TL;DR: Key Takeaways

The Paradigm Shift: Demand Side Response (DSR) allows businesses to earn revenue by turning down power (or exporting it) during peak times. Your energy connection is no longer just a cost - it’s a potential asset.

The “Too Small” Myth: New aggregation rules mean you no longer need 1MW of load to participate. Profile Class 3 & 4 SMEs can now join the party.

Revenue Stacking: You can now earn from multiple pots simultaneously: The Capacity Market, Demand Flexibility Service, wholesale arbitrage, and even REGOs.

Smart Meter Key: These changes became implemented in 2025. However, you do need a Smart Meter to play.

The Opportunity: Businesses actively participating in flexibility programmes can potentially offset a significant proportion of their energy costs, depending on their load profile and the programmes they qualify for.

Definition: Demand Side Response (DSR)

Demand Side Response is a scheme where the National Grid pays businesses to adjust their electricity usage during peak demand periods. Businesses earn money by reducing consumption, switching to on-site generation, or exporting stored energy back to the grid. Thanks to 2025 regulatory changes (P415), UK SMEs can now participate through aggregation - bundling smaller loads together to meet market thresholds. Businesses actively participating can potentially earn £5,000-£20,000 annually by “stacking” revenue from the Capacity Market, Demand Flexibility Service, and battery arbitrage, depending on their load profile and participation level.

What is Demand Side Response (DSR)?

At its simplest, Demand Side Response is a financial incentive for businesses to be flexible with their energy usage.

The National Grid struggles to balance supply and demand during peak times (like winter evenings). Instead of firing up an expensive gas plant to meet that demand, they pay businesses to:

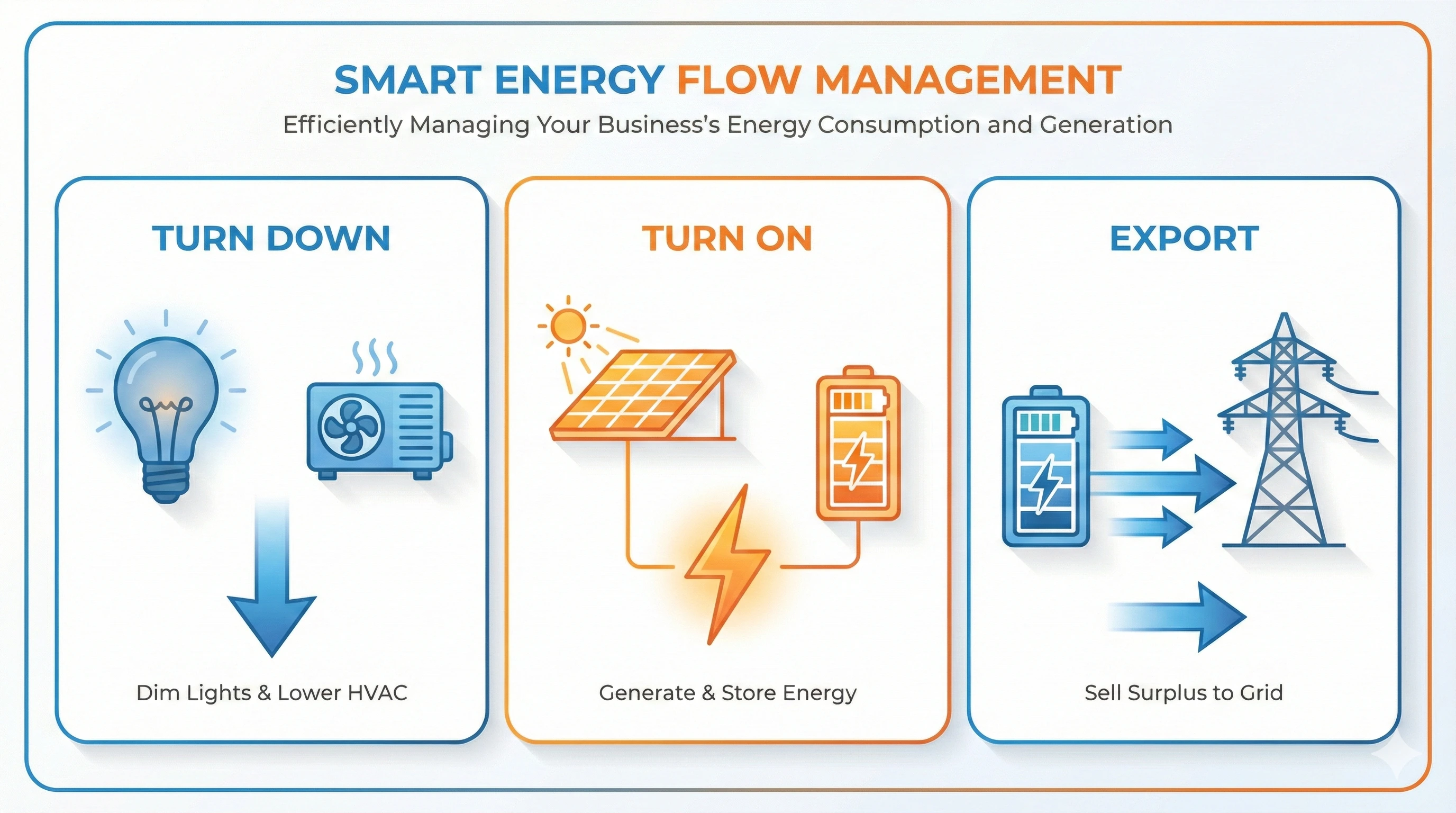

Turn Down: Temporarily reduce consumption. For a business, this could mean dimming lights, turning off HVAC systems, pausing machinery, or delaying the run-cycle of dishwashers and cleaning appliances.

Turn On: Switch to alternative power sources like on-site generation (e.g. solar) or battery storage.

Export: Send stored energy back to the grid from your batteries, solar panels, or V2G (Vehicle-to-Grid) EV chargers.

Historically, the entry requirements were high, excluding most SMEs. But as net zero targets tighten, the grid is desperate for flexibility from everyone.

The “Too Small to Bid” Myth

For years, the industry rule of thumb was that you needed at least 1MW of flexible load (roughly the power usage of a large factory) to bid for contracts. This excluded 80% of UK businesses.

This is no longer true.

Through Aggregation, third-party providers bundle hundreds of small businesses together to create one massive “virtual power plant.” To the Grid, it looks like 10MW of capacity; to you, it looks like a monthly revenue cheque.

