TL;DR: Key Takeaways

The Numbers: DESNZ Q4 2025 data shows very small businesses pay 41.15p/kWh for electricity versus 20.49p/kWh for extra large businesses - a 101% premium. For gas, the gap is even wider at 202%.

Why It’s So High: The 41.15p average is inflated by three factors: a significant minority of microbusinesses are on deemed rates without realising it (50-80% more expensive than fixed contracts), broker commissions of 3-5p/kWh are common for small businesses, and suppliers charge higher margins to customers with less negotiating power.

The Information Gap: 77% of UK businesses mistakenly believe broker services are free. In reality, commissions are embedded in the unit rate. If a broker finds you on 38p deemed rates, they can quote you 28p, pocket an 8p/kWh uplift, and you’ll think you got a great deal.

What To Do: Ask your broker for commission disclosure in writing (it’s been mandatory since October 2024). Check if you’re on deemed rates. Compare your rate against market prices - competitive fixed rates are currently around 22-24p/kWh.

There’s a quiet injustice in UK business energy that rarely makes headlines. Small businesses - the cafés, care homes, and corner shops that form the backbone of local economies - pay dramatically more for their energy than large corporations. Not a bit more. Double.

And a meaningful chunk of that premium goes to energy brokers - often without businesses even knowing.

Here’s what the data actually shows.

The price gap: DESNZ Q3 2025 data

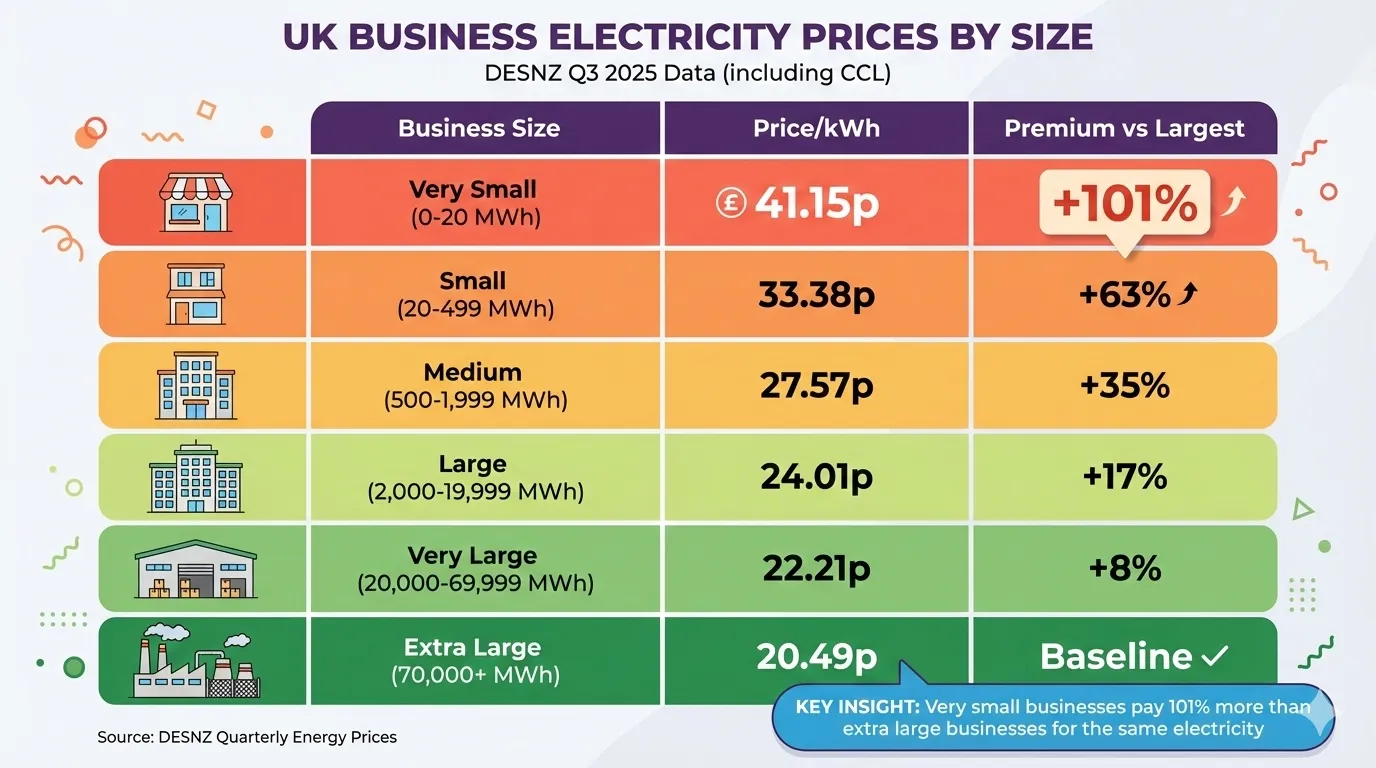

The Department for Energy Security and Net Zero publishes quarterly energy price statistics broken down by business size. The latest data from Q3 2025 (opens in new tab) reveals a stark disparity.

