TL;DR: Key Takeaways

- You’re signing two documents, not one. The 2-3 page contract form you sign references a separate T&Cs document (30-40 pages) that lives on the supplier’s website. That’s where the hidden clauses are.

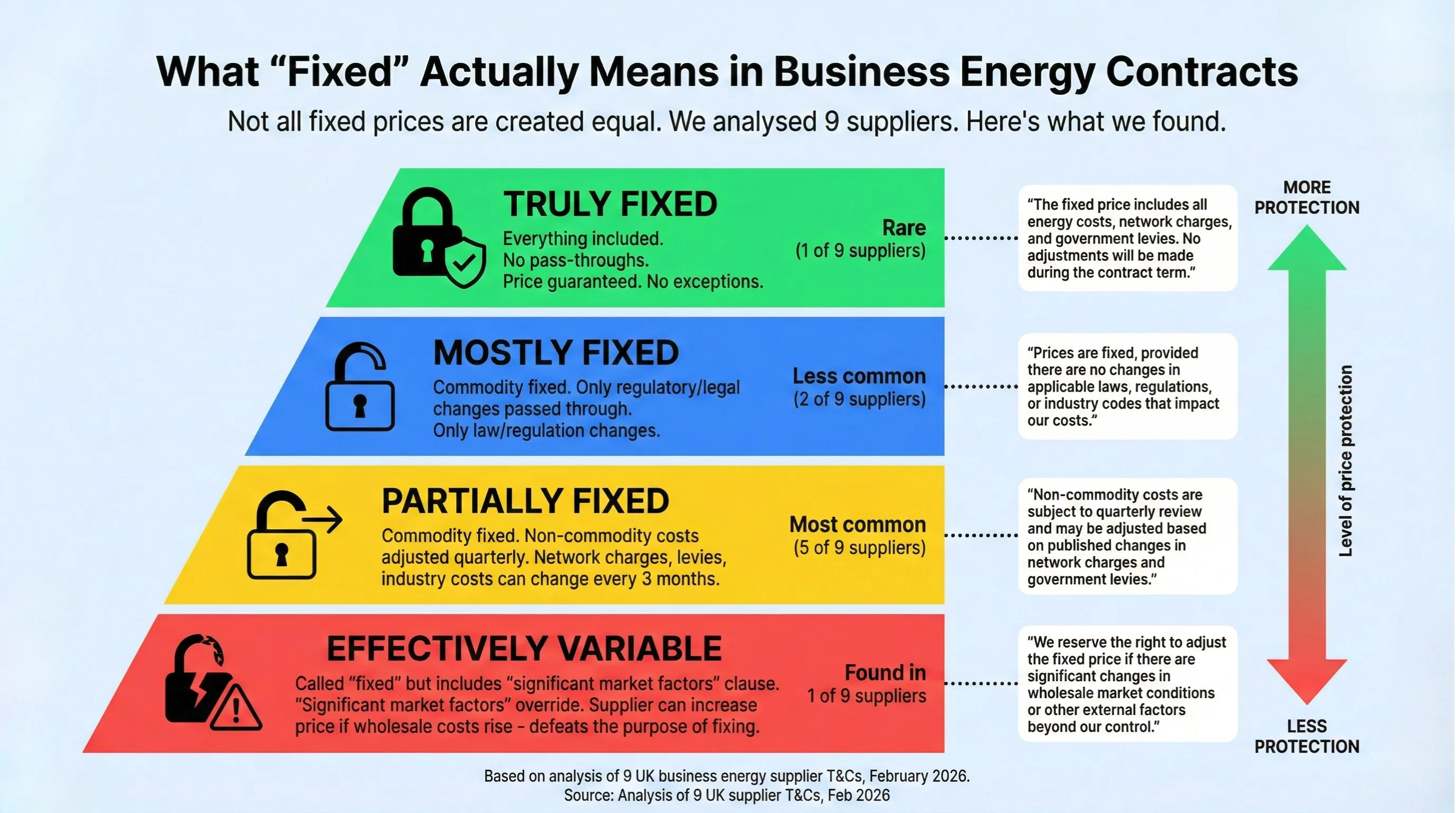

- “Fixed” rarely means fixed. Only 1 of 9 suppliers we analysed offers a truly all-inclusive fixed price. The rest pass through non-commodity cost changes - and one includes a clause broad enough to raise prices whenever wholesale costs increase.

