TL;DR: Key Takeaways

The News: Ofgem has approved £28.1bn to upgrade the UK electricity grid. This will be recovered through your energy bills.

The Cost: By 2031, a small office could pay an extra £1,790/year; a medium factory up to £9,760/year.

The Contract Trap: “Pass-Through” contracts expose you to all increases. “Fully Fixed” contracts offer protection - but check for “Change in Law” clauses that allow new levies to be passed through.

The Hidden Opportunity: If you have a Half-Hourly meter, you may be paying for unused kVA capacity. Reductions of 50% on capacity charges are common.

Action Required: Check your contract type and review your kVA allocation before costs rise further.

What’s Happening?

Ofgem has approved a massive £28.1bn upgrade to the UK electricity grid.

News broke on 4th December (opens in new tab) when the regulator published its RIIO-3 Final Determinations (opens in new tab), confirming this huge upfront investment to modernise the network for renewable energy.

Why Now? The Demand Inflection Point

For context, UK electricity demand is growing for the first time in 19 years. After nearly two decades of steady decline - industrial consumption fell 30% between 2005 and 2024 (from 117 TWh to 82.2 TWh) thanks to efficiency gains and deindustrialisation - 2024 marked an inflection point. The Energy Intensive Industries segment already showed the reversal, with 21% consumption growth in 2023 (from 8.3 TWh to 10.0 TWh), largely driven by data centre expansion. Demand is now projected to grow 50% by 2035 and double by 2050.

Three forces are driving this surge:

- Electric vehicles: From 1.5 million today to an estimated 25 million by 2035

- Heat pumps: Installations scaling from 60,000/year to 600,000/year by 2028

- Data centres and AI: Hyperscale computing requires massive grid capacity

The £28.1bn upgrade isn’t just about renewables - it’s about building a grid that can handle this unprecedented demand growth. The costs will be recovered through your bills.

The flip side - flexibility as opportunity: While grid costs are rising, the same infrastructure changes are creating a new revenue opportunity. The UK flexibility market (businesses being paid to adjust their energy usage on demand) is projected to reach £6 billion by 2030. The Capacity Market alone cleared £1.45 billion in 2025-26 - representing 44% year-over-year growth. Businesses with flexible loads, batteries, or on-site generation can now participate in these markets and offset rising network charges with grid services revenue.

While this is good news for the planet, it asks a very expensive question for business owners: Who is going to pay for it?

The answer is you. And for the first time, we know exactly how much.

The Cost to Your Business (By 2031)

Ofgem’s RIIO-3 overview (opens in new tab) reveals the specific cost increases for businesses:

| Business Type | Annual Increase |

|---|---|

| Small Shop / Kiosk | +£70/year |

| Small Office / Hotel | +£1,790/year |

| Medium-Sized Factory | +£9,760/year |

This money will be recovered through “Network Charges” on your bill. However, when and how you pay depends entirely on the contract you sign today.

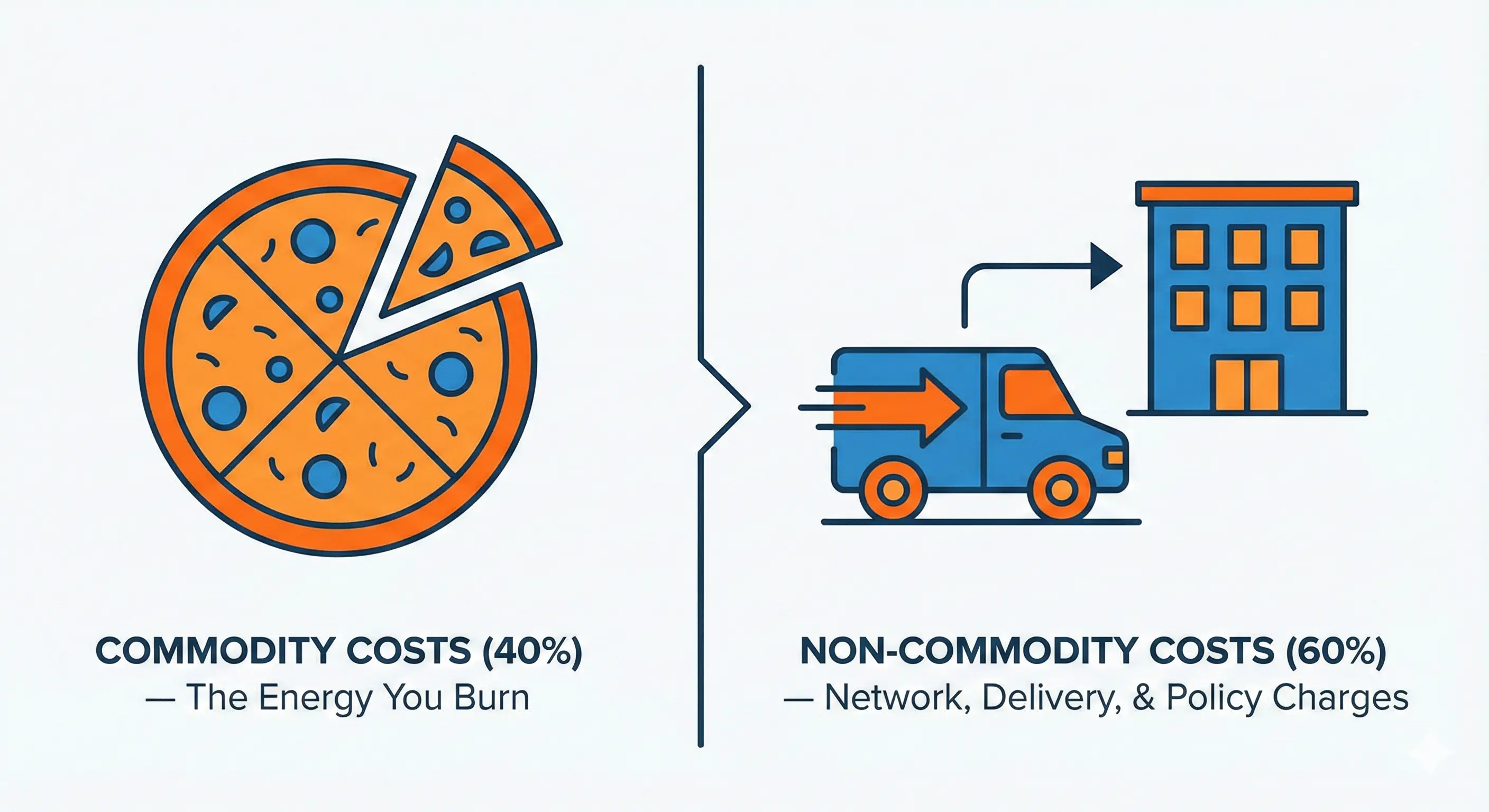

The Anatomy of Your Bill: “Pizza vs. Delivery”

To understand where this cost sits, you need to understand how a business energy bill is built.

Think of it like ordering a pizza:

Commodity Costs (~40%): The price of the pizza itself - the gas/electricity you actually burn.

Non-Commodity Costs (~60%): The delivery fee, the driver’s wages, and the road tax - getting the energy to you.

Historically, businesses obsessed over the “Pizza Price” (Commodity). But today, the “Delivery Fee” (Non-Commodity) makes up the majority of your bill - as of Q4 2025 it’s approximately 60% - and this is the part that is rising to pay for the upgrade.

The Jargon Buster: What Are These Charges?

The £28bn upgrade will hike two specific “Delivery Fees”:

TNUoS (Transmission Network Use of System)

The Analogy: The “Motorway Toll.”

This pays for the huge high-voltage pylons that carry energy across the country - the National Grid (opens in new tab). Think of it as the cost of using the electricity motorway.

DUoS (Distribution Use of System)

The Analogy: The “Local Delivery Driver.”

This pays for the local poles, wires, and substations that bring power from the motorway to your front door. Your local Distribution Network Operator (DNO) charges this.

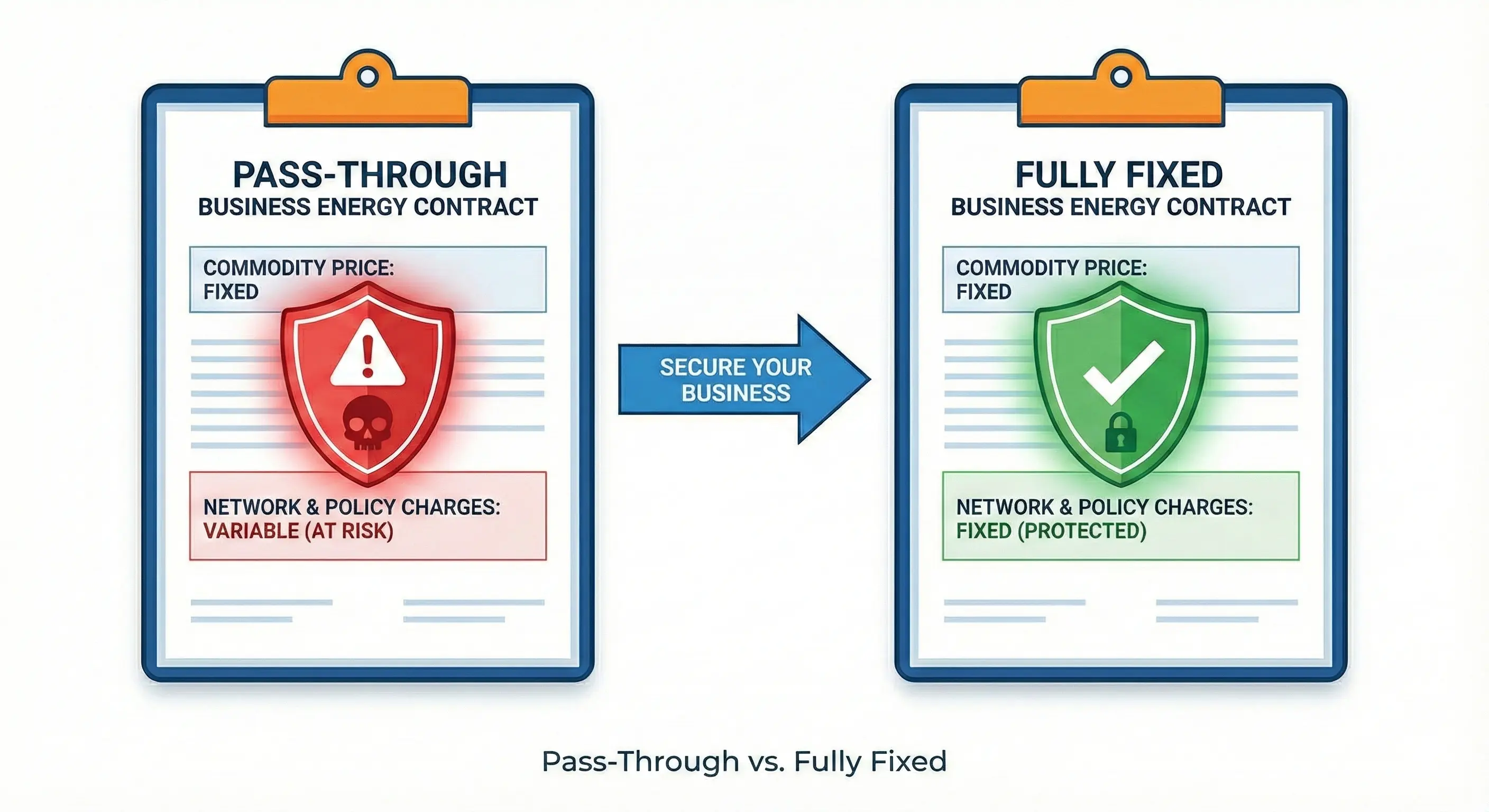

The Contract Trap: Fixed vs. Pass-Through

Now that we know costs are rising, how does your contract protect you?

The “Pass-Through” Trap

Many brokers offer contracts that look incredibly cheap on paper. This is often because they are Pass-Through contracts.

How it works: You fix the “Pizza Price” (Commodity), but the “Delivery Fee” (Non-Commodity) is variable.

The Risk: When these new grid charges hit, your supplier passes them straight to you. Your “cheap” rate skyrockets mid-contract.

Warning: A contract showing 20p/kWh on a Pass-Through basis could effectively become 28p/kWh once the full network charge increases hit - and you have no protection.

The “Fully Fixed” Shield (With a Caveat)

A “Fully Fixed” or “Fully Inclusive” contract attempts to lock in both Commodity and Non-Commodity costs for the duration of the term.

The Benefit: The supplier takes the risk. If TNUoS charges go up, they usually absorb the cost.

The Important Caveat: Most “Fully Fixed” contracts contain a “Change in Law” clause. This means if the government introduces a completely new levy that didn’t exist when you signed (like the Nuclear RAB levy launching November 2025 (opens in new tab)), suppliers may still pass this through - even on fixed contracts. However, for existing charges like TNUoS and DUoS that are simply increasing, a Fully Fixed contract typically protects you while a Pass-Through contract does not.

The Insider Nuance: Ofgem has confirmed they are “smoothing” the cost increase to avoid a massive spike in April 2026. However, the cost must be paid eventually. Locking in a fixed rate now shields you from the uncertainty of this 5-year inflation.

| Contract Type | Commodity (Energy) | Non-Commodity (Network) | Your Risk Level |

|---|---|---|---|

| Pass-Through | Fixed | Variable | High - exposed to all increases |

| Fully Fixed | Fixed | Fixed | Low - supplier absorbs increases |

The “Highway Lane” Opportunity: Optimising Your kVA

For larger businesses (especially those with Half-Hourly “00” meters), this upgrade impacts another cost: your Availability Charge (kVA).

Does this apply to you? Check your bill for “Availability Charge” or “kVA”. If you don’t see these terms, you’re not paying for reserved capacity and can skip this section. This typically only affects larger businesses with Half-Hourly meters.

What is kVA? (The Highway Analogy)

Imagine a highway where you reserve a specific lane just for your truck, so it’s always empty whenever you need it.

- You pay for that lane 24/7, whether you drive on it or not

- If you reserve a massive lane but only drive a Mini Cooper, you’re wasting money

Many businesses are paying for “Highway Lanes” (kVA capacity) they booked 15 years ago when they had heavy machinery. Today, with LED lights and efficient motors, they might be using only 20% of it.

The “Ghost Capacity” Problem

Your local grid operator (DNO) doesn’t like this. They are legally required to keep that capacity reserved for you (“Ghost Capacity”). They would much rather you gave it back so they can sell it to the new EV charging hub down the street that actually needs it.

How to Optimise Your kVA Capacity

You can use data to safely reduce this cost:

- Analyse Data: Review 12 months of your Half-Hourly (HH) usage data

- Find the Peak: Identify the absolute maximum spike in demand you hit last year (e.g., 200 kVA)

- Add a Buffer: Add a 10-15% safety margin (Target = 230 kVA)

- Compare: If your contract says you’re paying for 500 kVA, but you only need 230 kVA, you can apply to reduce your capacity

The Result: You stop paying for the empty highway lane. Reductions of 50% on capacity charges are common.

How Meet George Can Help

If you have a Half-Hourly meter, Meet George can handle the entire kVA optimisation process for you:

- Data Analysis: We ingest and analyse your Half-Hourly Data (HHD) to identify your actual peak demand

- Safe Recommendation: We calculate an optimised capacity with appropriate safety buffers

- DNO Liaison: We contact your local Distribution Network Operator on your behalf to request the capacity reduction

- Ongoing Monitoring: We track your usage to ensure you stay within your new capacity limits

This removes the complexity and ensures you don’t accidentally trigger Excess Capacity Penalties.

The Smart Rule: Plan Before You Cut

While reducing capacity saves money, you must be strategic.

If you reduce your capacity to 230 kVA and then install new machinery that pushes you to 250 kVA, you will face Excess Capacity Penalties - often 3x the standard rate.

Before reducing, always ask: “Are we planning to expand operations or install EV chargers in the next 12 months?”

If the answer is yes, keep the buffer.

Summary: Protect Your Business

The £28bn upgrade is happening. The costs are coming.

Action 1 - Check Your Contract: Are you on “Pass-Through” or “Fully Fixed”? If you don’t know, ask your supplier or check your contract terms.

Action 2 - Check Your kVA: Are you paying for a highway lane you don’t use? Request your maximum demand data from your supplier.

Action 3 - Time Your Switch: If your contract is expiring soon, consider locking in a Fully Fixed rate before the network charge increases accelerate.

Ready to check if you’re exposed to these rising costs? Learn how to switch business energy suppliers or join the Meet George platform waitlist to get transparent quotes with no undisclosed fees.