TL;DR: Key Takeaways

The Headline: Media reported that slowing Net Zero could “save households £500 a year.”

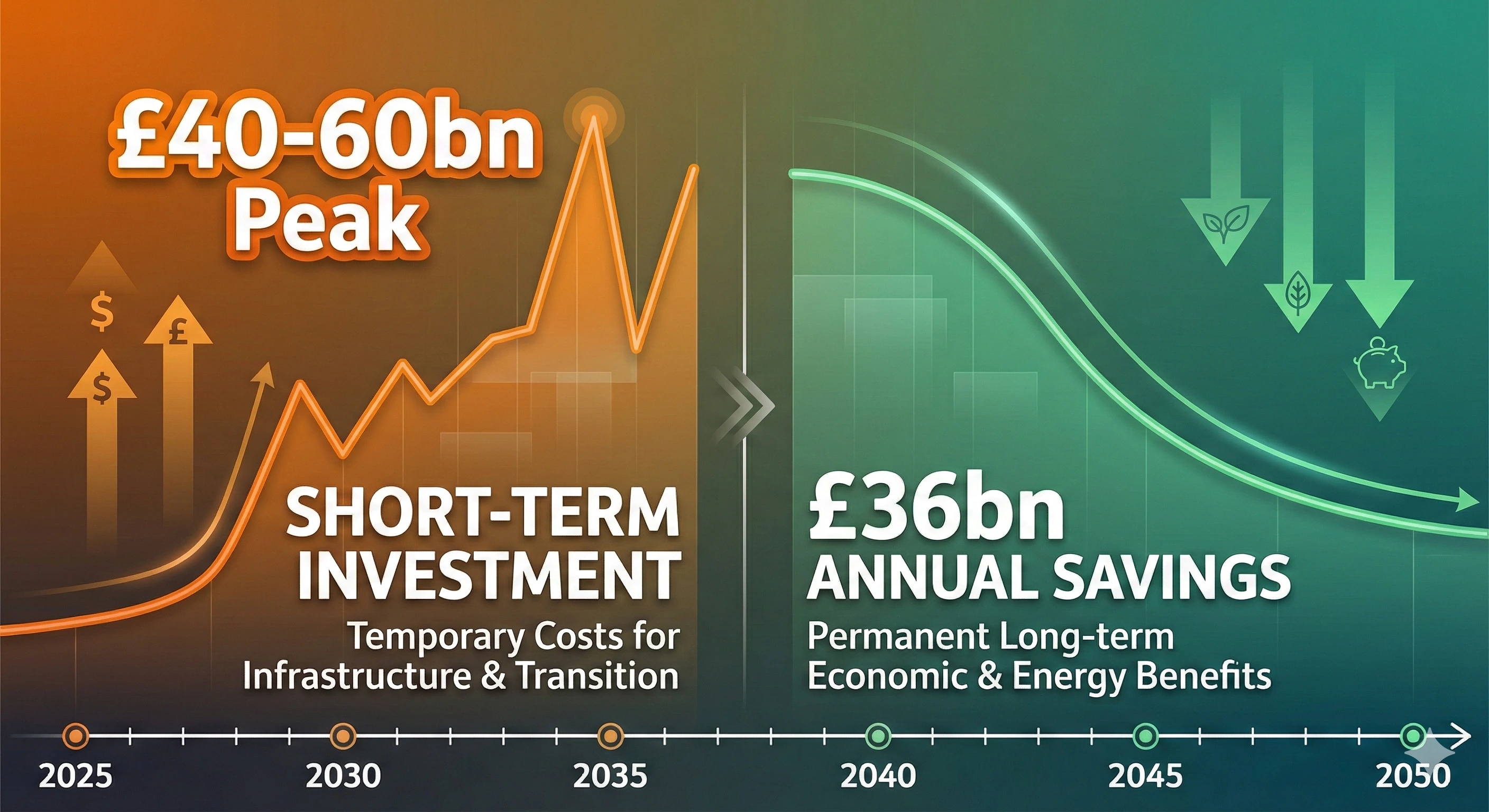

The Reality: The NESO report (opens in new tab) actually shows the “greenest” scenario saves the UK £36bn per year over 25 years compared to delay.

The Hidden Cost: “Doing nothing” keeps UK businesses hooked on volatile gas markets - the same markets that caused the 2022 energy crisis.

The Business Strategy: You cannot control national infrastructure spend. But you can control how much of it lands on your bill through flexibility.

The Action: Businesses that shift usage away from peak times can access the “Flexibility Discount” - cheaper, greener power while competitors pay for the expensive infrastructure upgrades.

What the Headlines Missed

The NESO (National Energy System Operator) report shows that a well-managed Net Zero transition could halve UK energy costs as a proportion of GDP - from 10% today to 5-6% by 2050. The short-term investment spike is real, but the long-term savings are larger. The question for business owners is not “will costs rise?” but “who pays the most?”

