TL;DR: Key Takeaways

The Hidden Tax: A security deposit acts as a hidden tax on your working capital. Energy suppliers demand upfront cash as insurance against “bad debt risk” - money that sits in their bank account, not yours, often for 12+ months.

The Credit Check Reality: Every commercial energy supplier runs a business credit check, but risk thresholds vary wildly. Supplier A might approve you instantly; Supplier B might demand thousands in cash deposits for the same company.

The Interest Question: Some suppliers pay interest on held deposits (linked to base rates). Others explicitly pay nothing. Ask in writing before paying - inflation erodes uncompensated deposits daily.

You Can Negotiate: Deposit demands are opening offers, not legal requirements. Offer Direct Debit mandates, Director Guarantees, or Smart Meter installation to reduce or eliminate upfront payment demands.

The Deemed Rate Trap: Refusing a deposit and staying on out-of-contract tariffs costs more. Deemed rates (40-60% higher than fixed) often exceed the deposit amount within months.

Why Suppliers Demand Security Deposits

If you have applied for a business energy contract recently, you might have been hit with a nasty surprise: a demand for a Security Deposit.

For many small businesses and SMEs, this is a shock. You expected a monthly electricity bill or gas bill, not a request for thousands of pounds upfront just to turn the lights on.

Volatile wholesale energy prices have made commercial energy suppliers more risk-averse. They are increasingly using credit checks and creditworthiness assessments to hoard your cash before agreeing to supply your premises.

Here is exactly what the rules say, how to negotiate better terms, and how to avoid locking up your working capital for years.

The Business Credit Score Reality

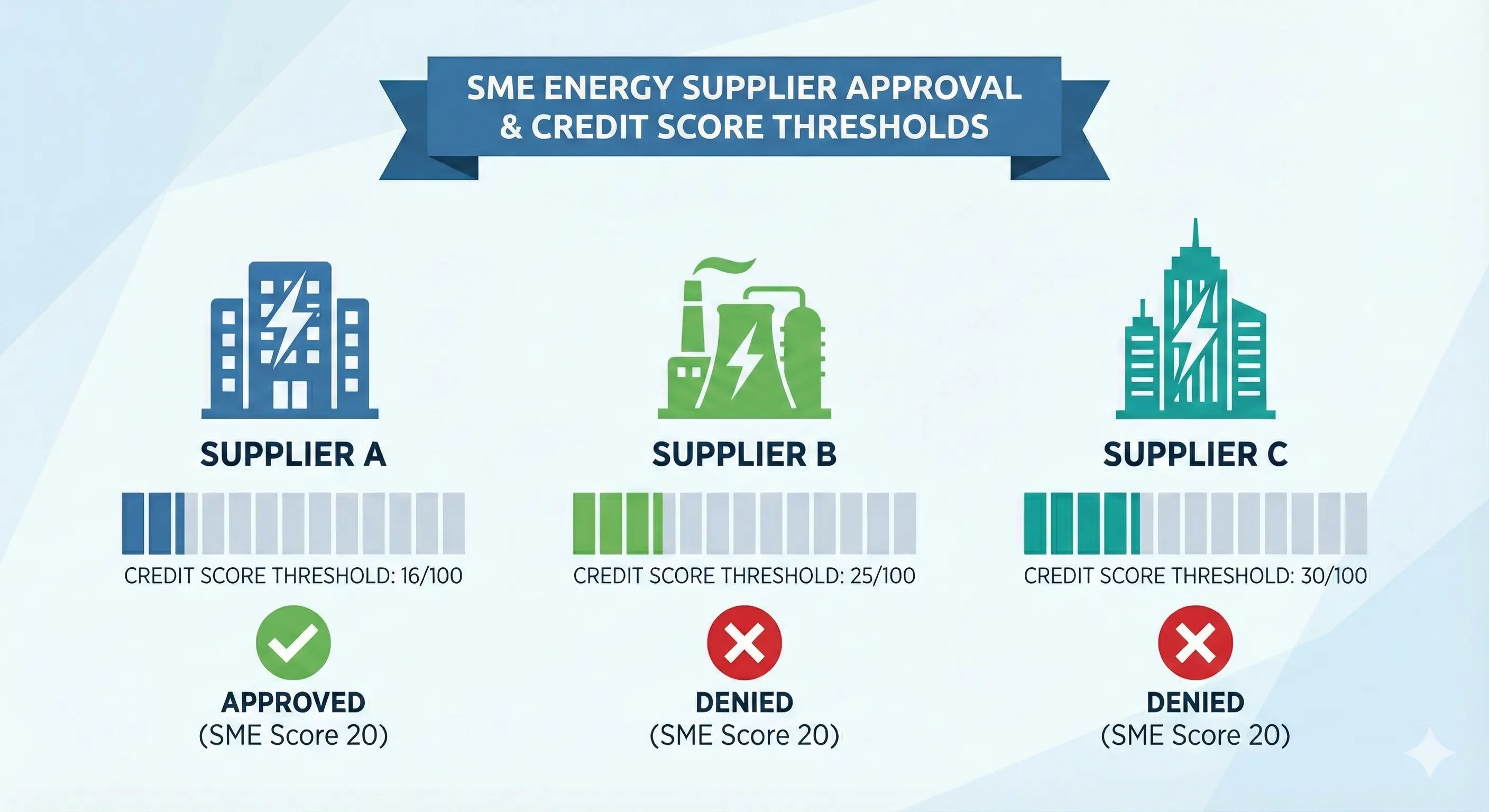

First, a correction: Every supplier runs a credit check. This is a standard part of the commercial energy application process. However, suppliers have different “Risk Thresholds” and credit appetites.

- Supplier A might be happy with a business credit score of 16/100

- Supplier B might demand a score of 30/100 or higher

If your company falls below a supplier’s specific threshold, they classify you as a “Bad Debt Risk” or high-risk customer. The Security Deposit becomes their insurance policy against potential payment default.

The Problem: This money sits in their bank account earning them interest, not yours, often for 12 months or more. For an SME with tight cash flow margins, that locked-up capital could be the difference between business growth and stagnation.

The Rules: Can They Actually Do This?

Yes. There is no single legislative “cap” on commercial energy deposits, but Ofgem rules (opens in new tab) and contract law provide a regulatory framework suppliers must follow.

The “Fairness” Test

Energy suppliers must treat business customers fairly (especially if you qualify as a Microbusiness under Ofgem definitions). Industry best practice typically limits deposits to 1-3 months of estimated energy consumption.

Red Flag: If a supplier demands 6 months of usage or more as an upfront payment, challenge it immediately. This falls outside standard industry practice and may breach fairness requirements under the Supply Licence Conditions.

The Interest Rule (The Hidden Money)

Here is a critical nuance most business owners miss: Check if your deposit earns interest.

The Good: Some major suppliers state in their terms and conditions that they will pay interest on held cash, often pegged to a base rate (e.g., Bank of England base rate minus a margin).

The Bad: Other suppliers, particularly challenger brands, explicitly state in their T&Cs that no interest will be paid on security deposits.

The Maths: If a supplier demands a large sum with no interest, inflation is eating your money every day. At 4% inflation, a deposit of several thousand pounds loses hundreds in real purchasing power over 12 months.

The Advice: If a supplier demands a significant deposit, ask them in writing: “Does this deposit accrue interest, and at what rate?” If the answer is no, factor that opportunity cost into your decision.

The Bear Traps: Risks You Need to Know

Paying the deposit isn’t just about cash flow management; it’s about business leverage. Here are two common traps that catch SMEs:

Trap 1: The “Deemed Rate” Drift

If you refuse to pay a deposit and refuse to sign a fixed-term contract, the supplier will place you on “Deemed Rates” or out-of-contract tariffs.

The Cost: These variable rates are often 40-60% higher than negotiated fixed contract rates.

The Maths: It is often cheaper to pay a moderate deposit to secure a competitive fixed rate than to pay thousands extra in deemed energy rates over a year. Do the cost-benefit calculation before you walk away from a contract offer.

| Scenario | Deposit Requirement | Annual Unit Rate | Financial Impact |

|---|---|---|---|

| Fixed Contract (with deposit) | Upfront cash held | ~22p/kWh | Deposit returned after 12 months |

| Deemed Rates (no deposit) | None required | ~35p/kWh+ | Thousands extra per year in energy costs, never returned |

Trap 2: The “Forgot to Ask” Refund

Commercial energy contracts state deposits are returned only when the account is closed and “all sums are paid in full.”

The Contractual Gate: Some suppliers explicitly state in their T&Cs that the deposit is used to pay off the final balance first, and only the “remaining funds” are returned. This creates a time lag - you might switch in June, but if the final bill isn’t reconciled until September (due to disputes or meter read delays), the deposit sits in limbo.

The “Automatic” Myth: While Ofgem introduced strict rules in 2024 forcing suppliers to refund “Credit Balances” (overpayments) within 10 working days of a final bill, Security Deposits are often treated differently. A “Credit Balance” is money you overpaid on your bill. A “Security Deposit” is often held in a separate “holding account.” Automated systems that sweep for credit balances might miss the separate security deposit ledger entirely. Unless a human or a specific process triggers the release, it can sit there indefinitely.

The Scale of the Problem: Ofgem data (October 2025) revealed that £240 million currently sits in closed energy accounts across the UK - much of this from businesses that switched or moved and simply forgot to chase their closing balance, or had cheques sent to old premises they could no longer access.

The Fix: Put a “Deposit Refund Date” reminder in your calendar for your contract end date. When you switch, send a formal email to your old supplier: “Please confirm the return of my £[X] deposit plus any accrued interest to the following bank account: [details].” Get written confirmation of when to expect the funds.

How to Negotiate (Yes, You Can Negotiate)

A deposit demand is an opening offer, not a legal requirement. Suppliers want payment security. Give them that security a different way that preserves your working capital.

Tactic A: The Direct Debit Swap

The Pitch: “I cannot pay a large upfront deposit, but I will sign a Direct Debit Mandate today for automated monthly payments.”

Why It Works: Direct Debits significantly reduce their risk of non-payment and late payment. The supplier can automatically collect the monthly bill without chasing invoices or dealing with payment delays. Many suppliers will waive or significantly reduce the deposit requirement if you commit to automated monthly payments rather than invoice terms.

Success Rate: High. This is the most commonly accepted alternative to cash deposits in the commercial energy sector.

Tactic B: The Director Guarantee

The Pitch: “My business is a new limited company so it has no established credit history. I will provide a Personal Director’s Guarantee instead of tying up cash.”

Why It Works: A Director’s Guarantee gives the supplier legal recourse against you personally if the business defaults on energy payments. This is often considered stronger security than a refundable deposit because it’s not capped.

The Risk: This puts your personal assets at risk, so proceed with caution. Consult an accountant or solicitor before signing any personal guarantee. And understand your contract cancellation options before committing. But it does preserve your business cash flow for operations and growth.

Best For: New limited companies with no trading history but directors with personal assets and good personal credit scores.

Tactic C: The Smart Meter Trade

The Pitch: “Install a Smart Meter so you get daily consumption reads. You will never have debt risk because I’ll pay for exactly what I use each month.”

Why It Works: Traditional meters are read quarterly, meaning suppliers estimate your usage and bill you based on projections. This creates “Estimated Bill” risk - the supplier might under-bill you for months based on incorrect estimates, then hit you with a large catch-up bill you cannot immediately pay.

Smart Meters eliminate this estimation risk. The supplier sees your actual daily energy consumption data and can bill accurately on a monthly basis. This removes the uncertainty that drives deposit demands. Read our guide on smart meter myths and mandates to understand what smart metering means for your business.

Success Rate: Moderate. Works best combined with Tactic A (Direct Debit) for maximum impact on their risk assessment.

The 4-Step Deposit Optimisation Strategy

If you are facing a deposit demand right now, follow these steps to minimise or eliminate the cash requirement:

Step 1: Check Your Business Credit Report

Is there a mistake on your business credit file? A small unpaid utility bill, County Court Judgement (CCJ), or late payment marker from 3 years ago could be triggering a large energy deposit demand today.

Action: Request your business credit report from Experian Business (opens in new tab), Equifax Business (opens in new tab), or Creditsafe (opens in new tab). Review it for errors, outdated information, or disputes you’ve already resolved. Fix any inaccuracies with the credit reference agency before reapplying to energy suppliers.

Step 2: Shop Around Multiple Suppliers

Credit policies and risk appetites vary wildly between energy suppliers. Supplier A might demand thousands in deposits; Supplier B might demand nothing for the same business with identical credit profile.

Action: Get quotes from at least 5 different commercial energy suppliers before accepting any deposit terms. Meet George compares 20+ suppliers instantly, showing you which have the most favourable credit policies for your business profile.

Step 3: Negotiate with Alternatives

Use the tactics above. Offer Direct Debit payment, a Director’s Guarantee, or Smart Meter installation. Frame your proposal as reducing their payment default risk through alternative security, not just avoiding the upfront cash requirement.

Action: Put your counter-offer in writing via email. Get their response in writing too for documentation purposes.

Step 4: Document Everything

If you must pay a deposit, get all the terms confirmed in writing before payment:

- When exactly is it returned?

- Is interest paid, and at what rate?

- What specific conditions trigger return?

- What is the process for claiming your refund?

Action: Save this documentation in a “Legal” or “Energy Contracts” folder. Set a calendar reminder for the refund eligibility date.

The Deemed Rates vs Deposit Calculation

Before refusing a deposit entirely, run this cost-benefit calculation to see which option actually costs your business more.

The Formula

Extra Annual Cost = Annual Usage (kWh) x Rate Difference (£/kWh)Where:

- Rate Difference = Deemed Rate minus Fixed Contract Rate

Worked Example: A Typical SME

Let’s use a real-world example of a small retail shop using 30,000 kWh of electricity per year (roughly average for a small business).

| Factor | Value |

|---|---|

| Annual Usage | 30,000 kWh |

| Deemed Rate | 35p/kWh |

| Fixed Contract Rate | 22p/kWh |

| Rate Difference | 13p/kWh |

Calculation:

Extra Annual Cost = 30,000 kWh x £0.13 = £3,900 per yearThe Decision

| If Deposit Demanded Is… | The Smart Choice Is… |

|---|---|

| Less than £3,900 | Pay the deposit - you get it back, but deemed rate losses are gone forever |

| More than £3,900 | Negotiate hard or find a different supplier |

The Key Insight: A £2,500 deposit that gets returned after 12 months costs you far less than £3,900 in extra deemed rate charges that you’ll never recover. The deposit is a temporary cash flow hit; deemed rates are permanent losses.

For trusted charity advice on managing commercial energy debt and supplier disputes, see Business Debtline’s guidance on gas and electricity (opens in new tab).

What Ofgem Says About Small Business Protection

Ofgem’s Non-Domestic Market Review 2024 (opens in new tab) expanded regulatory protections for small businesses in the commercial energy market.

Key Regulatory Points:

- Microbusinesses (under 10 employees, annual turnover under 2 million euros, or annual consumption under 100,000 kWh electricity / 293,000 kWh gas) receive enhanced consumer-style protections

- Suppliers must provide clear, fair, and transparent contract terms

- Deposit demands must be proportionate to actual assessed credit risk

- Complaints about unfair or excessive deposit demands can be escalated to the Energy Ombudsman for independent adjudication

If you believe a deposit demand is disproportionate, discriminatory, or unfair based on your actual creditworthiness, document everything thoroughly and consider filing a formal complaint with the supplier’s complaints procedure, then escalating to the Ombudsman if unresolved.

Summary: Don’t Let Them Hold Your Cash Hostage

A security deposit acts as a hidden tax on your business working capital.

- Challenge it - deposit demands are negotiable, not mandatory legal requirements

- Negotiate alternatives - Direct Debit mandates, personal guarantees, or Smart Meters

- Check the interest terms - no interest means inflation erodes your deposit value daily

- Set refund reminders - don’t leave money sitting in old supplier accounts after switching

- Do the cost-benefit maths - sometimes paying a deposit beats paying inflated deemed rates

Need a second opinion on your deposit demand? If a broker or supplier is demanding a deposit that feels excessive or unfair, email the quote to hello@meetgeorge.co.uk. We can tell you if it’s standard industry practice or a shakedown.

Ready to switch with Meet George without the hassle? Back to the main guide: How to Switch Business Energy