- Volume tolerance clauses punish normal usage fluctuations. If your consumption falls outside a set band (sometimes just plus or minus 10%), you can be charged at deemed rates - typically 2-4x your contracted price.

- Some contracts make you personally liable. Director personal guarantee clauses quietly undo the limited liability protection of your company structure - putting your personal assets on the line for a utility bill.

- Payment terms can be as short as 6 days. Miss the deadline and you face fees of up to £100 per overdue invoice. Three suppliers in our sample give you 7 days or less.

Whether you sign a new business energy contract through a broker or go direct with a supplier, you’ll typically sign a 2-3 page “Principal Terms” or “Contract Acceptance Form”. It shows your rates, contract length, and payment method. What it doesn’t show you are the full terms and conditions - 30 to 40 pages - that live on the supplier’s website. And buried in those pages are clauses that could cost your business thousands in charges you never expected.

There are roughly 45 business energy suppliers operating in the UK. We analysed the T&Cs of 9 of them - a mix of large incumbents and smaller challengers - to see what’s actually in the contracts SMEs are signing. Every single one had at least one clause that most business owners would want to know about before signing. Several had clauses that could fundamentally change what you thought you were paying.

A note on “red flags”: Not every clause in this article is inherently unreasonable. Suppliers need to manage commercial risk - volume tolerances protect them from wildly inaccurate consumption forecasts, exit fees hedge their wholesale positions, and payment terms reflect their own cash flow needs. The problem isn’t that these clauses exist. It’s that most SME owners never know about these energy contract risks until they get hit with an unexpected charge. Our goal isn’t to demonise suppliers - it’s to help you understand exactly what you’re signing up to, so you can make an informed decision.

Here are the 7 red flags we found - and how to spot them before you sign.

Red Flag 1: You’re not signing what you think you’re signing

This is the one that enables all the others.

When you sign a business energy contract, you typically sign a “Principal Terms” document or “Contract Acceptance Form” - a 2-3 page summary showing your unit rates, contract length, payment method, and (if you used a broker) the broker’s commission. It looks straightforward.

But somewhere on that form, there’s a line like this:

“Termination Fees: See clause 11 of our Terms and Conditions”

Or this:

“Options at Contract End: See clause 8 of our Terms and Conditions”

The full T&Cs - the ones that actually govern your contract - are a separate document, usually hosted on the supplier’s website. In our sample, several suppliers referenced T&Cs that the business owner would need to go and find online. One supplier’s full terms run to 42 pages.

There is no cooling-off period on business energy contracts. Once you sign - or even verbally agree via a broker - you’re bound by every clause in those terms, including the ones you never read. And that’s assuming your broker actually read and explained the full T&Cs to you - complaints data suggests many don’t.

How to spot it: Look for phrases like “See our Terms and Conditions”, “Subject to our Standard Terms”, or any clause number reference pointing to an external document. If you see them, request the full T&Cs and read them before signing.

Red Flag 2: “Fixed” prices that aren’t fixed

A “fixed” business energy contract should mean your price stays the same for the contract term. For many suppliers, it doesn’t.

Most “fixed” contracts only fix the commodity cost (wholesale energy). The non-commodity charges - network costs (DUoS, TNUoS), government levies (Climate Change Levy, Renewables Obligation, Contracts for Difference, Feed-in Tariffs), capacity charges, and balancing costs (BSUoS) - are passed through as they change. Non-commodity charges now make up roughly 60% of a typical business electricity bill (opens in new tab), so “fixed commodity only” leaves a lot of your bill exposed to change.

But some suppliers go much further. One supplier’s T&Cs include this variation clause:

“Your prices are fixed for the duration of your contract unless there are any changes outside of our control, this may include… If there are significant market factors increasing the cost of supply.”

The phrase “significant market factors” is broad enough to drive a bus through. It effectively allows the supplier to increase prices during a “fixed” contract if wholesale costs rise - which is the entire point of fixing in the first place.

What “fixed” actually means across suppliers:

| What’s Fixed | Supplier Approach | How Common |

|---|---|---|

| Everything (truly all-inclusive) | Fully fixed, fully inclusive | Rare (1 of 9) |

| Commodity only, pass-throughs itemised | Standard “fixed” product | Most common (5 of 9) |

| Commodity with quarterly adjustments | Quarterly non-commodity updates | Common (2 of 9) |

| “Fixed” with market factor override | Broad variation clause | Concerning (1 of 9) |

How to spot it: Search the T&Cs for “pass-through”, “variation”, “third party costs”, and “market factors”. Ask the supplier directly: “Under what circumstances can my price change during the contract?” If you want genuine budget certainty, look for “fully fixed, fully inclusive” products - and verify the T&Cs match the marketing.

Red Flag 3: Volume tolerance traps

A volume tolerance clause sets a consumption band around your estimated annual consumption. If your actual usage falls outside that band, you pay penalties.

The worst version we found charges the entire deviation at out-of-contract rates:

“Where your actual consumption of energy is 10% over or under the consumption agreed on your contract, we will charge this difference at our out of contract rates.”

That means if your usage deviates by more than 10% in either direction - up or down - the excess or shortfall is charged at out-of-contract rates, which are typically 2-4x your contracted rate. So if you agreed 10,000 kWh and used 8,500 kWh (15% under), the 1,500 kWh shortfall gets charged at deemed rates - potentially turning a competitive contract into an expensive one.

Another supplier takes a different approach with absolute minimums:

“The Customer must use a minimum of 1,200 kWh of electricity per month. If the Customer uses less than the minimum, the Supplier may revise the Customer’s pricing.”

That’s 14,400 kWh per year. Any small retail unit, part-time operation, or seasonal business using less faces price revisions. And the supplier doesn’t warn you when you’re approaching the threshold - you’ll only find out when the revised pricing appears on your bill.

Volume tolerance comparison:

| Tolerance Type | Mechanism | Severity |

|---|---|---|

| Plus or minus 10%, excess at out-of-contract rates | Deviation charged at deemed rates | Critical |

| 1,200 kWh/month absolute minimum | Price revision if below threshold | High |

| Plus or minus 10-20%, cost reimbursement | Reasonable cost recovery | Moderate |

| No tolerance | No penalty for any usage level | None |

How to spot it: Search for “volume”, “tolerance”, “minimum consumption”, or “estimated annual consumption”. If there’s a tolerance band, calculate whether your usage reliably stays within it. Seasonal businesses, startups, and small offices are most at risk. Several suppliers have no volume tolerance at all - they exist, and they’re worth finding.

Red Flag 4: Fair use policies on peak-time usage

This is the most counter-intuitive trap we found. One supplier’s T&Cs include a “Fair Use Policy” that limits peak-time electricity usage:

“Fair Use Policy: means using no more than 50% of the electricity used, over an averaging period of 3 months, during Critical Times.”

“Critical Times: means Monday to Friday between 12pm and 7pm.”

Read that again. If more than 50% of your electricity usage happens between midday and 7pm on weekdays, the supplier can increase your charges.

That’s standard business hours. A cafe open 8am-6pm would concentrate most usage in that window. An office open 9am-5pm would too. Almost every business that operates during the day would breach this policy.

This is likely to become a bigger issue. Market-Wide Half-Hourly Settlement (MHHS) is migrating all electricity meters to half-hourly data collection. Previously, most SME meters (profile classes 03 and 04) were settled using estimated consumption profiles rather than actual half-hourly readings. As these meters move to half-hourly settlement, suppliers will have precise data on exactly when you use electricity - making fair use policies like this far easier to monitor and enforce.

It’s dressed up as a “fair use” policy - a term borrowed from telecoms that sounds reasonable. In practice, it penalises businesses for operating during normal working hours.

How to spot it: Search for “fair use”, “critical times”, or “peak” in the T&Cs. If the policy defines peak hours that overlap with your operating hours, calculate what percentage of your usage falls in that window. Only 1 of 9 suppliers in our sample had this clause - but if you don’t look, you won’t know.

Red Flag 5: Hidden director personal guarantees

Some business energy contracts include a clause that makes the signing director personally liable for the company’s energy debts:

“The director of yours who signs the Agreement on your behalf guarantees and undertakes to us that he or she shall irrevocably and unconditionally be jointly and severally liable for any and all payments.”

This means if the business can’t pay its energy bills, the supplier can pursue the director personally. Their house, savings, personal assets - all potentially on the line for a utility bill.

Many SME owners specifically set up limited companies for liability protection. A personal guarantee in an energy contract quietly undoes that protection.

Partnership contracts often go even further:

“All Partners of the Customer (whether their names are mentioned above or not) are jointly and severally liable for this Contract.”

This makes every partner personally liable - even ones who didn’t sign the contract.

How to spot it: Search for “guarantee”, “personally liable”, “jointly and severally”, or “director” in the T&Cs. In our sample, 2 of 9 suppliers included automatic personal guarantee or partnership liability clauses. Others may require guarantees conditionally (based on credit checks). Not all suppliers require them - alternatives exist.

Red Flag 6: Payment terms shorter than your invoice cycle

Most businesses expect 14-30 days to pay an invoice. Some energy suppliers give you 6.

Payment terms across suppliers:

| Payment Window | Suppliers | Risk Level |

|---|---|---|

| 6 days | 1 supplier | Critical |

| 7 days | 2 suppliers | High |

| 10 days / 10 business days | 2 suppliers | Moderate |

| 14 days | 2 suppliers | Standard |

Six days from invoice to payment. If the invoice arrives on a Wednesday and your accounts payable runs fortnightly, you’ve already missed the deadline. If you’re not sure what to look for on your invoice, our guide on how to read a business energy bill breaks it down line by line.

Late payment fees compound the problem. One supplier charges up to £100 per overdue invoice plus 8% above the Bank of England base rate (opens in new tab). Another charges a £50 fee every time a direct debit is cancelled, plus £75 (or 6% of the bill, whichever is greater) for non-direct-debit payments.

How to spot it: Check “payment terms” on the contract form and in the T&Cs. If payment is due within 7 days or less, honestly assess whether your accounts process can reliably meet that every single month. Also check late payment fees - they vary enormously between suppliers.

Red Flag 7: Uncapped exit fees (mark-to-market)

If you need to leave a contract early - whether the contract isn’t right for your business, your circumstances have changed, or you’ve found a better deal - some suppliers calculate exit fees based on wholesale market movements:

“Mark to Market Loss: means an amount equal to the Market Price Difference multiplied by the Total Estimated Consumption.”

Here’s what that means in practice. Say you signed when wholesale electricity was 25p/kWh. You want to exit when wholesale has dropped to 20p/kWh. Your remaining estimated consumption is 50,000 kWh.

Exit fee: (25p - 20p) x 50,000 kWh = £2,500 - plus transaction costs.

There’s no cap. If wholesale prices fall further, the fee increases. The supplier calculates it “in their sole discretion”, and you have no visibility into the calculation until you try to leave.

This creates a perverse situation: the better the market gets for you, the more expensive it is to take advantage of it. You’re effectively locked in even when cheaper rates are available elsewhere.

Not all suppliers use mark-to-market fees. Some have no exit fees at all. Others use capped, formula-based calculations that are proportional and predictable.

How to spot it: Search for “termination”, “exit fee”, “mark to market”, and “early cancellation” in the T&Cs. If the exit fee is based on wholesale price movements with no cap, factor this into your decision - especially if you think energy prices might fall during your contract term. For more on what happens if you need to exit early, see our guide on cancelling a business energy contract.

Business energy contract checklist: 7 questions before you sign

Use this before signing any business energy contract:

- Have I read the full T&Cs? Not just the principal terms - the complete document. If it’s on the supplier’s website, download it.

- Is the price genuinely fixed? Look for pass-through clauses, variation rights, and “market factors” language. Ask the supplier directly.

- Are there volume tolerance requirements? If yes, does your usage reliably stay within the band? Include seasonal variation.