The P415 Game Changer

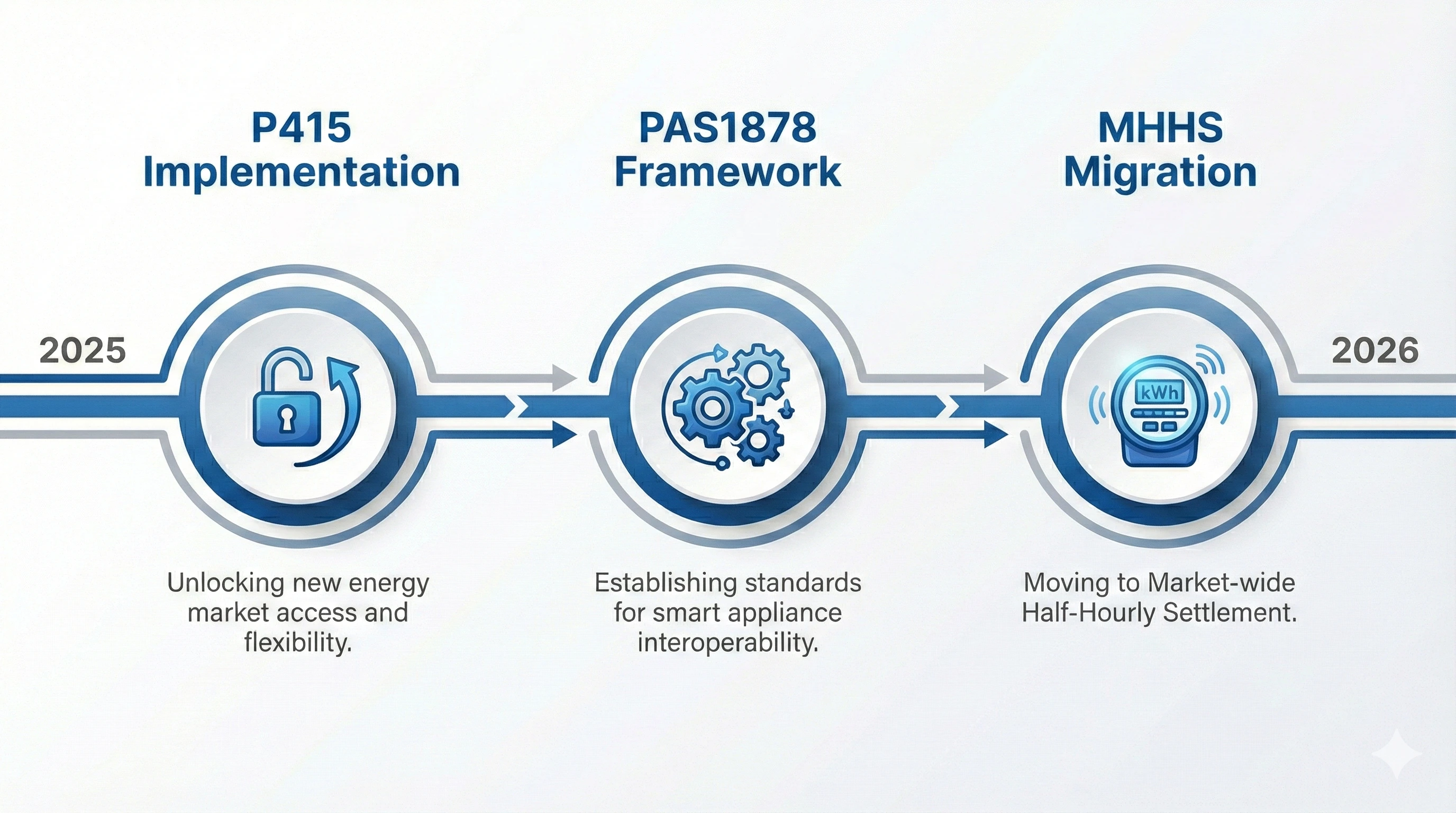

A critical regulatory change known as P415 became implemented in 2025. This is part of the broader Ofgem 2026 regulatory roadmap that is reshaping the energy market.

Old Rule: Only licensed energy suppliers could access the lucrative “Balancing Mechanism.”

New Rule: Independent aggregators can access it directly.

The Result: You don’t need your energy supplier’s permission to trade your flexibility. You can separate your supply (who sells you power) from your flexibility (who pays you for it).

Revenue Stacking: Turning Watts into Cash

The real magic happens when you “stack” revenue streams. Instead of earning from just one programme, 2025 rules allow you to participate in multiple markets simultaneously.

