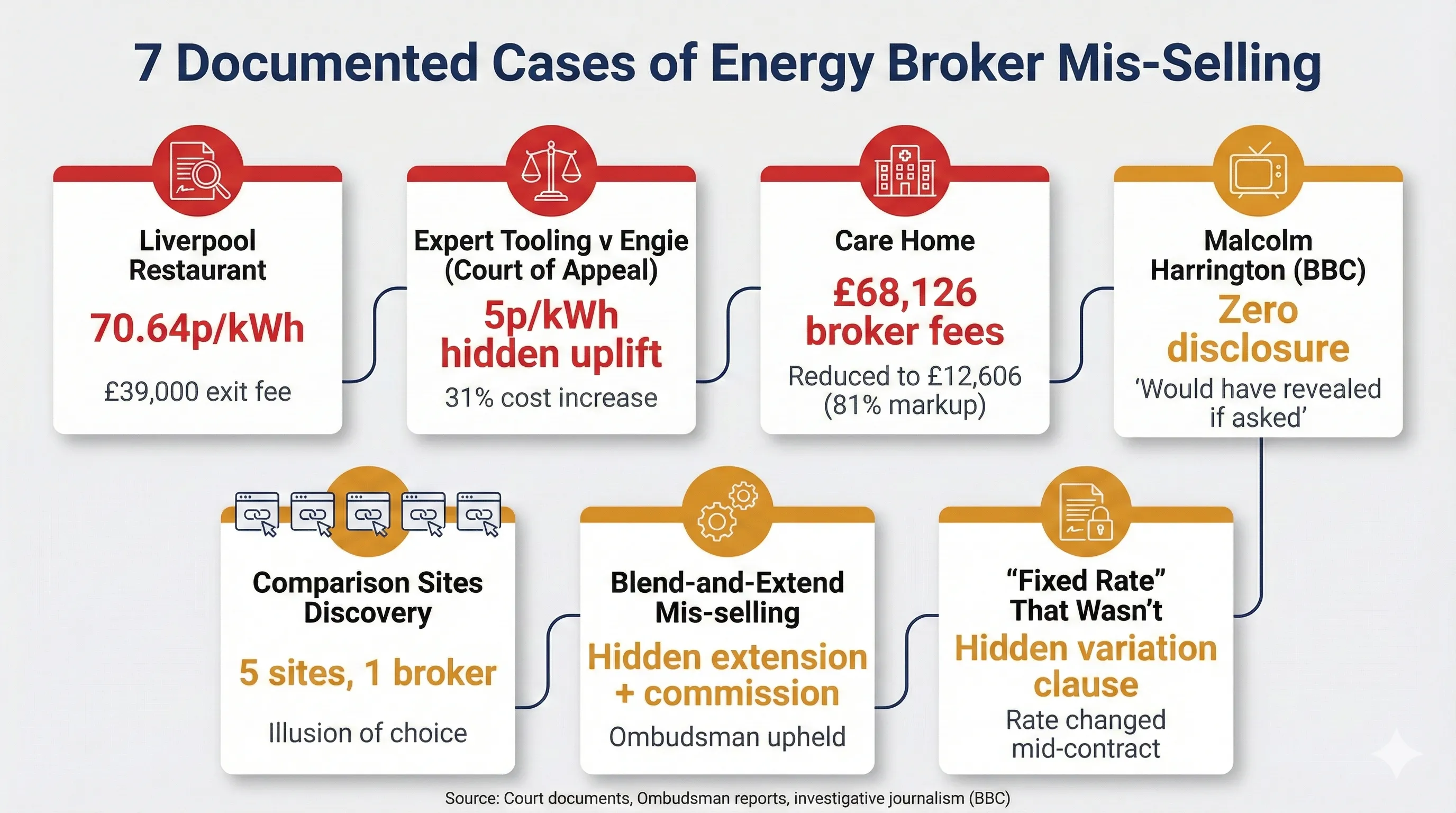

A Liverpool restaurant owner signed an energy contract through a broker in 2022. The rate: 70.64p per kWh for electricity. Monthly bills hit £4,300 - roughly four times what they should have been paying at market rates. When they tried to exit, the supplier demanded £39,000 in termination fees.

The broker was subsequently convicted of fraud.

This isn’t an isolated case. It’s part of a pattern that triggered a 112% surge in broker complaints in 2024, prompted the government to announce Ofgem as the direct regulator of energy brokers for the first time, and spawned a £2 billion collective legal action against undisclosed commissions.

Here’s the documented evidence - the cases that exposed what was happening in the UK’s business energy broker market.

TL;DR: The Key Facts

The scale: 1,568 broker complaints to the Energy Ombudsman in 2024 - up 112% from the previous year. 58% upheld. 88% related to sales practices.

The worst cases: 70.64p/kWh contracts, £68,126 broker fees (reduced to £12,606 on review), 5p/kWh hidden uplifts increasing costs by 31%.

The pattern: Crisis-era pressure tactics, hidden uplift in unit rates, Level 2 LOAs enabling auto-renewals without consent, 73% of businesses thinking brokers were free.

The response: Mandatory commission disclosure (October 2024), expanded ADR access (December 2024), direct Ofgem regulation (2026-2027), and a £2 billion collective action.

The failure: Only 52 of 2,700+ brokers (2%) signed the voluntary TPI Code of Conduct. Self-regulation didn’t work.

The Documented Cases: Business Energy Contract Mis-Selling

These cases are drawn from court records, Ombudsman reports, industry investigations, and verified media coverage. Each represents a pattern that affected thousands of UK businesses.

Case 1: The Liverpool Restaurant - 70.64p/kWh

What happened: A restaurant owner in Liverpool was contacted by an energy broker during the 2022 energy crisis. Under pressure from warnings about rising prices, they signed a three-year electricity contract.

The rate: 70.64p per kWh - at a time when competitive commercial rates were around 25-35p/kWh.

The cost: Monthly bills of approximately £4,300, compared to roughly £1,000 at market rates. Over the three-year term, the overcharge would have exceeded £100,000.

The trap: When the owner tried to exit the contract, the supplier demanded £39,000 in termination fees.

The outcome: The broker was subsequently convicted of fraud (opens in new tab). The case became a reference point for mis-selling discussions across industry forums.

Why it matters: This case demonstrates the extreme end of crisis-era mis-selling - rates more than double the market, combined with exit fees designed to make escape impossible.

Case 2: Expert Tooling v Engie - The Court of Appeal Precedent

What happened: A manufacturing business discovered their energy broker had added a hidden uplift to their contract without disclosure.

The uplift: Over 5p per kWh added to the unit rate - increasing the client’s costs by 31%.

The commission structure: The broker took 80% of their commission upfront, creating an incentive to maximise the initial rate regardless of whether it served the client’s interest.

The court finding: The Court of Appeal found that this practice created a conflict of interest between the broker’s financial incentive and their duty to the client.

Why it matters: This case established legal precedent that brokers using hidden uplifts may be acting against their clients’ interests. It’s now cited in LOA disclosure discussions and formed part of the evidence base for Ofgem’s regulatory intervention.

Case 3: The Care Home - £68,126 in Broker Fees

What happened: A care home was quoted broker fees as part of their energy contract arrangement.

The quoted fee: £68,126 in broker commission.

The independent review: When the fee was reviewed independently, it was reduced to £12,606.

The markup: 81% - more than five times what the service was worth.

The source: Care England (opens in new tab) highlighted this case as evidence of why regulatory intervention was needed.

Why it matters: Care homes operate on tight margins with high energy usage. An 81% markup on broker fees represents money diverted from care provision. This case became a catalyst for sector-specific advocacy around broker regulation.

Case 4: Malcolm Harrington - BBC Rip Off Britain

Who: Malcolm Harrington, a B&B owner in West Sussex.

What happened: Malcolm used an energy broker to switch his business energy. Commission was never mentioned during the sales process.

The discovery: When Malcolm later challenged the broker about undisclosed fees, their response was that commissions “would have been revealed had Malcolm asked.”

Malcolm’s response: “I started to get really angry because I just couldn’t see the logic behind why I as a customer should have to ask them to reveal something that was hidden.”

The exposure: The case was featured on BBC Rip Off Britain (opens in new tab), bringing broker commission practices to mainstream attention.