The “Do Nothing” Tax

If you read the headlines this week (opens in new tab), you might think going green is about to cost your business a fortune.

The reality is the opposite.

A new report from NESO dropped a bombshell figure: achieving Net Zero requires surging investment, potentially peaking at £40-60bn per year over the next decade. Predictably, the headlines screamed that slowing down would save households £500 a year.

As a business owner, seeing that figure probably makes you want to hit the brakes. But if you look past the headline, the report actually proves why “doing nothing” is the most expensive strategy of all.

The “Falling Behind” Trap

The report models a “Falling Behind” scenario where the UK misses its targets. On paper, this saves £350bn in investment.

But there is a catch. That saving relies on ignoring the cost of carbon and the cost of volatility.

The report explicitly notes that fossil fuel markets have caused “half of all recessions since the 1970s”. By “saving money” on Net Zero infrastructure, we keep UK businesses hooked on the volatile international gas markets that caused your rates to spike in 2022.

The Reality: You can either pay for investment (which builds an asset) or you can pay for gas (which burns money). The report confirms that when you account for carbon costs, the “greenest” scenario actually saves the UK £36bn a year over the next 25 years compared to slowing down.

The Investment Spike (And Who Pays It)

There is no hiding the fact that costs will rise in the short term. NESO predicts spending will average £28-40bn annually through to 2040, with peaks potentially reaching £60bn in the next decade. This money goes into:

Generation: New projects like Sizewell C (nuclear) and offshore wind farms.

Networks: Upgrading the wires and pylons to carry all this new power to where it is needed.

Why this matters to you: These costs are recovered through Network Charges - the non-commodity part of your bill. As the grid builds more infrastructure, these fixed costs will likely rise.

This brings us to the “Winner” and “Loser” divide.

The “Secret Mechanism”: Why Flexibility is the Hedge

The report admits that the long-term benefit of this investment is “far lower energy costs.”

But how do you access those lower costs today, while investment is still high?

Flexibility.

Here is the part most brokers will not explain:

The Grid’s Problem

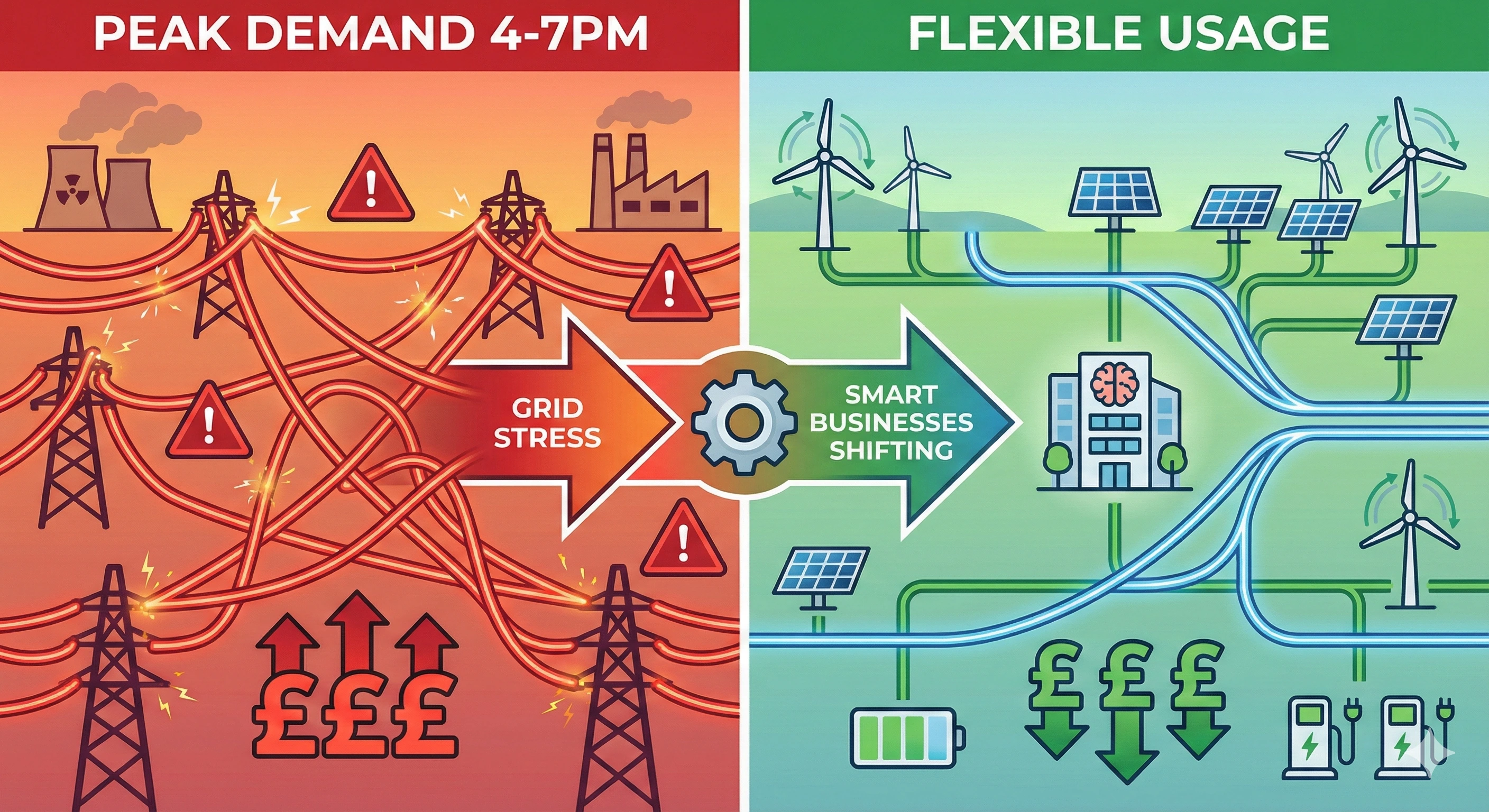

Building new wires is expensive. The Grid only has to build them if everyone uses power at the same time (Peak Demand). The 4-7 PM evening peak is when the system is most stressed - and most expensive to serve.

The Solution

If you use power when the wind is blowing and demand is low, you are not stressing the system. You are actually helping balance the grid.

The Reward

To encourage this, the market is moving to Time-of-Use pricing. If you are “flexible” (shifting usage away from the peak), you bypass the expensive bottlenecks.

This is the “Flexibility Discount.” While your competitors pay for the £40bn+ annual infrastructure upgrade through high peak rates, flexible businesses can effectively “opt out” of the cost by using the cheaper, greener power that the infrastructure was built to deliver.

How Flexibility Works in Practice

The regulatory changes of 2025 have opened up flexibility markets that were previously reserved for industrial giants. The Ofgem 2026 roadmap details how these changes fit into the broader transformation of the energy market. Here is what is now available to SMEs:

1. Time-of-Use Tariffs

Under MHHS (Market-wide Half-Hourly Settlement), your smart meter data allows suppliers to offer rates that vary by time of day. Peak electricity might cost 35p/kWh while off-peak costs 15p/kWh.

The Maths: If you can shift 100 kWh from peak to off-peak each day, you save £20/day or £7,300/year.

2. Demand Side Response (DSR)

You can actually earn money by being flexible. The National Grid pays businesses to reduce consumption during stress events or export stored power back to the grid.

The Opportunity: Businesses actively participating in flexibility programmes can potentially offset a meaningful proportion of their energy costs, depending on their load profile and the programmes they qualify for. Learn how DSR can turn your energy bill into income.

3. On-Site Generation and Storage

Solar panels and batteries allow you to generate cheap power during the day and use it during the expensive evening peak - completely bypassing grid costs during the most expensive windows.

The 2022 Warning: What “Doing Nothing” Actually Costs

If the abstract numbers do not convince you, remember 2022.

When Russia invaded Ukraine, international gas prices spiked. UK businesses saw their energy bills double, triple, or worse. Many did not survive.

That was the cost of “doing nothing.” The UK had not invested enough in domestic, renewable generation. We were dependent on volatile international gas markets - and we paid the price.

The NESO report confirms this is not a one-off risk. Fossil fuel price shocks have caused “half of all recessions since the 1970s.” Net Zero is not just an environmental strategy - it is an economic resilience strategy.

The question is whether you want to pay for assets that generate cheap power domestically, or continue paying for imported gas that funds foreign governments and causes recessions.

Summary: Do Not Fear the Net Zero Bill

The NESO report confirms that the transition is expensive, but necessary to end our exposure to fossil fuel recessions.

You cannot control the national infrastructure spend. But you can control how much of it lands on your bill.

The Strategy for 2026:

Stop “Average” Billing: You need a contract that rewards you for when you use power, not just how much you use. MHHS is ending average billing - make sure you are on the right side of that change.

Get Data-Ready: You cannot be flexible if you do not know your load shape. Get a smart meter installed (it is free) and start understanding your usage patterns.

Explore Flexibility: Consider whether your business can shift usage, install storage, or participate in DSR programmes.

How Meet George Helps

At Meet George, we do not just switch your supplier. We analyse your data to see if you are ready to access the “Flexibility Discount” that the big players are already using.

Interested in Flexibility? If you want to explore flexibility options for your business today, email us at flexibility@meetgeorge.co.uk. We can introduce you to our vetted partners who handle the flexibility management on your behalf.

The headlines want you to fear Net Zero. The data says the real risk is doing nothing.

Sources & Further Reading:

- The Guardian: Reaching Net Zero - Cost Explainer (opens in new tab)

- NESO: Clean Power 2030 Report (opens in new tab)

- Carbon Brief: Net Zero is Cheapest Option Analysis (opens in new tab)

- NESO: Our Progress Towards Net Zero (opens in new tab)

- Ofgem: MHHS Decision and Full Business Case (opens in new tab)