The UK business energy broker market serves over 5.7 million SMEs, yet operates with minimal oversight. This report consolidates data from Companies House (opens in new tab), the Energy Ombudsman (opens in new tab), Ofgem (opens in new tab), and RECCo (opens in new tab) to provide an authoritative picture of an industry on the cusp of regulation.

This is the 2026 edition. Last verified: January 2026.

Key Findings

- 2,790 brokers are registered with the Energy Ombudsman’s ADR scheme alone - the true market size exceeds 2,700+

- Only 2% (52 of 2,700+) have signed the voluntary TPI Code of Practice after 20+ months

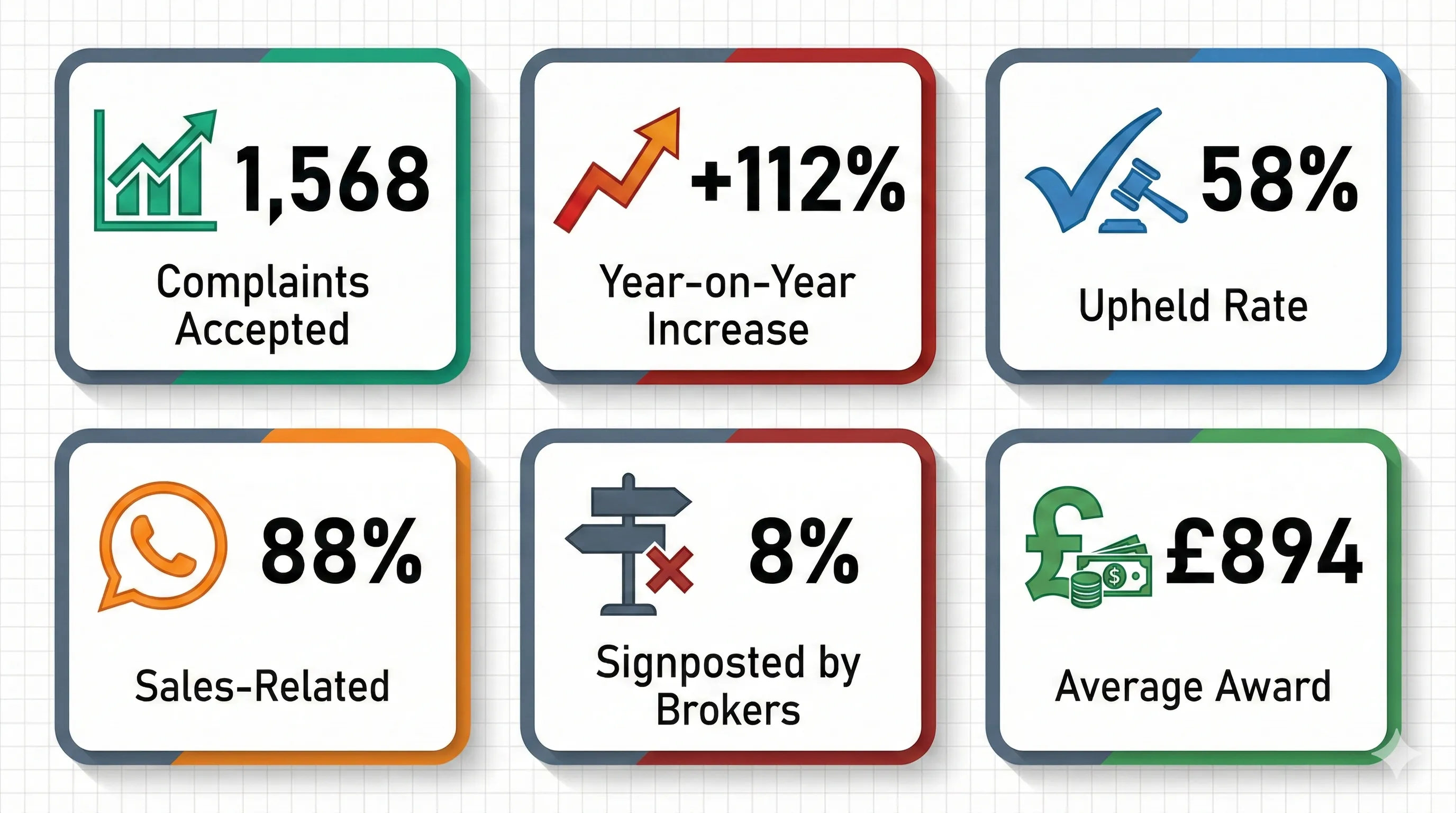

- Complaints surged 112% in 2024, with 88% relating to sales practices - not service delivery

