TL;DR: Key Takeaways

The Broker Crackdown: Ofgem will conduct a market survey of all TPIs in the first half of 2026. Registration will become mandatory, with a 12-18 month sunrise period for existing brokers.

Flexibility Opens Up: P483 removes barriers so aggregators can trade your flexibility without you needing half-hourly metering first. Smaller businesses can now participate.

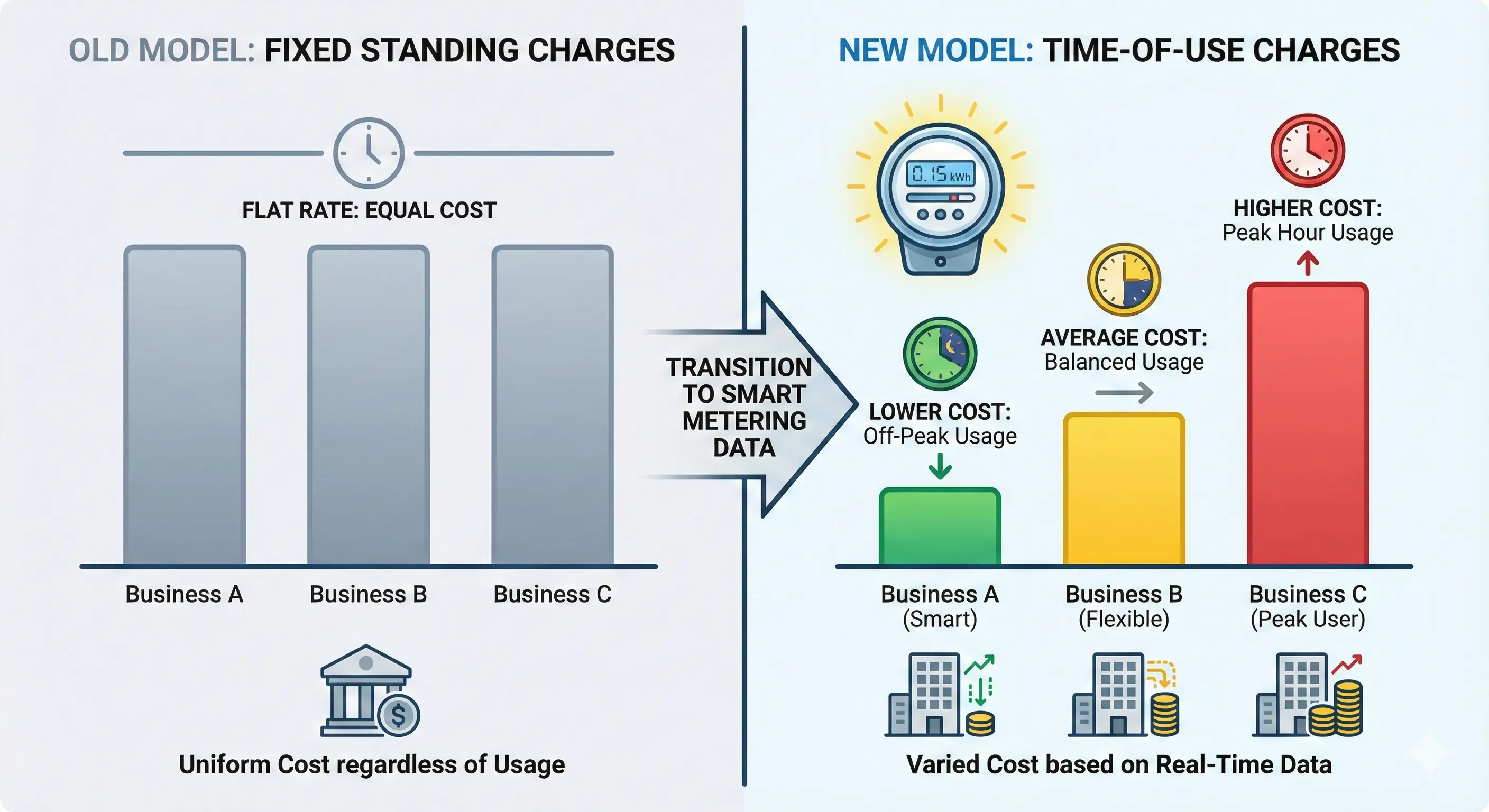

Cost Allocation Changes: The CARR review is examining whether costs should shift from flat charges to time-of-use pricing. Data-rich businesses will benefit; data-poor businesses will lose.

