The free ride ends: New 3p/mile EV tax confirmed

Plus: Ofgem’s new supplier "naughty list" and why vans are safe from the tax hike.

Joshua Winterton

November 30th, 2025

A quick note from me (Josh):

Welcome to The George Briefing. Each week, my co-founder Lu and I use our tech-focused lens to go directly to the source of change in the UK energy market, the official publications from Ofgem and the UK Government. Our goal is to cut through the noise and deliver the key regulatory developments and changes that will impact your business's bottom line, all explained in simple, actionable terms.

This weeks developments are:

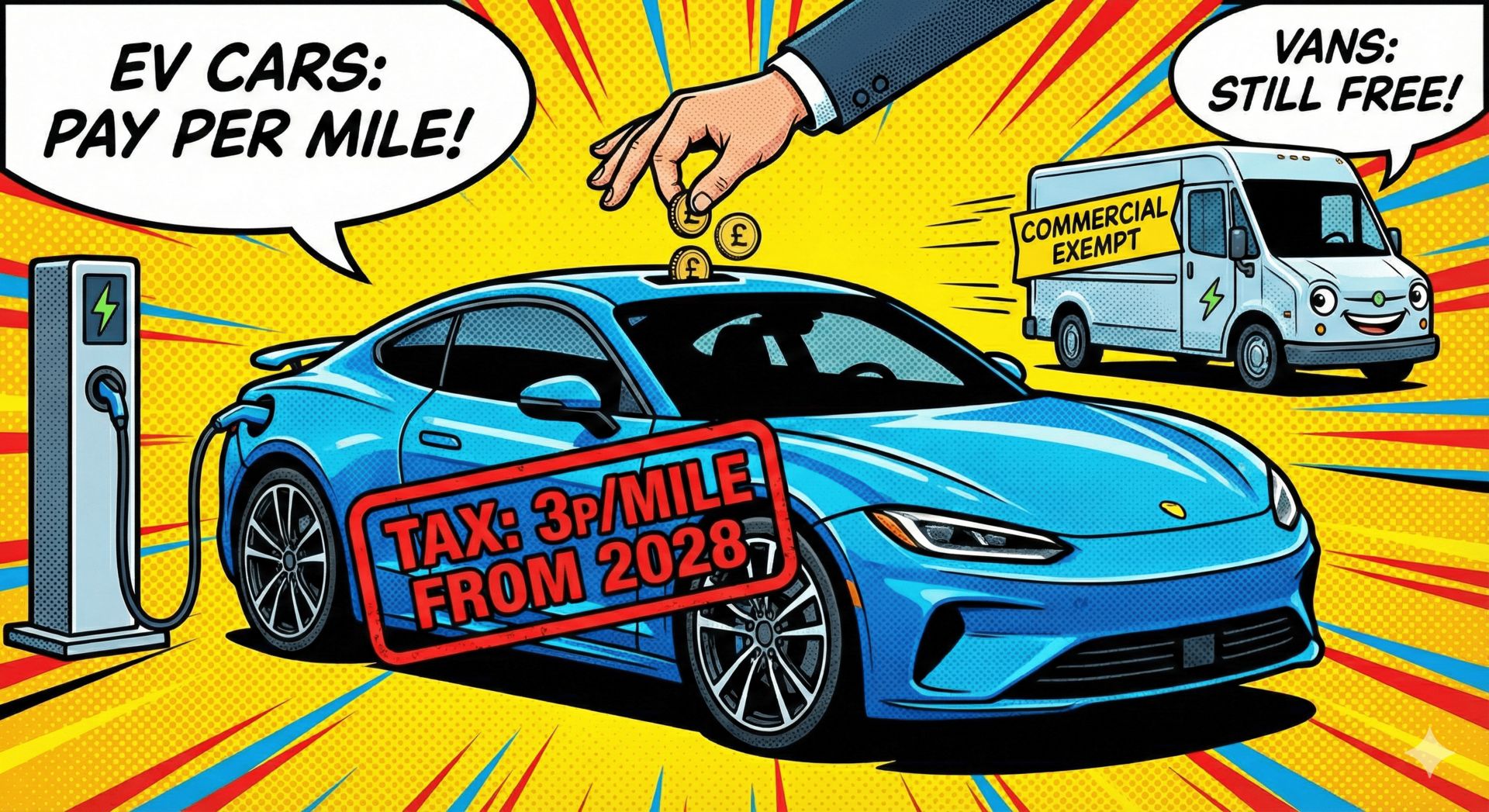

The Free Ride Ends: New 3p/Mile EV Tax Hit (But Vans Are Safe)

The 'Naughty List': Ofgem Names & Shames Risky Gas Suppliers

The Winter Price Trap: Regulators Admit 'Loophole' Is Spiking Bills

This Week's B2B Market Pulse

Hidden Gems Also Worth Reading

LATEST DEVELOPMENTS

The Guardian

Image source: Gemini / Meet George

The Spark: A new 3p-per-mile charge for electric cars from 2028 signals the end of the tax-free ride for EVs, forcing businesses to recalculate the long-term cost of their company car fleets.

The details:

A new pay-per-mile charge will be introduced from 2028, taxing fully electric cars 3p per mile and plug-in hybrids 1.5p per mile.

Crucially for businesses, electric vans, buses, and HGVs will be exempt from this new mileage charge.

Fuel duty on petrol and diesel will remain frozen until September 2026, after which the 'temporary' 5p-a-litre cut will be reversed in stages.

To offset the new tax, the government is extending the electric car grant until 2030 and raising the 'luxury car tax' threshold for EVs to £50,000.

Why it matters: This is the government firing the starting gun on normalising EV taxation. For years, the Treasury has watched its £25bn-a-year income from fuel duty shrink, and this pay-per-mile system is the long-awaited replacement. The real-world impact for your business P&L is that the total cost of ownership calculation for EVs is changing. While they will still be cheaper to run than petrol cars, the gap is set to narrow. The most critical detail that many will miss is the exemption for electric vans and HGVs. This creates a clear two-tier system: electrifying your commercial fleet remains a massive long-term cost-saver, while the financial case for company cars, though still strong, now has a future tax liability attached.

What you can do:

Update your fleet strategy: When calculating the Total Cost of Ownership (TCO) for company cars, factor in an additional 3p-per-mile running cost for any EVs you plan to operate beyond 2028.

Prioritise electrifying vans: The exemption for commercial vehicles makes the business case for switching to electric vans even more compelling. Accelerate any plans to transition your van fleet to lock in tax and fuel savings.

Forecast rising fuel costs: With the 5p fuel duty cut set to be reversed from late 2026, start building higher petrol and diesel costs into your financial forecasts for 2027 onwards.

Ofgem

Image source: Gemini / Meet George

The Spark: Ofgem is now publicly naming and shaming gas suppliers who fail to pay their green energy levies, creating a new 'credit watch' list for businesses to vet their provider's financial stability.

The details:

Ofgem has launched a public 'Green Gas Levy (GGL) default register' to list any licensed gas supplier that fails to meet its obligations under the Green Gas Support Scheme (GGSS).

Defaults include failing to make quarterly levy payments, not lodging sufficient credit cover, or missing 'mutualisation' payments (costs spread after a supplier fails).

The register will detail the supplier's name, the specific obligation they missed, and any financial penalties imposed.

This information will be kept on the register for at least one year and will also be included in Ofgem's bi-annual Supplier Performance Report.

Why it matters: What's the real-world impact here? This isn't just more regulatory paperwork; it's a new, vital due diligence tool for your business. A supplier appearing on this list for failing to pay its levies is a significant red flag about its financial health and operational discipline. During the energy crisis, many businesses were burned when their 'cheap' supplier went bust, forcing them onto expensive default tariffs with a new provider. This register gives you a direct, official insight into a supplier's stability before you sign a contract, helping you avoid partners who could pose a direct risk to your operational continuity and budget.

What you can do:

Before signing or renewing a gas contract, check the Ofgem 'Green Gas Levy default register' as part of your due diligence.

If your current or prospective supplier is on the list, ask them (or your broker) for a direct explanation of the default.

Add 'Check Ofgem supplier registers' as a standard step in your energy procurement process to mitigate supplier risk.

Ofgem

Image source: Gemini / Meet George

The Spark: The energy regulator has admitted a loophole in its rules is still allowing power plants to charge excessively high prices during cold snaps, directly inflating a hidden cost on your business's electricity bill.

The details:

Ofgem introduced a new rule in October 2023, the Inflexible Offers Licence Condition (IOLC), to stop power generators from charging excessive prices in the last-minute Balancing Mechanism.

The regulator's analysis shows the rule has been partially effective, stopping generators who cancel their plans on the day from then offering to come back online at exorbitant rates.

However, a loophole remains: the rule doesn't apply to generators who had no plan to generate in the first place, some of whom have charged 'very high prices' during recent winters when supply was tight.

Ofgem is now monitoring this behaviour and has warned it will consider 'further intervention' if the practice continues to add to consumer costs.

Why it matters: This isn't just technical market chatter; it's about a specific, volatile, and often misunderstood part of your non-commodity costs. Think of the 'Balancing Mechanism' as the grid's A&E department – it's used for last-minute fixes to keep the lights on. When it gets busy on a cold winter evening, some generators are charging A&E prices. Ofgem has stopped some of this price-gouging, but not all of it. For your business's P&L, this means the risk of volatile Balancing Services Use of System (BSUoS) charges remains, making budget forecasting for winter energy spend notoriously difficult, especially for firms on pass-through contracts.

What you can do:

Check your contract type. If you are on a pass-through or flexible contract, ask your supplier for a breakdown of your non-commodity charges to see how exposed you are to volatile balancing costs (BSUoS).

Discuss risk management with your energy broker. Ahead of your next renewal, model the cost difference between a fully-fixed contract (which offers budget certainty on these charges) and a pass-through tariff (which offers potential savings but carries risk).

Explore Demand Side Response (DSR). If your business has operational flexibility, ask your supplier about schemes that pay you to reduce electricity use during peak times, which helps lower these system-wide balancing costs.

LATEST MARKET NUMBERS

⚡ The Market Pulse

Wholesale Electricity Price (weekly avg.): 8.38 p/kWh (🔻 -0.36 p/kWh / -4.1%) Based on £83.75/MWh. A welcome relief. Prices have cooled off as wind generation returns to the grid.

Wholesale Gas Price: 2.56 p/kWh (🔻 -0.13 p/kWh / -4.8%) Based on 75.00p/therm. A solid drop. Gas is getting cheaper, continuing the downward trend from last week.

UK Carbon Price (UKA): £58.11 per tonne (🔺 +£0.27 / +0.5%) Flat. Barely moving. Carbon remains a stable, non-volatile component of your bill right now.

Wind + Solar Generation (Share of UK Mix): 45.2% (🔺 +8.5 pts / +23.2%) The cavalry arrived. A massive bounce back in green power, reclaiming nearly half the grid's supply.

The Meet George Take

The "Wind Bailout." If last week was a lesson in the cost of silence, this week is a demonstration of the value of a breeze.

The data confirms exactly what we predicted: as soon as the wind picked back up, electricity prices fell. Renewable generation surged to 45.2% of the mix (up 8.5 percentage points), flooding the grid with cheaper power and forcing those expensive gas peaker plants offline.

Notice the correlation? Wholesale gas dropped 4.8%, and electricity followed suit with a 4.1% drop. The market is functioning normally again. Last week's "disconnect" - where gas was cheap but power was expensive - has closed because we no longer need to burn excessive amounts of gas to keep the lights on.

The Bottom Line: This volatility is the new baseline. We swung from a "Dunkelflaute" price spike to a "High Wind" discount in the space of seven days. For businesses on flexible contracts, this week is a win. For those looking to fix, it’s a reminder that timing is everything - signing a contract during a "still week" effectively locks in a panic premium for the long term. Wait for the wind.

ALSO ON OUR RADAR

📰/📊 News also worth reading

A PLUG FOR GEORGE 🔌

Enjoying the briefing? The same philosophy - cutting through the noise to find what impacts your bottom line - is at the heart of what we're building.

At Meet George we’re building AI-powered business energy switching, launching Q1 2026. While we complete the full automation platform, we're offering manual forensic analysis by our founding team - the same insights our platform will deliver instantly, just delivered by humans within 5 business days.

Request a free analysis and we'll uncover hidden broker fees, inflated unit rates, standing charges, and potential overspend. Transparent 1p/kWh commission, shown separately. No sales pressure.