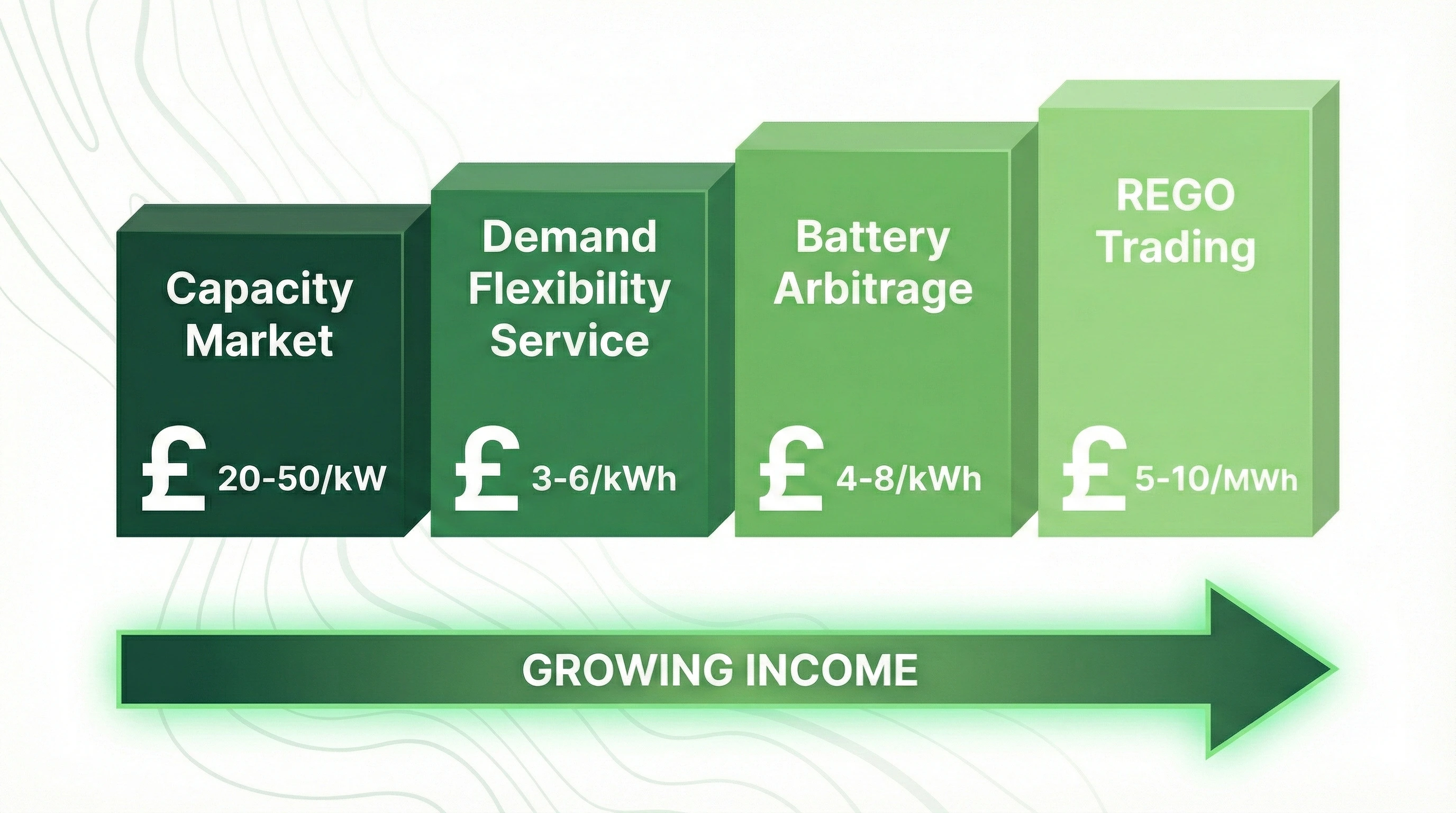

1. The Capacity Market (CM)

This is a retainer fee just for being available.

The Deal: You agree to be available to cut power if a “Stress Event” happens (which is rare).

The Value: Typical revenues are £20-£50 per kW per year.

2025 Update: The government has introduced 3-year agreements for “unproven DSR” with a low entry threshold, specifically designed to encourage new entrants.

2. Demand Flexibility Service (DFS)

Originally a winter trial, this is evolving into a year-round service.

The Deal: The Grid asks you to reduce power for a specific hour (usually 5 pm - 6 pm).

The Value: In 2023/24, businesses earned £3-£6 per kWh reduced. For a medium-sized site, this can scale to £5,000-£20,000 annually.

3. Battery Export & Arbitrage

If you have solar panels or batteries, you can buy cheap power at night (off-peak) and sell it back during the day.

The Supplier Trap: If you export with the same supplier who handles your import, they often pay a higher “bundled” rate. If you split them, the export rate drops significantly.

The Aggregator Fix: Independent aggregators (like Axle Energy (opens in new tab)) can bypass this by trading your power directly on the Balancing Mechanism, often beating standard supplier rates regardless of who you buy power from.

4. The “Hidden” Stack: REGO Trading

If you generate renewable power (Solar/Wind), you also generate REGOs (Renewable Energy Guarantees of Origin). Historically, suppliers swallowed these for free.

The Nuance: Platforms like Soldera (opens in new tab) now allow smaller generators to sell these certificates separately from their power. It is a small but meaningful additional revenue stream that most brokers forget to mention.

The 2025 Rule Changes (P415 & PAS1878)

To participate, your hardware needs to speak the Grid’s language.

PAS1878 Framework

Completing in 2025, this standard ensures “Smart Appliances” (like EV chargers and HVAC systems) are interoperable. The Department for Energy Security and Net Zero (DESNZ) has explicitly consulted on making this mandatory to stop Original Equipment Manufacturers (OEMs) from trapping businesses in “walled gardens.”

Warning: Do not let a contractor or manufacturer sell you “dumb” assets in 2025. Ask them: “Is this device PAS1878 compliant and interoperable?” If not, you are buying a piece of hardware that cannot switch aggregators.

Smart Meter Mandate

Suppliers are under pressure to hit a 68.7% rollout target for non-domestic smart meters. Once your Profile Class 3 or 4 meter is migrated to Market-wide Half-Hourly Settlement (MHHS), you are technically capable of participating in flexibility markets.

The “Bear Traps” to Watch Out For

While the revenue is real, the penalties for getting it wrong are steep.

Baseline Errors

Payments are calculated based on your “Baseline” (what you would have used). If your historical data is patchy (due to no smart meter), you could face 20-50% underpayments or disputes.

Double Counting

You must strictly declare your participation. If you claim Capacity Market payments for the same battery you are using for another conflicting service without declaring it, you risk termination fees.

The “Persistence” Drop-Off

Many SMEs sign up, earn money, and then drop out because the paperwork is complex. This erodes long-term value. Automation is the only way to make this sustainable.