- 77% of businesses using brokers believed the service was free (Ofgem research)

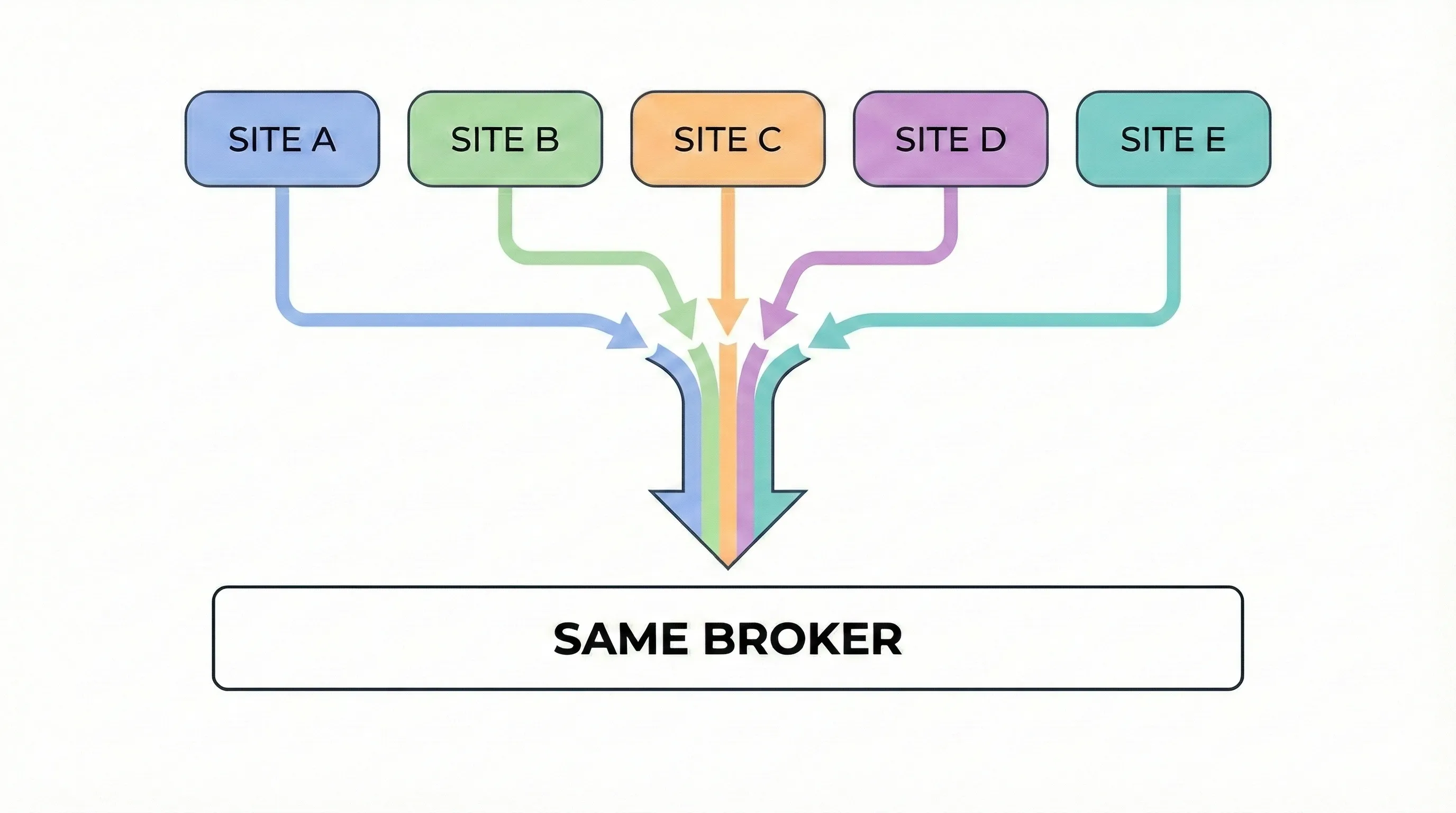

- All five major comparison sites route business energy customers to the same underlying broker

- Commissions typically range 2-5p/kWh - translating to £1,000-£2,500/year for a 50,000 kWh business

- Ofgem regulation expected 2027 - mandatory registration with fit-and-proper-person checks

Executive Summary

The core findings:

- Market consolidation is more extreme than it appears. All five major comparison sites route to a single broker, creating an illusion of choice.

- Self-regulation has failed. Only 2% of brokers have signed the voluntary transparency code after 20+ months.

- Complaints are accelerating. A 112% increase in Ombudsman cases while overall energy complaints fell 24%.

- Regulation is coming. Ofgem will become the direct regulator of brokers from 2027, with mandatory registration and enforcement powers.

1. Market Structure

Market Size and Concentration

The UK business energy broker market comprises an estimated 2,700+ operators, ranging from sole traders to large corporate entities. The Energy Ombudsman’s ADR scheme (opens in new tab) currently lists 2,790 registered brokers (as of January 2026) - though some brokers use alternative ADR providers (the Dispute Resolution Ombudsman or Utilities Intermediaries Association).

Key structural facts:

| Metric | Value | Source |

|---|---|---|

| Estimated active brokers | 2,700+ | Industry estimates |

| Energy Ombudsman ADR members | 2,790 | Energy Ombudsman register (Jan 2026) |

| Brokers exited ADR (2023-24) | 470 | Energy Ombudsman 2025 Report |

| SME switches via brokers | ~70% | Ofgem research |

| Brokers with complaints | 25% of registered | Energy Ombudsman 2025 Report |

The 70% figure is significant: the majority of UK business energy switches flow through intermediaries rather than direct to suppliers. This makes broker conduct a systemic issue for the SME energy market.

Comparison Site Consolidation

One of the most striking findings involves the comparison site market. Our investigation into comparison site ownership revealed that all five major UK comparison brands route their business energy customers to the same underlying broker - a single large intermediary that handles business energy enquiries from across the comparison site ecosystem.

Source: Company disclosures, website footers, and partnership announcements

This consolidation means that when SME owners attempt to “shop around” by trying multiple comparison sites, they receive quotes from the same sales operation. The branding differs; the underlying service, commission structure, and renewal practices are identical.

White-Label Networks

The comparison site pattern is replicated at smaller scale through white-label broker networks. Several large brokers power multiple websites that appear independent but route to the same backend operation.

This creates a market structure where apparent competition masks actual consolidation. Businesses believing they’re comparing different services are often simply giving the same broker multiple opportunities to close a sale.

2. Transparency Metrics

TPI Code Adoption: 2%

The TPI Code of Practice, administered by RECCo (the independent body that manages the industry’s Retail Energy Code), was launched in October 2023 as a voluntary transparency framework. After 20+ months:

The Code requires signatories to:

- Disclose their status as an intermediary, not the supplier

- Explain commission calculation before contract signing

- Show all quotes received, not just the recommended option

- Maintain ADR registration and a complaints procedure

- Train staff on Code requirements

These are basic professional standards. The 98% non-adoption rate suggests most brokers prefer to avoid public transparency commitments.

Data source: REC Portal TPI Register (opens in new tab), verified January 2026

Commission Disclosure

Until October 2024, brokers had no legal obligation to disclose commissions. Ofgem research (opens in new tab) found that:

- 77% of businesses using brokers believed the service was free

- Only 14% thought they paid anything at all

- 13% were unsure

This perception gap enabled the undisclosed uplift model, where commissions of 2-5p/kWh were embedded in unit rates without customer awareness.

What changed in October 2024: Ofgem’s Non-Domestic Market Review mandated that brokers must disclose commission when asked, and that commission must be clearly shown on the contract itself. This applies to all non-domestic contracts. However:

- Disclosure during the sales process is still reactive (only when requested)

- Quote comparison doesn’t show commission breakdown - you see the all-in rate

- Enforcement relies on supplier licence conditions, not direct broker regulation

Information Asymmetry

The broker market is characterised by extreme information asymmetry:

| What Brokers Know | What Businesses Know |

|---|---|

| All supplier base rates | Only the all-in quote presented |

| Commission ranges by supplier | Commission amount (if they ask) |

| Credit appetite by supplier | Whether they were accepted |

| Historical switching patterns | Only their own contract history |

| Renewal timing and margins | Often nothing until auto-renewed |

This asymmetry is why businesses struggle to assess value. Without seeing the supplier’s base rate separately from the broker’s uplift, there’s no way to compare broker costs across providers.

3. Complaint Trends

2024: A 112% Surge

The Energy Ombudsman’s 2025 Broker Report (opens in new tab) documented a dramatic increase in broker complaints:

| Metric | 2023 | 2024 | Change |

|---|---|---|---|

| Complaints accepted | 741 | 1,568 | +112% |

| Upheld in customer’s favour | 69% | 58% | -11pp |

| Sales-related complaints | 71% | 88% | +17pp |

| Signposted by broker | 5% | 8% | +3pp |

| Remedies implemented on time | 57% | 63% | +6pp |

Source: Energy Ombudsman Broker Report 2025 (opens in new tab)

Why Complaints Surged

Three factors converged in 2024:

1. Crisis-era mis-selling catching up. During 2022-2023, brokers used the energy crisis to pressure businesses into contracts with inflated commissions. Those 2-3 year contracts have now expired. Businesses discovering what they actually paid are complaining.

2. Awareness increasing. Mandatory commission disclosure (October 2024) revealed fees that were previously undisclosed. Media coverage of broker practices - including BBC Watchdog investigations - raised the profile of the issue.

3. ADR access expanding. Since December 2024, small businesses (under 50 employees) can use the Energy Ombudsman for broker disputes. Previously, only microbusinesses qualified.

88% Are Sales-Related

The composition of complaints is telling. Nearly 9 in 10 relate to the sales process:

- Misrepresentation of rates, savings, or contract terms

- Undisclosed commissions discovered after signing

- Pressure tactics to sign immediately

- Unsuitable contracts that didn’t match business needs

- Auto-renewals without informed consent

Only 6% of complaints concern customer service. The problem is systemic to how contracts are sold, not incidental to service delivery.

Real-World Examples

The data becomes more concrete through individual cases:

Care home overcharging. Care England reported (opens in new tab) that a care home was quoted £68,126 in broker fees - reduced to £12,606 when independently reviewed. That’s an 81% markup from a broker supposedly working in the care home’s interest.

Undisclosed commission discovery. Malcolm Harrington, a B&B owner in West Sussex, told BBC Rip Off Britain (opens in new tab) about discovering undisclosed commissions: “Commission had never been mentioned. I guess they built up trust which as it turned out was betrayed.” When challenged, his broker claimed commissions “would have been revealed had Malcolm asked.” His response: “I started to get really angry because I just couldn’t see the logic behind why I as a customer should have to ask them to reveal something that was hidden.”

Ofgem’s finding. The regulator’s April 2024 Non-Domestic Market Review found brokers “in some cases nearly doubling the cost of the energy contracts they sell.”

These aren’t edge cases. The 88% sales-related complaint figure suggests they represent a pattern.

The Signposting Failure

When complaints aren’t resolved within 8 weeks, brokers should signpost customers to the Ombudsman. In 2024, only 8% did so.

This means 92% of businesses who reached the Ombudsman found it themselves. The Ombudsman has stated they handle “less than a third of the disputes that we should” - suggesting actual grievances could be 3x higher than recorded complaints.

Financial Outcomes

When complaints are upheld:

- Average financial award: £894

- 58% uphold rate (down from 69% in 2023, but still majority)

- Only 63% of remedies implemented on time

The remedy compliance figure is concerning. More than a third of businesses who won their case faced delays getting what they were awarded. Mid-2024 saw compliance fall to just 27% before recovering to 80% after Ombudsman intervention.