The Timeline: Market survey in H1 2026, registration requirements to follow. MHHS completes October 2025, CARR reforms ongoing through 2026.

What the Ofgem Forward Work Programme Signals

While most people are winding down for the holidays, Ofgem has published their regulatory roadmap for the next two years. The message is clear: the era of undisclosed commissions, opaque broker practices, and “average” billing is ending. Businesses that adapt early will benefit. Those that wait may find themselves on the wrong side of the new pricing structures.

1. The Broker Crackdown is Real

For years, the business energy market has been described as a “Wild West” of undisclosed commissions and aggressive sales tactics. That era is ending.

The government has confirmed it intends to appoint Ofgem as the regulator for Third Party Intermediaries (TPIs). When Parliamentary time allows, Ofgem will gain powers to:

- Create and enforce high-level principles for TPI conduct

- Develop specific rules outlining permissible and prohibited behaviours

- Implement a registration process requiring all TPIs to be authorised before operating

The 2026 Market Survey

In preparation for its new role, Ofgem will conduct a detailed market survey beginning in the first half of 2026. The goals include:

- Building a robust quantitative model of the TPI market structure

- Identifying the relative prevalence of consumer harms

- Quantifying market activity across different TPI types

The Sunrise Period

Once Ofgem is formally appointed as regulator, existing TPIs will have a 12-18 month “sunrise period” to register and demonstrate compliance. Brokers who cannot meet the new standards will be forced out of the market.

- Gov.uk: Regulating TPIs - Government Response (opens in new tab)

- Ofgem: TPI Programme (opens in new tab)

What This Means for You

The Warning: If your current energy partner is not transparent about how they get paid today, they likely will not survive the new rules coming in 2026. Check your contract - under existing Ofgem rules, broker commission must already be disclosed.

The Opportunity: You can future-proof your business by moving to transparent, digital platforms now, rather than waiting for the regulator to force the issue.

2. Flexibility is the Main Event

Ofgem is pivoting. Their focus is shifting from just “protecting consumers” to “enabling consumer-led flexibility.”

The regulator has explicitly approved changes to unlock barriers so aggregators can trade flexibility more easily - even for smaller businesses.

P483: The Game Changer

In August 2025, Ofgem approved BSC P483 - a Balancing and Settlement Code modification that removes the requirement for customers to be half-hourly settled before aggregators can trade their flexibility.

Marzia Zafar, Ofgem’s deputy director of governance for data and digitalisation, explained:

On its own, P483 might seem like a minor technical change. But in the bigger picture, it’s a crucial piece of the puzzle that will unlock new opportunities for customers to participate in the green revolution effortlessly.

She added that the code change makes flexibility “inclusive, accessible and impactful even before MHHS is fully rolled out.”

Translation: You Won’t Just Pay for Energy - You’ll Trade It

The regulator wants to make it easier for businesses with EV chargers, batteries, or HVAC systems to sell their flexibility to the grid. If you can reduce consumption during peak times - or export stored power - you can earn money instead of just spending it.

This is not theoretical. Businesses are already participating in flexibility programmes and earning revenue from the grid. Learn how Demand Side Response can turn your energy bill into income.

3. Data is the New Currency

Ofgem confirms they are moving towards a “more data-driven, outcomes-based approach.”

Crucially, they are progressing the Cost Allocation and Recovery Review (CARR) - a major review launched in July 2025 examining how costs are shared across the entire energy system.

What CARR is Examining

The review looks at four cost categories on your bill:

- Wholesale costs - the market price of electricity and gas

- Network costs - building and maintaining transmission/distribution infrastructure

- Policy costs - government schemes for renewables, efficiency, and consumer support

- Supplier operating costs - the margin your supplier takes

Currently, roughly 60% of system costs are allocated to non-domestic consumers and 40% to domestic, broadly in line with usage. Ofgem is asking whether this split remains appropriate.

