TL;DR: Key Takeaways

Your Supply is Safe: If your business energy supplier fails, your gas and electricity will NOT be cut off. Ofgem’s Supplier of Last Resort (SoLR) (opens in new tab) process ensures a new supplier is appointed within days.

Don’t Switch Yet: Do not attempt to switch suppliers during the SoLR transition. This can complicate your transfer and make it harder to recover any credit. Wait until the transfer completes.

Credit is NOT Guaranteed for Businesses: Unlike domestic customers, business credit balances are not automatically protected (opens in new tab). Ofgem will try to appoint a supplier willing to honour your credit, but if they won’t, you’ll need to claim as a creditor.

Watch for Deemed Rates: The new supplier will put you on expensive deemed rates - typically 40-60% higher than fixed contracts. You can switch away immediately with no exit fees.

Act Fast After Transfer: Once your account is fully transferred, compare deals and switch to a fixed contract. Every week on deemed rates could cost a typical SME £50-100 extra.

What Happens When Your Energy Supplier Fails?

When a UK energy supplier goes bust, Ofgem - the energy regulator - steps in immediately. Your supply continues without interruption. Here’s the timeline:

Day 1-3: Ofgem Appoints a New Supplier

Ofgem runs a rapid process to appoint a “Supplier of Last Resort” (SoLR). Licensed suppliers can bid to take on the failed supplier’s customers. Ofgem selects based on their ability to handle the customer base and offer reasonable terms.

Recent example: When Tomato Energy collapsed on 5th November 2025 (opens in new tab), affecting 8,400 business accounts and 15,300 households, British Gas was appointed as SoLR within days and began supplying customers from 9th November (opens in new tab).

Week 1-2: Your Account is Transferred

The appointed supplier takes over your account. They’ll:

- Contact you to confirm the transfer (within 2 weeks)

- Request meter readings (if you don’t have a Half-hourly meter)

- Set up billing under their systems

- Attempt to honour your credit balance (not guaranteed for businesses)

After Transfer: You’re Free to Switch

Once the transfer completes, you’re a customer of the new supplier - but you’re not locked in. If they’ve placed you on deemed rates (which is almost certain), you can switch to any other supplier immediately.

Case Study: When Tomato Energy Went Bust

The Backstory

Tomato Energy, a Basingstoke-based supplier, had been showing warning signs for months. In April 2025, Ofgem stopped them from taking on new customers due to concerns over financial resilience and unpaid debts of around £3 million. By October 2025, Ofgem had issued a Notice of Proposal to impose a £1.5 million penalty after Tomato failed to address capital and liquidity deficiencies.

On 5th November 2025, Tomato Energy officially ceased trading - becoming the 31st supplier to collapse since 2021 (opens in new tab).

A Real Business Affected: THIS Workspace

One of the businesses caught up in the Tomato Energy collapse was THIS Workspace (opens in new tab), a coworking and office space provider in Bournemouth. Like thousands of other SMEs, they woke up to news that their energy supplier had gone bust. Read our full case study on how we helped THIS Workspace find an annual saving of £15,208.

Here’s what happened:

Day 1 (5th November): THIS Workspace received notification that Tomato Energy had ceased trading. They immediately took meter readings and gathered their account documentation.

Day 4 (9th November): British Gas was appointed as Supplier of Last Resort and began supplying energy to all former Tomato customers. Supply continued uninterrupted throughout.

Week 2: British Gas made contact to confirm the transfer, verify meter details, and set up the new account.

The outcome: THIS Workspace’s supply was never at risk. But like all transferred customers, they were placed on British Gas’s standard variable tariff - significantly more expensive than their previous fixed rate.

The Lesson

The Tomato Energy collapse perfectly illustrates both the protection and the risk:

- Protection: No business lost supply. The SoLR process worked exactly as designed.

- Risk: Every affected business was automatically placed on expensive default rates. Those who didn’t act quickly to switch paid hundreds or thousands more than necessary.

As Centrica’s Chief Executive Chris O’Shea noted at the time: “Tomato’s demise marks the 31st supplier to collapse since 2021. Every household in the UK has faced a £100 bill as a result of these failures.”

For businesses, the hidden cost is even higher when you factor in deemed rates.

The 7-Step Survival Guide

Step 1: Don’t Panic - Your Supply is Protected

Your gas and electricity will not be cut off. This is guaranteed by Ofgem’s licensing framework. Even during the chaotic period when 29 suppliers failed between 2021-2022 (opens in new tab), no business lost supply.

Take a breath. Your priority now is protecting yourself from overpaying, not from losing power.

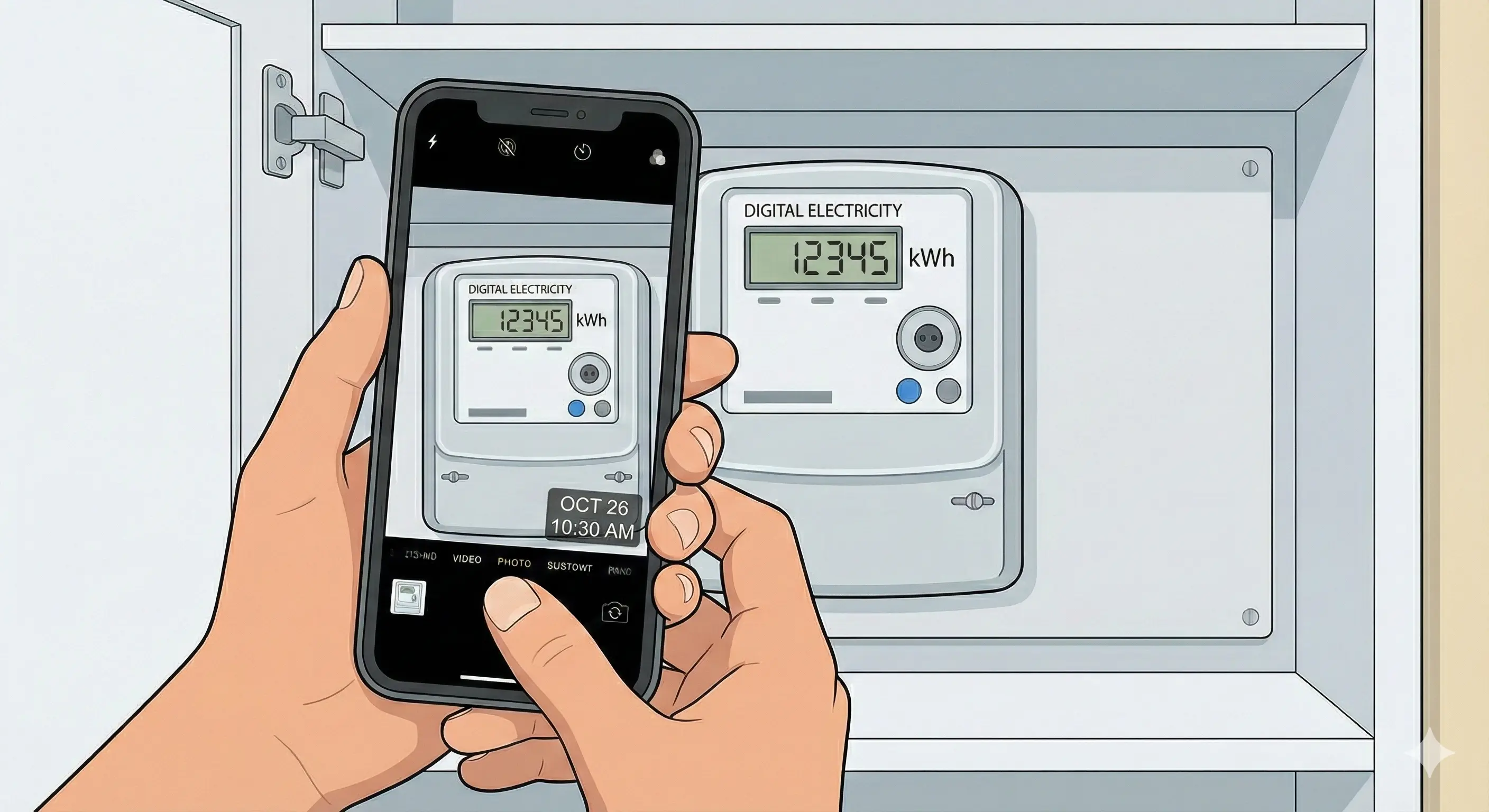

Step 2: Take Meter Readings Immediately

The moment you hear about the failure, record your meter readings:

- Electricity: Your MPAN (13 digits, found on your bill) and the kWh reading

- Gas: Your MPRN (6-10 digits) and the m³ reading

Photograph them with a timestamp. This protects you from:

- The failed supplier billing you for energy you didn’t use

- The new supplier overcharging you on their higher rates

- Disputes about your closing/opening balance

Already have a Half-hourly (HH) meter? Your readings are sent automatically to your supplier, so you don’t need to submit them manually. However, still take a photo as evidence of what your meter showed on the failure date - useful if disputes arise later.

Not sure if you have a Half-hourly meter? Under Market-wide Half-Hourly Settlement (MHHS), Profile Class 03 and 04 meters are being migrated from Non-Half-Hourly (NHH) to Half-hourly settlement. If your meter has been migrated, your supplier will already receive automatic readings. Check with your supplier if you’re unsure - but taking a photo is always good practice regardless.

Step 3: Gather Your Account Information

Find and save:

- Your last bill from the failed supplier

- Your credit balance (if any) - document this carefully as it may not transfer automatically

- Your direct debit amount and date

- Your contract end date (if you had one)

- Your annual consumption (look for “Annual Quantity” or AQ on gas, “EAC” on electricity)

You’ll need these when the new supplier contacts you - and when you eventually switch to a better deal.

Step 4: Wait for Ofgem’s Announcement

Critical: Do NOT try to switch suppliers during the SoLR transition period.

Here’s why:

- Switching during transition can complicate your account transfer

- It may be harder to recover any credit you’re owed if you switch early

- You could end up in a billing dispute between multiple suppliers

Instead, monitor Ofgem’s website (opens in new tab) for the announcement of which supplier has been appointed. This typically takes 2-3 days.

Step 5: Contact Your New Supplier

The appointed supplier should contact you within 2 weeks. If they don’t:

- Find their contact details on the Ofgem announcement

- Call their business energy team (not the domestic number)

- Have your MPAN/MPRN and meter readings ready

Ask about:

- Whether your credit balance will be honoured (not guaranteed for business customers)

- What tariff you’ve been placed on

- Any contract terms or exit fees (there shouldn’t be any)

If they won’t honour your credit: You’ll need to register as a creditor with the failed supplier’s administrator. This process can take over a year and recovery is not guaranteed.

What about security deposits? Suppliers sometimes request deposits from new business customers to protect against non-payment risk. However, as a SoLR transfer customer, you’re not technically “new” - you’re an existing energy market customer with a payment history. The new supplier has inherited your account, not signed you up fresh. This means they typically can’t require a deposit as part of the transfer. If they do request one, push back and ask them to justify it based on your payment history with the failed supplier. Read more about business energy security deposits.

Step 6: Check What Tariff You’re On

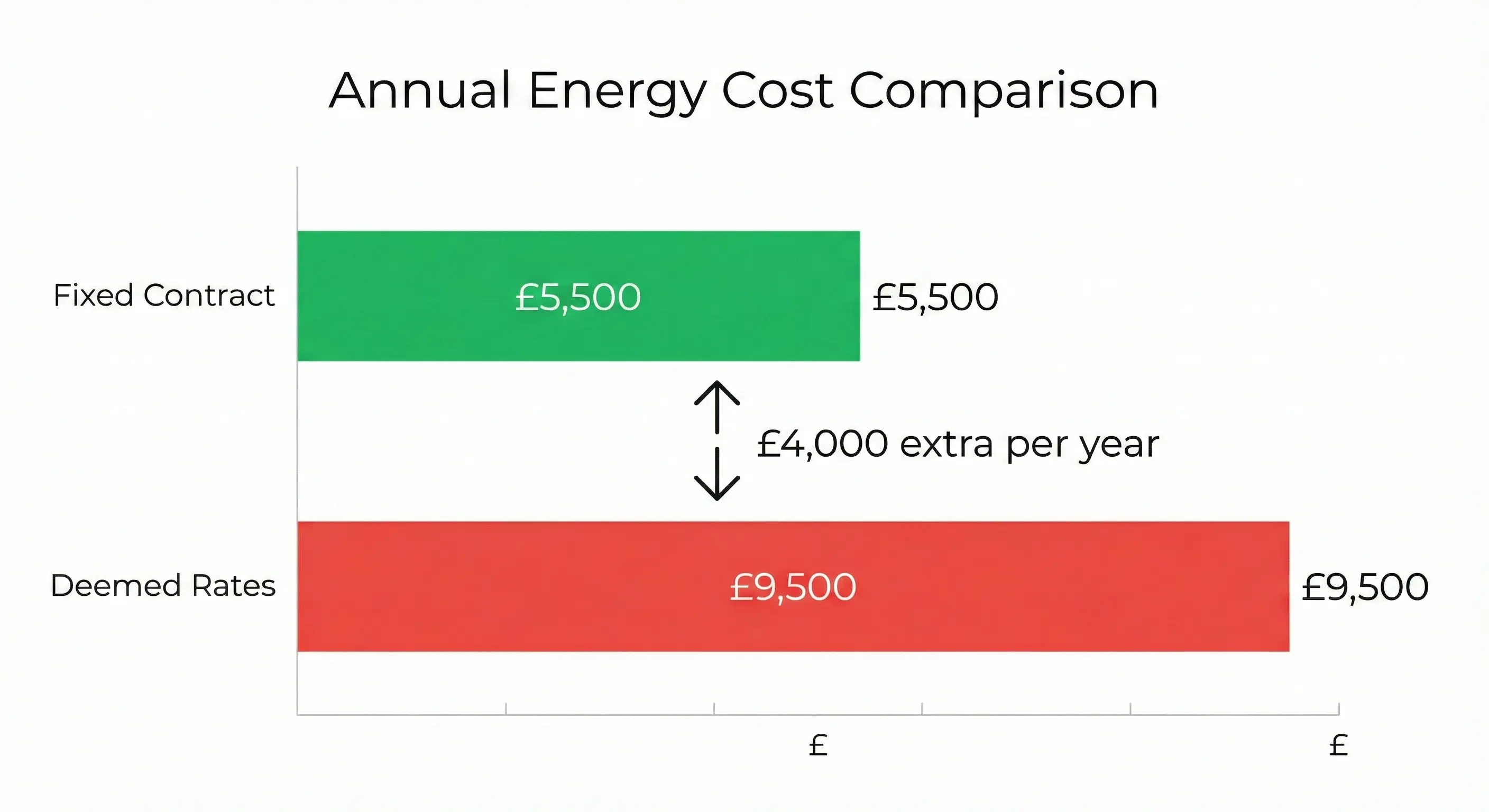

Here’s the trap: the new supplier will almost certainly place you on their deemed rates - the most expensive tariff they offer.

Deemed rates are typically:

- 40-60% higher than fixed contracts

- Around 35-45p/kWh versus 22-25p/kWh for a fixed deal

- Charged because you have no contract with the new supplier

Why are deemed rates so expensive? When you sign a fixed contract, your supplier knows you’ll be a customer for 1-3 years. This allows them to buy your energy in advance on the wholesale market at predictable prices - a process called “hedging”. But when you’re on deemed rates, you could leave tomorrow. The supplier can’t hedge because they don’t know how long you’ll stay, so they buy your energy on the volatile day-ahead market and charge you a premium to cover their risk. Learn more about why deemed rates are so expensive.

A typical SME using 25,000 kWh/year could pay £3,000-4,000 extra annually on deemed rates.

Ask the new supplier for written confirmation of:

- Your unit rate (p/kWh) for electricity and gas

- Your standing charge (p/day)

- Any contract terms or notice periods

Step 7: Compare and Switch to a Better Deal

Once your transfer is complete, you’re free to switch. Deemed rates have no exit fees - that’s the one silver lining.

Don’t delay. Every week on deemed rates costs a typical SME £50-100 in unnecessary charges. Compare business energy deals and switch to a fixed contract immediately. For a detailed walkthrough, see our business energy comparison guide.

The Financial Impact: What Supplier Failure Really Costs

Immediate Costs

| Impact | Typical Cost | Risk Level |

|---|---|---|

| Deemed rate premium | 40-60% vs. fixed rates | High |

| Standing charge increase | 10-20% higher | Medium |

| Admin time (traditional switching) | 2-4 hours | Certain |

| Admin time (with Meet George) | ~10 minutes | Certain |

| Lost credit balance (if not honoured) | Variable | Medium |

Example: A Small Retail Business

Before supplier failure:

- Fixed contract at 22p/kWh electricity

- Annual bill: £5,500

After SoLR transfer (on deemed rates):

- Deemed rate at 38p/kWh electricity

- Annual bill: £9,500

Extra cost if they don’t switch: £4,000/year - or £333/month being wasted.

The Compounding Problem

If you don’t act quickly, you face a double hit:

- Deemed rates from the SoLR transfer (40-60% premium)

- Rising network charges - TNUoS charges are increasing by 10-20% from April 2026

This is why volume tolerance traps and undisclosed broker commissions become even more dangerous after a supplier failure. You’re vulnerable and time-pressured - exactly when bad actors try to lock you into poor deals.

Common Mistakes to Avoid

Mistake 1: Switching Too Early

The error: Panicking and signing up with a new supplier the day you hear about the failure.

The problem: Your switch may fail because the SoLR process is still running. You could end up with duplicate accounts, lost credit, or worse - a locked-in bad contract you can’t escape.

The fix: Wait until Ofgem confirms the SoLR appointment and your new supplier has contacted you (typically within 2 weeks).

Mistake 2: Assuming Your Credit is Protected

The error: Expecting your credit balance to automatically transfer like it would for domestic customers.

The problem: Business credit balances are NOT automatically protected (opens in new tab). Ofgem will try to appoint a supplier willing to honour credit, but if they won’t, you’ll need to register as a creditor with the administrator - and may wait over a year for partial recovery.

The fix: Document your credit balance with screenshots and statements before the failure. Follow up with the new supplier in writing immediately. If they won’t honour it, contact the administrator promptly to register your claim.

Mistake 3: Staying on Deemed Rates

The error: Accepting the new supplier’s default tariff without question.

The problem: You could be paying 40-60% more than necessary for months or years.

The fix: The moment your transfer completes, compare business energy deals and switch. Deemed rates have no exit fees - use that to your advantage.

Mistake 4: Using a Rushed Broker

The error: Accepting the first broker call you receive after the failure.

The problem: Opportunistic brokers target businesses after supplier failures, knowing you’re vulnerable. They may lock you into contracts with undisclosed commissions of 3-5p/kWh. Learn how to spot the difference between good and bad brokers.

The fix: Take your time. Compare multiple quotes. Ask brokers to disclose their commission in writing before signing anything. Check whether they’ve signed the TPI Code of Practice - only 52 of 2,700+ UK brokers have committed to transparency standards. Watch out for Level 2 LOAs that give brokers signing authority over your account.

Mistake 5: Not Preparing for Next Time

The error: Assuming this won’t happen again.

The problem: Market volatility continues. More suppliers may fail, especially smaller ones exposed to wholesale price spikes. As the Tomato Energy collapse showed, warning signs can appear months before failure - but businesses often aren’t watching.

The fix: Keep records of your MPAN/MPRN, consumption data, and contract details. Know your contract end date. Set calendar reminders to review your energy deal annually - and avoid the digital renewal trap.

What If It’s Worse? (Special Administration)

Most supplier failures use the SoLR process described above. But sometimes, a supplier is too large to transfer quickly. In these cases, Ofgem may use Special Administration instead.

What’s Different?

- The failed supplier continues operating under administrator control

- Credit balances may take longer to recover

- The transition period can last months, not weeks

Example: Bulb Energy entered Special Administration in November 2021 and wasn’t fully sold to Octopus Energy until 2024.

What to Do

If your supplier enters Special Administration:

- Your supply continues as normal

- You’ll receive communications from the administrators

- You CAN usually switch away (unlike SoLR)

- Credit recovery may require a formal claim

Contact Citizens Advice (opens in new tab) for guidance specific to Special Administration cases. If you’re a Microbusiness, you have additional protections under Ofgem regulations.

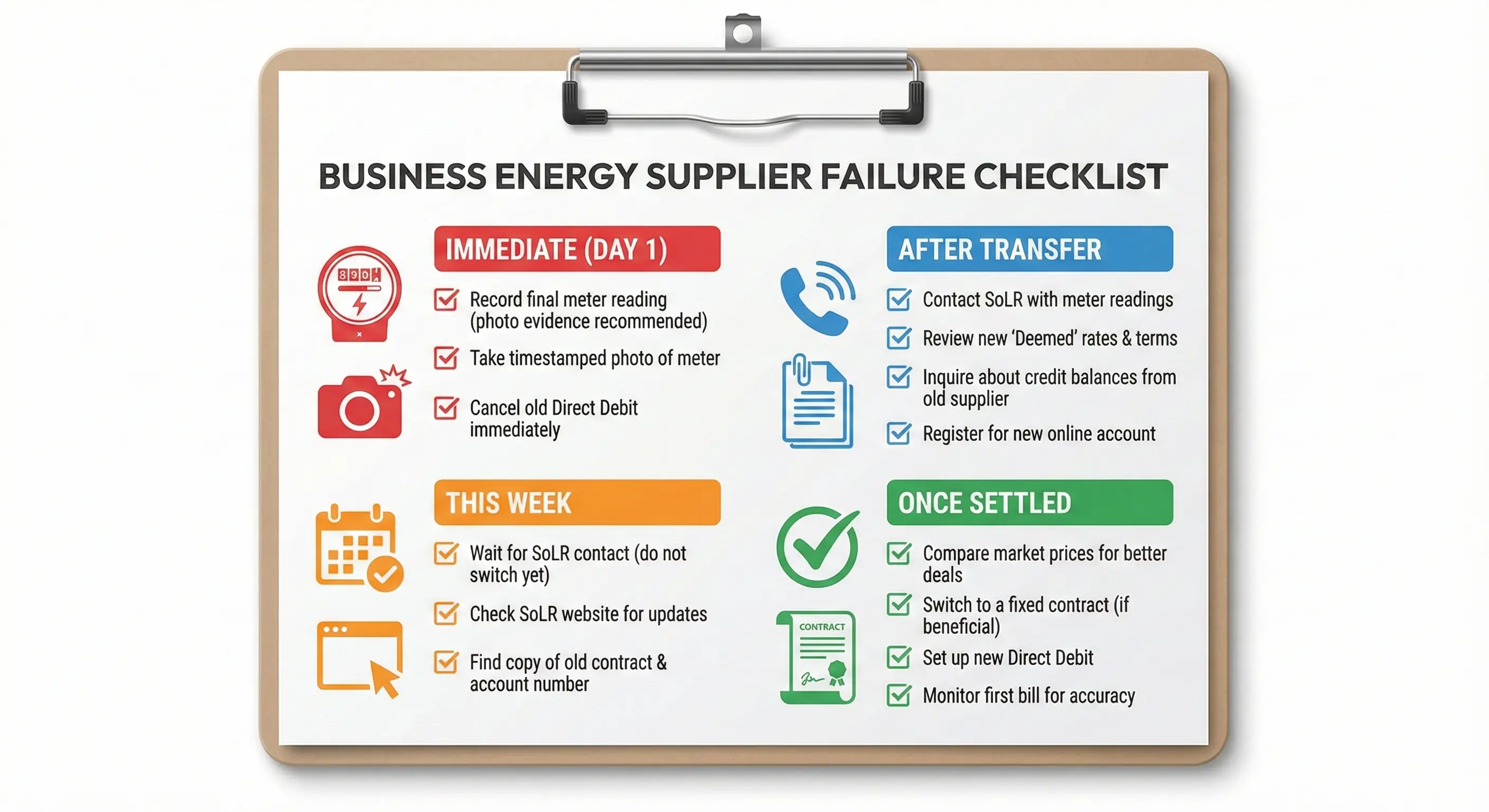

Your Supplier Failure Checklist

Use this checklist when you hear about a supplier failure:

Immediate (Day 1):

- Take meter readings and photograph them (even if you have a Half-hourly meter)

- Screenshot your account showing credit balance

- Save your last bill

- Find your MPAN and MPRN numbers

This Week:

- Check Ofgem’s website for SoLR announcement

- Do NOT attempt to switch yet

- Cancel any pending switches you may have started

After New Supplier Contacts You (Within 2 Weeks):

- Confirm transfer with new supplier

- Ask if credit balance will be honoured

- Get written confirmation of your new rates

- If credit not honoured, contact administrator to register as creditor

Once Settled:

- Sign a Letter of Authority to get quotes

- Switch to a fixed contract if on deemed rates

- Consider longer-term contracts for price stability

Getting Help

Official Sources

- Ofgem: Supplier failure updates (opens in new tab)

- Citizens Advice: Energy supplier problems (opens in new tab)

- Energy Ombudsman: Complaints and disputes (opens in new tab)

If Your Credit Isn’t Honoured

If the new supplier won’t honour your credit balance:

- Get confirmation in writing from the new supplier

- Find the administrator details (usually announced with the failure)

- Register as a creditor - the administrator will have a claims process

- Keep all documentation of your credit balance as evidence

- Be prepared to wait - recovery can take 12+ months and may only be partial

If You’re Struggling Financially

High energy costs from a supplier failure can push businesses toward insolvency. If you’re struggling:

- Contact HMRC about Time to Pay arrangements (opens in new tab)

- Seek free advice from an insolvency practitioner

- Consider a formal energy audit to reduce consumption

Switch Faster with Meet George

Stuck on expensive deemed rates after a supplier failure? Traditional switching can take hours of phone calls, comparing quotes, and paperwork. Meet George makes it faster.

Upload your bill, see your savings, switch in minutes. Our AI-powered platform compares deals from trusted suppliers, shows you exactly what you’ll save, and handles the switch for you - with a transparent 1p/kWh commission clearly shown upfront.

No undisclosed fees. No pushy sales calls. No Level 2 LOAs that let brokers sign contracts without your consent.

Compare business energy deals now or request early access to the Meet George platform.

The Bottom Line

Energy supplier failures are disruptive but survivable. Your supply is protected. But unlike domestic customers, your credit balance is NOT guaranteed to transfer.

The businesses that suffer most are those who:

- Panic and make bad decisions

- Don’t document their account before the failure

- Assume their credit is protected when it isn’t

- Stay on deemed rates for months or years

Take the time to follow the steps above. Document everything - especially your credit balance. And the moment your transfer completes, compare deals and switch to a proper fixed contract.

Your supplier may have failed you. Don’t let that failure cost you thousands more in unnecessary charges.