TL;DR: Key Takeaways

In short: Your business energy bill is not designed to be understood. But once you know what each charge means, you can spot errors, challenge overcharges, and stop paying more than you should.

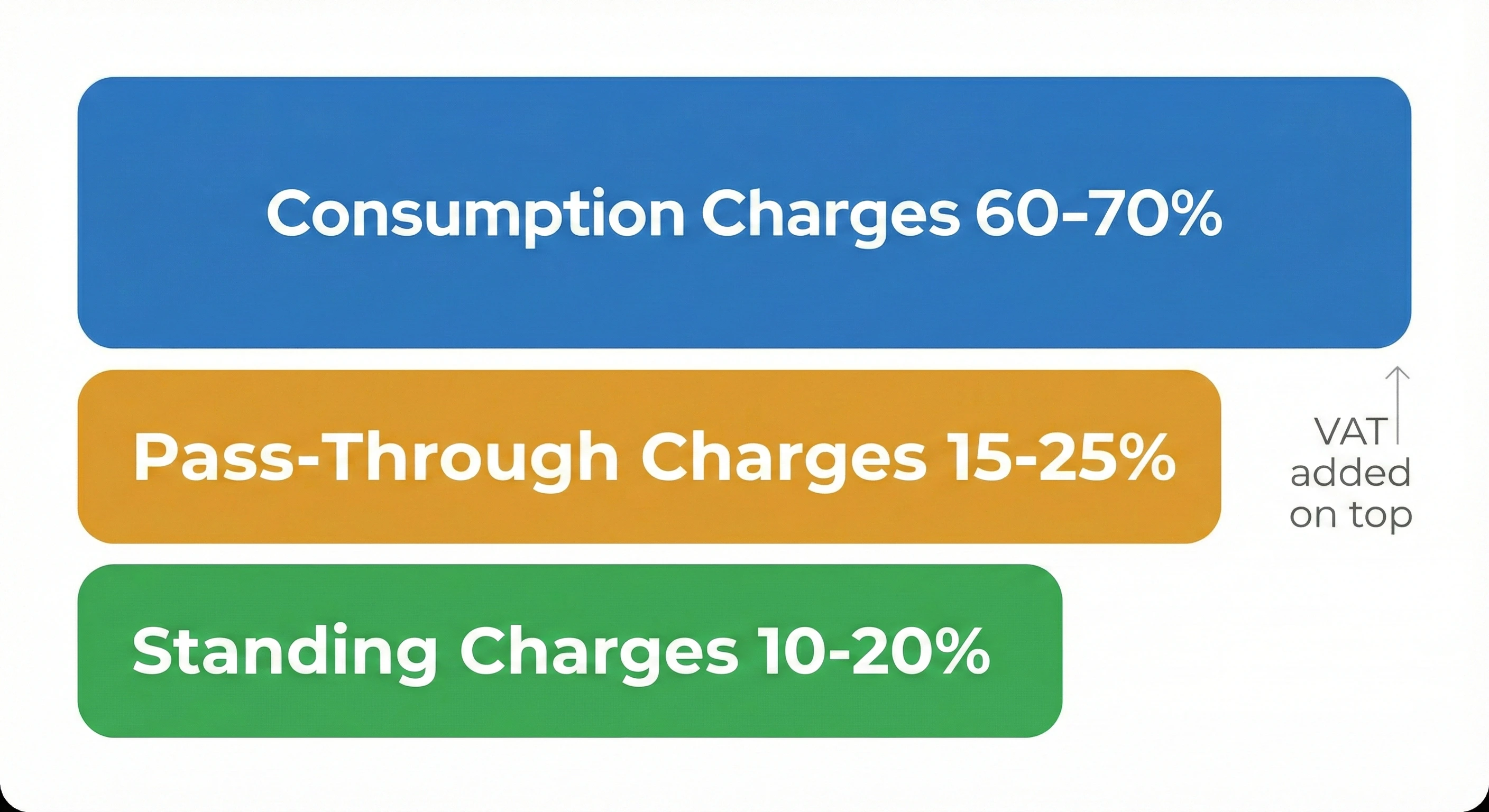

The Big Picture: A typical business electricity bill breaks down into three parts - consumption charges (60-70%), standing charges (10-20%), and non-commodity pass-through charges (15-25%). VAT is then added on top.