- Ofgem: Cost Allocation and Recovery Review (opens in new tab)

- Ofgem Press Release: Major Cost Allocation Review (opens in new tab)

The “Winner/Loser” Divide

The reforms being explored include:

- Time-of-use pricing - costs vary based on when you use power

- Regional pricing - costs vary based on where you are located

- Capacity-based charges - costs linked to your peak demand, not just total usage

Old Model: Everyone pays a flat “standing charge” or “average” network rate regardless of when they use power.

New Model: Costs are allocated based on when and how you use the grid.

Who Wins, Who Loses?

Winners: Businesses with granular smart meter data who can prove they use power efficiently and avoid peak times.

Losers: Businesses with no data visibility who get stuck with “average” (higher) costs because the system cannot differentiate them.

This is why MHHS (Market-wide Half-Hourly Settlement) matters so much. Without half-hourly data, you cannot prove you are an efficient user. You will be treated as average - and average is becoming expensive. A smart meter is the essential first step.

4. The Regulatory Convergence

These three threads - TPI regulation, flexibility markets, and cost allocation - are not separate initiatives. They are converging into a single vision:

Transparent pricing → You know exactly what you pay and why

Data-driven allocation → Efficient users pay less than inefficient ones

Flexibility rewards → Businesses that help the grid get paid for it

Regulated intermediaries → Brokers cannot embed undisclosed fees or mislead you

The businesses that will thrive in 2026 and beyond are the ones that understand this convergence and position themselves accordingly.

What You Should Do Now

Step 1: Audit Your Current Broker

Check your energy contract for commission disclosure. If you have a Level 2 LOA giving your broker signing authority, consider switching to a transparent platform before renewal.

Do you know:

- Exactly how much your broker earns per kWh?

- Whether they have authority to renew your contract without your explicit approval?

- What their incentive is when recommending a supplier?

If you cannot answer these questions, read our guide on how brokers are paid and what to watch for.

Step 2: Get Data-Ready

You cannot benefit from the new pricing structures without data. Request a free smart meter from your current supplier - it is a standard service included in your standing charge.

Once you have half-hourly data, you can:

- Prove you are an efficient user (lower costs under CARR)

- Access time-of-use tariffs (lower rates for off-peak usage)

- Participate in flexibility markets (earn money, not just spend it)

Step 3: Explore Flexibility

With P483 approved, the barriers to flexibility participation have fallen. If you have:

- Predictable power usage patterns

- Battery storage or solar panels

- EV charging infrastructure

- HVAC systems you can schedule

…you may be sitting on a flexibility asset worth thousands per year.

Interested? Email us at flexibility@meetgeorge.co.uk to explore your options. We can introduce you to our vetted partners who handle the flexibility management on your behalf.

Why Meet George is Built for This Future

The message from the regulator is clear: the future of energy is transparent, flexible, and data-driven.

Meet George was built for exactly this future:

Transparent Pricing: We charge just 1p/kWh - that is typically 75% cheaper than the undisclosed commissions most brokers charge SME clients. You see exactly what we earn.

No Signing Authority: We use a Level 1 LOA only - we fetch quotes on your behalf, but you approve every contract. No auto-renewals, no surprises.

Self-Service Control: Switch your energy contract yourself, from start to finish. Our end-to-end platform handles everything digitally - sign your LOA in-app, compare quotes instantly, and complete your contract signing without leaving the platform. No email tennis, no sales calls, no chasing PDFs. Businesses can now switch their energy in 10 minutes.

Flexibility Partnerships: We have vetted flexibility partners who can include your business in aggregation pools - no expensive consultants required.

Do not wait for 2026 regulations to fix your energy contract. Fix it yourself today.

Ready to switch to transparent energy pricing? Learn the complete 5-step switching process or join the Meet George platform waitlist to be notified when we launch - switch in 10 minutes with full transparency, no undisclosed fees.

Sources & Further Reading:

- Ofgem: Forward Work Programme (opens in new tab)

- Gov.uk: Regulating TPIs - Government Response (opens in new tab)

- Ofgem: TPI Programme (opens in new tab)

- Ofgem: P483 Decision Document (opens in new tab)

- Ofgem: Cost Allocation and Recovery Review (opens in new tab)

- Ofgem: Major Cost Allocation Review Press Release (opens in new tab)