4. Cost Analysis

Understanding Broker Commission

Broker commissions are typically structured as pence-per-kilowatt-hour (p/kWh) added to the supplier’s base rate. This means the total cost depends on your energy consumption - higher usage means higher absolute commission, though the per-unit rate may be lower.

Commission ranges based on industry data and Ombudsman cases:

| Period | Typical Range | Context |

|---|---|---|

| Pre-crisis (before 2022) | 1-2p/kWh | Stable market, lower margins |

| Crisis peak (2022-2023) | 4-7p/kWh | Volatility masked higher uplift |

| Current (2024-2026) | 2-5p/kWh | Market stabilising, scrutiny increasing |

During the crisis, when unit rates spiked to 40-50p/kWh, a 5p uplift was less noticeable as a percentage. Now that prices have stabilised around 20-25p/kWh, the same uplift represents a larger proportion of the total bill.

Public Data: What Companies House Reveals

UK company law requires limited companies to file accounts with Companies House (opens in new tab). These public filings provide one of the few windows into broker economics.

For example, public filings from the UK’s largest business energy broker (by customer numbers) reveal the following workforce composition:

| Metric | Value |

|---|---|

| Total staff | 512 |

| Sales staff | 288 (56%) |

| IT staff | 93 (18%) |

| Operations | 71 (14%) |

| Administration | 60 (12%) |

Source: Companies House (opens in new tab) public filing, FY2025

This workforce composition - with more than half dedicated to sales - reflects the phone-based, relationship-driven nature of traditional broker services.

This structure isn’t inherently problematic. Many businesses value the personal service, expert guidance, and hand-holding that broker sales teams provide - particularly when navigating complex contracts or multi-site portfolios. The cost structure reflects the service model.

The question for each business is whether that service model matches their needs and whether they’re getting value for the commission paid.

The Traditional Model

The traditional broker model involves:

- Sales teams for outbound calling and relationship management

- Account managers for ongoing customer support

- Operations staff for contract processing and supplier liaison

- Compliance infrastructure for regulatory requirements

This human-intensive approach has costs that must be recovered through commission. For businesses that want guidance through the switching process, this can represent good value. For businesses that prefer self-service, alternative models are emerging.

5. Regulatory Timeline

The regulatory landscape for energy brokers is changing rapidly. Here’s the current timeline:

Already in Effect

Coming Next

What Regulation Will Include

The Government’s consultation response on TPI regulation (opens in new tab) confirmed Ofgem will gain:

- Mandatory registration for all TPIs

- Fit-and-proper-person tests for directors

- Conduct standards with enforcement powers

- Investigation authority for complaints

- Market removal powers for bad actors

Ed Miliband, Energy Secretary, was direct about the intent: to “end the wild west of ‘cowboy’ brokers charging sky-high fees.”

The TPI Code’s Future

RECCo has proposed making the TPI Code mandatory (opens in new tab) for all TPIs working with non-domestic suppliers. This would complement Ofgem’s broader regulatory framework, creating a dual system of industry code compliance and regulatory oversight.

Brokers who’ve already signed the voluntary Code are positioning themselves for the regulatory future. The 98% who haven’t may face a steeper compliance curve.

6. What This Means for Businesses

The Problem Summary

UK businesses face a broker market characterised by:

- Apparent choice, actual consolidation - Multiple brands, same underlying service

- Undisclosed costs - Commissions embedded in rates, not shown separately

- Low transparency adoption - Only 2% committed to voluntary standards

- Rising complaints - 112% increase, with 88% about sales practices

- Weak enforcement - Only 63% of remedies implemented on time

- Delayed regulation - Direct oversight not expected until 2027

What You Can Do Now

Before switching:

-

Ask for commission disclosure in writing. Since October 2024, brokers must tell you. Get the p/kWh rate and total £ value.

-

Check TPI Code status. Visit the REC Portal (opens in new tab) to verify your broker’s commitment to transparency standards.

-

Request all quotes received. Code signatories must show every supplier quote, not just their recommendation.

-

Understand the Letter of Authority. Know whether you’re signing a Level 1 (data access) or Level 2 (contract authority) LOA.

If things go wrong:

-

Document everything. Keep contracts, emails, and notes on verbal promises.

-

Complain formally. Write to your broker - this starts the 8-week clock.

-

Escalate to the Ombudsman. After 8 weeks (or a deadlock letter), contact energyombudsman.org (opens in new tab).

-

Know your eligibility. Since December 2024, businesses under 50 employees can use the Ombudsman for broker disputes.

Questions to Ask Any Broker

| Question | Why It Matters |

|---|---|

| ”What is your commission rate in p/kWh?” | Forces specific disclosure |

| ”Have you signed the TPI Code?” | Tests transparency commitment |

| ”Can I see all supplier quotes you received?” | Reveals cherry-picking |

| ”What happens at renewal?” | Exposes auto-renewal practices |

| ”Will you ever sign contracts on my behalf?” | Clarifies LOA type |

The Alternative Landscape

For businesses seeking alternatives to the traditional broker model, three options exist:

| Factor | Traditional Broker | Self-Service Platform | Direct to Supplier |

|---|---|---|---|

| Commission | 2-5p/kWh (often undisclosed) | 1-2p/kWh (transparent) | None |

| Getting quotes | Online or phone | Online, instant | Contact each supplier individually |

| Completing the switch | Phone calls, paperwork, broker-assisted | Online, self-service | Phone/email with supplier |

| Market comparison | Yes (broker’s panel) | Yes (platform’s panel) | No - single supplier only |

| Time required | Low - broker handles process | Medium - you review and decide | High - multiple calls/forms |

| Transparency | Variable (check TPI Code status) | Typically high | N/A |

| Contract signing | Often via Level 2 LOA (broker signs) | You sign directly | You sign directly |

| Best for | Complex needs, multi-site, prefer phone | Tech-comfortable, want control | Large businesses with buying power |

TPI Code signatories represent the more transparent end of traditional brokers - committed to disclosure standards, though still a small pool (52 of 2,700+).

The market is evolving. Regulation, technology, and increased awareness are creating pressure for change. Businesses that understand the current landscape can make better decisions while waiting for systemic improvements.

Methodology and Sources

This report consolidates data from:

Primary Sources

- Energy Ombudsman ADR Register (opens in new tab) - Live register of ADR-registered brokers (2,790 as of January 2026)

- Energy Ombudsman Broker Report 2025 (opens in new tab) - Complaints data December 2023 to November 2024

- REC Portal TPI Register (opens in new tab) - TPI Code signatory list, verified January 2026

- Ofgem Non-Domestic Market Review (opens in new tab) - Regulatory decisions and research data

- DESNZ TPI Regulation Consultation (opens in new tab) - Government policy direction

- Companies House (opens in new tab) - Public filings for UK limited companies

Secondary Analysis

- Comparison site ownership via company disclosures and website footers

- Industry estimates for total broker numbers (no single official register exists)

- Commission ranges from Ombudsman case studies and industry sources

Limitations

- No single official register of all UK energy brokers exists; 2,700+ is an industry estimate based on the Energy Ombudsman’s 2,790 registered brokers plus those with alternative ADR providers (DRO, UIA)

- Complaint data likely understates actual grievances due to low signposting rates

- Self-reported TPI Code compliance; no independent verification of ongoing adherence

- Commission range data is based on Ombudsman cases and industry sources, not comprehensive market data

Related Reading:

- What is a Good Energy Broker Commission Rate? - Deep dive into broker cost structures

- Only 52 of 2,700+ Brokers Signed the TPI Code - Analysis of voluntary transparency adoption

- Energy Broker Complaints Up 112% - Full breakdown of Ombudsman data

- Ofgem’s 2026 Roadmap - Detailed regulatory timeline

Sources:

- Energy Ombudsman - ADR Register (Live Data) (opens in new tab)

- Energy Ombudsman - Broker Report 2025 (PDF) (opens in new tab)

- REC Portal - TPI Code Signatories (opens in new tab)

- Ofgem - Non-Domestic Market Review (opens in new tab)

- Ofgem - TPI Programme (opens in new tab)

- DESNZ - TPI Regulation Consultation (opens in new tab)

- Energy Consultants Association - 2025 Ombudsman Report Analysis (opens in new tab)

- Companies House (opens in new tab)