Electricity prices (including Climate Change Levy):

| Business Size | Price per kWh | Premium vs Extra Large |

|---|---|---|

| Very Small (0-20 MWh/year) | 41.15p | +101% |

| Small (20-499 MWh) | 33.38p | +63% |

| Medium (500-1,999 MWh) | 27.57p | +35% |

| Large (2,000-19,999 MWh) | 24.01p | +17% |

| Very Large (20,000-69,999 MWh) | 22.21p | +8% |

| Extra Large (70,000+ MWh) | 20.49p | Baseline |

A very small business pays 41.15p per kWh. An extra large business pays 20.49p. That’s a 101% premium for being small.

Gas prices (including CCL):

| Business Size | Price per kWh | Premium vs Very Large |

|---|---|---|

| Very Small (under 278 MWh/year) | 10.92p | +202% |

| Small (278-2,777 MWh) | 7.28p | +101% |

| Medium (2,778-27,777 MWh) | 5.45p | +51% |

| Large (27,778-277,777 MWh) | 4.31p | +19% |

| Very Large (277,778+ MWh) | 3.62p | Baseline |

For gas, the gap is even more extreme. Very small businesses pay 202% more than very large ones.

This isn’t new. But according to Ofgem’s January 2026 State of the Market report (opens in new tab), the gap is widening.

Why the gap exists

The 41.15p/kWh average for very small businesses isn’t just about economies of scale. It’s inflated by several compounding factors.

1. Deemed rates drag the average up

A significant proportion of microbusinesses are on “deemed” or out-of-contract rates - often without realising it. According to Ofgem’s guidance on deemed contracts (opens in new tab), these rates can be 50-80% higher than negotiated contracts. If you miss your renewal window or take over premises without setting up a new contract, you automatically fall onto deemed rates.

In 2025, deemed rates average around 35p/kWh - and can exceed 45p/kWh. When 10% of businesses are paying rates like this, it significantly inflates the overall average.

Real Example: Dream Looks Boutique

A Marylebone fashion boutique came to us after paying 38.6p/kWh on deemed rates for two years - without realising it. They’d simply missed their renewal window and never noticed.

We switched them to a 3-year fixed contract at 22.31p/kWh (including our transparent 1p/kWh fee) - a 46% reduction saving them £3,921 over 3 years. Our total commission over that period? Around £180.

This is the asymmetry in action: a sophisticated procurement team at a large company would never let a contract lapse onto deemed rates - the cost would be immediately visible and significant. But a small business owner focused on running their shop? It happens constantly. And it’s exactly these cases that drag up the 41.15p/kWh average.

2. Suppliers charge more to smaller customers

This isn’t arbitrary. From a supplier’s perspective, small customers are:

- Higher risk - more likely to default, go bust, or have credit issues

- Higher cost to serve - same billing, metering, and customer service overhead spread over less volume

- Less profitable per transaction - a 15,000 kWh café generates a fraction of the margin of a 70,000 MWh factory

So suppliers build higher margins into SME rates. They can, because small businesses have less negotiating power and often don’t know what competitive rates look like.

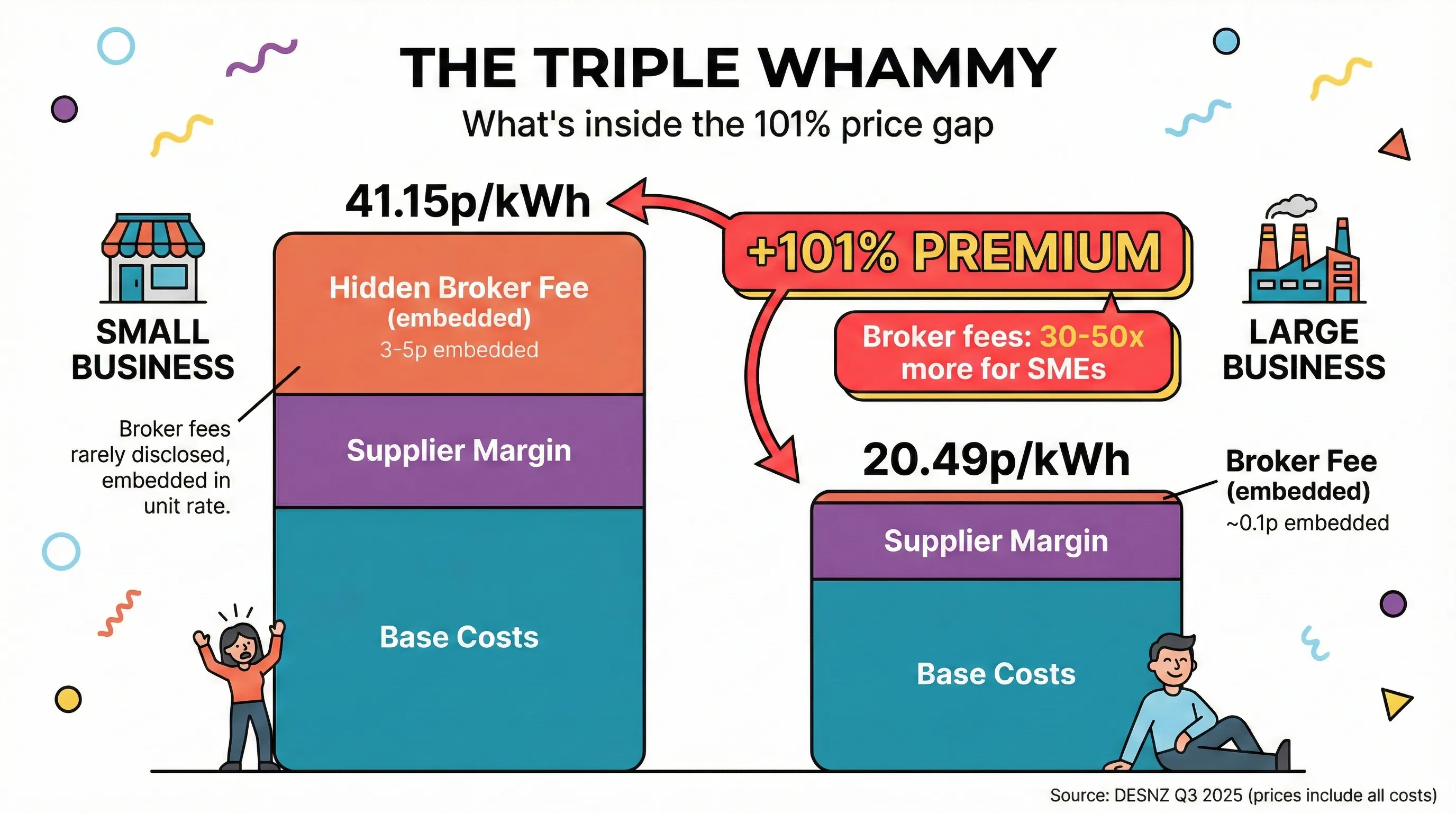

3. Broker commissions compound the problem

Ofgem’s Microbusiness Strategic Review (opens in new tab) found that pricing for small firms “is still far from fully transparent” and that suppliers hold vastly more information than customers. The regulator noted that many microbusinesses “don’t realise how much of what they pay via their energy bill goes to their broker.”

Which brings us to the third whammy.

The broker commission gap

Energy brokers position themselves as helpful intermediaries who search the market and find you the best deal. Many advertise their services as “free.”

They’re not free. You just don’t see the fee.

Traditionally, broker commissions were embedded directly into the unit rate. If a supplier’s direct price was 22p/kWh, a broker might add 4p and quote you 26p. You’d never know the difference.

Research into Third Party Intermediary (TPI) practices reveals a consistent pattern: brokers charge small businesses far more than large ones. (For more on the current state of the industry, see our State of Business Energy Brokers 2026 report.)

| Business Size | Typical Broker Commission | Range | Multiple vs Large |

|---|---|---|---|

| Micro/Very Small | 3-5p/kWh | 2-8p+ | 30-50x |

| Small | 1-2p/kWh | 0.5-4p | 10-20x |

| Medium | 0.3-0.5p/kWh | 0.2-1p | 3-5x |

| Large/Industrial | ~0.1p/kWh | 0.05-0.2p | Baseline |

The range matters. While “typical” commissions for micro businesses might be 3-5p/kWh, the information asymmetry creates opportunities for much higher uplift.

Consider this scenario: a broker finds a café on deemed rates at 38p/kWh. They quote 28p/kWh - a genuine saving of 10p. The business owner is delighted. But if the competitive market rate is 22p/kWh, that broker just embedded a 6p/kWh commission while looking like a hero. Over a 3-year contract at 15,000 kWh/year, that’s £2,700 in undisclosed fees.

This isn’t hypothetical. Ofgem has noted (opens in new tab) that “even small p/kWh uplifts can amount to large total costs over a contract period.” The regulator is now working to bring TPIs under direct oversight for the first time.

Meanwhile, large industrial clients pay as little as 0.05-0.1p/kWh - often negotiated as flat fees rather than per-unit commissions.

The asymmetry is staggering. And it’s enabled by one simple fact: 77% of UK businesses mistakenly believe broker services are free.

The triple whammy in numbers

The DESNZ figures show what businesses actually pay - and those prices already include deemed rates, supplier margins, and broker commissions baked in. Let’s break down where the 101% premium likely comes from:

| Factor | Contribution to Gap | Notes |

|---|---|---|

| Deemed rates (~10% of microbusinesses) | Significant | Businesses on 35-45p rates drag up the 41.15p average |

| Supplier margins | Moderate | Higher risk, higher cost to serve, less negotiating power |

| Broker commissions | 3-6p/kWh typical | Compared to ~0.1p for large industrial clients |

| Lack of shopping around | Variable | Many SMEs don’t know what competitive rates look like |

The 20.66p/kWh gap between small and large businesses comes from three compounding factors:

- Deemed rates and inertia - many microbusinesses are on expensive out-of-contract rates without realising it

- Supplier margins - suppliers charge more per unit to smaller, riskier customers

- Broker commissions - brokers take 30-50x more per kWh from small businesses

To put this in perspective: competitive fixed rates for small businesses in early 2026 are around 22-24p/kWh. If you’re paying significantly more than that, you’re likely on deemed rates, paying inflated broker commission, or both.

For a café using 15,000 kWh of electricity per year, that 2p/kWh broker commission represents £300 annually. Money that could pay for equipment, staff hours, or simply staying open another month.

For a care home using 50,000 kWh? That’s £1,000 per year going to an intermediary who may have done nothing more than make a phone call.

Regulatory findings confirm the problem

This isn’t speculation. Multiple regulatory bodies have documented these practices:

Ofgem (2024-2025): Found that pricing for small firms remains opaque and that many microbusinesses don’t realise how much they’re paying brokers. Responded by mandating commission disclosure from October 2024.

Competition and Markets Authority (2016): Found widespread disengagement among small businesses and low trust in brokers - only 32% of microbusinesses had a positive view of brokers, compared to 55% of large businesses.

Citizens Advice: Called it “a shame it’s taken so long” for regulators to tackle rogue brokers, citing frequent mis-selling complaints.

Federation of Small Businesses: Warned that over 1 million UK small businesses were locked into expensive energy deals at the peak of 2022 prices, often via brokers, unable to benefit when market prices fell. This experience created lasting wariness - many SMEs now avoid long-term contracts entirely, paradoxically leaving them on even more expensive deemed rates.

The evidence prompted the government to act. Following a consultation in September 2024, DESNZ confirmed in October 2025 (opens in new tab) that Ofgem will become the direct regulator of TPIs - bringing energy brokers under formal oversight for the first time.

The legal reckoning

The lack of transparency has also triggered legal action. Over 5,000 UK small businesses have joined class action lawsuits seeking to reclaim undisclosed commissions, with total claims potentially reaching £2 billion. (See our full breakdown of energy broker mis-selling cases.)

The landmark case Expert Tooling vs Engie (opens in new tab) reached the Court of Appeal in March 2025. The court found that the broker breached its fiduciary duty by not informing the client of the commission added to their contract.

The ruling established that brokers must ensure customers are “fully informed of all material circumstances” - including the exact amount of any commission and that it’s added to the unit price. Failure to do so constitutes a legal breach.

More claims are now emerging on the back of this precedent.

What small businesses can do

The regulatory landscape is shifting, but change takes time. Here’s what you can do now:

1. Ask the question directly

Since October 2024, you have the legal right to know exactly what commission your broker is taking. Ask for it in writing, in pence per kWh. If they won’t tell you, walk away.

2. Get the supplier’s direct price

Before accepting any broker-arranged contract, ask the supplier what their direct price would be without the broker. The difference is what you’re paying for the broker’s service. Decide if it’s worth it.

3. Check your existing contracts

If you signed a business energy contract in the last six years and weren’t told about broker commissions, you may have grounds to reclaim them. Several law firms are pursuing no-win-no-fee claims.

4. Consider self-service alternatives

The broker model exists because comparing business energy used to be genuinely difficult. That’s changing. Platforms now exist that let you see wholesale prices directly and switch without undisclosed intermediaries.

5. Don’t auto-renew

Rollover contracts often include fresh commission charges. Set a calendar reminder 3-4 months before your contract ends and actively shop around.

The bigger picture

The SME energy pricing gap isn’t just a market quirk - it’s a structural disadvantage that makes it harder for small businesses to compete. When a café pays twice as much per unit of electricity as a warehouse, that cost flows through to everything: prices, wages, margins, survival.

Brokers didn’t create this gap. But for years, many exploited it - adding undisclosed fees to customers least equipped to spot them, while giving volume discounts to large clients who’d notice immediately.

The good news: transparency is coming. Mandatory commission disclosure, direct TPI regulation, and court rulings establishing fiduciary duties are all moving in the right direction.

The bad news: for thousands of small businesses locked into long contracts with embedded commissions, the damage is already done.

If you’re one of them, now’s the time to understand what you’re actually paying - and plan your next contract accordingly.

Related reading: