens in new tab) |

| ”What type of LOA are you asking me to sign?” | Level 1 = data only. Level 2 = contract authority. |

| ”What happens at renewal?” | Reveals auto-renewal practices |

| ”Will you ever sign contracts on my behalf?” | Clarifies Level 2 LOA implications |

Acceptable Answers

- Commission rate disclosed clearly (e.g., “1.5p/kWh”)

- Willing to show supplier’s base rate

- Shows all quotes, explains recommendation

- Either signed TPI Code or can explain why not

- Level 1 LOA only, or clear justification for Level 2

- Notifies you before renewal, doesn’t auto-renew without consent

Red Flag Answers

- “Our service is free” (it’s not)

- “Commission is commercially confidential”

- “We only show the best quote” (best for whom?)

- “The LOA is just standard procedure” (read it)

- “We’ll handle renewals so you don’t have to worry” (auto-renewal setup)

The Regulatory Picture

The broker market is changing. Here’s what’s already in effect and what’s coming:

Already in Effect

October 2024: Mandatory commission disclosure for all non-domestic contracts. Brokers must disclose their fee if asked, and commission must be clearly shown on the contract itself.

December 2024: ADR access expanded to small businesses (under 50 employees). Previously only microbusinesses could use the Energy Ombudsman (opens in new tab) for broker disputes.

December 2024: Suppliers can only work with ADR-registered brokers. Effectively mandatory registration, enforced through supplier licence conditions.

Coming Next

2026: Ofgem (opens in new tab) surveys TPIs and designs the regulatory framework. Consultation on specific rules expected.

2027: Broker registration opens (subject to parliamentary timing). Mandatory registration with fit-and-proper-person checks.

2028+: Full enforcement - only registered, compliant brokers can operate. Ofgem gains powers including fines and market bans.

The Government’s consultation response on TPI regulation (opens in new tab) was explicit: the aim is to “end the wild west of ‘cowboy’ brokers charging sky-high fees.”

For a full regulatory timeline, see our State of Business Energy Brokers 2026 report.

How Meet George Approaches Commission

We charge a flat 1p/kWh fee - shown separately, not embedded in your unit rate.

For a business using 25,000 kWh/year on a 3-year contract, that’s £750 total - compared to £2,250-£3,750 with a typical 3-5p/kWh broker.

But the rate isn’t the only difference:

| Factor | Meet George | Typical Broker |

|---|---|---|

| Commission rate | 1p/kWh (fixed) | 2-5p/kWh (variable) |

| How it’s shown | Separate line item | Embedded in unit rate |

| LOA type | Level 1 only (you sign everything) | Often Level 2 (broker can sign) |

| Quotes shown | All supplier quotes | Usually just “recommended” |

| Renewals | You’re notified, you decide | May auto-renew |

| Sales calls | None | Yes |

| TPI Code | Signed | 98% haven’t signed |

We’re not the right choice for everyone. If you want someone to handle everything, make phone calls, and manage the process for you - a traditional broker might suit you better. Their higher commission pays for that service. See how this compares to the traditional broker pricing model.

But if you want transparency, control, and to see exactly what you’re paying - that’s what we built.

The Bottom Line

A “good” energy broker commission rate for SMEs is 1-2p/kWh, disclosed upfront.

But “good” isn’t just about the number. It’s about:

- Transparency: Do you know what you’re paying?

- Control: Who signs your contracts?

- Choice: Are you seeing all options or just cherry-picked ones?

- Value: What service do you get for the fee?

The October 2024 disclosure rules and incoming 2027 regulation are pushing the market toward transparency. Brokers who’ve already adopted transparent pricing - like the 52 TPI Code signatories - are positioning themselves for that future.

Those still relying on undisclosed uplift and Level 2 LOAs will find it harder to operate as scrutiny increases.

You don’t have to wait for regulation to make better decisions. Ask the questions. Check the LOA type. Calculate the actual cost. And decide whether you’re getting value for what you’re paying.

Sources:

- Ofgem - Non-Domestic Market Review Decision (opens in new tab)

- Ofgem - Third Party Intermediaries Programme (opens in new tab)

- DESNZ - TPI Regulation Consultation Response (opens in new tab)

- Energy Ombudsman - Broker Report 2025 (PDF) (opens in new tab)

- REC Portal - TPI Code Signatories (opens in new tab)

- Expert Tooling vs Engie - Court of Appeal Judgment (opens in new tab)

- Care England - Ofgem to Clamp Down on Rogue Energy Brokers (opens in new tab)

- DESNZ - Gas and Electricity Prices in the Non-Domestic Sector (opens in new tab)