- Is there a fair use or peak time policy? If yes, does it conflict with your normal operating hours?

- Am I accepting personal liability? Look for director guarantees and partnership liability clauses.

- Can my business meet the payment terms? Check the deadline in days, and check late payment fees.

- What are the exit fees? Is there a cap? Is it mark-to-market? Or are there no exit fees at all?

If you can’t answer these questions from the contract form alone, that tells you something. Request the full T&Cs. Read them. Or use a platform that reads them for you.

Ultimately, it’s your responsibility to read and understand the full T&Cs before signing. Suppliers aren’t obliged to highlight which clauses might not suit your business - a volume tolerance that’s fine for one customer could be a trap for another. If you’re using a broker, they should be doing this analysis for you. If you’re going direct, you need to do it yourself.

Why the cheapest price isn’t always the best deal

Here’s a real example. A small London fashion boutique - Dream Looks - had been on deemed rates for two years, paying roughly double market price. When we pulled quotes, the cheapest supplier offered 51% savings. Sounds like the obvious choice.

But Dream Looks uses around 500 kWh per month. That cheapest supplier’s T&Cs require a minimum of 1,200 kWh per month - more than double their actual usage. The same supplier’s fair use policy would penalise them for using electricity during normal retail hours. Two red flags from this article, both triggered immediately.

The second-cheapest option - 46% savings instead of 51% - had no volume minimums, no fair use restrictions, and clean exit terms. It scored 82/100 on our tariff ranking system versus 49/100 for the “cheapest” option.

The 5% difference in headline savings (51% vs 46%) amounts to only a few pounds per month on Dream Looks’ usage - far less than the volume tolerance penalties they’d face for using less than 1,200 kWh on the cheaper contract.

What we’re building at Meet George

This is exactly why we’re building AI for business energy switching. Not to find you the cheapest price - but to find you the best contract.

Our tariff ranking system analyses supplier T&Cs alongside price, scoring contracts across multiple dimensions - not just cost, but how well the contract actually fits your business. A cheap tariff with a volume tolerance trap scores lower than a slightly more expensive clean contract.

Because every red flag in this article came from a real contract that a real business could sign today. The only difference is whether someone reads the T&Cs first.

Further reading and resources

If you’ve found red flags in your current contract, here’s what to do next:

- Check your current contract: How to read your business energy bill - understand what you’re actually paying for

- Understand your options: How to switch business energy supplier - a step-by-step guide

- Know your rights: Can I cancel my business energy contract? - what happens if you need to exit

- Watch for broker red flags too: Energy broker mis-selling cases - documented examples of broker misconduct

- Understand broker fees: Hidden broker commissions explained - what your broker might not be telling you

For official guidance, Ofgem’s non-domestic market review (opens in new tab) outlines the minimum standards suppliers must meet. If your business qualifies as a micro business (fewer than 10 employees or annual turnover under EUR 2 million), you have some additional protections under Ofgem’s Standards of Conduct - including requirements around transparency, contract terms, and complaints handling. These protections are limited compared to residential consumers, but they do give you some recourse. If you’re in dispute with a supplier, the Energy Ombudsman (opens in new tab) handles complaints for micro businesses. Citizens Advice (opens in new tab) offers free, independent guidance on business energy issues.

Important: Energy supplier terms and conditions can change at any time. The clauses and comparisons in this article are based on T&Cs we analysed in early 2026 (contract versions from 2024-2025). There are roughly 45 business energy suppliers in the UK - our sample of 9 covers a mix of large incumbents and smaller challengers but is not exhaustive. Suppliers may have updated their terms since publication. Always request and read the current version of a supplier’s full T&Cs before signing any contract.

Sources: Supplier T&Cs analysed include contracts from 9 UK business energy suppliers (2024-2025 contract versions). All clauses quoted are from publicly available terms and conditions documents. Non-commodity charge data from Cornwall Insight (opens in new tab). For more on energy contract regulation, see Ofgem’s non-domestic market review (opens in new tab) and the government’s Smart Metering Implementation Programme (opens in new tab). For small business support, see the Federation of Small Businesses (opens in new tab) energy guidance.