Actionable Steps: How to Start

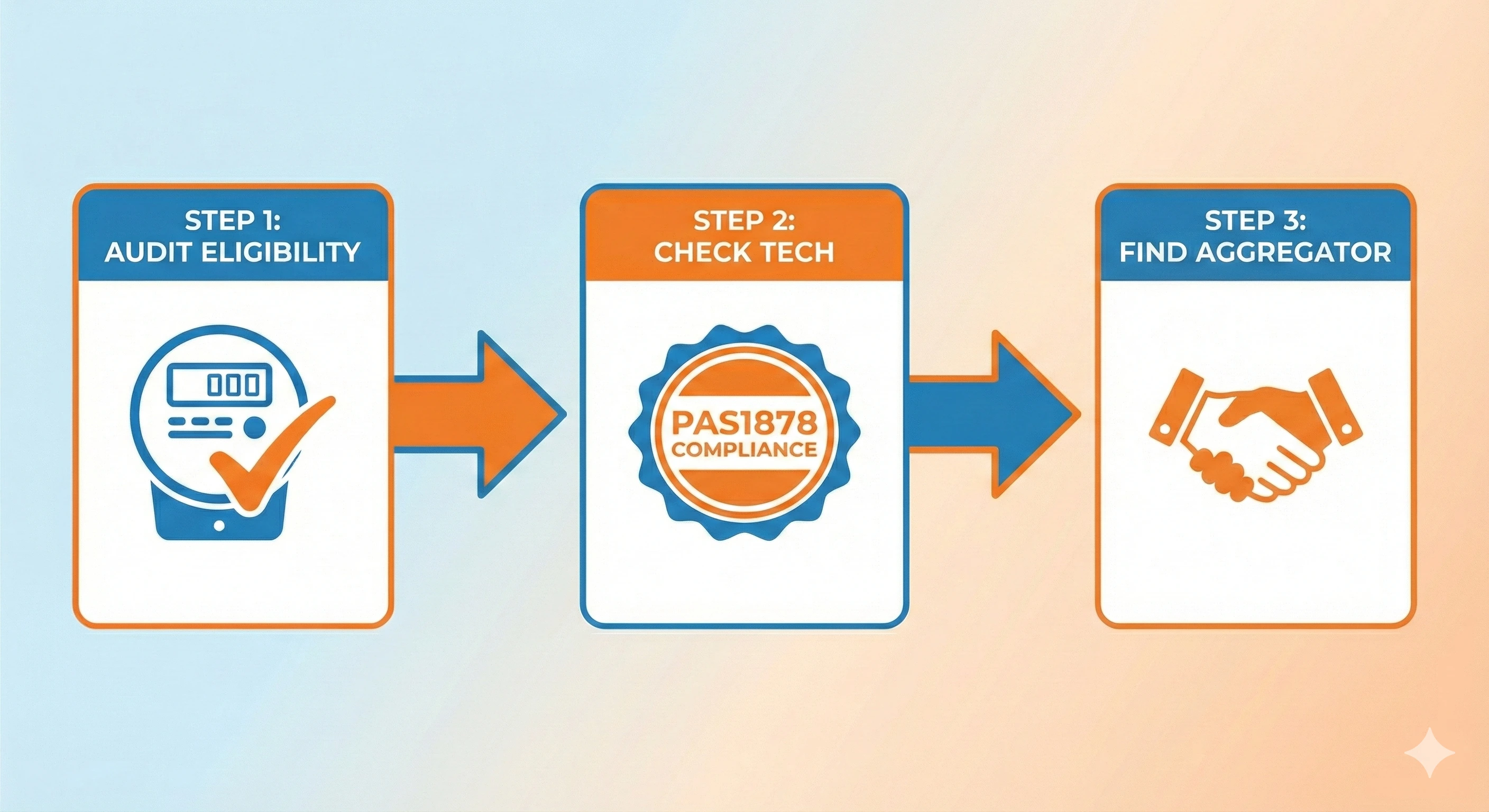

Step 1: Audit Your Eligibility

Do you have a half-hourly smart meter? If not, request one from your supplier immediately. It is the passport to this market.

Step 2: Check Your Tech

Are you installing new EV chargers or HVAC? Ensure they are PAS1878 compliant. Do not accept “proprietary” systems that lock you out of the open market.

Step 3: Find an Aggregator

You cannot do this alone. You need a “Flexibility Service Provider” to bundle your load.

Meet George has flexibility partners that we work with who can include you in their aggregation pool. We handle the complexity so you can just get paid.

Interested? Email us at flexibility@meetgeorge.co.uk if you are interested in exploring your flexibility options.

Step 4: Centralise Your Data

Meet George isn’t just for switching. Our platform forensically analyses your consumption data to identify if you have the “Load Profile” that aggregators pay for. We can spot export meters and usage patterns that signal you are sitting on a goldmine.

Don’t think of energy as only an expense. Think of it also as a balance sheet asset.

The £6bn Opportunity

The UK’s flexibility market is projected to be worth £6 billion annually by 2030. Most of that value is currently captured by large industrial users. But the regulatory changes of 2025 are opening the door to SMEs.

If you own a business with predictable power usage, battery storage, or EV charging infrastructure, you could be sitting on an asset worth thousands per year.

The question isn’t whether to participate - it’s whether to be an early adopter or wait until your competitors have already locked in the best aggregator deals.

Ready to explore your flexibility options? Learn how to switch business energy suppliers and set up the foundation for DSR participation, or contact us about our flexibility partner programme.

Sources & Further Reading: