TL;DR: Key Takeaways

In short: Most UK businesses pay 20% VAT on energy, but many qualify for just 5%. The difference on a typical small business electricity bill is £850+ per year - money that’s yours if you know the rules.

The De Minimis Rule: If your business uses less than 1,000 kWh of electricity per month (or 4,397 kWh of gas), you automatically qualify for 5% VAT. HMRC treats this as “domestic equivalent” usage regardless of whether it’s a business premises.

Suppliers Default to 20%: Energy suppliers assume you pay 20% VAT unless you tell them otherwise. Many eligible businesses overpay for years simply because they never checked or submitted a VAT declaration certificate.

You Can Claim Refunds: If you’ve been overcharged, you can claim back overpaid VAT for up to 4 years. That’s potentially £3,400+ sitting in your supplier’s pocket.

November 2025 Budget: The Autumn Budget 2025 (opens in new tab) confirmed no changes to VAT rates on energy. The standard 20% and reduced 5% rates remain unchanged, as does the de minimis threshold.

What VAT Rate Do Businesses Pay on Energy?

The standard VAT (opens in new tab) rate on business electricity and gas in the UK is 20%. This is what most businesses pay, and it’s what energy suppliers charge by default.

However, HMRC provides a reduced rate of 5% for qualifying uses. The most common qualification route for microbusinesses and small businesses is the de minimis threshold - essentially, if you use below a certain amount of energy, HMRC treats it as domestic-equivalent and charges the lower rate.

Here’s the problem: suppliers don’t automatically check whether you qualify. They apply 20% and wait for you to tell them otherwise.

This means thousands of UK businesses - particularly small offices, shops, salons, and cafés - are paying 15 percentage points more VAT than they should. On a £5,000 annual electricity bill, that’s £625 per year going straight to HMRC that didn’t need to.

The De Minimis Threshold: Do You Qualify for 5%?

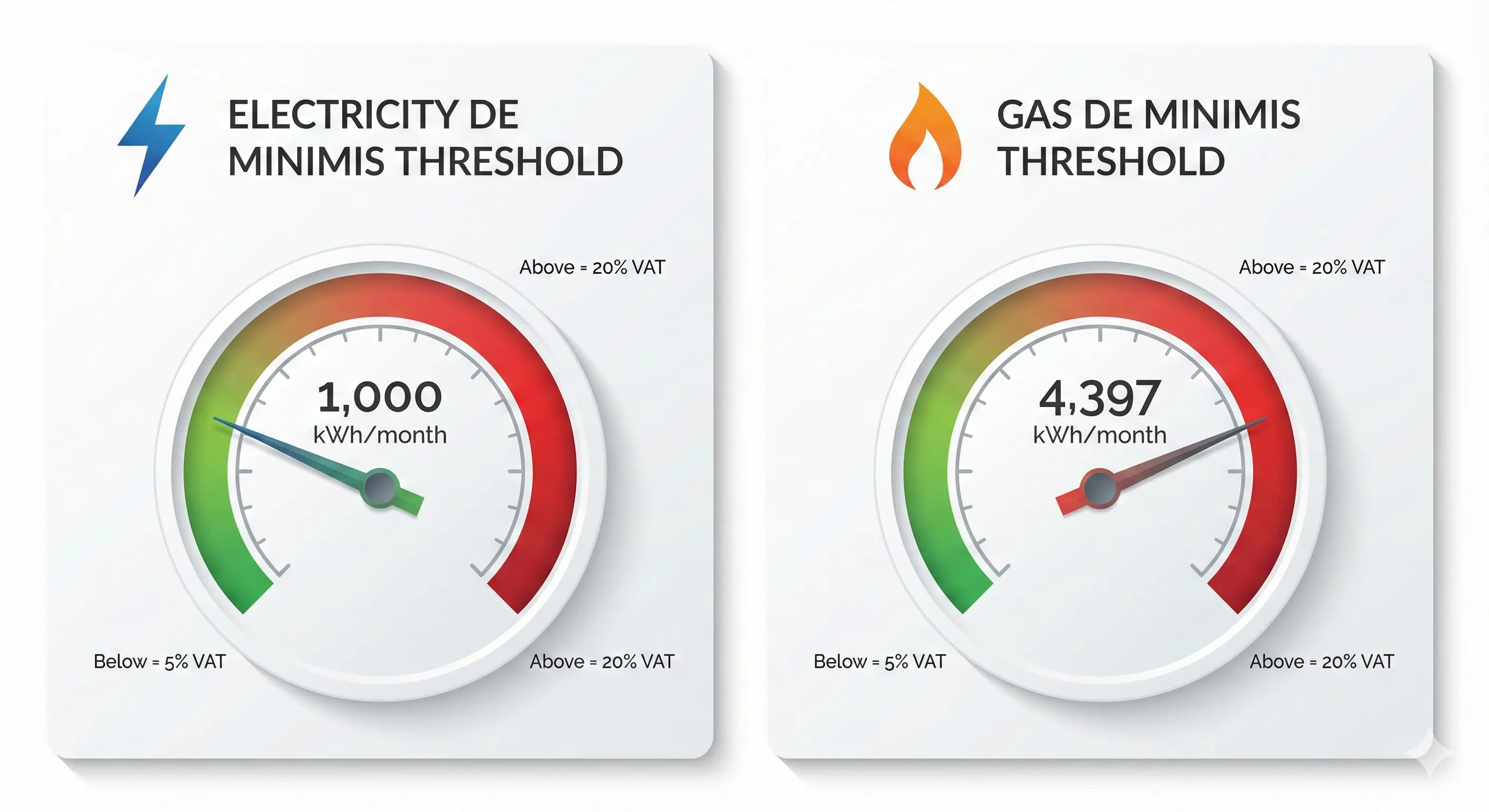

The de minimis rule is simple: if your energy consumption falls below certain thresholds, you qualify for 5% VAT - no questions asked about what the energy is used for.

Electricity De Minimis Threshold

| Period | Threshold |

|---|---|

| Daily | Less than 33 kWh |

| Monthly | Less than 1,000 kWh |

| Annual | Less than 12,000 kWh |

Gas De Minimis Threshold

| Period | Threshold |

|---|---|

| Daily | Less than 145 kWh (5 therms) |

| Monthly | Less than 4,397 kWh (150 therms) |

| Annual | Less than 52,764 kWh |

How to check: Look at your latest bill for your monthly or annual consumption. If you’re below these thresholds, you should be paying 5% VAT. If you’re being charged 20%, you’re overpaying.

Who Else Qualifies for 5% VAT?

Beyond the de minimis rule, several business types qualify for the reduced rate regardless of usage:

Automatic 5% VAT Qualifiers

- Charities - For non-business activities (fundraising events, worship, community services)

- Residential care homes - Energy used for resident accommodation

- Self-catering holiday lets - Treated as domestic use

- Student halls of residence - Educational residential accommodation

- Places of worship - Churches, mosques, temples, synagogues

Mixed-Use Premises (60% Rule)

If your premises uses 60% or more of its energy for qualifying purposes (domestic or charitable), the entire supply can be charged at 5%.

For example: A building that’s 70% residential flats and 30% ground-floor office would qualify for 5% on the whole bill.

For premises below 60% qualifying use, you can still claim apportioned VAT - paying 5% on the qualifying portion and 20% on the rest. This requires a declaration to your supplier showing your calculation.

The Real Cost: How Much Are You Losing?

The difference between 5% and 20% VAT is substantial. Here’s what typical businesses lose if they’re overcharged:

Electricity VAT Overpayment (Annual)

| Business Size | Typical Annual Bill | VAT at 5% | VAT at 20% | Annual Overpayment |

|---|---|---|---|---|

| Micro (home office, small shop) | £2,700 | £135 | £540 | £405 |

| Small (café, salon, small office) | £5,700 | £285 | £1,140 | £855 |

| Medium (restaurant, larger retail) | £11,500 | £575 | £2,300 | £1,725 |

Gas VAT Overpayment (Annual)

| Business Size | Typical Annual Bill | VAT at 5% | VAT at 20% | Annual Overpayment |

|---|---|---|---|---|

| Micro | £920 | £46 | £184 | £138 |

| Small | £1,830 | £92 | £366 | £274 |

| Medium | £3,690 | £185 | £738 | £553 |

Combined electricity and gas: A small business paying 20% instead of 5% on both fuels loses approximately £1,130 per year. Over a 3-year fixed-term contract, that’s £3,390 - roughly the cost of a new commercial dishwasher or three months’ rent for a small unit.

Why Suppliers Charge 20% by Default

There are three reasons suppliers default to the higher rate:

1. It’s Safer for Them

If a supplier charges 5% to someone who doesn’t qualify, they’re liable for the underpaid VAT. Charging 20% means they never underpay HMRC - the risk sits entirely with you.

2. It’s More Profitable

This is cynical but true: suppliers know most businesses never check. The extra 15% flows through their billing systems, and while it goes to HMRC rather than their profit, it creates no friction for them.

3. The Burden of Proof Is on You

HMRC’s VAT Notice 701/19 (opens in new tab) places the responsibility on customers to declare their qualifying status. Suppliers are following the rules - they’re just not being helpful about it. Ofgem, the energy regulator, doesn’t directly govern VAT - this is HMRC’s domain.

How to Claim the 5% Rate

If you qualify for reduced VAT, here’s how to claim it:

Step 1: Check Your Current Rate and Usage

Review your last 12 months of bills. Look for:

- The VAT rate being charged (usually shown as a line item)

- Your monthly or annual consumption in kWh

- Whether you’re above or below the de minimis threshold

Step 2: Download Your Supplier’s VAT Declaration Form

Every supplier has their own form. Search “[your supplier] VAT declaration certificate” or call their business customer line. Common forms include:

- Declaration for de minimis usage

- Declaration for charitable use

- Declaration for mixed-use apportionment

Step 3: Complete and Submit the Declaration

You’ll need to specify:

- Your account/meter details (MPAN for electricity, MPRN for gas)

- Your qualifying reason

- Supporting calculations if claiming mixed-use

Step 4: Request a Backdated Refund

If you’ve been overpaying, explicitly request a refund for previous bills. You can claim back up to 4 years of overpaid VAT. Suppliers may resist - escalate through their complaints process if needed.

Step 5: Verify Future Bills

After submitting your declaration, check your next bill to confirm 5% VAT is being applied. Declarations sometimes get lost in supplier systems.

Common Mistakes That Cost You Money

Based on what we see at Meet George, these are the most frequent VAT errors:

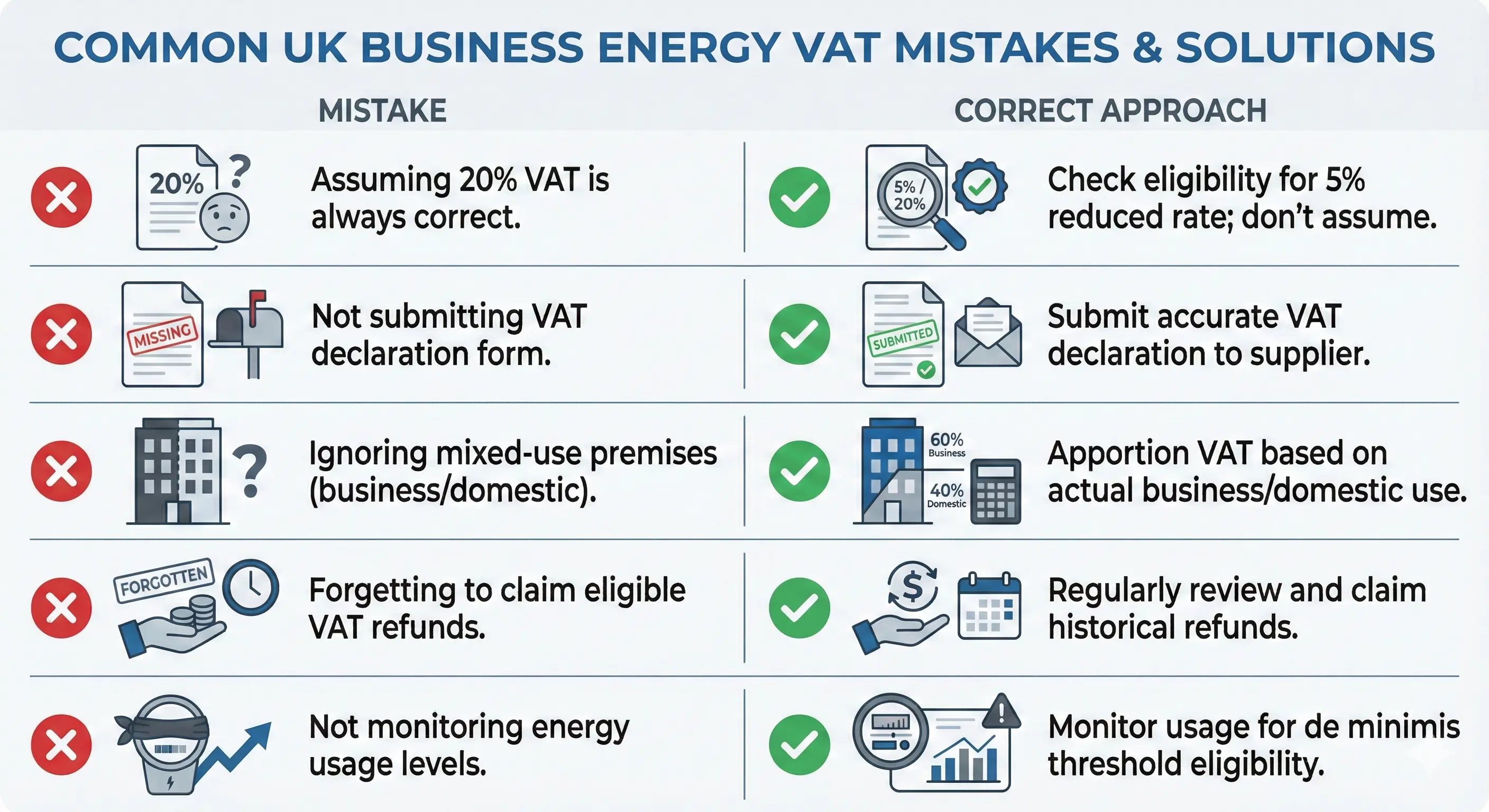

1. Assuming 20% Is Correct

Many business owners see 20% VAT on their bill and assume “that’s just what businesses pay.” They never check whether they qualify for less.

Fix: Always check your consumption against the de minimis threshold. If you’re a small office, café, or shop, there’s a good chance you qualify.

2. Not Submitting a Declaration for Qualifying Uses

Charities, care homes, and holiday lets often don’t realise they need to proactively submit a certificate. Suppliers won’t apply 5% without it.

Fix: If you fall into a qualifying category, submit a declaration immediately - even if you’re mid-contract.

3. Ignoring Mixed-Use Apportionment

Businesses in mixed-use premises (e.g., a flat above a shop) often pay 20% on everything when they could claim 5% on the residential portion.

Fix: Calculate your split and submit an apportionment declaration. Even 40% at 5% is better than 0%.

4. Forgetting to Claim Refunds

Discovering you’ve overpaid is only half the battle. Many businesses correct future bills but forget to claim the backdated refund.

Fix: Explicitly request a refund for up to 4 years of overpayments. Put a specific figure in your request.

5. Not Monitoring Usage Changes

A business that’s below de minimis in summer might exceed it in winter when heating is running. This can trigger a VAT rate change mid-year.

Fix: Review your quarterly usage via your smart meter data or bills. If you’re close to the threshold, budget for potential VAT changes.

What If Your Supplier Refuses?

If your supplier won’t apply the 5% rate or refuses a refund:

Stage 1: Formal Complaint

Submit a written complaint through their official complaints process. Reference HMRC VAT Notice 701/19 (opens in new tab) and provide evidence of your qualifying status (bills, meter readings, calculations).

Stage 2: Energy Ombudsman

If unresolved after 8 weeks (or you receive a “deadlock” letter), escalate to the Energy Ombudsman (opens in new tab). They can make binding decisions on billing disputes, including VAT errors.

Stage 3: HMRC VAT Error Correction

For significant overpayments, you may need to submit a VAT error correction directly to HMRC. This is typically for amounts over £10,000 or where the supplier is uncooperative. Consult an accountant for this route.

VAT vs Climate Change Levy: Double Savings

If you qualify for 5% VAT under the de minimis rule, you’re also likely exempt from the Climate Change Levy (CCL) - an additional environmental tax on business energy.

CCL rates for 2025-26:

- Electricity: 0.775p per kWh

- Gas: 0.672p per kWh

For a small business using 10,000 kWh of electricity annually, CCL exemption saves an additional £77.50 per year on top of the VAT reduction.

Like VAT, you need to submit a declaration to claim CCL exemption. Many suppliers combine this with the VAT declaration form - check whether yours does.

Does Switching Supplier Affect VAT?

No. Your VAT rate is determined by HMRC rules, not by your supplier. Switching to a cheaper energy deal doesn’t change your VAT status.

However, when you switch:

- You’ll need to submit a new VAT declaration to your new supplier

- Your qualifying status resets - the new supplier will default to 20% until you declare otherwise

- Any refund claims for overcharges stay with your old supplier

Tip: When using Meet George or comparing business energy quotes, factor in VAT correctly. If you’re comparing a quote at 22p/kWh, remember that’s before VAT - at 20% it becomes 26.4p/kWh, at 5% it becomes 23.1p/kWh.

November 2025 Budget: What Changed?

The Autumn Budget 2025 (opens in new tab) announced by Chancellor Rachel Reeves on 26 November 2025 made no changes to VAT rates on energy.

Key confirmations:

- Standard VAT rate remains 20% (manifesto commitment)

- Reduced rate remains 5% for qualifying uses

- De minimis thresholds unchanged

The budget did announce removal of certain environmental levies from household electricity bills (saving households approximately £130-150 annually), but this applies to domestic customers, not businesses.

For businesses, the VAT and CCL framework remains as it was throughout 2025. The rules in this article apply for the foreseeable future.

Quick Reference: VAT on Business Energy

| Question | Answer |

|---|---|

| Standard business energy VAT rate | 20% |

| Reduced rate for qualifying uses | 5% |

| Electricity de minimis (monthly) | Less than 1,000 kWh |

| Gas de minimis (monthly) | Less than 4,397 kWh |

| Who qualifies automatically | Charities, care homes, holiday lets, low users |

| How to claim reduced rate | Submit VAT declaration to supplier |

| Refund period for overpayments | Up to 4 years |

| Escalation for disputes | Energy Ombudsman |

Next Steps

- Check your bills - Are you paying 5% or 20% VAT? What’s your monthly consumption?

- Compare to thresholds - Electricity under 1,000 kWh/month? Gas under 4,397 kWh/month?

- Download the declaration form - From your current supplier’s website

- Submit and request refund - Include backdated claim for up to 4 years

- Monitor going forward - Verify future bills show the correct rate

If you’re also paying over the odds on your unit rate or standing charge (see our complete standing charges guide), VAT is just one piece of the puzzle. Switching supplier could save you far more - especially if you’re stuck on deemed rates (learn more about why deemed rates cost 80% more) - but make sure you’re not overpaying on VAT first, or you’ll carry that error to your new contract.

Ready to stop overpaying? Learn how to switch business energy in 10 minutes or join the Meet George waitlist for transparent switching with no undisclosed broker fees.