Why it matters: This case crystallised the fundamental problem with undisclosed commissions - the expectation that customers should somehow know to ask about fees that were deliberately hidden from them. It’s now referenced in discussions about why mandatory disclosure was necessary.

Case 5: The Comparison Site Discovery

What happened: A MoneySavingExpert forum user investigated why they kept receiving identical quotes from different comparison sites.

The discovery: “All the brokers (Uswitch, ComparetheMarket, GoCompare, etc.) use the same energy broker company called Bionic… you invariably end at Bionic.”

Another user’s observation: “The screen says it will offer you the best prices - all the prices and company logos are blurred out - and an ‘Energy Expert’ calls you on your phone.”

The source: MoneySavingExpert Forums (opens in new tab)

Why it matters: This wasn’t mis-selling in the traditional sense - it was the revelation that “shopping around” across major comparison sites was an illusion. We covered the full investigation in our analysis of how all comparison sites route to the same broker.

Case 6: Blend-and-Extend Mis-selling

What happened: A business was offered a “blend and extend” deal by their broker.

What is blend-and-extend? When your contract is approaching renewal, a broker may offer to “blend” your current rate with new market rates, then “extend” your contract term. The pitch sounds attractive: avoid the hassle of switching, lock in rates before they rise, smooth out price volatility. In practice, it means signing a new contract before your current one expires.

What they weren’t told:

- The deal would extend their lock-in period by years

- The blended rate included increased broker commission baked in

- They could have secured better rates by waiting for their contract to expire and comparing the open market

The outcome: The Energy Ombudsman (opens in new tab) upheld the complaint when the business discovered the true cost.

The source: Energy Ombudsman Broker Report 2025 (opens in new tab)

Why it matters: Blend-and-extend offers sound beneficial - who wouldn’t want to “lock in” rates during volatile markets? But when the blended rate includes fresh commission on top of existing commission, and extends the lock-in period, the business loses flexibility and pays more. This case pattern affects thousands of businesses offered these deals during the 2022-2023 crisis.

Case 7: The “Fixed Rate” That Wasn’t Fixed

What happened: A business signed what they believed was a fixed-rate energy contract after their broker presented it as protection against price rises.

The hidden clause: Buried in the contract terms was a clause allowing the supplier to vary the rate during the contract period.

What the broker disclosed: Nothing. The variation clause was never mentioned during the sales process.

The discovery: The business only learned about the clause when their “fixed” rate increased mid-contract.

The source: Energy Ombudsman Broker Report 2025 (opens in new tab)

Why it matters: “Fixed rate” is one of the most commonly misrepresented terms in business energy sales. Many contracts contain clauses allowing pass-through of certain charges, or in extreme cases, full rate variation. When brokers present these as “fixed” without explaining the caveats, businesses make decisions based on false security.

The Pattern: How Hidden Broker Commissions Work

Across all documented cases, the same elements appear repeatedly.

Crisis-Era Pressure Tactics

During 2022-2023, wholesale energy prices hit 10-11x historical norms (opens in new tab). Brokers weaponised this uncertainty.

Documented tactics from the Energy Ombudsman report (opens in new tab) include:

- Warnings that prices would reach £1/kWh if businesses didn’t sign immediately

- Claims that “this rate won’t be available tomorrow”

- Artificial urgency designed to prevent comparison shopping

Hidden Uplift in Unit Rates

The standard broker commission structure embeds fees in your unit rate. Instead of charging a separate, visible fee, brokers add 2-7p/kWh to the rate the supplier quotes them.

During the crisis, when rates were 40-50p/kWh, a 5p uplift was barely noticeable - it looked like market volatility. Now that rates have stabilised around 20-25p/kWh, that same uplift represents a much larger percentage of the total cost.

Level 2 LOAs Enabling Auto-Renewals

A Level 2 Letter of Authority gives a broker “power of attorney” over your energy - including the ability to sign contracts on your behalf.

The Ombudsman report documented cases where:

- Businesses were auto-renewed without any contact

- New contracts included fresh commission on top of existing arrangements

- Businesses only discovered the renewal when bills arrived

The “Free Service” Illusion

Ofgem research (opens in new tab) found that 73% of businesses using brokers believed they weren’t charged for the service. Only 14% thought they paid anything at all.