The Charges That Confuse Everyone: CCL is a carbon tax. TNUoS pays for the national grid. DUoS pays for local distribution. Capacity charges are based on your maximum demand. None of these are optional, but all of them can be wrong.

The Most Common Errors: Estimated readings (10-30% inaccurate), wrong VAT rate (15% overcharge if 20% applied instead of 5%), billing period errors (extra days = extra standing charges), and incorrect capacity charges.

What To Do: Check every bill against your contract. Submit actual meter readings monthly. Query anything you do not understand. You have 12 months to dispute charges.

Why Business Energy Bills Are So Confusing

If you have ever looked at your business energy bill and felt completely lost, you are not alone.

A recent survey found that the majority of SME owners struggle to understand their energy bills - and this confusion costs real money. According to the Energy Ombudsman’s latest data, billing issues now account for 52% of all supplier complaints (up from just 23% in 2023), with 34% of complainants citing overcharging. Errors on business energy bills are common, and most go unnoticed because the charges are so opaque.

Unlike domestic energy bills (which are relatively simple), business electricity bills can contain 15+ different line items across multiple categories. Gas bills are simpler, but still contain terminology that most business owners have never encountered.

This guide breaks down every charge you will see on a typical UK business energy bill, explains what each one means, shows you what reasonable ranges look like, and tells you exactly what to check for errors.

The Anatomy of a Business Electricity Bill

Important: There is no standard format for business energy bills in the UK. Every supplier designs their bills differently - some are one page, others are three or four. Some itemise every charge, others bundle them together. The terminology varies too. This guide covers the key elements you will find on most bills, but yours may look different.

Here is what each section typically contains:

1. Header Information

The top of your bill contains essential reference information:

| Field | What It Means | Why It Matters |

|---|---|---|

| Account Number | Your unique customer identifier | Needed for all communications with supplier |

| Invoice Number | Unique reference for this specific bill | Required for payment and disputes |

| Invoice Date | When the bill was generated | Usually 1-5 days after billing period ends |

| Billing Period | The dates covered (e.g., 01/08/2025 - 31/08/2025) | Should be one calendar month (28-31 days) |

| Due Date | Payment deadline | Typically 10-14 days from invoice date |

| MPAN | Meter Point Administration Number | Your meter’s unique identifier (see breakdown below) |

| Contract End Date | When your current deal expires | Critical for avoiding deemed rates |

Understanding Your MPAN:

Your MPAN appears on your bill in two lines:

| Line | Digits | What It Contains |

|---|---|---|

| Top Line | 8 or 9 digits | Profile Class (2) + MTC or SSC (3 or 4) + LLFC (3) |

| Bottom Line | 13 digits | Your unique meter identifier (MPAN Core) |

Why top lines vary: Since September 2025, meters migrating to MHHS have a 9-digit top line. The old 3-digit Meter Timeswitch Code (MTC) has been replaced by a 4-digit Standard Settlement Configuration (SSC). Non-migrated meters still show the original 8-digit format. Both formats are valid - the bottom 13 digits are what uniquely identify your meter. See TotalEnergies’ guide to supply number format changes (opens in new tab) for more detail.

Note on Contract End Date: Not all suppliers show the contract end date on your bill - some do, some do not. This date is vital for switching because your new supplier needs it to commence supply from the day after your current contract expires. If your bill does not show this date, check your original contract or contact your supplier. When using Meet George, if your bill does not include this date, we will ask you for it - uploading your energy contract will provide this information if needed.

What to check: Verify the billing period is correct (not overlapping with previous bills or missing days). Note your contract end date and set a reminder 90 days before.

2. Meter Information

This section identifies your meter and shows your consumption:

| Field | What It Means | Typical Values |

|---|---|---|

| Meter Serial Number | Physical identifier on your meter | Alphanumeric code |

| Meter Type | Smart meter or Non-smart meter | Affects billing accuracy (see below) |

| Profile Class | Your consumption pattern category | See breakdown below |

| Meter Readings | kWh consumed during billing period | Marked A (actual) or E (estimated) |

| Number of Days | Days in billing period | Should match calendar month |

Profile Class breakdown:

| Profile Class | Customer Type | Metering |

|---|---|---|

| 01-02 | Domestic customers | Non-half-hourly |

| 03-04 | Typical SMEs (shops, offices, restaurants) | Non-half-hourly |

| 05-08 | Larger businesses with higher usage | Half-hourly metered |

| 00 | Large commercial/industrial | Half-hourly metered |

Under Market-wide Half-Hourly Settlement (MHHS), Profile Class 03 and 04 meters are gradually migrating to half-hourly settlement. This migration runs until the end of 2027, after which all meters will be settled half-hourly.

Smart vs Non-smart meters:

The meter type significantly affects billing accuracy:

- Smart meters send readings automatically to your supplier, eliminating estimated bills. This means you only pay for what you actually use, reducing the risk of overcharging and unexpected back-billing.

- Non-smart meters require manual readings. If you do not submit readings regularly, your supplier estimates your usage - often inaccurately. This can cause cash flow problems: overestimates mean you pay too much upfront, underestimates mean a large catch-up bill later.

Single-rate vs Multi-rate Meters:

If your meter measures day and night consumption separately, you will see two readings:

- Day Rate - Consumption during peak hours (typically 7am-11pm)

- Night Rate - Consumption during off-peak hours (typically 11pm-7am)

This multi-rate setup is similar to Economy 7 for domestic customers. Night rates are usually 15-20% cheaper than day rates because electricity demand is lower overnight. If you can shift energy-intensive activities (heating, equipment charging, some manufacturing processes) to night hours, you can reduce costs. This concept of shifting usage to benefit from cheaper rates is related to Demand Side Response (DSR), where businesses can even earn money by adjusting their consumption patterns.

What to check: Is the reading Actual (A) or Estimated (E)? If estimated, your bill could be 10-30% wrong. Submit your own reading to get an accurate bill. Better yet, request a smart meter upgrade to eliminate estimates entirely.

Main Charges: What You Pay for Energy

The main charges section covers your core energy costs:

Unit Rate (p/kWh)

The unit rate is what you pay per kilowatt-hour (kWh) of electricity consumed. This is your primary cost driver.

How it is calculated:

kWh consumed × unit rate (p/kWh) = consumption cost

Example from a real bill:

- Day consumption: 44,807 kWh × 20.17p/kWh = £9,037.63

- Night consumption: 16,921 kWh × 17.17p/kWh = £2,905.28

Typical ranges (2025-2026):

| Business Type | Electricity (p/kWh) | Gas (p/kWh) |

|---|---|---|

| Small office (low usage) | 24-32p | 7-10p |

| Retail/hospitality | 22-28p | 6-9p |

| Light industrial | 20-26p | 5-8p |

| High usage (contracted) | 18-24p | 5-7p |

What to check: Compare your unit rate to your contract. If it is significantly higher, you may have rolled onto deemed rates without realising. Also check for undisclosed broker commissions - since October 2024, suppliers must disclose commission in your contract. Understanding the difference between good and bad brokers can save you thousands.

Standing Charge (p/day)

The standing charge is a fixed daily fee you pay regardless of how much energy you use. It covers the cost of maintaining your connection to the grid.

How it is calculated:

Number of days × standing charge (p/day) = standing charge cost

Example:

- 31 days × 75p/day = £23.25

Unified vs Itemised Standing Charges:

Some suppliers show a single unified standing charge that bundles everything together. Others itemise it separately, showing transmission charges, distribution charges, and meter charges as distinct line items. Both approaches are valid - they should add up to the same total. If your bill shows itemised charges, check each component matches your contract.

Typical ranges (2025-2026):

| Meter Type | Electricity (p/day) | Gas (p/day) |

|---|---|---|

| Single-phase (small SME) | 40-80p | 25-50p |

| Three-phase (medium business) | 70-150p | 40-80p |

| Half-hourly metered (Profile 05-08) | 100-500p | 60-150p |

| Large commercial (Profile 00) | 500-5,000p+ | 150-500p+ |

Note: Standing charges for large commercial sites (Profile Class 00) vary enormously depending on capacity, location, and connection type. A warehouse with 500kVA capacity pays significantly more than a small shop.

What to check: Verify the number of days matches the billing period. A common error is billing for 32-35 days instead of 31, which adds extra standing charge costs. Also check the rate matches your contract.

Pass-Through Charges: The Hidden 25%

Pass-through charges are costs your supplier pays to third parties (National Grid, regional distributors, government) and passes directly to you. These are often the most confusing part of a business energy bill.

Important: Even if you are on a fixed-rate contract, pass-through charges can increase during your contract term. Most contracts only fix the commodity (energy) cost, not these additional charges.

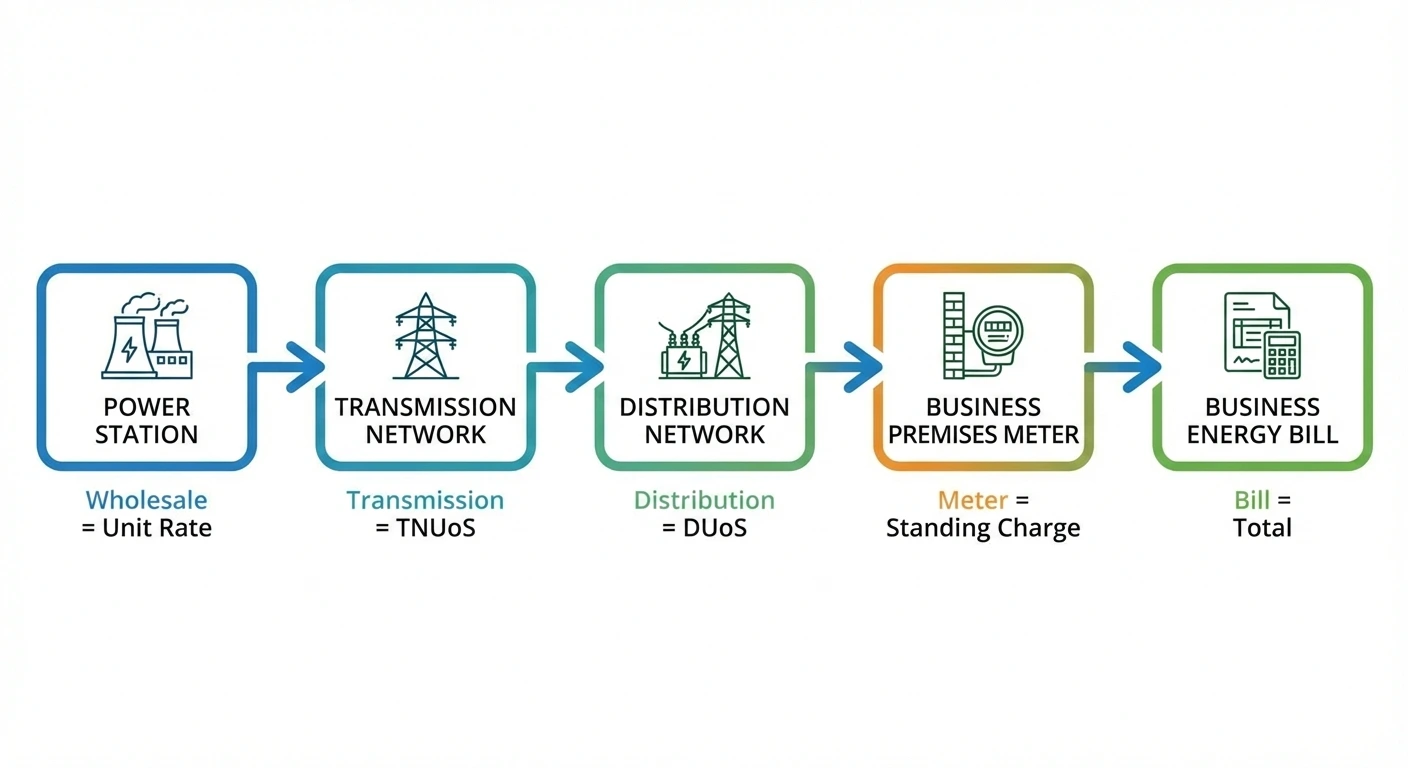

Transmission Charges (TNUoS)

TNUoS (Transmission Network Use of System) charges pay for the national high-voltage transmission network operated by National Grid.

How they appear on your bill:

| Charge Type | What It Means | How It Is Calculated |

|---|---|---|

| Transmission Fixed Charge | Daily fee for grid access | p/day × number of days |

| TNUoS Demand Charge | Based on peak usage (Triad periods) | p/kWh on peak consumption |

Example:

- Transmission Fixed Charge: 31 days × 2,273.95p/day = £704.93

Why TNUoS matters in 2026: TNUoS charges are increasing by 96% from April 2026 (opens in new tab) (£3.84bn to £7.52bn annually). This will add approximately 5%+ to business electricity bills regardless of your contracted rate.

Distribution Charges (DUoS)

DUoS (Distribution Use of System) charges pay for the local distribution network that delivers electricity from the national grid to your premises. These are set by your regional Distribution Network Operator (DNO).

Regional variation: DUoS charges vary significantly by location. Businesses in rural areas or regions with older infrastructure typically pay more than those in urban areas. Your DNO (Distribution Network Operator) sets these charges based on the cost of maintaining the local network.

Capacity Charges

Capacity charges are based on your agreed maximum demand (measured in kVA - kilovolt-amperes). They ensure the network has enough capacity to supply your peak requirements.

Note for most SMEs: Capacity charges typically only appear on bills for larger businesses with Profile Class 00 (half-hourly metered) supplies. If you are a typical SME on Profile Class 03 or 04, you probably will not see these charges on your bill - your capacity costs are bundled into your standing charge instead.

How they appear on your bill (for Profile Class 00):

| Charge | What It Means | Typical Rate |

|---|---|---|

| Capacity Charge | Fee for your agreed maximum demand | 6-10p per kVA per day |

| Excess Capacity Charge | Penalty for exceeding agreed capacity | Same rate, applied to excess |

| Reactive Capacity Charge | Fee for poor power factor | 0.2-0.4p per kVArh |

Example:

- Capacity Charge: 250 kVA × 8.08p/kVA/day × 31 days = £626.20

What to check: If your Excess Capacity Charge is consistently zero, you may be paying for more capacity than you need. Conversely, if you are frequently charged for excess, you should increase your agreed capacity to avoid penalty rates.

Government Levies and Taxes

Climate Change Levy (CCL)

The Climate Change Levy (CCL) is a government tax on business energy designed to incentivise carbon reduction. It was introduced under the Finance Act 2000 (opens in new tab) and applies to most non-domestic energy consumption.

Current CCL rates (2025-2026):

- Electricity: 0.775p/kWh

- Gas: 0.672p/kWh

How it is calculated:

Total kWh consumed × CCL rate = CCL charge

Example:

- 61,728 kWh × 0.775p/kWh = £478.39

Who is exempt from CCL:

- Charities for non-business use

- Very low energy users (under de minimis thresholds)

- Energy-intensive industries with Climate Change Agreements (CCAs)

- Electricity used in certain transport (electrified rail, some electric vehicle charging)

Note on renewable energy: Prior to August 2015, businesses could claim CCL exemption for electricity backed by Renewable Energy Guarantees of Origin (REGOs) via Levy Exemption Certificates (LECs). This scheme has ended - renewable electricity generated after 1 August 2015 is not CCL-exempt. If a supplier claims your “green tariff” is CCL-exempt, verify this carefully.

What to check: Verify the CCL rate matches current government rates (these change each April). If you believe you qualify for exemption, contact your supplier with supporting documentation.

VAT

VAT is applied to your total bill (including all charges and CCL).

VAT rates for business energy:

| Category | VAT Rate | Who Qualifies |

|---|---|---|

| Standard rate | 20% | Most businesses |

| Reduced rate | 5% | Charities, low usage (under de minimis) |

What to check: If your business uses less than 1,000 kWh of electricity per month (or 4,397 kWh of gas), you may qualify for 5% VAT instead of 20%. This is a 15% saving that many small businesses miss. See our complete guide to VAT on business energy.

How Gas Bills Differ from Electricity Bills

Gas bills are simpler than electricity bills because they lack several charges. Note that gas meters use an MPRN (Meter Point Reference Number) instead of an MPAN:

| Charge | Electricity | Gas |

|---|---|---|

| Unit rate | Yes | Yes |

| Standing charge | Yes | Yes |

| CCL | Yes (0.775p/kWh) | Yes (0.672p/kWh) |

| TNUoS | Yes | No |

| DUoS | Yes | Yes (but simpler) |

| Capacity charges | Yes | No |

| Day/Night rates | Common | Rare |

Gas measurement conversion:

Gas meters measure consumption in cubic metres (m³) or cubic feet (ft³), which is then converted to kWh for billing:

m³ × volume correction factor (1.02264) × calorific value (~39.5) ÷ 3.6 = kWh

Your bill will show both the meter reading (in m³) and the converted kWh figure.

Note on gas transportation charges: While gas bills do not show TNUoS (that is electricity-only), they do include transportation elements in settlement. These are sometimes labelled as NTS (National Transmission System) or LDZ (Local Distribution Zone) charges on detailed invoices or contracts. Most SME gas bills bundle these into the unit rate, so you will not see them itemised - but they exist and affect your rate. If your supplier provides a detailed breakdown, you may see these listed separately.

Common Billing Errors and How to Spot Them

Business energy bills frequently contain errors. Here are the most common and how to identify them:

1. Estimated Readings (10-30% Error Rate)

The problem: Suppliers estimate your usage based on historical patterns when they do not have actual readings. These estimates are often significantly wrong.

How to spot it: Look for an E next to the meter reading instead of A.

The fix: Submit actual meter readings monthly via your supplier’s portal or by email. If you have been overcharged based on estimates, request a recalculation with your actual reading.

2. Wrong VAT Rate (15% Overcharge)

The problem: Some qualifying businesses are charged 20% VAT when they should pay 5%.

How to spot it: Check your monthly electricity usage. If it is consistently under 1,000 kWh, you may qualify for the reduced rate.

The fix: Complete a VAT declaration form (opens in new tab) and submit it to your supplier. You can claim refunds for overpaid VAT retrospectively.

3. Billing Period Errors (Extra Days)

The problem: Bills sometimes cover more than one calendar month, resulting in extra standing charges.

How to spot it: Count the days in the billing period. It should be 28-31 days, not 32-35+.

The fix: Contact your supplier and request a corrected bill.

4. Wrong Capacity Charges

The problem: Your agreed capacity (kVA) may not match your actual needs, leading to overpayment or excess charges.

How to spot it: If Excess Capacity Charge is always zero, you may be over-provisioned. If it is frequently charged, you are under-provisioned.

The fix: Request a capacity review from your supplier or DNO.

5. Incorrect Contract Rates

The problem: Your unit rate or standing charge does not match what you agreed in your contract.

How to spot it: Compare bill rates against your signed contract.

The fix: Contact your supplier with a copy of your contract. Under Ofgem’s Standard Licence Conditions (opens in new tab), suppliers must honour contracted rates.

6. Wrong Meter or Wrong Address (Crossed Meters)

The problem: Your bill is for the wrong meter - either the MPAN/MPRN is incorrect, or your meter is physically feeding someone else’s premises (and vice versa). This is surprisingly common in multi-tenant buildings.

Why it happens:

- MPAN/MPRN linked incorrectly in supplier systems after a move-in, tenancy change, or meter exchange

- “Crossed meters” in shared buildings - your meter physically supplies a neighbour

- Similar addresses get mixed up (Unit 1 vs Flat 1, Rear vs Front, same postcode)

- The billing address can be wrong even if the supply point (MPAN/MPRN) is correct - and vice versa

How to spot it:

- Address on the bill does not match the site you occupy

- Meter serial number on the bill does not match the meter on the wall

- MPAN/MPRN does not match other documentation (lease, previous bills)

- Consumption seems wildly different from expected (you might be paying for a neighbour’s usage)

The fix: Physically check the meter serial number matches your bill. If there is a mismatch, contact your supplier immediately with photos of your meter. For crossed meters in multi-tenant buildings, you may need your landlord or managing agent involved to resolve with the DNO.

7. Credit Notes and Rebills (Double Payment Risk)

The problem: Suppliers sometimes issue credit notes and rebills when correcting errors. If you do not recognise these, you might pay the same period twice or miss a refund you are owed.

How to spot it:

- An invoice with a negative total (credit note)

- Multiple invoices for overlapping periods

- “Rebill” or “Adjustment” in the invoice description

- A significantly lower or higher amount than usual

The fix: Keep records of all invoices and credit notes. When you receive a rebill, check which original invoice it replaces and ensure you have not already paid it. If in doubt, request a statement of account showing all charges and payments.

8. Change of Tenant / Occupier Proration Errors

The problem: When you move into new premises, the bill should be prorated from your move-in date. Sometimes suppliers charge for periods before you occupied the site, or the previous tenant’s charges appear on your account.

How to spot it:

- Billing period starts before your tenancy/lease began

- Charges for usage that occurred before you moved in

- Account balance includes debt from previous occupier

The fix: Provide your supplier with proof of your move-in date (lease agreement, completion date). Under Ofgem rules, you should only be charged for energy consumed after you became responsible for the supply. If the supplier is chasing debt from a previous occupier, provide evidence you are a new customer.

A Real Bill Breakdown: What Each Section Means

Here is how a typical monthly business electricity bill breaks down:

| Category | Example Amount | % of Total |

|---|---|---|

| Day Unit Rate (44,807 kWh × 20.17p) | £9,037.63 | 51% |

| Night Unit Rate (16,921 kWh × 17.17p) | £2,905.28 | 16% |

| Standing Charge (31 days × 75p) | £23.25 | <1% |

| Transmission Charge (TNUoS) | £704.93 | 4% |

| Distribution Charges (DUoS) | £956.42 | 5% |

| Capacity Charge (250 kVA) | £626.20 | 4% |

| Climate Change Levy | £478.39 | 3% |

| Subtotal | £14,732.10 | 83% |

| VAT (20%) | £2,946.42 | 17% |

| Total | £17,678.52 | 100% |

Key insight: For this high-usage business, consumption charges (unit rates) represent 67% of the pre-VAT bill, while network charges (TNUoS + DUoS) represent 11%. For lower-usage businesses, standing charges and pass-through costs represent a higher percentage.

Your Bill Audit Checklist

Use this checklist every time you receive an energy bill:

Header Section:

- Billing period matches calendar month (28-31 days)

- No overlap with previous bill dates

- Contract end date noted (set reminder for 90 days before)

Meter Readings:

- Readings are Actual (A) not Estimated (E)

- kWh consumption seems reasonable vs previous months

- Day/night split (if applicable) makes sense for your usage pattern

Main Charges:

- Unit rate matches your contract

- Standing charge matches your contract

- Number of days calculation is correct

Pass-Through Charges:

- Capacity charge matches your agreed kVA

- No unexpected excess capacity charges

- TNUoS/DUoS charges are itemised (not bundled)

Taxes:

- CCL rate is current (0.775p/kWh electricity, 0.672p/kWh gas)

- Correct VAT rate applied (20% or 5% if qualifying)

- VAT calculated on correct subtotal

Final Check:

- All line items add up to the total

- Due date gives reasonable payment window

- Payment details are correct

What To Do If You Find an Error

If you identify an error on your business energy bill:

-

Gather evidence - Take photos of your meter reading, collect previous bills showing correct charges, and have your contract ready.

-

Contact your supplier - Call or email their business customer service team. Quote your account number, invoice number, and clearly explain the error.

-

Put it in writing - Follow up phone calls with an email summarising what was discussed and agreed. This creates a paper trail.

-

Set a deadline - Suppliers should resolve billing disputes within 8 weeks under Ofgem rules.

-

Escalate if needed - If unresolved after 8 weeks (or you receive a deadlock letter), microbusinesses can escalate to the Energy Ombudsman for free independent resolution.

Time limit: You have 12 months from the bill date to dispute charges. After this, suppliers are not obligated to investigate.

How Smart Meters Change Your Bill

If you have a smart meter, your bills will be more accurate because:

- No more estimates - Readings are transmitted automatically

- Half-hourly data - Under MHHS (Market-wide Half-Hourly Settlement), all meters will provide granular consumption data

- Time-of-use visibility - You can see exactly when you use energy and optimise accordingly

However, smart meters do not change the structure of your bill - you still pay unit rates, standing charges, and pass-through costs. They just make the readings more accurate.

Quick Reference: Typical Charge Ranges (2025-2026)

| Charge | Electricity | Gas |

|---|---|---|

| Unit rate | 18-32p/kWh | 5-10p/kWh |

| Standing charge (SME) | 40-150p/day | 25-80p/day |

| Standing charge (large commercial) | 500-5,000p+/day | 150-500p+/day |

| CCL | 0.775p/kWh | 0.672p/kWh |

| VAT | 5% or 20% | 5% or 20% |

| TNUoS | 1-5p/kWh (increasing 96% Apr 2026) | N/A |

| Capacity (Profile 00 only) | 6-10p/kVA/day | N/A |

Still Confused? Let Meet George Help

Understanding your energy bill is the first step. But comparing bills across suppliers, spotting undisclosed broker commissions, and navigating contract terms is where it gets complicated.

Meet George takes the confusion out of business energy:

- Upload your bill and our AI extracts every charge automatically

- See your costs broken down in plain English - not industry jargon

- Compare quotes with the supplier’s base rate and our 1p/kWh fee shown separately

- Spot errors before they cost you money

- Switch when ready - no cold calls, no pressure, no undisclosed fees

Your energy bill should not require a decoder ring. Request early access for transparent, AI-powered energy switching.