This misconception is by design. When commission is embedded in unit rates rather than invoiced separately, businesses don’t see what they’re paying.

No Evidence to Defend Claims

Many Ombudsman complaints were upheld partly because brokers couldn’t produce recordings of original sales calls. Without evidence of what was actually said, the Ombudsman relied on the business owner’s testimony.

Falsified Evidence

The 2025 Ombudsman report flagged specific broker behaviours including:

- Submitting falsified call recordings as evidence

- Providing falsified quotation documents

- Advising businesses to submit false changes of tenancy to avoid exit fees

These aren’t edge cases - they represent a pattern of conduct from brokers actively working against their customers’ interests.

The Numbers: UK Energy Broker Complaints Data

The Energy Ombudsman’s 2025 Broker Report (opens in new tab) quantifies what these cases represent. (We wrote a detailed analysis of the report’s findings.)

| Metric | 2023 | 2024 | Change |

|---|---|---|---|

| Broker complaints accepted | 741 | 1,568 | +112% |

| Complaints upheld | 69% | 58% | -11pp |

| Sales-related complaints | 71% | 88% | +17pp |

| Signposted by broker | 5% | 8% | +3pp |

| Brokers leaving ADR scheme | - | 470 | - |

Key insight: 88% of complaints relate to how contracts were sold - not service delivery, not billing, but the sales process itself.

The signposting scandal: Only 8% of complaints were signposted by brokers. Meaning 92% of businesses who reached the Ombudsman found it themselves. The Ombudsman acknowledges they handle “less than a third of the disputes that we should.”

Brokers leaving: 470 brokers exited the ADR scheme since 2023. Some were expelled for non-compliance; others left with disputes pending.

The Regulatory Response: Energy Broker Regulation UK

These cases didn’t happen in a vacuum. They triggered a regulatory response that’s still unfolding.

October 2024: Mandatory Commission Disclosure

Ofgem’s Non-Domestic Market Review (opens in new tab) made commission disclosure mandatory for ALL non-domestic contracts. Brokers must now show their fee when asked.

The limitation: Disclosure happens at contract stage, not when comparing quotes. You still don’t see commission breakdowns while deciding which quote to accept.

December 2024: Expanded ADR Access

Small businesses (under 50 employees, under £6.5m turnover) can now bring broker disputes to the Energy Ombudsman. Previously, only microbusinesses had access.

This expansion potentially adds 200,000 businesses to the eligible population.

2026-2027: Direct Ofgem Regulation

The government has confirmed that Ofgem will become the direct regulator of energy brokers for the first time. The details are still being finalised, but the new regime is likely to include:

- Mandatory broker registration

- Fit-and-proper-person checks

- Enforcement powers including fines and bans

- Direct Ofgem oversight rather than self-regulation

The specifics haven’t been formally proposed yet, but Ed Miliband, Energy Secretary, stated the intent clearly: to “end the wild west of ‘cowboy’ brokers charging sky-high fees.”

The TPI Code: Voluntary Self-Regulation Failed

The TPI Code of Conduct was the industry’s attempt at self-regulation, managed by RECCo (opens in new tab) (the Retail Energy Code Company). After 20+ months, only 52 of approximately 2,700+ brokers have signed - a 2% adoption rate.

The failure of voluntary measures is precisely why direct regulation is coming.

The £2 Billion Collective Action

Beyond individual complaints, a broader legal response is underway.

Harcus Parker (opens in new tab), a law firm specialising in group litigation, is pursuing a collective legal action against undisclosed broker commissions. Their estimate: £2 billion in hidden fees across affected UK businesses.

The claim targets:

- Brokers who failed to disclose commissions to business customers

- Particularly during the 2022-2023 crisis when hidden fees were at their highest

- Practices that may constitute breach of fiduciary duty

Affected businesses can register their interest through the Energy Litigation (opens in new tab) portal.

How to Check If You’ve Been Mis-Sold an Energy Contract

If you’ve used an energy broker in the past five years, particularly during 2022-2023, here’s how to assess your position.

Step 1: Request Commission Disclosure

Email your broker asking for the exact commission amount on your contract in pence per kWh. Since October 2024, they’re legally required to disclose this.

What to write: “Please provide written disclosure of the commission rate applied to my energy contract, expressed in pence per kWh. I understand this disclosure is required under Ofgem’s Non-Domestic Market Review rules.”

If they refuse or give vague answers, that’s evidence of potential problems.

Step 2: Compare Your Rate to Market

Check your current unit rate against market rates for your usage level. Resources:

- Upload a bill or enter your meter details on a comparison platform to see live market prices

- Check the Cornwall Insight (opens in new tab) wholesale price indices

- Compare with other businesses in your sector

If you’re paying 3-7p/kWh more than comparable businesses, you may have been overcharged through hidden uplift.

Step 3: Review Your Letter of Authority

Find any LOA you signed with your broker. Check for Level 2 language:

Dangerous phrases:

- “Authority to sign contracts”

- “Power of attorney”

- “Exclusive authority”

- “Act on your behalf”

If you signed a Level 2 LOA, your broker may have signed contracts without your knowledge - including renewals with fresh commission.

If you find you’ve signed a Level 2 LOA: Revoke it immediately. Businesses have reported being signed into new contracts years after their original switch. Email your broker with clear revocation language:

“I hereby revoke the Letter of Authority signed on [DATE] with immediate effect. You are no longer authorised to act on my behalf, request data from suppliers, or sign any contracts in my name. Please confirm receipt of this revocation and that my details have been removed from your active client list within 7 days.”

Keep a copy and follow up if they don’t confirm.

Step 4: Gather Your Evidence

Before complaining, collect:

- Your original contract

- Any emails or communications from the broker

- Bills showing rates you’re paying versus what was quoted

- Notes on what you were told during sales calls

- Request call recordings from your broker - they may have recorded the original call

Step 5: Complain Formally

Submit a written complaint to your broker stating:

- What happened and when

- What you expected versus what you got

- What you want them to do about it

This starts the 8-week clock before you can escalate.

Step 6: Escalate to the Ombudsman

After 8 weeks (or if you receive a “deadlock letter”), submit your complaint to energyombudsman.org (opens in new tab).

| Eligibility | Businesses under 50 employees |

| Cost | Free |

| Average resolution | 16 days |

| Uphold rate | 58% |

| Average award | £894 |

Additional Resources

Check if your broker signed the TPI Code of Conduct: recportal.co.uk/tpis (opens in new tab)

See how much commission you might be paying: Commission Calculator

Understand how hidden commissions work: Hidden Broker Commissions Explained

Know your LOA rights: What is a Letter of Authority?

Register for the collective action: energylitigation.com (opens in new tab)

The Bigger Picture

These cases represent documented, verified instances of broker misconduct. They’re not rumours or allegations - they’re court records, Ombudsman decisions, and regulatory findings.

But they’re also the visible part of the problem. The Energy Ombudsman acknowledges handling “less than a third of the disputes that we should.” With an 8% signposting rate, most businesses with legitimate grievances never reach the complaint process.

The actual scale of broker mis-selling is likely 3-4x what official figures show.

What’s changing is accountability. Mandatory disclosure, expanded ADR access, direct Ofgem regulation, and collective legal action are closing the gap between what brokers did and what happens next.

For UK businesses, the question isn’t whether these practices happened. The evidence is documented. The question is whether you know your rights - and whether you’ll exercise them.

Sources:

- Energy Ombudsman - Broker Report 2025 (PDF) (opens in new tab)

- Energy Ombudsman - Reports and Data (opens in new tab)

- Ofgem - Non-Domestic Market Review Decision (opens in new tab)

- Ofgem - Non-Domestic 2024 Research Report (opens in new tab)

- Care England - Ofgem to Clamp Down on Rogue Energy Brokers (opens in new tab)

- Business Energy Claims - Energy Broker Exposed on BBC (opens in new tab)

- MoneySavingExpert Forums - Business Energy Mis-Selling (opens in new tab)

- MoneySavingExpert Forums - Comparison Site Discovery (opens in new tab)

- Harcus Parker - Energy Broker Litigation (opens in new tab)

- REC Portal - TPI Code Signatories (opens in new tab)

- Ofgem - Wholesale Market Indicators (opens in new tab)